What Is the Matching Concept in Accounting Matching principle is especially important in the concept of accrual accounting. Matching principle states that business should match related revenues and expenses in the same period. They do this in order to link the costs of an asset or revenue to its benefits.The purpose of the matching principle is to maintain consistency across a business's income statements and balance sheets. Here's how it works: Expenses are recorded on the income statement in the same period that related revenues are earned.A business concern should follow the matching concept primarily to confirm the true profit or loss made during the current accounting year or period. In the same year or period, the business concerned may pay or obtain payments that may or may not relate to the current year.

Why is it important to match costs and revenues in a specific time period : The matching principle requires expenses to be recognized in the period in which the related revenues are earned. Accrued expenses are recognized when incurred, regardless of payment timing. This ensures expenses are matched with revenues generated, providing accurate financial reporting.

What are the pros and cons of matching principle

The main advantage of matching concept is that it allows matching revenue with the expenses to calculate the net profit but it have several disadvantages also the main disadvantage is that sometimes it is very difficult to estimate the actual profit received or benefits received and benefits likely to be received in …

What is an example of matching concept : Example: A textile manufacturer sells clothing worth INR 10 lakhs in July. The cost to manufacture these clothes was INR 6 lakhs. According to the Matching Principle, the INR 6 lakhs cost (COGS) is recognized in July, alongside the revenue, to match the expense with the revenue it generated accurately.

Answer and Explanation: The accounting principle of matching is best demonstrated by: b. Associating effort (expense) with accomplishment (revenue). The matching principle requires any expenses associated with revenue to be recorded in the same period. Going concern is an important principle to determine how a company should reduce its expenses or sell its assets. It helps the company to defer some of the prepaid expenses until the future accounting periods. This will allow the company to efficiently utilize its assets.

What does the matching principle require

The matching principle requires that expenses be recognized: Multiple Choice in the same period in which all the assets are used up. in the same period in which the revenue generated by these expenses is recognized.A matching format offers several advantages. Items are easy to construct and are more efficient than multiple-choice. Items are economical of space and time and are written in a compact form. Questions written as matching items are reasonably free from guessing.Difference Between Accrual and Matching Concept

The accrual concept refers to recording the transactions whenever they are incurred or earned, regardless of actual outflow or inflow of cash. On the other hand, the matching concept specifically focuses on recognition and recording transactions of expenses in business. According to the matching principle, the purchase price of a fixed asset is not related to the accounting period because the benefit derived from its use will be spread over a number of years. Therefore, only depreciation related to the accounting period is considered for determination of profit.

Why is materiality important to auditors : Why is materiality important As the basis for the auditor's opinion, ISAs require auditors to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement. The concept of materiality is therefore fundamental to the audit.

What is an example of a going concern concept : Going Concern Concept Examples:

Let us see some examples of the going concern concept: A company ABC Ltd. makes a specialized chemical and sells it in the market. All of a sudden the government of the country where ABC operates puts a ban on the manufacture, import, export, and sale of this specific chemical.

What is the purpose of accounting concepts

Accounting concepts are essential for understanding and using financial statements. They provide a framework for recording, reporting, and interpreting financial transactions and information in a consistent and uniform manner. This makes financial statements more reliable and useful for decision-making. Questions written as matching items are reasonably free from guessing. Disadvantages of matching items are that they are suitable for measuring association only, and they are susceptible to clues. Good matching items are also difficult to write.Exact matching is the most powerful matching method in that no functional form assumptions are required on either the treatment or outcome model for the method to remove confounding due to the measured covariates; the covariate distributions are exactly balanced.

What is the relationship between the matching concept and accrual accounting : The Matching Principle states the expenses of a company must be recognized in the same period as when the corresponding revenue was “earned.” Per the matching principle, expenses are recognized once the income resulting from the expenses is recognized and “earned” under accrual accounting standards.

Antwort Why is the matching concept important? Weitere Antworten – What is the significance of matching concept

What Is the Matching Concept in Accounting Matching principle is especially important in the concept of accrual accounting. Matching principle states that business should match related revenues and expenses in the same period. They do this in order to link the costs of an asset or revenue to its benefits.The purpose of the matching principle is to maintain consistency across a business's income statements and balance sheets. Here's how it works: Expenses are recorded on the income statement in the same period that related revenues are earned.A business concern should follow the matching concept primarily to confirm the true profit or loss made during the current accounting year or period. In the same year or period, the business concerned may pay or obtain payments that may or may not relate to the current year.

Why is it important to match costs and revenues in a specific time period : The matching principle requires expenses to be recognized in the period in which the related revenues are earned. Accrued expenses are recognized when incurred, regardless of payment timing. This ensures expenses are matched with revenues generated, providing accurate financial reporting.

What are the pros and cons of matching principle

The main advantage of matching concept is that it allows matching revenue with the expenses to calculate the net profit but it have several disadvantages also the main disadvantage is that sometimes it is very difficult to estimate the actual profit received or benefits received and benefits likely to be received in …

What is an example of matching concept : Example: A textile manufacturer sells clothing worth INR 10 lakhs in July. The cost to manufacture these clothes was INR 6 lakhs. According to the Matching Principle, the INR 6 lakhs cost (COGS) is recognized in July, alongside the revenue, to match the expense with the revenue it generated accurately.

