A stock market collapse typically occurs when the economy is overheated, inflation is rising, market speculation is rampant, and there is significant uncertainty about the path of an economy.According to the astute observations of our esteemed stock market experts, the ongoing Lok Sabha elections, FIIs' selling, bounce back in the US dollar rates, hawkish US Fed fueling treasury yields, unimpressive Q4 results 2024 season and rising India VIX Index are some of the primary reasons that have been dragging …Stocks suffered their longest losing streak of the year, as geopolitical turmoil rattled Wall Street and investors slashed their bets on the Federal Reserve cutting interest rates any time soon. The S&P 500 fell 0.9 percent on Friday, its sixth consecutive decline, marking its worst run since October 2022.

Why are stock prices decreasing : Financial performance:

On the other hand, if a company's financial performance starts to decline, its share price is likely to decrease. This can happen due to a variety of factors, such as decreased demand for the company's products or services, increased competition, or economic downturns.

When was the last big stock market crash

Table

Name

Date

2015–2016 stock market selloff

18 Aug 2015

2018 cryptocurrency crash

20 Sep 2018

2020 stock market crash

24 Feb 2020

2022 stock market decline

3 Jan 2022

What happens if the stock market goes down : Do I lose all my money if the stock market crashes While your stock holdings will likely take a hit in value during a stock market crash, most stocks generally retain a portion of their value. Each crash is a bit different, and the impact on various stocks and market sectors can vary widely.

Staggering data reveals 90% of retail investors underperform the broader market. Lack of patience and undisciplined trading behaviors cause most losses. Insufficient market knowledge and overconfidence lead to costly mistakes. Your portfolio might lose value, but losing value is different than losing money. When stock prices fall, your investments are not worth as much. But the market will inevitably rebound, and when that happens, stock prices will increase once again — and your portfolio will regain the value it lost.

Will the market correct in 2024

The market sees a greater than 80% chance of at least five rate cuts from current levels by the end of 2024. Investor optimism about the economic outlook has improved dramatically from a year ago, but there's still a risk that Fed policy tightening could tip the economy into a recession in 2024.While there could be a growth slowdown in the first half of 2024, experts believe growth should resume in the second half of the year. Americans faced many financial challenges this year, from persistent inflation to increasingly expensive debt.Hundreds of stocks have broken the buck this year, following a slump in the once-hot market for buzzy startups seeking rapid growth. As of Friday, 557 stocks listed on U.S. exchanges were trading below $1 a share, up from fewer than a dozen in early 2021, according to Dow Jones Market Data. What determines stock prices The price of a stock is largely determined by supply and demand. If demand is high, the price tends to go up, and if supply is high, the price tends to go down.

