The Nasdaq Composite Index is one of the most widely-watched indexes in the world and is often seen as a stand-in for the technology sector, due to its heavy weighting in tech companies.Around 80% of the Nasdaq Composite's index weightings overlap with the Nasdaq-100, while the remaining 20% gives the Nasdaq Composite a differentiating exposure for investors who seek to track other innovative companies beyond the 100 largest.The Nasdaq Composite is a stock market index that consists of the stocks that are listed on the Nasdaq stock exchange. To be included in the index: A stock must be listed exclusively on the Nasdaq market.

What are the rules for Nasdaq Composite : Criteria for Inclusion in the NASDAQ Composite

The security must be among the following types of securities: American Depositary Receipts, ordinary shares, common stock, Share of Beneficial Interest, Real Estate Investment Trusts, Limited Partnership Interests, and tracking stocks.

Should I invest in Nasdaq or S&P 500

So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.

Is it smart to invest in the Nasdaq : Nasdaq currently carries a Zacks Rank #3 (Hold). Year to date, the stock has gained 7.7% compared with the industry's rise of 5.9%. The Zacks Consensus Estimate for 2024 and 2025 earnings has moved 1 cent north each in the past 30 days, reflecting analyst optimism.

In terms of annualized returns, NDX registered 14.3% returns as compared to 9.2% for S&P 500 with an annualized volatility of 23% versus 21%. Overall, the Nasdaq-100 has outperformed 11 out of the last 15 calendar years, and on pace to do so by a wide margin in 2023. Nasdaq 20% Rule: Stockholder Approval Requirements for Securities Offerings | Practical Law. An overview of the so-called Nasdaq 20% rule requiring stockholder approval before a listed company can issue twenty percent or more of its outstanding common stock or voting power.

What is the Nasdaq $1 dollar rule

Under certain circumstances, to ensure that the company can sustain long-term compliance, Nasdaq may require the closing bid price to equal or to exceed the $1.00 minimum bid price requirement for more than 10 consecutive business days before determining that a company complies.The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%. You could have earned a maximum 10-year CAGR return of 21% by investing in Nasdaq 100, while in the case of S&P 500, you could have earned a maximum return of 14% in the past 15 years.The one time it's okay to choose a single investment

That's because your investment gives you access to the broad stock market. Meanwhile, if you only invest in S&P 500 ETFs, you won't beat the broad market. Rather, you can expect your portfolio's performance to be in line with that of the broad market. So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.

