In 1941, Paul Talbot Babson purchased Poor's Publishing and merged it with Standard Statistics to become Standard & Poor's Corp. In 1966, the company was acquired by The McGraw-Hill Companies, extending McGraw-Hill into the field of financial information services.Standard & Poor’s

Standard & Poor's (S&P) is a leading index provider and data source of independent credit ratings. The McGraw-Hill Cos. purchased S&P in 1966, and in 2016, the company became known as S&P Global.S&P Global (formerly Standard & Poor's), which sponsors a number of other market indexes—and also operates one of the “Big Three” credit rating agencies—traces its roots to an investment information service begun in 1860 by Henry Varnum Poor. In 1941, Poor's original company, Poor's Publishing, merged with Standard…

What is Standard and Poor’s 500 index Fund : The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

Is BBB better than BB

Investors should be aware that an agency downgrade of a company's bonds from 'BBB' to 'BB' reclassifies its debt from investment grade to junk status. Although this is merely a one-step drop in credit rating, the repercussions can be severe.

Is BBB+ a good rating : Investors typically group bond ratings into 2 major categories: Investment-grade refers to bonds rated Baa3/BBB- or better. High-yield (also referred to as "non-investment-grade" or "junk" bonds) pertains to bonds rated Ba1/BB+ and lower.

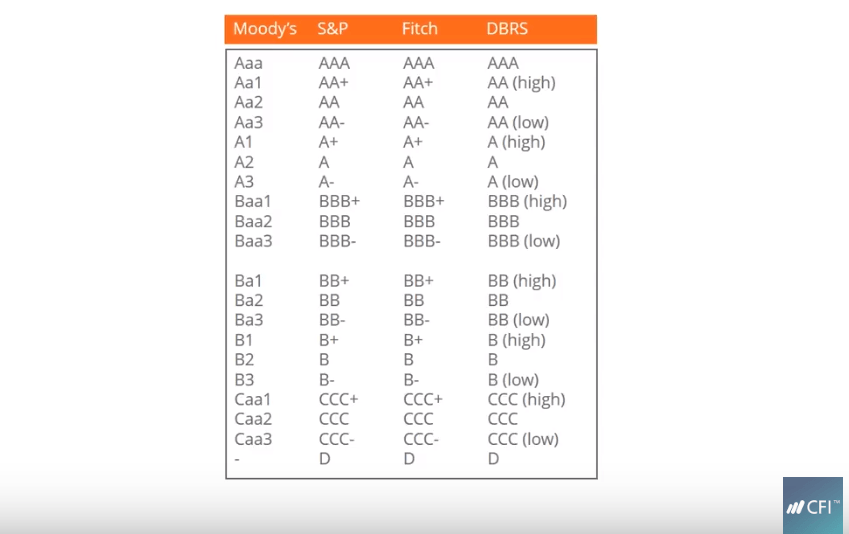

The scale runs from AAA to D and intermediate ratings of (+) or (-) are offered at each level between AA and CCC (for example, BBB+, BBB and BBB-). S&P may also offer guidance (referred to as a credit watch) on whether it is likely to be upgraded (positive), downgraded (negative) or uncertain (neutral). S&P Global Market Intelligence provides high-quality industry data, financial data, news, analysis, and research to its client investors based on the client's portfolio. Its clients include universities, corporations, government agencies, and investment professionals.

How does spgi make money

When a global bond is issued, S&P Ratings earns revenue by charging the issuer to rate the creditworthiness of its bond for investors. A corporate, such as Microsoft, must get a new rating each time they raise capital, including for M&A.In 1941, Poor's Publishing merged with Standard Statistics Company to form Standard & Poor's. On Monday, March 4, 1957, the index was expanded to its current 500 companies and was renamed the S&P 500 Stock Composite Index.While most S&P index funds will have similar holdings, they may vary in terms of their fees, such as expense ratios. Expense ratios are annual fees you pay to help cover a fund's expenses. If you invest in a fund with a 0.25% expense ratio, you'll pay $2.50 annually for every $1,000 invested. Investors typically group bond ratings into 2 major categories: Investment-grade refers to bonds rated Baa3/BBB- or better. High-yield (also referred to as "non-investment-grade" or "junk" bonds) pertains to bonds rated Ba1/BB+ and lower.

Is BBB rating junk : 'bbb' ratings denote good prospects for ongoing viability. The financial institution's fundamentals are adequate, such that there is a low risk that it would have to rely on extraordinary support to avoid default. However, adverse business or economic conditions are more likely to impair this capacity.

Is BBB+ a junk bond : Investment-grade refers to bonds rated Baa3/BBB- or better. High-yield (also referred to as "non-investment-grade" or "junk" bonds) pertains to bonds rated Ba1/BB+ and lower.

