What is the Criteria for Inclusion in the S&P 500 Index

Minimum Market Capitalization of $8.2 billion.

Structured as Corporation Based in the U.S. with Common Stock in Capitalization.

Listed on an Eligible U.S. Exchange (e.g. NYSE, NASDAQ)

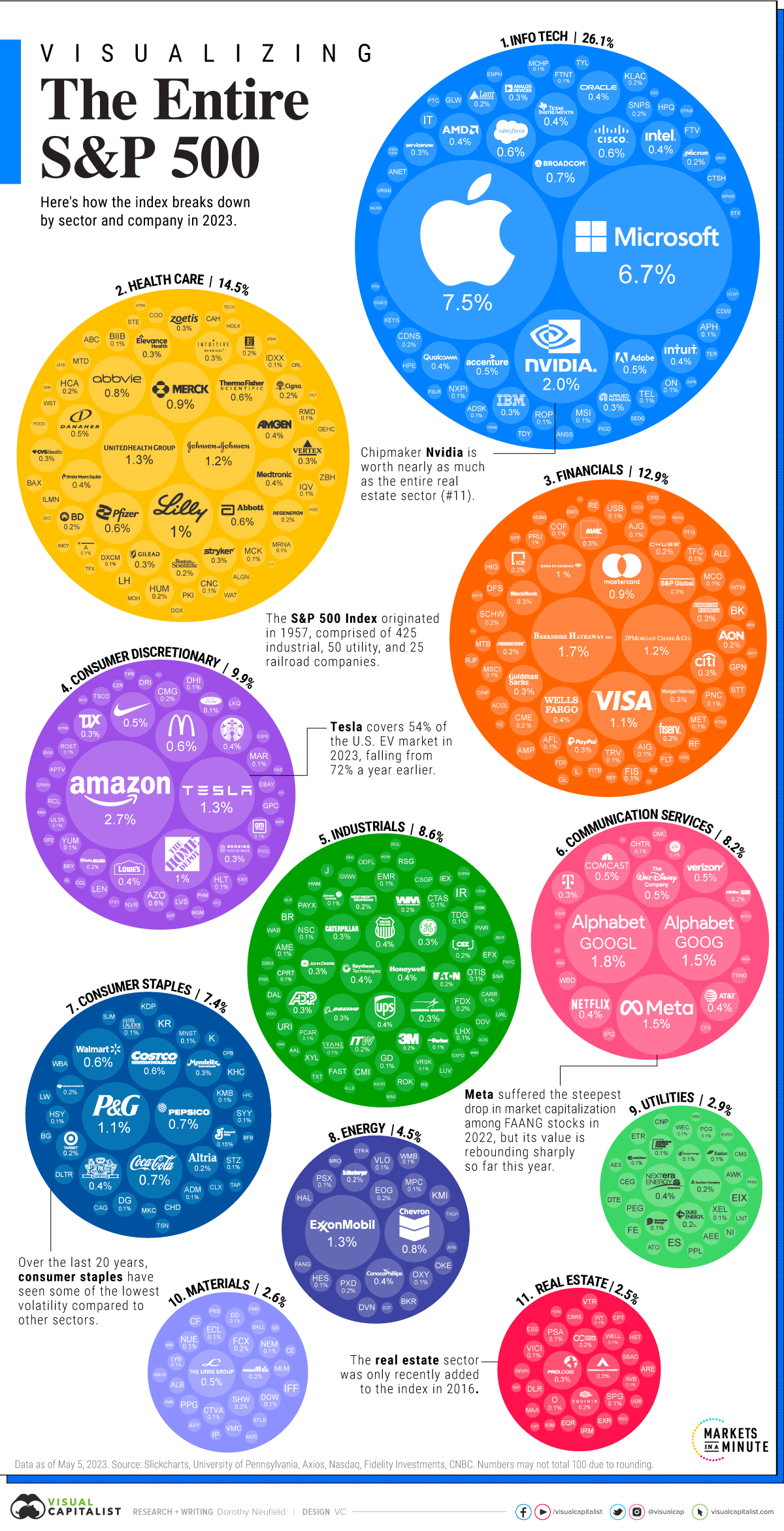

S&P 500 companies by weight

Key points. The S&P 500 index is often used as a proxy for the broader U.S. stock market.

