Why Investors Choose the S&P 500. Index investing allows individuals to effectively follow the market activity of up to 500 companies with the S&P 500. An index fund or exchange-traded fund (ETF) that benchmarks to the S&P 500 allows investors to gain exposure to all those stocks.Key Points. The S&P 500 has hit 20 intraday highs in 2024. As stocks climb higher many stock valuations may be stretched beyond their intrinsic value. But it's still possible to find great investment opportunities as the stock market hits new all-time highs.The S&P 500 is generally considered one of the most reliable indicators of the overall health and direction of the US stock market. Investors and analysts use the S&P 500 as a benchmark to gauge the performance of their investment portfolios, as well as the general state of the US economy.

Should I put all my money in the S&P 500 : Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky. S&P 500 index funds or ETFs will track the performance of the S&P 500, which means when the S&P 500 does well, your investment will, too. (The opposite is also true, of course.)

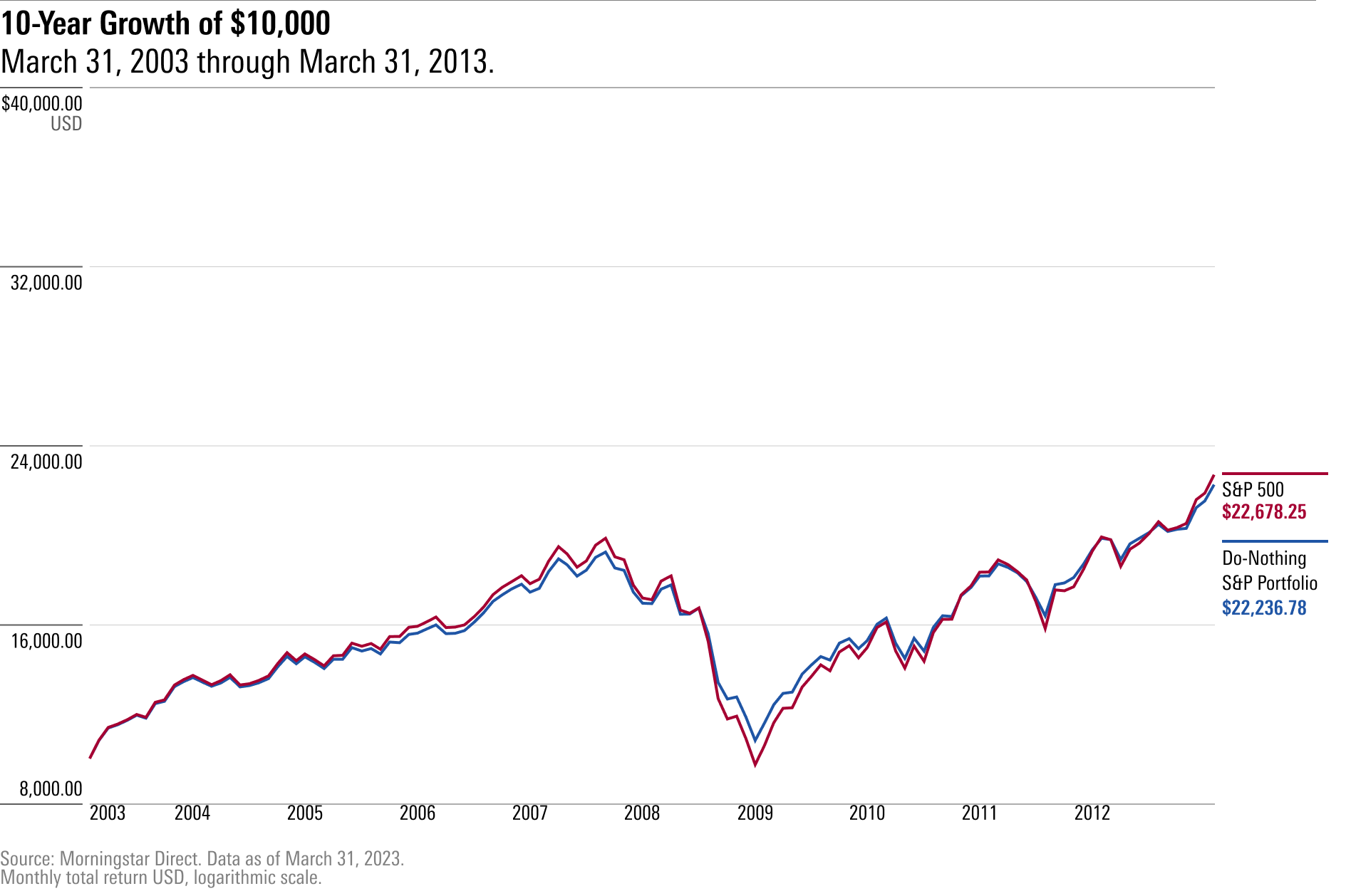

What if I invested $1000 in S&P 500 10 years ago

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

How much will S&P be worth in 10 years : Stock market forecast for the next decade

Year

Price

2027

6200

2028

6725

2029

7300

2030

8900

Used in tandem with our revised EPS forecast of $237, this model anticipates that the S&P 500 will end 2024 at nearly 5,300 and is right in line with our new price target. The S&P 500 is typically regarded as the benchmark for US equities and has produced average annual returns of about 10%, or a bit more than 7%, adjusted for inflation. The S&P 500, a proxy for the US stock market, has historically outperformed many other financial investments.

Why not just invest in S&P 500

The S&P 500 is all US-domiciled companies that over the last ~40 years have accounted for ~50% of all global stocks. By just owning the S&P 500 you miss out on almost half of the global opportunity set which is another ~10,000 public companies.

