Owning more than two or three credit cards can become unmanageable for many people. However, your credit needs and financial situation are unique, so there's no hard and fast rule about how many credit cards are too many. The important thing is to make sure that you use your credit cards responsibly.As a regulated financial institution, 100% of your deposits are safeguarded.What is the 5/24 rule Many card issuers have criteria for who can qualify for new accounts, but Chase is perhaps the most strict. Chase's 5/24 rule means that you can't be approved for most Chase cards if you've opened five or more personal credit cards (from any card issuer) within the past 24 months.

Is it OK to have 7 credit cards : How Many Credit Cards Should You Have There's no magic number of credit cards you should have. Know your spending habits and focus on paying on time.

Is my money safe if Revolut goes bust

Safeguarding helps protect you. It means if we became insolvent (unable to pay our debts), you'll get your money first. Our customers' claims would be paid out from our dedicated client money bank and asset accounts, before anyone else's claims are paid out.

Is it safe to keep large amounts of money on Revolut : Almost all deposits made by people and businesses with Revolut Bank UAB are protected by the state company Deposit and Investment Insurance. This means, if Revolut Bank UAB can't repay deposited money, the Deposit and Investment Insurance company will repay it to the depositors.

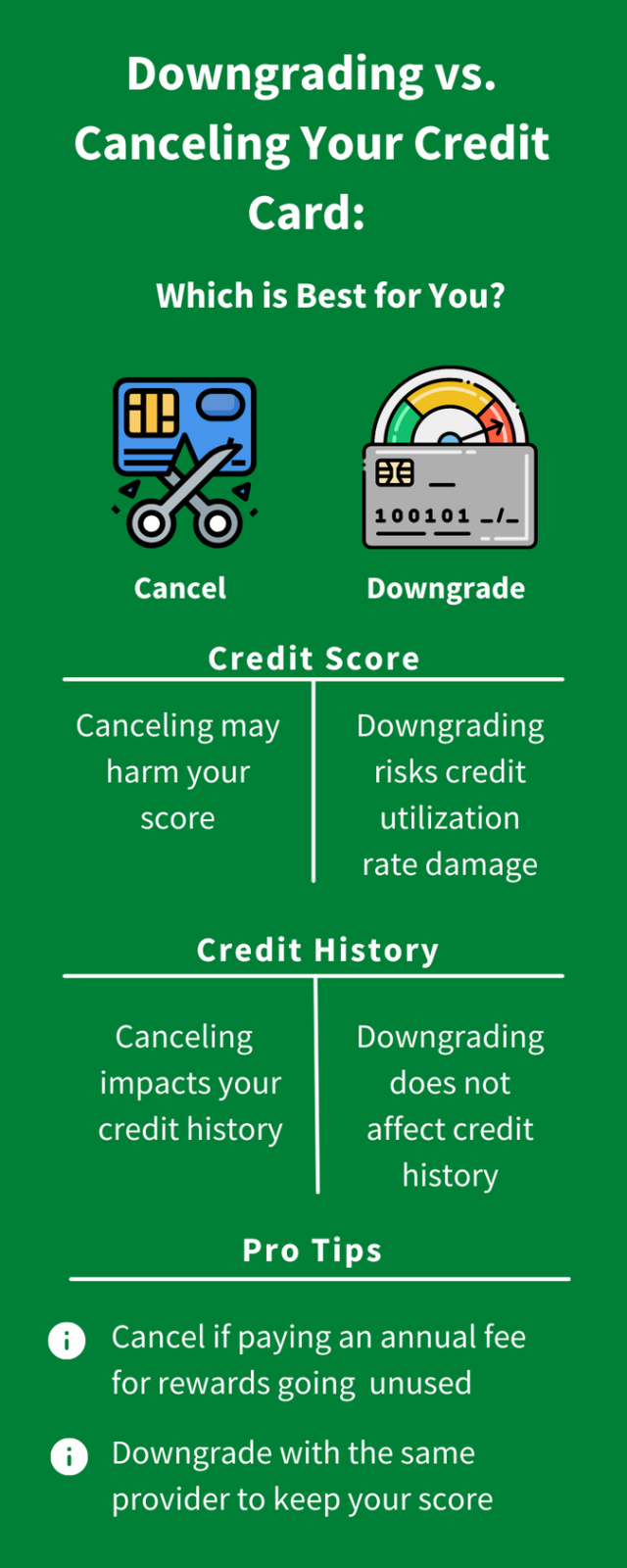

The golden rule of credit card usage is to do everything you can to pay off your entire balance each month. If you can do this, you won't be charged any interest. You'll be enjoying free credit and all the other benefits your card offers. Closing a charge card won't affect your credit history (history is a factor in your overall credit score). Closing a credit card could hurt your credit score by increasing your credit utilization if you don't pay off all your balances.

Is 10 credit cards bad

There is no right number of credit cards — it depends on how many you can manage. Having multiple credit cards helps reduce your utilization rate and provides lenders with more information to better gauge your creditworthiness.To sum things up, the answer is no, it isn't bad to have a zero balance on your credit cards. In fact, having a zero balance or close-to-zero balance on your credit cards can be beneficial in many ways.Nikolay Storonsky (born 21 July 1984) is a Russian-born British businessman. He is the co-founder and CEO of the financial technology company Revolut. When transferring substantial sums from your bank to your Revolut account, check your bank's payment limits for compliance and safety. Notably, funds held in Revolut are FDIC-insured. It provides coverage up to the legal maximum of 250,000 USD.

