Suspected fraud. Lack of use. Suspicious transactions. Disputes with your bank.You can directly approach your bank or its branch and submit a written application, requesting an automatic unblock of the ATM card. To verify your identity as the card's user, you must submit ID and address proof. Once these details are verified, the bank will unblock your card.Large purchases, charges from sellers in foreign countries, or activity that seems unusual may trigger the bank or credit union to lock down your account to avoid fraud.

Why is my debit card restricted : It can happen due to a variety of reasons such as entering the wrong PIN multiple times, expiration, theft, or loss of the card. However, the good news is that unblocking your ATM card is a simple and straightforward process.

Can a bank just block my account

Your bank freezes your account if it considers that your recent activity is suspicious. These measures are taken to prevent money laundering and terrorism. Most companies have nothing to do with terrorists or organized crime, but patterns of behavior or dollar amounts can be automatic red flags.

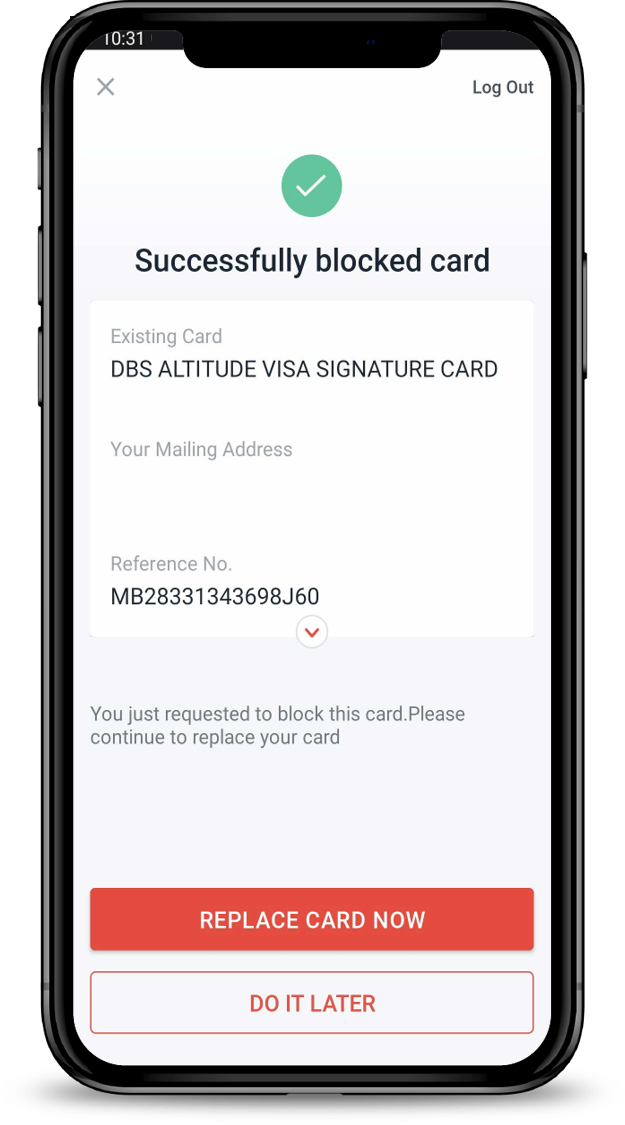

Can banks block debit cards : For most banks, Debit Cards can be blocked via Phone Banking as well. The procedure of how to block Debit Card by Phone Banking is: Call up the bank and authenticate yourself. Authenticate and confirm the Debit Card details.

Depending on the reason for the block, you can unblock your credit card by calling the bank or credit card company and discussing the issue. You may need to go through extra steps such as: Answering security questions to confirm your ID. Negotiating your credit limit. You may want to disable your Bank ATM card for a variety of reasons.

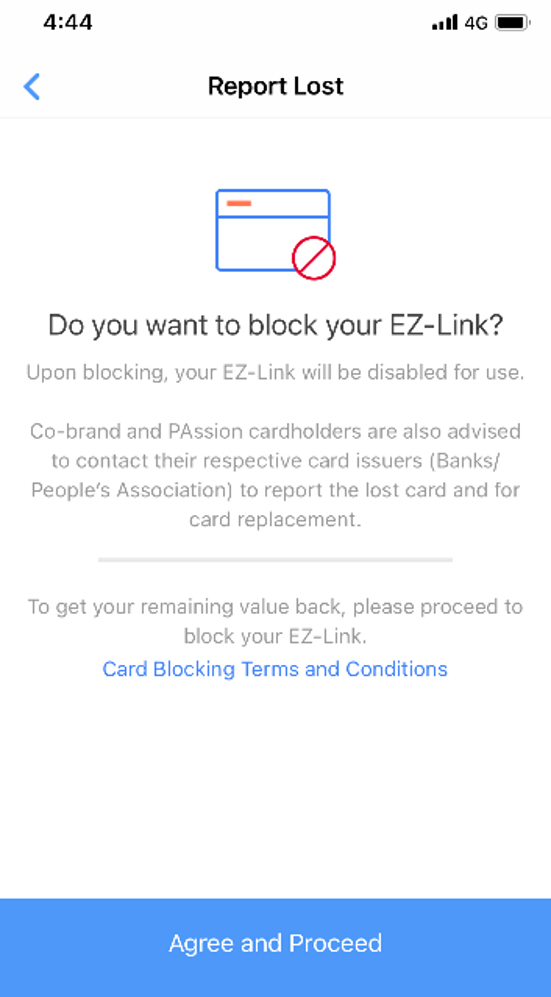

They misplaced their card and wished to avoid any fraudulent transactions.