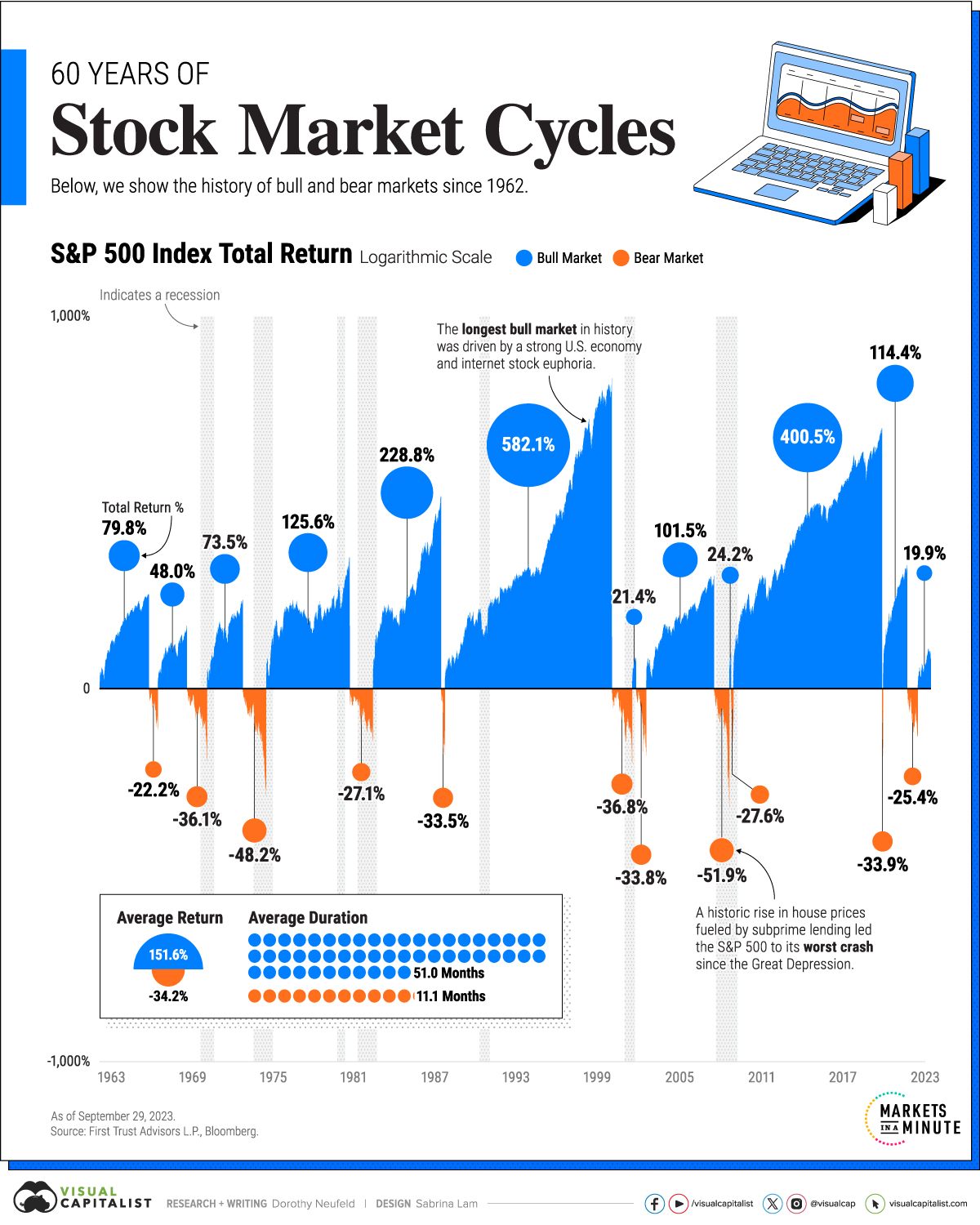

Has the S&P 500 ever lost money : In 2002, the fallout from frenzied investments in internet technology companies and the subsequent implosion of the dot-com bubble caused the S&P 500 to drop 23.4%. And in 2008, the collapse of the U.S. housing market and the subsequent global financial crisis caused the S&P 500 to fall 38.5%.

Can stock market go down to zero : Have any stock markets gone to zero before The answer is yes, although under extraordinary circumstances. Globally, only a few markets have suffered total market loss. The largest and most well known markets that went to zero are Russia in 1917 and China in 1949.

Should I pull my money out of the stock market in 2024

Stay the course

Pulling your money out of the market when stocks are down will only hurt you in the long run. “In this environment, investors should remain fully diversified across multiple asset classes and regions, and in line with one's financial goals and risk tolerance,” Mukherjee said. Another reason why day traders tend to lose money is that it's very different from long-term investing. While traders take advantage of price swings (which means they have to make specific predictions), investors tend to buy a diversified basket of assets for the long haul.According to various studies and reports, between 70% to 90% of retail traders lose money every quarter.

Do 90% of people lose money in the stock market : About 90% of investors lose money trading stocks. That's 9 out of every 10 people — both newbies and seasoned professionals — losing their hard earned dollars by trying to outsmart an unpredictable and extremely volatile machine.

