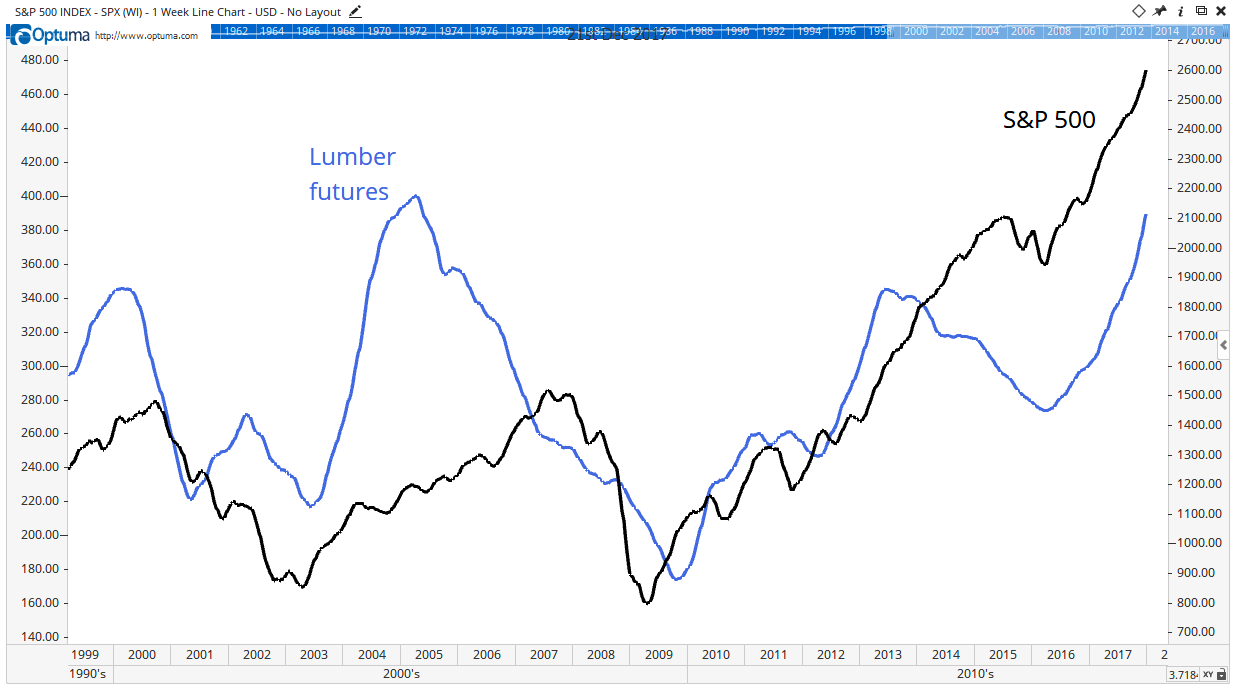

If more people want to buy a stock (demand) than sell it (supply), then the price moves up. Conversely, if more people wanted to sell a stock than buy it, there would be greater supply than demand, and the price would fall. Understanding supply and demand is easy.In general, strong earnings generally result in the stock price moving up (and vice versa). But some companies that are not making that much money still have a rocketing stock price. This rising price reflects investor expectations that the company will be profitable in the future.The rally to new highs has been driven by more balanced leadership. This chart shows the performance of sectors within the S&P 500 since the end of 2023, with Utilities and Technology outperforming industrials and Financials. Source: Bloomberg.

Is it good if the stock market goes up : An up market does not necessarily have a positive impact on all investors. For example, traders who own stocks can benefit when the stock market is up. However, bond traders may lose money because bonds often fall in value when stocks rise.

Will stocks go up in 2024

As a whole, analysts are optimistic about the outlook for stock prices in 2024. The consensus analyst price target for the S&P 500 is 5,090, suggesting roughly 8.5% upside from current levels.

Is 2024 a bull market : Here are some reasons why 2024 is shaping up to be a historic bull market. The 'sell in May and go away' adage says to sell in May and go away thru October. A full 6 months. And then buy back into the market in November and stay in thru April.

Soleno Therapeutics (SLNO)

As I hinted above, Soleno Therapeutics (NASDAQ:SLNO) is the only stock trading on a major exchange that has gained by more than 1000% since the first trading day of 2023. It's the maximum allowable increase or decrease in a company's stock price. The price range for equities might range from 2% to 20%. The stock exchange determines this range after reviewing the share's past price behaviour. The daily price range also considers the previous day's closing price.

How much will the S&P 500 be worth in 2025

That suggests the S&P 500 could trade to 6,000 by August 2025, and to as high as 6,150 by November 2025. But in the short-term, amid the ongoing weakness in stocks, Suttmeier said investors should keep an eye on potential support levels for the S&P 500 at 5,000 as well as a range from 4,600 to 4,800.Based on the stock market's historic performance, there's never necessarily a bad time to buy — as long as you keep a long-term outlook. The market can be volatile in the short term (even in strong economic times), but it has a perfect track record of seeing positive returns over many years.Based on the latest S&P 500 monthly data, the market is overvalued somewhere in the range of 88% to 149%, depending on the indicator, down from last month's 92% to 154%. The S&P 500 is now 20% overvalued based on calculations comparing the stock market with the bond market, says Jack Ablin, chief investment officer at Cresset Capital Management. That's a scary pronouncement as it means a 20% crash is needed just to make the S&P 500 fairly priced.

