The current decline in lithium prices can be primarily attributed to the slowing growth of electric vehicle sales in China. This is coupled with the broader slowdown in the Chinese economy. As demand remains sluggish at previous pricing levels and supply surpasses demand, prices have inevitably fallen.Goldman Sachs' forecast and market dynamics

They estimated the lithium market would return to a deficit in 2024; but now the analysts say it could take longer. Goldman Sachs analysts now see the lithium market bottoming out in 2025.“Investment opportunities in lithium stocks, particularly ASX lithium stocks, are promising.” “Experts predict a lithium price recovery, averaging around $45,000 per metric ton from 2023 to 2030, aligning with the expected demand surge.”

What is the price of lithium in 2024 : Arcadium Lithium's (NYSE:ALTM) prices of more than $20,000 per metric ton for its lithium carbonate and hydroxide sales. Barron's believes that lithium prices will begin to stabilize soon. It also reported that the metal's price had climbed 15% in 2024, reaching the highest level since December.

Will lithium stocks recover

Given these forecasts, although there are some near-term headwinds, the industry is poised for a recovery in 2024 as several key projects come online. Investors must understand the dangers, though, if they choose to participate in the market. Growth is the key factor that astute investors must monitor.

Will lithium go up again : Lithium prices are not expected to rebound to the euphoric levels observed in late 2022, at any time between now and the end of 2029, according to the Department of Industry and Resources. In 2023, a rush of investment in lithium production followed the high prices of 2022, driving a significant global supply surge.

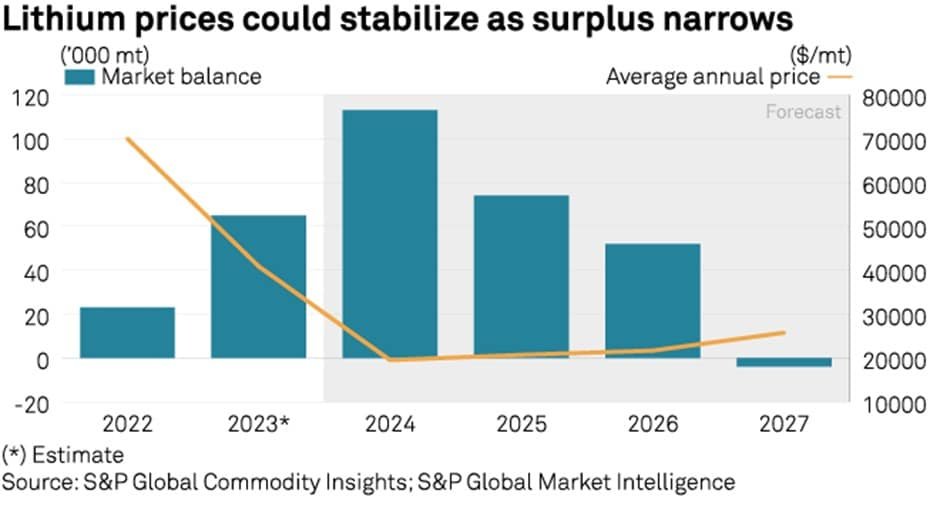

Lithium prices are not expected to rebound to the euphoric levels observed in late 2022, at any time between now and the end of 2029, according to the Department of Industry and Resources. In 2023, a rush of investment in lithium production followed the high prices of 2022, driving a significant global supply surge. Prices have bottomed out but have struggled to meaningfully rebound, partly because miners, refiners and carmakers are still working through a mound of surplus stock clogging up the supply chain.

Is lithium the next boom

The decision to invest in the lithium industry begins with one compelling data point: Global battery cell demand for lithium will soar nearly seven-fold by 2030, according to McKinsey Battery Insights.Despite a recent sector downturn, lithium stocks are still in charging mode for 2024. April 3, 2024, at 3:45 p.m. Lithium batteries make up the underside of many EVs and power their electric motors.Fastmarkets forecasted at the end of January that global lithium supply would further increase by 30% in 2024, although the company noted that if more companies reduce production, this increase may be lower. Lithium Americas Corp. currently has an average brokerage recommendation (ABR) of 1.57, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by seven brokerage firms. An ABR of 1.57 approximates between Strong Buy and Buy.

Will lithium stocks go up : He continues: “Our bullish view comes from two key factors. First, we think market sentiment is extremely negative on the direction of lithium prices. We forecast prices will rise in 2024 and average around $25,000 per metric ton from 2024 through 2030.

Will lithium ever recover : Lithium prices are not expected to rebound to the euphoric levels observed in late 2022, at any time between now and the end of 2029, according to the Department of Industry and Resources.