Their account had been compromised, and they needed to avoid making any illicit transactions until the matter was handled.

How do you fix a locked card

How To Unlock Your Debit Card. Depending on the issuer's policies, you may be able to lock, unlock, and manage cards online via the online platform or app. If your issuer doesn't provide such functionality, you can typically contact customer service, and they'll unlock the card.In order to unblock your card, follow these steps:

Put your card into an ATM. Enter the correct PIN (which you can find in-app) Select 'PIN services' Select 'PIN Unlock'There are several reasons why a debit card may be declined even if you have money in your account. Common reasons include travel and reaching your daily purchase limit. Stay on top of your cards and consider using budgeting apps to help avoid debit card denial. On the other hand, your credit card information could have been compromised, so you'll want to call the issuer as soon as possible to find out the reason for the restriction. From there, a representative should be able to guide you with steps to get your account back in good standing.

How long do banks block you : For simpler situations or misunderstandings, usually, your account is frozen for seven to ten days. Complicated situations may require detailed information from you before the bank decides on the next course of action: to unfreeze or close the account entirely. This decision could take 30 days or more.

Why do banks block transactions : The Bank Finds the Purchase Suspicious

Your bank may block the transaction as part of its fraud protection measures.

Did my bank block my card

There are a couple of ways to find out if your debit card is blocked: Transaction Attempt: Try using your card at an ATM or for an online purchase. If the card is blocked, the transaction will be declined and you'll likely receive an error message. Bank Contact: Reach out to your bank directly. Banks prioritize the safety and security of their customers' funds. If they detect unusual transactions or patterns that raise suspicions of fraud or unauthorized access, they may block the account to prevent further potential losses.If the cardholder mistakenly or purposely has blocked the card, then he / she will have to submit a written application at the nearest bank branch. This must be accompanied by the cardholder's identity proofs so that the card can be unblocked.

What happens if your card is blocked : While a block on a credit card can cause you to bump up against your credit limit and have charges declined, a block on your debit card can cause any payments you're making from your linked bank account to bounce, potentially resulting in late fees and other penalties.

Antwort Why do cards get blocked? Weitere Antworten – Why would a bank block your card

The main reasons accounts get blocked:

Suspected fraud. Lack of use. Suspicious transactions. Disputes with your bank.You can directly approach your bank or its branch and submit a written application, requesting an automatic unblock of the ATM card. To verify your identity as the card's user, you must submit ID and address proof. Once these details are verified, the bank will unblock your card.Large purchases, charges from sellers in foreign countries, or activity that seems unusual may trigger the bank or credit union to lock down your account to avoid fraud.

Why is my debit card restricted : It can happen due to a variety of reasons such as entering the wrong PIN multiple times, expiration, theft, or loss of the card. However, the good news is that unblocking your ATM card is a simple and straightforward process.

Can a bank just block my account

Your bank freezes your account if it considers that your recent activity is suspicious. These measures are taken to prevent money laundering and terrorism. Most companies have nothing to do with terrorists or organized crime, but patterns of behavior or dollar amounts can be automatic red flags.

Can banks block debit cards : For most banks, Debit Cards can be blocked via Phone Banking as well. The procedure of how to block Debit Card by Phone Banking is: Call up the bank and authenticate yourself. Authenticate and confirm the Debit Card details.

Depending on the reason for the block, you can unblock your credit card by calling the bank or credit card company and discussing the issue. You may need to go through extra steps such as: Answering security questions to confirm your ID. Negotiating your credit limit.

You may want to disable your Bank ATM card for a variety of reasons.

How do you fix a locked card

How To Unlock Your Debit Card. Depending on the issuer's policies, you may be able to lock, unlock, and manage cards online via the online platform or app. If your issuer doesn't provide such functionality, you can typically contact customer service, and they'll unlock the card.In order to unblock your card, follow these steps:

Put your card into an ATM. Enter the correct PIN (which you can find in-app) Select 'PIN services' Select 'PIN Unlock'There are several reasons why a debit card may be declined even if you have money in your account. Common reasons include travel and reaching your daily purchase limit. Stay on top of your cards and consider using budgeting apps to help avoid debit card denial.

On the other hand, your credit card information could have been compromised, so you'll want to call the issuer as soon as possible to find out the reason for the restriction. From there, a representative should be able to guide you with steps to get your account back in good standing.

How long do banks block you : For simpler situations or misunderstandings, usually, your account is frozen for seven to ten days. Complicated situations may require detailed information from you before the bank decides on the next course of action: to unfreeze or close the account entirely. This decision could take 30 days or more.

Why do banks block transactions : The Bank Finds the Purchase Suspicious

Your bank may block the transaction as part of its fraud protection measures.

Did my bank block my card

There are a couple of ways to find out if your debit card is blocked: Transaction Attempt: Try using your card at an ATM or for an online purchase. If the card is blocked, the transaction will be declined and you'll likely receive an error message. Bank Contact: Reach out to your bank directly.

Banks prioritize the safety and security of their customers' funds. If they detect unusual transactions or patterns that raise suspicions of fraud or unauthorized access, they may block the account to prevent further potential losses.If the cardholder mistakenly or purposely has blocked the card, then he / she will have to submit a written application at the nearest bank branch. This must be accompanied by the cardholder's identity proofs so that the card can be unblocked.

What happens if your card is blocked : While a block on a credit card can cause you to bump up against your credit limit and have charges declined, a block on your debit card can cause any payments you're making from your linked bank account to bounce, potentially resulting in late fees and other penalties.