Invest in Real Estate. If you are looking for a way to turn $15k into $100k, investing in real estate can be a great option.

Invest in the stock market.

Day trading foreign exchange.

Crypto trading.

Loan it out with interest.

Start dropshipping.

Here's how a $500 monthly investment could turn into $1 million

Years Invested

Balance At the End of the Period

10

$102,422

20

$379,684

30

$1,130,244

40

$3,162,040

17. 12. 2023 Assuming an annual return rate of 7%, investing $50,000 for 20 years can lead to a substantial increase in wealth. If you invest the money in a diversified portfolio of stocks, bonds, and other securities, you could potentially earn a return of $159,411.11 after 20 years.

How much will the S&P 500 grow in the next 10 years : Returns in the S&P 500 over the coming decade are more likely to be in the 3%-6% range, as multiples and margins are unlikely to expand, leaving sales growth, buybacks, and dividends as the main drivers of appreciation.

Do most investors beat the S&P 500 : Commonly called the S&P 500, it's one of the most popular benchmarks of the overall U.S. stock market performance. Everybody tries to beat it, but few succeed.

Will the S&P 500 always grow

The S&P 500 has returned 1,800% over the last three decades, compounding at 10.3% annually. That period encompasses enough different market conditions that similar returns are likely over the next three decades. That does not mean the S&P 500 always goes up. There are two approaches you could take. The first is increasing the amount you invest monthly. Bumping up your monthly contributions to $200 would put you over the $1 million mark. The other option would be to try to exceed a 7% annual return with your investments.Most people can live comfortably on $100K a year. If you live in an area with a high cost of living and/or have a large family or very high expenses and/or debt, it may be more difficult to live comfortably on $100K a year. In either case, it is usually not challenging to afford basic living expenses.

How much to invest to make $1 million in 15 years : But in order to be a millionaire via investing in 15 years, you'd only have to invest $43,000 per year (assuming a 6% real rate of return, which accounts for inflation). I know, I know – only $43,000 per year. No big deal. *From this point forward, the average real rate of return we'll be assuming is 6%.

Antwort Why is the S&P the best investment? Weitere Antworten – Why invest in S&P 500

Why Investors Choose the S&P 500. Index investing allows individuals to effectively follow the market activity of up to 500 companies with the S&P 500. An index fund or exchange-traded fund (ETF) that benchmarks to the S&P 500 allows investors to gain exposure to all those stocks.Key Points. The S&P 500 has hit 20 intraday highs in 2024. As stocks climb higher many stock valuations may be stretched beyond their intrinsic value. But it's still possible to find great investment opportunities as the stock market hits new all-time highs.The S&P 500 is generally considered one of the most reliable indicators of the overall health and direction of the US stock market. Investors and analysts use the S&P 500 as a benchmark to gauge the performance of their investment portfolios, as well as the general state of the US economy.

Should I put all my money in the S&P 500 : Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky. S&P 500 index funds or ETFs will track the performance of the S&P 500, which means when the S&P 500 does well, your investment will, too. (The opposite is also true, of course.)

What if I invested $1000 in S&P 500 10 years ago

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

How much will S&P be worth in 10 years : Stock market forecast for the next decade

Used in tandem with our revised EPS forecast of $237, this model anticipates that the S&P 500 will end 2024 at nearly 5,300 and is right in line with our new price target.

The S&P 500 is typically regarded as the benchmark for US equities and has produced average annual returns of about 10%, or a bit more than 7%, adjusted for inflation. The S&P 500, a proxy for the US stock market, has historically outperformed many other financial investments.

Why not just invest in S&P 500

The S&P 500 is all US-domiciled companies that over the last ~40 years have accounted for ~50% of all global stocks. By just owning the S&P 500 you miss out on almost half of the global opportunity set which is another ~10,000 public companies.

Here's how a $500 monthly investment could turn into $1 million

17. 12. 2023

:max_bytes(150000):strip_icc()/sp.asp-final-95a518b3895741c699a73ec763d5e37f.png)

Assuming an annual return rate of 7%, investing $50,000 for 20 years can lead to a substantial increase in wealth. If you invest the money in a diversified portfolio of stocks, bonds, and other securities, you could potentially earn a return of $159,411.11 after 20 years.

How much will the S&P 500 grow in the next 10 years : Returns in the S&P 500 over the coming decade are more likely to be in the 3%-6% range, as multiples and margins are unlikely to expand, leaving sales growth, buybacks, and dividends as the main drivers of appreciation.

Do most investors beat the S&P 500 : Commonly called the S&P 500, it's one of the most popular benchmarks of the overall U.S. stock market performance. Everybody tries to beat it, but few succeed.

Will the S&P 500 always grow

The S&P 500 has returned 1,800% over the last three decades, compounding at 10.3% annually. That period encompasses enough different market conditions that similar returns are likely over the next three decades. That does not mean the S&P 500 always goes up.

There are two approaches you could take. The first is increasing the amount you invest monthly. Bumping up your monthly contributions to $200 would put you over the $1 million mark. The other option would be to try to exceed a 7% annual return with your investments.Most people can live comfortably on $100K a year. If you live in an area with a high cost of living and/or have a large family or very high expenses and/or debt, it may be more difficult to live comfortably on $100K a year. In either case, it is usually not challenging to afford basic living expenses.

How much to invest to make $1 million in 15 years : But in order to be a millionaire via investing in 15 years, you'd only have to invest $43,000 per year (assuming a 6% real rate of return, which accounts for inflation). I know, I know – only $43,000 per year. No big deal. *From this point forward, the average real rate of return we'll be assuming is 6%.