A business concern should follow the matching concept primarily to confirm the true profit or loss made during the current accounting year or period. In the same year or period, the business concerned may pay or obtain payments that may or may not relate to the current year.Importance of the Matching Principle

Helps determine the company's financial status by keeping financial statements consistent: The matching principle in accounting aligns expenses and revenues, ensuring consistency in financial statements and preventing misrepresenting of financial results.The purpose of the matching principle is to maintain consistency across a business's income statements and balance sheets. Here's how it works: Expenses are recorded on the income statement in the same period that related revenues are earned.

What are the advantages of matching concept : Matching associated costs to the generated revenue provides a more accurate picture of the profitability of a product line or service than other methods of accounting. The matching principle can also be used to spread accrued interest costs across the expected life of a capital expense.

What are the effects of matching concept

Businesses primarily use the matching concept in accounting to ensure financial statement consistency. For instance, the income statement, balance sheet, and so on. Recognizing expenses at the incorrect time can greatly distort the financial statements. A company's financial position may become inaccurate as a result.

What is an example of matching concept : Example: A textile manufacturer sells clothing worth INR 10 lakhs in July. The cost to manufacture these clothes was INR 6 lakhs. According to the Matching Principle, the INR 6 lakhs cost (COGS) is recognized in July, alongside the revenue, to match the expense with the revenue it generated accurately.

Here is why you should do it in a targeted manner with business matchmaking.

Better planning.

Find interesting contacts.

Simple time management.

Follow up contacts after event.

Structured data acquisition.

Improved preparation.

Control everything through one software.

New monetisation opportunities.

Sorting and matching things helps develop visual perceptual skills, thinking and memory skills. These important brain skills help with attention and problem-solving.

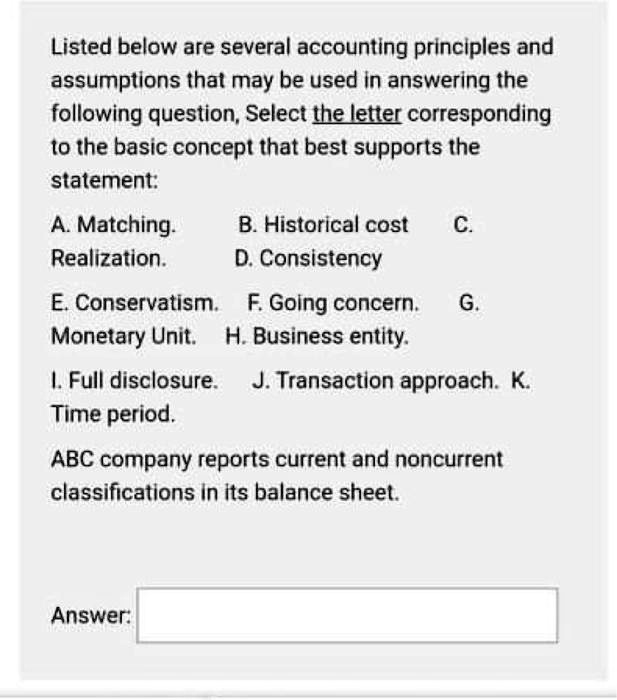

Does the matching principle still apply

Even the tried and true “matching principle” is not quite dead—it still exists as long as its application does not create deferrals on the balance sheet that are inconsistent with the accounting framework's definition of assets or liabilities.Answer and Explanation: The accounting principle of matching is best demonstrated by: b. Associating effort (expense) with accomplishment (revenue). The matching principle requires any expenses associated with revenue to be recorded in the same period.Businesses primarily use the matching concept in accounting to ensure financial statement consistency. For instance, the income statement, balance sheet, and so on. Recognizing expenses at the incorrect time can greatly distort the financial statements. A company's financial position may become inaccurate as a result. Matching principle limitations

There are some limitations to this concept, including the following: More challenging when there is no direct cause-and-effect relationship between revenues and expenses. Doesn't work as well when related revenue is spread out over time, as with marketing or advertising costs.

What does the matching concept determine : What is the Matching Principle The matching principle is an accounting concept that dictates that companies report expenses at the same time as the revenues they are related to. Revenues and expenses are matched on the income statement for a period of time (e.g., a year, quarter, or month).

What is the difference between accrual concept and matching concept : Difference Between Accrual and Matching Concept

The accrual concept refers to recording the transactions whenever they are incurred or earned, regardless of actual outflow or inflow of cash. On the other hand, the matching concept specifically focuses on recognition and recording transactions of expenses in business.

