Why Investors Choose the S&P 500. Index investing allows individuals to effectively follow the market activity of up to 500 companies with the S&P 500. An index fund or exchange-traded fund (ETF) that benchmarks to the S&P 500 allows investors to gain exposure to all those stocks.Key Points. The S&P 500 has hit 20 intraday highs in 2024. As stocks climb higher many stock valuations may be stretched beyond their intrinsic value. But it's still possible to find great investment opportunities as the stock market hits new all-time highs.The easiest way to invest in the S&P 500

The simplest way to invest in the index is through S&P 500 index funds or ETFs that replicate the index. You can purchase these in a taxable brokerage account, or if you're investing for retirement, in a 401(k) or IRA, which come with added tax benefits.

Is investing in S&P 500 safe : The S&P 500 is generally considered one of the most reliable indicators of the overall health and direction of the US stock market. Investors and analysts use the S&P 500 as a benchmark to gauge the performance of their investment portfolios, as well as the general state of the US economy.

Why is S&P 500 so popular

The S&P 500 is largely considered an essential benchmark index for the U.S. stock market. Composed of 500 large-cap companies across a breadth of industry sectors, the index captures the pulse of the American corporate economy.

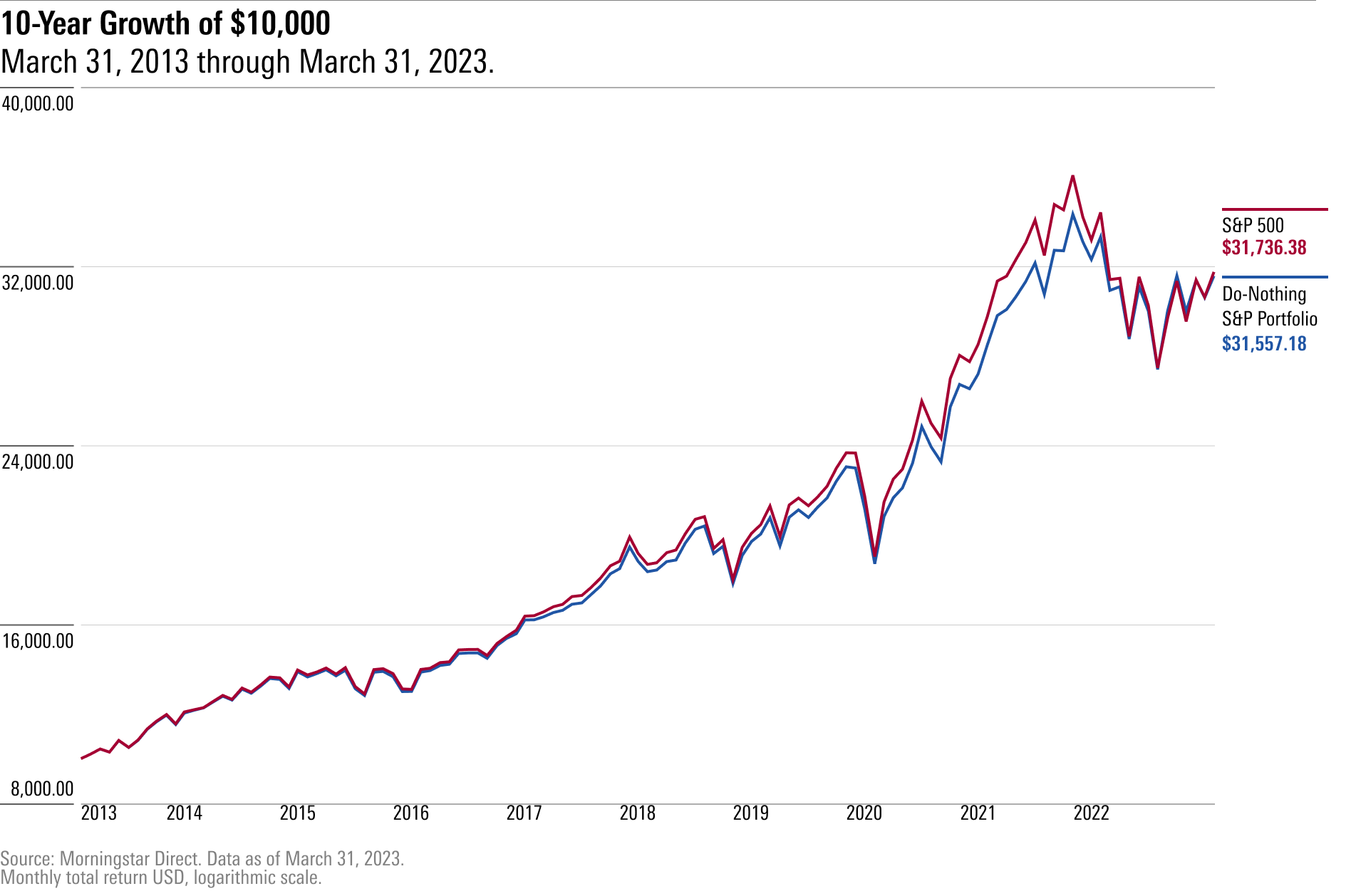

What if I invested $1000 in S&P 500 10 years ago : Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

Used in tandem with our revised EPS forecast of $237, this model anticipates that the S&P 500 will end 2024 at nearly 5,300 and is right in line with our new price target. The S&P 500 topped 5,300 for the first time ever Wednesday, rallying 1% after the Labor Department revealed core inflation fell to its lowest level since April 2021 at 3.6%.

What is a major benefit of owning an S & P 500 index fund

Advantages of Using the S&P 500 as a Benchmark