Will lithium stock recover

After rising manyfold in 2022, the increasing stocks of the precious metal are leading to depressed prices, which has had a knock-on effect on lithium stocks. However, the long-term outlook of lithium stocks remains strong due to the strong uptick in demand for electric vehicles. Lithium supply response charges ahead of demand

Looking forward to 2024, we are now in a situation where some new supply is being ramped up while some high-cost production is being cut. Fastmarkets expects lithium supply to increase by 30% in 2024.While many analysts and miners still expect prices to rebound substantially over the next few years as demand gathers pace, a faster flow of supply from a more diverse global mining base could mean the next boom-and-bust cycle will be shorter and less extreme — perhaps pointing to a maturing market.

Antwort Why are lithium stocks down? Weitere Antworten – Why is the lithium price falling

The current decline in lithium prices can be primarily attributed to the slowing growth of electric vehicle sales in China. This is coupled with the broader slowdown in the Chinese economy. As demand remains sluggish at previous pricing levels and supply surpasses demand, prices have inevitably fallen.Goldman Sachs' forecast and market dynamics

They estimated the lithium market would return to a deficit in 2024; but now the analysts say it could take longer. Goldman Sachs analysts now see the lithium market bottoming out in 2025.“Investment opportunities in lithium stocks, particularly ASX lithium stocks, are promising.” “Experts predict a lithium price recovery, averaging around $45,000 per metric ton from 2023 to 2030, aligning with the expected demand surge.”

What is the price of lithium in 2024 : Arcadium Lithium's (NYSE:ALTM) prices of more than $20,000 per metric ton for its lithium carbonate and hydroxide sales. Barron's believes that lithium prices will begin to stabilize soon. It also reported that the metal's price had climbed 15% in 2024, reaching the highest level since December.

Will lithium stocks recover

Given these forecasts, although there are some near-term headwinds, the industry is poised for a recovery in 2024 as several key projects come online. Investors must understand the dangers, though, if they choose to participate in the market. Growth is the key factor that astute investors must monitor.

Will lithium go up again : Lithium prices are not expected to rebound to the euphoric levels observed in late 2022, at any time between now and the end of 2029, according to the Department of Industry and Resources. In 2023, a rush of investment in lithium production followed the high prices of 2022, driving a significant global supply surge.

Lithium prices are not expected to rebound to the euphoric levels observed in late 2022, at any time between now and the end of 2029, according to the Department of Industry and Resources. In 2023, a rush of investment in lithium production followed the high prices of 2022, driving a significant global supply surge.

Prices have bottomed out but have struggled to meaningfully rebound, partly because miners, refiners and carmakers are still working through a mound of surplus stock clogging up the supply chain.

Is lithium the next boom

The decision to invest in the lithium industry begins with one compelling data point: Global battery cell demand for lithium will soar nearly seven-fold by 2030, according to McKinsey Battery Insights.Despite a recent sector downturn, lithium stocks are still in charging mode for 2024. April 3, 2024, at 3:45 p.m. Lithium batteries make up the underside of many EVs and power their electric motors.Fastmarkets forecasted at the end of January that global lithium supply would further increase by 30% in 2024, although the company noted that if more companies reduce production, this increase may be lower.

Lithium Americas Corp. currently has an average brokerage recommendation (ABR) of 1.57, on a scale of 1 to 5 (Strong Buy to Strong Sell), calculated based on the actual recommendations (Buy, Hold, Sell, etc.) made by seven brokerage firms. An ABR of 1.57 approximates between Strong Buy and Buy.

Will lithium stocks go up : He continues: “Our bullish view comes from two key factors. First, we think market sentiment is extremely negative on the direction of lithium prices. We forecast prices will rise in 2024 and average around $25,000 per metric ton from 2024 through 2030.

Will lithium ever recover : Lithium prices are not expected to rebound to the euphoric levels observed in late 2022, at any time between now and the end of 2029, according to the Department of Industry and Resources.

Will lithium stock recover

After rising manyfold in 2022, the increasing stocks of the precious metal are leading to depressed prices, which has had a knock-on effect on lithium stocks. However, the long-term outlook of lithium stocks remains strong due to the strong uptick in demand for electric vehicles.

Lithium supply response charges ahead of demand

Looking forward to 2024, we are now in a situation where some new supply is being ramped up while some high-cost production is being cut. Fastmarkets expects lithium supply to increase by 30% in 2024.While many analysts and miners still expect prices to rebound substantially over the next few years as demand gathers pace, a faster flow of supply from a more diverse global mining base could mean the next boom-and-bust cycle will be shorter and less extreme — perhaps pointing to a maturing market.