Should I pull my money out of the stock market in 2024 : Stay the course

Pulling your money out of the market when stocks are down will only hurt you in the long run. “In this environment, investors should remain fully diversified across multiple asset classes and regions, and in line with one's financial goals and risk tolerance,” Mukherjee said.

Will market bounce back in 2024 : Heading into 2024, investors are optimistic the same macroeconomic tailwinds that fueled the stock market's 2023 rally will propel the S&P 500 to new all-time highs in 2024.

How long will this bull market last

The stock market's current bull rally could last for another 5 years, according to tech analyst Gene Munster. Munster said a new crop of AI companies will go public and drive a boom in the stock market. But Munster expects the stock market rally to morph into a bubble that eventually bursts. The research by three U.S. finance professors led by University of Arizona professor Scott Cederberg comes to the surprising conclusion that a portfolio holding 100% stocks and no bonds is best, even for people already in retirement.Can you over-diversify a portfolio Yes. Holding 50 stocks rather than 25 may lower your downside risk somewhat, but it can also reduce your profit potential. And at that point, it may be better to consider investing through an index fund, or even a combination of several sector-based funds.

What is the 11am rule in trading : It is not a hard and fast rule, but rather a guideline that has been observed by many traders over the years. The logic behind this rule is that if the market has not reversed by 11 am EST, it is less likely to experience a significant trend reversal during the remainder of the trading day.

Antwort Why does the stock market keep going up? Weitere Antworten – Why do stock prices keep increasing

If more people want to buy a stock (demand) than sell it (supply), then the price moves up. Conversely, if more people wanted to sell a stock than buy it, there would be greater supply than demand, and the price would fall. Understanding supply and demand is easy.In general, strong earnings generally result in the stock price moving up (and vice versa). But some companies that are not making that much money still have a rocketing stock price. This rising price reflects investor expectations that the company will be profitable in the future.The rally to new highs has been driven by more balanced leadership. This chart shows the performance of sectors within the S&P 500 since the end of 2023, with Utilities and Technology outperforming industrials and Financials. Source: Bloomberg.

Is it good if the stock market goes up : An up market does not necessarily have a positive impact on all investors. For example, traders who own stocks can benefit when the stock market is up. However, bond traders may lose money because bonds often fall in value when stocks rise.

Will stocks go up in 2024

As a whole, analysts are optimistic about the outlook for stock prices in 2024. The consensus analyst price target for the S&P 500 is 5,090, suggesting roughly 8.5% upside from current levels.

Is 2024 a bull market : Here are some reasons why 2024 is shaping up to be a historic bull market. The 'sell in May and go away' adage says to sell in May and go away thru October. A full 6 months. And then buy back into the market in November and stay in thru April.

Soleno Therapeutics (SLNO)

As I hinted above, Soleno Therapeutics (NASDAQ:SLNO) is the only stock trading on a major exchange that has gained by more than 1000% since the first trading day of 2023.

It's the maximum allowable increase or decrease in a company's stock price. The price range for equities might range from 2% to 20%. The stock exchange determines this range after reviewing the share's past price behaviour. The daily price range also considers the previous day's closing price.

How much will the S&P 500 be worth in 2025

That suggests the S&P 500 could trade to 6,000 by August 2025, and to as high as 6,150 by November 2025. But in the short-term, amid the ongoing weakness in stocks, Suttmeier said investors should keep an eye on potential support levels for the S&P 500 at 5,000 as well as a range from 4,600 to 4,800.Based on the stock market's historic performance, there's never necessarily a bad time to buy — as long as you keep a long-term outlook. The market can be volatile in the short term (even in strong economic times), but it has a perfect track record of seeing positive returns over many years.Based on the latest S&P 500 monthly data, the market is overvalued somewhere in the range of 88% to 149%, depending on the indicator, down from last month's 92% to 154%.

The S&P 500 is now 20% overvalued based on calculations comparing the stock market with the bond market, says Jack Ablin, chief investment officer at Cresset Capital Management. That's a scary pronouncement as it means a 20% crash is needed just to make the S&P 500 fairly priced.

Should I pull my money out of the stock market in 2024 : Stay the course

Pulling your money out of the market when stocks are down will only hurt you in the long run. “In this environment, investors should remain fully diversified across multiple asset classes and regions, and in line with one's financial goals and risk tolerance,” Mukherjee said.

Will market bounce back in 2024 : Heading into 2024, investors are optimistic the same macroeconomic tailwinds that fueled the stock market's 2023 rally will propel the S&P 500 to new all-time highs in 2024.

How long will this bull market last

The stock market's current bull rally could last for another 5 years, according to tech analyst Gene Munster. Munster said a new crop of AI companies will go public and drive a boom in the stock market. But Munster expects the stock market rally to morph into a bubble that eventually bursts.

The research by three U.S. finance professors led by University of Arizona professor Scott Cederberg comes to the surprising conclusion that a portfolio holding 100% stocks and no bonds is best, even for people already in retirement.Can you over-diversify a portfolio Yes. Holding 50 stocks rather than 25 may lower your downside risk somewhat, but it can also reduce your profit potential. And at that point, it may be better to consider investing through an index fund, or even a combination of several sector-based funds.

What is the 11am rule in trading : It is not a hard and fast rule, but rather a guideline that has been observed by many traders over the years. The logic behind this rule is that if the market has not reversed by 11 am EST, it is less likely to experience a significant trend reversal during the remainder of the trading day.