The key advantage of using the S&P 500 as a benchmark is the wide market breadth of the large-cap companies included in the index. The index can provide a broad view of the economic health of the U.S. because it covers so many companies in so many different sectors.Assuming an average annual return rate of about 10% (a typical historical average), a $10,000 investment in the S&P 500 could potentially grow to approximately $25,937 over 10 years.In 1980, had you invested a mere $1,000 in what went on to become the top-performing stock of S&P 500 (^GSPC 0.09%), then you would be sitting on a cool $1.2 million today. That equates to a total return of 120,936%. The S&P 500—the Standard & Poor's 500 Index—is considered to be one of the best measures of U.S. stock market performance, tracking 500 of the largest and most stable publicly traded companies in the country. The top 25 stocks in the S&P 500 by weight represent the largest, most influential companies in the index.

Why might an investor prefer the S&P 500 over the DJIA : But there is one main distinction between these two indexes: The S&P 500 has 500 of the largest companies, which is why some investors believe it provides a more accurate picture of the economy. The Dow Jones, on the other hand, is composed of 30 blue-chip companies.

How much to invest to make $1,000,000 in 10 years : In order to hit your goal of $1 million in 10 years, SmartAsset's savings calculator estimates that you would need to save around $7,900 per month. This is if you're just putting your money into a high-yield savings account with an average annual percentage yield (APY) of 1.10%.

What happens if you invest $100 000 in the S&P 500

If you take your $100,000 and put it in an S&P 500 index fund, you could end up with over $1 million within 24 years if the index produces returns in line with its historical average. If you keep saving, you can get there even faster. Returns in the S&P 500 over the coming decade are more likely to be in the 3%-6% range, as multiples and margins are unlikely to expand, leaving sales growth, buybacks, and dividends as the main drivers of appreciation.A separate Reuters poll of economists published earlier this week predicted June was the most likely month the Fed would begin cutting. Analysts expect overall S&P 500 earnings to rise 9.5% in 2024 after increasing around 4% in 2023, LSEG data showed.