Answer and Explanation: The accounting principle of matching is best demonstrated by: b. Associating effort (expense) with accomplishment (revenue). The matching principle requires any expenses associated with revenue to be recorded in the same period.

Going concern is an important principle to determine how a company should reduce its expenses or sell its assets. It helps the company to defer some of the prepaid expenses until the future accounting periods. This will allow the company to efficiently utilize its assets.

What does the matching principle require

The matching principle requires that expenses be recognized: Multiple Choice in the same period in which all the assets are used up. in the same period in which the revenue generated by these expenses is recognized.A matching format offers several advantages. Items are easy to construct and are more efficient than multiple-choice. Items are economical of space and time and are written in a compact form. Questions written as matching items are reasonably free from guessing.Difference Between Accrual and Matching Concept

The accrual concept refers to recording the transactions whenever they are incurred or earned, regardless of actual outflow or inflow of cash. On the other hand, the matching concept specifically focuses on recognition and recording transactions of expenses in business.

According to the matching principle, the purchase price of a fixed asset is not related to the accounting period because the benefit derived from its use will be spread over a number of years. Therefore, only depreciation related to the accounting period is considered for determination of profit.

Why is materiality important to auditors : Why is materiality important As the basis for the auditor's opinion, ISAs require auditors to obtain reasonable assurance about whether the financial statements as a whole are free from material misstatement. The concept of materiality is therefore fundamental to the audit.

What is an example of a going concern concept : Going Concern Concept Examples:

Let us see some examples of the going concern concept: A company ABC Ltd. makes a specialized chemical and sells it in the market. All of a sudden the government of the country where ABC operates puts a ban on the manufacture, import, export, and sale of this specific chemical.

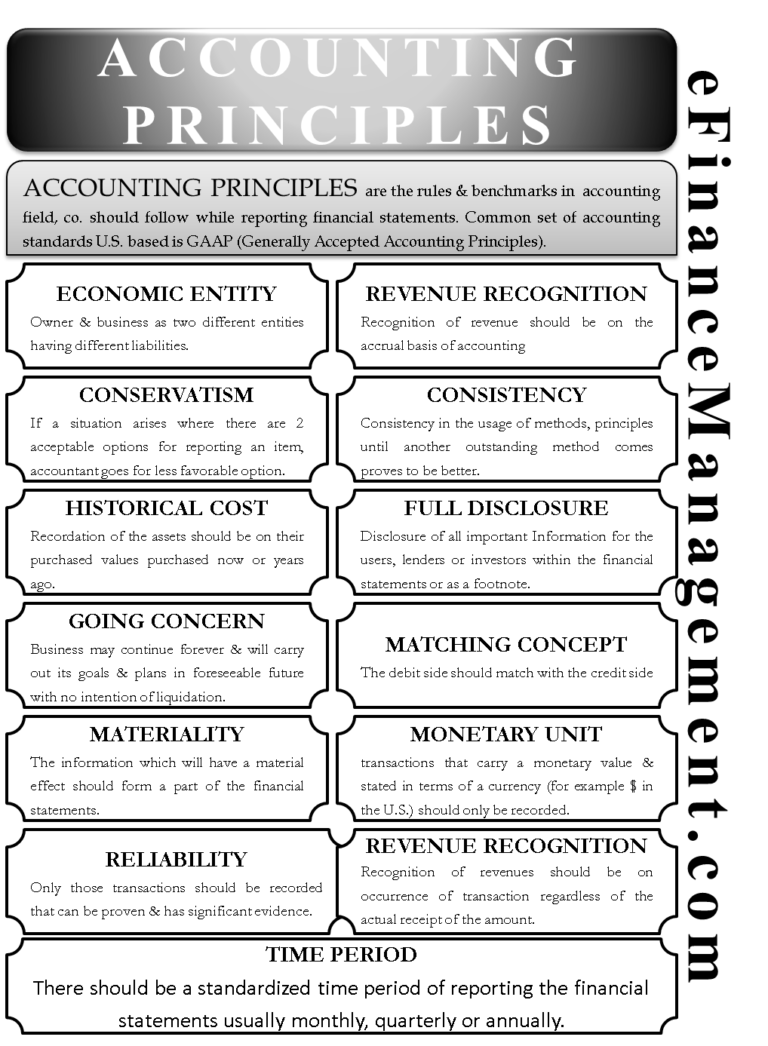

What is the purpose of accounting concepts

Accounting concepts are essential for understanding and using financial statements. They provide a framework for recording, reporting, and interpreting financial transactions and information in a consistent and uniform manner. This makes financial statements more reliable and useful for decision-making.

Questions written as matching items are reasonably free from guessing. Disadvantages of matching items are that they are suitable for measuring association only, and they are susceptible to clues. Good matching items are also difficult to write.Exact matching is the most powerful matching method in that no functional form assumptions are required on either the treatment or outcome model for the method to remove confounding due to the measured covariates; the covariate distributions are exactly balanced.

What is the relationship between the matching concept and accrual accounting : The Matching Principle states the expenses of a company must be recognized in the same period as when the corresponding revenue was “earned.” Per the matching principle, expenses are recognized once the income resulting from the expenses is recognized and “earned” under accrual accounting standards.