What if Revolut goes bust : Safeguarding helps protect you. It means if we became insolvent (unable to pay our debts), you'll get your money first. Our customers' claims would be paid out from our dedicated client money bank and asset accounts, before anyone else's claims are paid out.

What is the 2 90 rule for credit cards : 1-in-5 rule: This states that you can only apply for one American Express card every five days. 2-in-90 rule: You can only be approved for up to two American Express cards within a 90 day period.

What is the 15 30 rule for credit cards

You make one payment 15 days before your statement is due and another payment three days before the due date. By doing this, you can lower your overall credit utilization ratio, which can raise your credit score. Keeping a good credit score is important if you want to apply for new credit cards. Canceling a credit card will cause a direct hit to your credit score, so more often than not, you'll want to keep the account open. Correctly managing an open, rarely-used account may require some extra attention, but the added effort will help your credit in the long run.Your credit utilization ratio goes up

By closing a credit card account with zero balance, you're removing all of that card's available balance from the ratio, in turn, increasing your utilization percentage. The higher your balance-to-limit ratio, the more it can hurt your credit.

What is the 5 24 rule : What is the 5/24 rule Many card issuers have criteria for who can qualify for new accounts, but Chase is perhaps the most strict. Chase's 5/24 rule means that you can't be approved for most Chase cards if you've opened five or more personal credit cards (from any card issuer) within the past 24 months.

Antwort Will canceling a credit card hurt? Weitere Antworten – How many credit cards are too many

Owning more than two or three credit cards can become unmanageable for many people. However, your credit needs and financial situation are unique, so there's no hard and fast rule about how many credit cards are too many. The important thing is to make sure that you use your credit cards responsibly.As a regulated financial institution, 100% of your deposits are safeguarded.What is the 5/24 rule Many card issuers have criteria for who can qualify for new accounts, but Chase is perhaps the most strict. Chase's 5/24 rule means that you can't be approved for most Chase cards if you've opened five or more personal credit cards (from any card issuer) within the past 24 months.

Is it OK to have 7 credit cards : How Many Credit Cards Should You Have There's no magic number of credit cards you should have. Know your spending habits and focus on paying on time.

Is my money safe if Revolut goes bust

Safeguarding helps protect you. It means if we became insolvent (unable to pay our debts), you'll get your money first. Our customers' claims would be paid out from our dedicated client money bank and asset accounts, before anyone else's claims are paid out.

Is it safe to keep large amounts of money on Revolut : Almost all deposits made by people and businesses with Revolut Bank UAB are protected by the state company Deposit and Investment Insurance. This means, if Revolut Bank UAB can't repay deposited money, the Deposit and Investment Insurance company will repay it to the depositors.

The golden rule of credit card usage is to do everything you can to pay off your entire balance each month. If you can do this, you won't be charged any interest. You'll be enjoying free credit and all the other benefits your card offers.

Closing a charge card won't affect your credit history (history is a factor in your overall credit score). Closing a credit card could hurt your credit score by increasing your credit utilization if you don't pay off all your balances.

Is 10 credit cards bad

There is no right number of credit cards — it depends on how many you can manage. Having multiple credit cards helps reduce your utilization rate and provides lenders with more information to better gauge your creditworthiness.To sum things up, the answer is no, it isn't bad to have a zero balance on your credit cards. In fact, having a zero balance or close-to-zero balance on your credit cards can be beneficial in many ways.Nikolay Storonsky (born 21 July 1984) is a Russian-born British businessman. He is the co-founder and CEO of the financial technology company Revolut.

When transferring substantial sums from your bank to your Revolut account, check your bank's payment limits for compliance and safety. Notably, funds held in Revolut are FDIC-insured. It provides coverage up to the legal maximum of 250,000 USD.

What if Revolut goes bust : Safeguarding helps protect you. It means if we became insolvent (unable to pay our debts), you'll get your money first. Our customers' claims would be paid out from our dedicated client money bank and asset accounts, before anyone else's claims are paid out.

What is the 2 90 rule for credit cards : 1-in-5 rule: This states that you can only apply for one American Express card every five days. 2-in-90 rule: You can only be approved for up to two American Express cards within a 90 day period.

What is the 15 30 rule for credit cards

You make one payment 15 days before your statement is due and another payment three days before the due date. By doing this, you can lower your overall credit utilization ratio, which can raise your credit score. Keeping a good credit score is important if you want to apply for new credit cards.

Canceling a credit card will cause a direct hit to your credit score, so more often than not, you'll want to keep the account open. Correctly managing an open, rarely-used account may require some extra attention, but the added effort will help your credit in the long run.Your credit utilization ratio goes up

By closing a credit card account with zero balance, you're removing all of that card's available balance from the ratio, in turn, increasing your utilization percentage. The higher your balance-to-limit ratio, the more it can hurt your credit.

What is the 5 24 rule : What is the 5/24 rule Many card issuers have criteria for who can qualify for new accounts, but Chase is perhaps the most strict. Chase's 5/24 rule means that you can't be approved for most Chase cards if you've opened five or more personal credit cards (from any card issuer) within the past 24 months.