Is the s&p500 overpriced : The average S&P 500 stock is as overvalued as the 'Magnificent Seven': Goldman. While this doesn't necessarily mean the rally is nearing its end, high valuations typically lead to weaker returns over the months ahead, according to…

Antwort Why is the S&P 500 is such a popular investing strategy? Weitere Antworten – Why invest in S&P 500

Why Investors Choose the S&P 500. Index investing allows individuals to effectively follow the market activity of up to 500 companies with the S&P 500. An index fund or exchange-traded fund (ETF) that benchmarks to the S&P 500 allows investors to gain exposure to all those stocks.Key Points. The S&P 500 has hit 20 intraday highs in 2024. As stocks climb higher many stock valuations may be stretched beyond their intrinsic value. But it's still possible to find great investment opportunities as the stock market hits new all-time highs.The easiest way to invest in the S&P 500

The simplest way to invest in the index is through S&P 500 index funds or ETFs that replicate the index. You can purchase these in a taxable brokerage account, or if you're investing for retirement, in a 401(k) or IRA, which come with added tax benefits.

Is investing in S&P 500 safe : The S&P 500 is generally considered one of the most reliable indicators of the overall health and direction of the US stock market. Investors and analysts use the S&P 500 as a benchmark to gauge the performance of their investment portfolios, as well as the general state of the US economy.

Why is S&P 500 so popular

The S&P 500 is largely considered an essential benchmark index for the U.S. stock market. Composed of 500 large-cap companies across a breadth of industry sectors, the index captures the pulse of the American corporate economy.

What if I invested $1000 in S&P 500 10 years ago : Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

Used in tandem with our revised EPS forecast of $237, this model anticipates that the S&P 500 will end 2024 at nearly 5,300 and is right in line with our new price target.

The S&P 500 topped 5,300 for the first time ever Wednesday, rallying 1% after the Labor Department revealed core inflation fell to its lowest level since April 2021 at 3.6%.

What is a major benefit of owning an S & P 500 index fund

Advantages of Using the S&P 500 as a Benchmark

The key advantage of using the S&P 500 as a benchmark is the wide market breadth of the large-cap companies included in the index. The index can provide a broad view of the economic health of the U.S. because it covers so many companies in so many different sectors.Assuming an average annual return rate of about 10% (a typical historical average), a $10,000 investment in the S&P 500 could potentially grow to approximately $25,937 over 10 years.In 1980, had you invested a mere $1,000 in what went on to become the top-performing stock of S&P 500 (^GSPC 0.09%), then you would be sitting on a cool $1.2 million today. That equates to a total return of 120,936%.

The S&P 500—the Standard & Poor's 500 Index—is considered to be one of the best measures of U.S. stock market performance, tracking 500 of the largest and most stable publicly traded companies in the country. The top 25 stocks in the S&P 500 by weight represent the largest, most influential companies in the index.

Why might an investor prefer the S&P 500 over the DJIA : But there is one main distinction between these two indexes: The S&P 500 has 500 of the largest companies, which is why some investors believe it provides a more accurate picture of the economy. The Dow Jones, on the other hand, is composed of 30 blue-chip companies.

How much to invest to make $1,000,000 in 10 years : In order to hit your goal of $1 million in 10 years, SmartAsset's savings calculator estimates that you would need to save around $7,900 per month. This is if you're just putting your money into a high-yield savings account with an average annual percentage yield (APY) of 1.10%.

What happens if you invest $100 000 in the S&P 500

If you take your $100,000 and put it in an S&P 500 index fund, you could end up with over $1 million within 24 years if the index produces returns in line with its historical average. If you keep saving, you can get there even faster.

Returns in the S&P 500 over the coming decade are more likely to be in the 3%-6% range, as multiples and margins are unlikely to expand, leaving sales growth, buybacks, and dividends as the main drivers of appreciation.A separate Reuters poll of economists published earlier this week predicted June was the most likely month the Fed would begin cutting. Analysts expect overall S&P 500 earnings to rise 9.5% in 2024 after increasing around 4% in 2023, LSEG data showed.

Is the s&p500 overpriced : The average S&P 500 stock is as overvalued as the 'Magnificent Seven': Goldman. While this doesn't necessarily mean the rally is nearing its end, high valuations typically lead to weaker returns over the months ahead, according to…