Antwort Why stock market is falling so much? Weitere Antworten – What is the reason for stock market down

A stock market collapse typically occurs when the economy is overheated, inflation is rising, market speculation is rampant, and there is significant uncertainty about the path of an economy.According to the astute observations of our esteemed stock market experts, the ongoing Lok Sabha elections, FIIs' selling, bounce back in the US dollar rates, hawkish US Fed fueling treasury yields, unimpressive Q4 results 2024 season and rising India VIX Index are some of the primary reasons that have been dragging …Stocks suffered their longest losing streak of the year, as geopolitical turmoil rattled Wall Street and investors slashed their bets on the Federal Reserve cutting interest rates any time soon. The S&P 500 fell 0.9 percent on Friday, its sixth consecutive decline, marking its worst run since October 2022.

Why are stock prices decreasing : Financial performance:

On the other hand, if a company's financial performance starts to decline, its share price is likely to decrease. This can happen due to a variety of factors, such as decreased demand for the company's products or services, increased competition, or economic downturns.

When was the last big stock market crash

Table

What happens if the stock market goes down : Do I lose all my money if the stock market crashes While your stock holdings will likely take a hit in value during a stock market crash, most stocks generally retain a portion of their value. Each crash is a bit different, and the impact on various stocks and market sectors can vary widely.

Staggering data reveals 90% of retail investors underperform the broader market. Lack of patience and undisciplined trading behaviors cause most losses. Insufficient market knowledge and overconfidence lead to costly mistakes.

Your portfolio might lose value, but losing value is different than losing money. When stock prices fall, your investments are not worth as much. But the market will inevitably rebound, and when that happens, stock prices will increase once again — and your portfolio will regain the value it lost.

Will the market correct in 2024

The market sees a greater than 80% chance of at least five rate cuts from current levels by the end of 2024. Investor optimism about the economic outlook has improved dramatically from a year ago, but there's still a risk that Fed policy tightening could tip the economy into a recession in 2024.While there could be a growth slowdown in the first half of 2024, experts believe growth should resume in the second half of the year. Americans faced many financial challenges this year, from persistent inflation to increasingly expensive debt.Hundreds of stocks have broken the buck this year, following a slump in the once-hot market for buzzy startups seeking rapid growth. As of Friday, 557 stocks listed on U.S. exchanges were trading below $1 a share, up from fewer than a dozen in early 2021, according to Dow Jones Market Data.

What determines stock prices The price of a stock is largely determined by supply and demand. If demand is high, the price tends to go up, and if supply is high, the price tends to go down.

Has the S&P 500 ever lost money : In 2002, the fallout from frenzied investments in internet technology companies and the subsequent implosion of the dot-com bubble caused the S&P 500 to drop 23.4%. And in 2008, the collapse of the U.S. housing market and the subsequent global financial crisis caused the S&P 500 to fall 38.5%.

Can stock market go down to zero : Have any stock markets gone to zero before The answer is yes, although under extraordinary circumstances. Globally, only a few markets have suffered total market loss. The largest and most well known markets that went to zero are Russia in 1917 and China in 1949.

Should I pull my money out of the stock market in 2024

Stay the course

Pulling your money out of the market when stocks are down will only hurt you in the long run. “In this environment, investors should remain fully diversified across multiple asset classes and regions, and in line with one's financial goals and risk tolerance,” Mukherjee said.

Another reason why day traders tend to lose money is that it's very different from long-term investing. While traders take advantage of price swings (which means they have to make specific predictions), investors tend to buy a diversified basket of assets for the long haul.According to various studies and reports, between 70% to 90% of retail traders lose money every quarter.

Do 90% of people lose money in the stock market : About 90% of investors lose money trading stocks. That's 9 out of every 10 people — both newbies and seasoned professionals — losing their hard earned dollars by trying to outsmart an unpredictable and extremely volatile machine.