What is the difference between BBB and BB+

BBB- Considered lowest investment-grade by market participants. BB+ Considered highest speculative-grade by market participants. BB Less vulnerable in the near-term but faces major ongoing uncertainties to adverse business, financial and economic conditions. The global credit rating industry is highly concentrated, with three leading agencies: Moody's, Standard & Poor's, and Fitch.SPY – Performance Comparison. In the year-to-date period, SPGI achieves a -1.83% return, which is significantly lower than SPY's 9.92% return. Over the past 10 years, SPGI has outperformed SPY with an annualized return of 19.79%, while SPY has yielded a comparatively lower 12.64% annualized return.

Is SPGI a good buy : The highest analyst price target is $530.00 ,the lowest forecast is $446.00. The average price target represents 19.41% Increase from the current price of $415.31. S&P Global's analyst rating consensus is a Strong Buy. This is based on the ratings of 17 Wall Streets Analysts.

Antwort Why is it called standard and poor? Weitere Antworten – Why is it standard and poor

In 1941, Paul Talbot Babson purchased Poor's Publishing and merged it with Standard Statistics to become Standard & Poor's Corp. In 1966, the company was acquired by The McGraw-Hill Companies, extending McGraw-Hill into the field of financial information services.Standard & Poor’s

Standard & Poor's (S&P) is a leading index provider and data source of independent credit ratings. The McGraw-Hill Cos. purchased S&P in 1966, and in 2016, the company became known as S&P Global.S&P Global (formerly Standard & Poor's), which sponsors a number of other market indexes—and also operates one of the “Big Three” credit rating agencies—traces its roots to an investment information service begun in 1860 by Henry Varnum Poor. In 1941, Poor's original company, Poor's Publishing, merged with Standard…

What is Standard and Poor’s 500 index Fund : The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

Is BBB better than BB

Investors should be aware that an agency downgrade of a company's bonds from 'BBB' to 'BB' reclassifies its debt from investment grade to junk status. Although this is merely a one-step drop in credit rating, the repercussions can be severe.

Is BBB+ a good rating : Investors typically group bond ratings into 2 major categories: Investment-grade refers to bonds rated Baa3/BBB- or better. High-yield (also referred to as "non-investment-grade" or "junk" bonds) pertains to bonds rated Ba1/BB+ and lower.

The scale runs from AAA to D and intermediate ratings of (+) or (-) are offered at each level between AA and CCC (for example, BBB+, BBB and BBB-). S&P may also offer guidance (referred to as a credit watch) on whether it is likely to be upgraded (positive), downgraded (negative) or uncertain (neutral).

S&P Global Market Intelligence provides high-quality industry data, financial data, news, analysis, and research to its client investors based on the client's portfolio. Its clients include universities, corporations, government agencies, and investment professionals.

How does spgi make money

When a global bond is issued, S&P Ratings earns revenue by charging the issuer to rate the creditworthiness of its bond for investors. A corporate, such as Microsoft, must get a new rating each time they raise capital, including for M&A.In 1941, Poor's Publishing merged with Standard Statistics Company to form Standard & Poor's. On Monday, March 4, 1957, the index was expanded to its current 500 companies and was renamed the S&P 500 Stock Composite Index.While most S&P index funds will have similar holdings, they may vary in terms of their fees, such as expense ratios. Expense ratios are annual fees you pay to help cover a fund's expenses. If you invest in a fund with a 0.25% expense ratio, you'll pay $2.50 annually for every $1,000 invested.

Investors typically group bond ratings into 2 major categories: Investment-grade refers to bonds rated Baa3/BBB- or better. High-yield (also referred to as "non-investment-grade" or "junk" bonds) pertains to bonds rated Ba1/BB+ and lower.

Is BBB rating junk : 'bbb' ratings denote good prospects for ongoing viability. The financial institution's fundamentals are adequate, such that there is a low risk that it would have to rely on extraordinary support to avoid default. However, adverse business or economic conditions are more likely to impair this capacity.

Is BBB+ a junk bond : Investment-grade refers to bonds rated Baa3/BBB- or better. High-yield (also referred to as "non-investment-grade" or "junk" bonds) pertains to bonds rated Ba1/BB+ and lower.

What is the difference between BBB and BB+

BBB- Considered lowest investment-grade by market participants. BB+ Considered highest speculative-grade by market participants. BB Less vulnerable in the near-term but faces major ongoing uncertainties to adverse business, financial and economic conditions.

The global credit rating industry is highly concentrated, with three leading agencies: Moody's, Standard & Poor's, and Fitch.SPY – Performance Comparison. In the year-to-date period, SPGI achieves a -1.83% return, which is significantly lower than SPY's 9.92% return. Over the past 10 years, SPGI has outperformed SPY with an annualized return of 19.79%, while SPY has yielded a comparatively lower 12.64% annualized return.

Is SPGI a good buy : The highest analyst price target is $530.00 ,the lowest forecast is $446.00. The average price target represents 19.41% Increase from the current price of $415.31. S&P Global's analyst rating consensus is a Strong Buy. This is based on the ratings of 17 Wall Streets Analysts.