What is the objective of business matching

In business matchmaking, companies are able to meet, network with and ultimately partner with other firms in order to meet strategic objectives. The practice is becoming more popular in an increasingly borderless world where businesses must expand into new markets and territories. Improved competitiveness: Product matching enables companies to evaluate their competitors and identify trends in the market. This information can be used to make informed decisions about product pricing and promotions, helping companies stay ahead of the competition.The main purpose of matching is to increase study efficiency for data collection and subsequent statistical analysis.

What is the aim of matching : Some typical goals for matching include the following ones: Identifying duplicate records for entities such as individuals, companies, suppliers, products, or events. Grouping records with the same or similar values, such as householding. Enriching existing data with new attributes from external sources.

Antwort Why business should follow matching concept? Weitere Antworten – Why should business concerns follow the matching concept

A business concern should follow the matching concept primarily to confirm the true profit or loss made during the current accounting year or period. In the same year or period, the business concerned may pay or obtain payments that may or may not relate to the current year.Importance of the Matching Principle

Helps determine the company's financial status by keeping financial statements consistent: The matching principle in accounting aligns expenses and revenues, ensuring consistency in financial statements and preventing misrepresenting of financial results.The purpose of the matching principle is to maintain consistency across a business's income statements and balance sheets. Here's how it works: Expenses are recorded on the income statement in the same period that related revenues are earned.

What are the advantages of matching concept : Matching associated costs to the generated revenue provides a more accurate picture of the profitability of a product line or service than other methods of accounting. The matching principle can also be used to spread accrued interest costs across the expected life of a capital expense.

What are the effects of matching concept

Businesses primarily use the matching concept in accounting to ensure financial statement consistency. For instance, the income statement, balance sheet, and so on. Recognizing expenses at the incorrect time can greatly distort the financial statements. A company's financial position may become inaccurate as a result.

What is an example of matching concept : Example: A textile manufacturer sells clothing worth INR 10 lakhs in July. The cost to manufacture these clothes was INR 6 lakhs. According to the Matching Principle, the INR 6 lakhs cost (COGS) is recognized in July, alongside the revenue, to match the expense with the revenue it generated accurately.

Here is why you should do it in a targeted manner with business matchmaking.

Sorting and matching things helps develop visual perceptual skills, thinking and memory skills. These important brain skills help with attention and problem-solving.

Does the matching principle still apply

Even the tried and true “matching principle” is not quite dead—it still exists as long as its application does not create deferrals on the balance sheet that are inconsistent with the accounting framework's definition of assets or liabilities.Answer and Explanation: The accounting principle of matching is best demonstrated by: b. Associating effort (expense) with accomplishment (revenue). The matching principle requires any expenses associated with revenue to be recorded in the same period.Businesses primarily use the matching concept in accounting to ensure financial statement consistency. For instance, the income statement, balance sheet, and so on. Recognizing expenses at the incorrect time can greatly distort the financial statements. A company's financial position may become inaccurate as a result.

Matching principle limitations

There are some limitations to this concept, including the following: More challenging when there is no direct cause-and-effect relationship between revenues and expenses. Doesn't work as well when related revenue is spread out over time, as with marketing or advertising costs.

What does the matching concept determine : What is the Matching Principle The matching principle is an accounting concept that dictates that companies report expenses at the same time as the revenues they are related to. Revenues and expenses are matched on the income statement for a period of time (e.g., a year, quarter, or month).

What is the difference between accrual concept and matching concept : Difference Between Accrual and Matching Concept

The accrual concept refers to recording the transactions whenever they are incurred or earned, regardless of actual outflow or inflow of cash. On the other hand, the matching concept specifically focuses on recognition and recording transactions of expenses in business.

What is the objective of business matching

In business matchmaking, companies are able to meet, network with and ultimately partner with other firms in order to meet strategic objectives. The practice is becoming more popular in an increasingly borderless world where businesses must expand into new markets and territories.

Improved competitiveness: Product matching enables companies to evaluate their competitors and identify trends in the market. This information can be used to make informed decisions about product pricing and promotions, helping companies stay ahead of the competition.The main purpose of matching is to increase study efficiency for data collection and subsequent statistical analysis.

What is the aim of matching : Some typical goals for matching include the following ones: Identifying duplicate records for entities such as individuals, companies, suppliers, products, or events. Grouping records with the same or similar values, such as householding. Enriching existing data with new attributes from external sources.