In 2023, communications services, information technology and consumer discretionary stocks vastly outpaced the rest of the S&P 500. “What kept driving the markets to new highs were companies that are insensitive to persistently higher interest rates,” says Haworth.The key advantage of using the S&P 500 as a benchmark is the wide market breadth of the large-cap companies included in the index. The index can provide a broad view of the economic health of the U.S. because it covers so many companies in so many different sectors.The S&P 500 is now 20% overvalued based on calculations comparing the stock market with the bond market, says Jack Ablin, chief investment officer at Cresset Capital Management. That's a scary pronouncement as it means a 20% crash is needed just to make the S&P 500 fairly priced.

Why might the S&P500 index be a better measure of stock market performance than the DJIA : For example, in a rising market, there might be instances when investors rotate out of established names into growth stocks that may not be represented in the index. During such periods, the S&P 500, which includes more companies, will have higher gains than the DJIA will.

Will the S&P 500 go up in 2024

As a whole, analysts are optimistic about the outlook for stock prices in 2024. The consensus analyst price target for the S&P 500 is 5,090, suggesting roughly 8.5% upside from current levels.

Is the S&P too concentrated : Goldman Sachs Research found that while investors usually think of elevated concentration as a sign of downside risk, the S&P 500 rallied more often than it declined during the 12 months following past episodes of peak concentration.

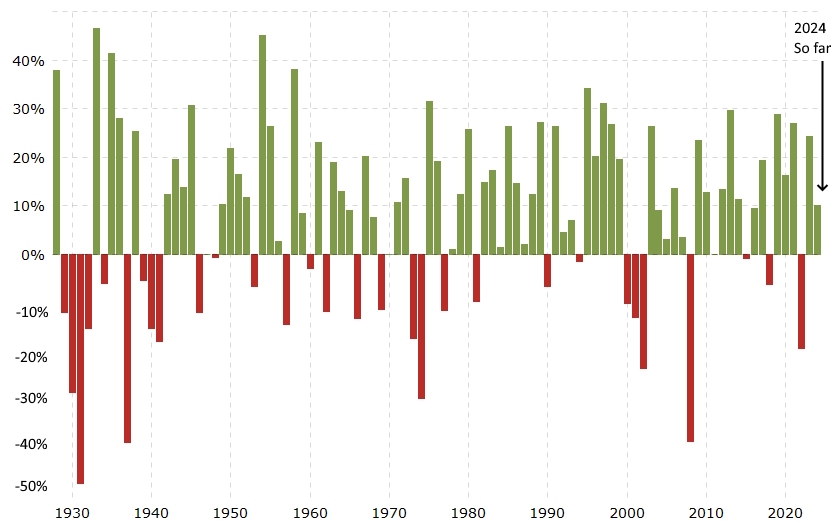

US Stock Market Performance

While the S&P 500 may be “egregiously expensive” versus its historical pricing, Bank of America strategists led by Savita Subramanian recently concluded that stocks are still poised to climb higher. Yet mid-caps have outperformed large- and small-caps, historically: the S&P MidCap 400 has beaten the S&P 500® and the S&P SmallCap 600® by an annualized rate of 2.03% and 0.92%, respectively, since December 1994.

Is it smart to buy S&P 500

The S&P 500 is generally considered one of the most reliable indicators of the overall health and direction of the US stock market. Investors and analysts use the S&P 500 as a benchmark to gauge the performance of their investment portfolios, as well as the general state of the US economy.The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky. S&P 500 index funds or ETFs will track the performance of the S&P 500, which means when the S&P 500 does well, your investment will, too. (The opposite is also true, of course.) Returns in the S&P 500 over the coming decade are more likely to be in the 3%-6% range, as multiples and margins are unlikely to expand, leaving sales growth, buybacks, and dividends as the main drivers of appreciation.

Should I invest in S&P now : Is now a good time to buy index funds If you're buying a stock index fund or almost any broadly diversified stock fund such as one based on the S&P 500, it can be a good time to buy if you're prepared to hold it for the long term.

Should I buy S and P now : The S&P 500 is less than 3% away from its all-time high, making some investors hesitant to buy an index fund. There's no way to time a correction, and even if you buy at the highs, you'll likely do fine over the long run. Dollar-cost averaging could be a far better strategy, no matter what the market is doing.