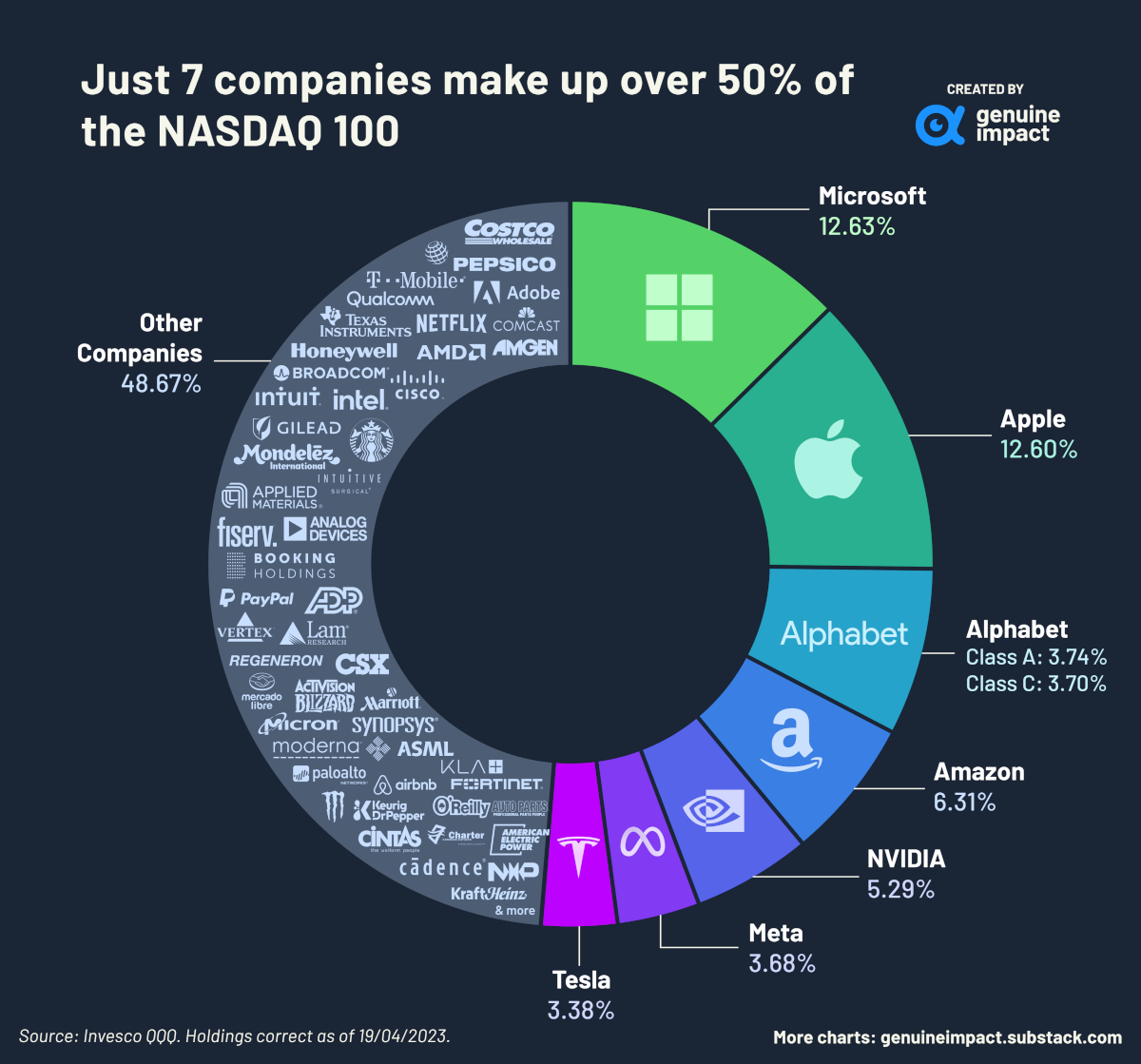

Why do people buy Nasdaq : Here are some of the top reasons that the Nasdaq-100 Index matters to investors. The constituents of the Nasdaq-100 are some of the biggest global brands. Currently, seven of the 10 largest companies in the world in terms of market capitalization are listed on Nasdaq and are a part of NDX.

What is the 10 minute rule for Nasdaq : If the public announcement is made during Nasdaq market hours, the Company must notify MarketWatch at least ten minutes prior to the announcement.

What is the $1 dollar rule for Nasdaq compliance

Under certain circumstances, to ensure that the company can sustain long-term compliance, Nasdaq may require the closing bid price to equal or to exceed the $1.00 minimum bid price requirement for more than 10 consecutive business days before determining that a company complies. A company warned about its shares' minimum bid price must achieve a closing price of $1 or more for 10 consecutive trading days during this period. Report-filing offenders must file the required reports, and then must file subsequent reports by the due dates.Assuming an average annual return rate of about 10% (a typical historical average), a $10,000 investment in the S&P 500 could potentially grow to approximately $25,937 over 10 years.

Should I invest in both Nasdaq and S&P : So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.

Antwort Why invest in Nasdaq Composite? Weitere Antworten – Why is the Nasdaq Composite important

The Nasdaq Composite Index is one of the most widely-watched indexes in the world and is often seen as a stand-in for the technology sector, due to its heavy weighting in tech companies.Around 80% of the Nasdaq Composite's index weightings overlap with the Nasdaq-100, while the remaining 20% gives the Nasdaq Composite a differentiating exposure for investors who seek to track other innovative companies beyond the 100 largest.The Nasdaq Composite is a stock market index that consists of the stocks that are listed on the Nasdaq stock exchange. To be included in the index: A stock must be listed exclusively on the Nasdaq market.

What are the rules for Nasdaq Composite : Criteria for Inclusion in the NASDAQ Composite

The security must be among the following types of securities: American Depositary Receipts, ordinary shares, common stock, Share of Beneficial Interest, Real Estate Investment Trusts, Limited Partnership Interests, and tracking stocks.

Should I invest in Nasdaq or S&P 500

So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.

Is it smart to invest in the Nasdaq : Nasdaq currently carries a Zacks Rank #3 (Hold). Year to date, the stock has gained 7.7% compared with the industry's rise of 5.9%. The Zacks Consensus Estimate for 2024 and 2025 earnings has moved 1 cent north each in the past 30 days, reflecting analyst optimism.

In terms of annualized returns, NDX registered 14.3% returns as compared to 9.2% for S&P 500 with an annualized volatility of 23% versus 21%. Overall, the Nasdaq-100 has outperformed 11 out of the last 15 calendar years, and on pace to do so by a wide margin in 2023.

:max_bytes(150000):strip_icc()/nasdaq-Final-ec04f4f222f449debf78f2bd7de5d603.jpg)

Nasdaq 20% Rule: Stockholder Approval Requirements for Securities Offerings | Practical Law. An overview of the so-called Nasdaq 20% rule requiring stockholder approval before a listed company can issue twenty percent or more of its outstanding common stock or voting power.

What is the Nasdaq $1 dollar rule

Under certain circumstances, to ensure that the company can sustain long-term compliance, Nasdaq may require the closing bid price to equal or to exceed the $1.00 minimum bid price requirement for more than 10 consecutive business days before determining that a company complies.The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%. You could have earned a maximum 10-year CAGR return of 21% by investing in Nasdaq 100, while in the case of S&P 500, you could have earned a maximum return of 14% in the past 15 years.The one time it's okay to choose a single investment

That's because your investment gives you access to the broad stock market. Meanwhile, if you only invest in S&P 500 ETFs, you won't beat the broad market. Rather, you can expect your portfolio's performance to be in line with that of the broad market.

So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.

Why do people buy Nasdaq : Here are some of the top reasons that the Nasdaq-100 Index matters to investors. The constituents of the Nasdaq-100 are some of the biggest global brands. Currently, seven of the 10 largest companies in the world in terms of market capitalization are listed on Nasdaq and are a part of NDX.

What is the 10 minute rule for Nasdaq : If the public announcement is made during Nasdaq market hours, the Company must notify MarketWatch at least ten minutes prior to the announcement.

What is the $1 dollar rule for Nasdaq compliance

Under certain circumstances, to ensure that the company can sustain long-term compliance, Nasdaq may require the closing bid price to equal or to exceed the $1.00 minimum bid price requirement for more than 10 consecutive business days before determining that a company complies.

A company warned about its shares' minimum bid price must achieve a closing price of $1 or more for 10 consecutive trading days during this period. Report-filing offenders must file the required reports, and then must file subsequent reports by the due dates.Assuming an average annual return rate of about 10% (a typical historical average), a $10,000 investment in the S&P 500 could potentially grow to approximately $25,937 over 10 years.

Should I invest in both Nasdaq and S&P : So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.