What is the S&P Capital IQ

What Is S&P Capital IQ S&P Capital IQ is the research division of S&P Global, one of the world's largest providers of ratings, data, research, and the S&P Dow Jones Indices. S&P Capital IQ provides detailed research and analysis of the stock market to a variety of investing stakeholders. In fact, research shows it's actually harder to lose money with the S&P 500 than it is to make money if you keep a long-term outlook. Analysts at Crestmont Research examined the S&P 500's historic performance to determine how often it was able to earn positive returns in a 20-year period.Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds.

Is it possible to beat sp500 : It's not easy to beat the S&P 500. In fact, most hedge funds and mutual funds underperform the S&P 500 over an extended period of time. That's because the S&P 500 selects from a large pool of stocks and continuously refreshes its holdings, dumping underperformers and replacing them with up-and-coming growth stocks.

Antwort Why is S&P so good? Weitere Antworten – Why is the S&P doing so well

A shift in market leadership

In 2023, communications services, information technology and consumer discretionary stocks vastly outpaced the rest of the S&P 500. “What kept driving the markets to new highs were companies that are insensitive to persistently higher interest rates,” says Haworth.The key advantage of using the S&P 500 as a benchmark is the wide market breadth of the large-cap companies included in the index. The index can provide a broad view of the economic health of the U.S. because it covers so many companies in so many different sectors.The S&P 500 is now 20% overvalued based on calculations comparing the stock market with the bond market, says Jack Ablin, chief investment officer at Cresset Capital Management. That's a scary pronouncement as it means a 20% crash is needed just to make the S&P 500 fairly priced.

Why might the S&P500 index be a better measure of stock market performance than the DJIA : For example, in a rising market, there might be instances when investors rotate out of established names into growth stocks that may not be represented in the index. During such periods, the S&P 500, which includes more companies, will have higher gains than the DJIA will.

Will the S&P 500 go up in 2024

As a whole, analysts are optimistic about the outlook for stock prices in 2024. The consensus analyst price target for the S&P 500 is 5,090, suggesting roughly 8.5% upside from current levels.

Is the S&P too concentrated : Goldman Sachs Research found that while investors usually think of elevated concentration as a sign of downside risk, the S&P 500 rallied more often than it declined during the 12 months following past episodes of peak concentration.

US Stock Market Performance

While the S&P 500 may be “egregiously expensive” versus its historical pricing, Bank of America strategists led by Savita Subramanian recently concluded that stocks are still poised to climb higher.

Yet mid-caps have outperformed large- and small-caps, historically: the S&P MidCap 400 has beaten the S&P 500® and the S&P SmallCap 600® by an annualized rate of 2.03% and 0.92%, respectively, since December 1994.

Is it smart to buy S&P 500

The S&P 500 is generally considered one of the most reliable indicators of the overall health and direction of the US stock market. Investors and analysts use the S&P 500 as a benchmark to gauge the performance of their investment portfolios, as well as the general state of the US economy.The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky. S&P 500 index funds or ETFs will track the performance of the S&P 500, which means when the S&P 500 does well, your investment will, too. (The opposite is also true, of course.)

Returns in the S&P 500 over the coming decade are more likely to be in the 3%-6% range, as multiples and margins are unlikely to expand, leaving sales growth, buybacks, and dividends as the main drivers of appreciation.

Should I invest in S&P now : Is now a good time to buy index funds If you're buying a stock index fund or almost any broadly diversified stock fund such as one based on the S&P 500, it can be a good time to buy if you're prepared to hold it for the long term.

Should I buy S and P now : The S&P 500 is less than 3% away from its all-time high, making some investors hesitant to buy an index fund. There's no way to time a correction, and even if you buy at the highs, you'll likely do fine over the long run. Dollar-cost averaging could be a far better strategy, no matter what the market is doing.

What is the S&P Capital IQ

What Is S&P Capital IQ S&P Capital IQ is the research division of S&P Global, one of the world's largest providers of ratings, data, research, and the S&P Dow Jones Indices. S&P Capital IQ provides detailed research and analysis of the stock market to a variety of investing stakeholders.

In fact, research shows it's actually harder to lose money with the S&P 500 than it is to make money if you keep a long-term outlook. Analysts at Crestmont Research examined the S&P 500's historic performance to determine how often it was able to earn positive returns in a 20-year period.Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds.

Is it possible to beat sp500 : It's not easy to beat the S&P 500. In fact, most hedge funds and mutual funds underperform the S&P 500 over an extended period of time. That's because the S&P 500 selects from a large pool of stocks and continuously refreshes its holdings, dumping underperformers and replacing them with up-and-coming growth stocks.