Microsoft (MSFT) Index weight: 7.09%

Apple (AAPL) Index weight: 5.65%

Nvidia Corp. (NVDA)

Amazon.com Inc (AMZN)

Meta Platforms Class A (META)

Alphabet Class A (GOOGL)

Berkshire Hathaway Class B (BRK.B)

The S&P 500's value is calculated by multiplying the market capitalization of each constituent company by the total number of shares outstanding. Market cap equals each company's share price multiplied by the total number of its shares outstanding. Shares outstanding are the stock that is held by shareholders.

What is the S&P 500 classified as : The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).

How is the S&P 500 chosen

The selection process for the S&P 500 is governed by quantitative criteria—including financial viability, public float, adequate liquidity, and company type—that determine whether a security is eligible for inclusion.

Can anyone invest in S&P 500 : The S&P 500 is a stock market index composed of about 500 publicly traded companies. You cannot directly invest in the index itself. You can buy individual stocks of companies in the S&P 500, or buy an S&P 500 index fund or ETF. Index funds typically carry less risk than individual stocks.

The selection process for the S&P 500 is governed by quantitative criteria—including financial viability, public float, adequate liquidity, and company type—that determine whether a security is eligible for inclusion.

10 Smallest Companies in the S&P500 Index. Business & Books. ·

495. Comerica Inc. ($CMA)

496. Mohawk Industries Inc. ($MHK)

497. Organon & Co ($OGN) Sector: Healthcare.

498. Ralph Lauren Corp ($RL) Sector: Consumer Cyclical.

499. Zions Bancorp ($ZION)

500. Fox Corp Class B ($FOX)

501. Lincoln National Corp ($LNC)

How is the S&P 500 selected

The selection process for the S&P 500 is governed by quantitative criteria—including financial viability, public float, adequate liquidity, and company type—that determine whether a security is eligible for inclusion.There are never any guarantees when investing, but an S&P 500 index fund is about as close as you can get to guaranteed positive long-term returns. In fact, analysts at Crestmont Research examined the S&P 500's rolling 20-year total returns to find out how many of those periods resulted in positive total gains.The S&P 500 is a stock market index that measures the performance of about 500 companies in the U.S. It includes companies across 11 sectors to offer a picture of the health of the U.S. stock market and the broader economy. The S&P 1500, or S&P Composite 1500 Index, is a stock market index of US stocks made by Standard & Poor's. It includes all stocks in the S&P 500, S&P 400, and S&P 600. This index covers approximately 90% of the market capitalization of U.S. stocks and is a broad measure of the U.S. equity market.

How do they pick stocks for the S&P 500 : The S&P 500 contains 505 common stocks (in some cases, companies have issued more than one class of shares) selected based on market capitalization, or the total value of a company's shares outstanding.

How to become a millionaire with the S&P 500 : Over its history, the S&P 500 has generated an average annual return of 9%, including re-invested dividends. At that rate, even a middle-class income is enough to become a millionaire over time. $500 a month, for example, is less than 10% of the median U.S. household's monthly income.

How to invest in S&P 500 as a foreigner

How to invest in S&P500 Index as a non-US resident. As an investor, we cannot invest directly in the S&P500 index. Instead, the easiest way to invest in the S&P500 index is through investing in the S&P500 Exchange-Traded Funds (ETFs). An ETF is an instrument that mirrors the performance of an underlying index. How to buy the S&P 500. You can't directly invest in the S&P 500 because it's an index, but you can invest in one of the many funds that use it as a benchmark and follow its composition and performance. As a Belgian investor, you can buy shares in an ETF (Exchange Traded Fund) that tracks the performance of the S&P 500 …For each index, the final decision about which stocks to add is made by an S&P Dow Jones Indices committee: the Averages Committee in the case of The Dow and the U.S. Index Committee in the case of the S&P 500.

How is the S&P 500 allocated : The S&P 500's value is calculated based on the market cap of each company, adjusted to consider only the number of shares that are traded publicly. However, each company in the S&P 500 is given a specific weighting, obtained by dividing the company's individual market cap by the S&P 500's total market cap.

Antwort Who qualifies for the S&P 500? Weitere Antworten – How to qualify for S&P 500

What is the Criteria for Inclusion in the S&P 500 Index

S&P 500 companies by weight

The S&P 500's value is calculated by multiplying the market capitalization of each constituent company by the total number of shares outstanding. Market cap equals each company's share price multiplied by the total number of its shares outstanding. Shares outstanding are the stock that is held by shareholders.

What is the S&P 500 classified as : The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).

How is the S&P 500 chosen

The selection process for the S&P 500 is governed by quantitative criteria—including financial viability, public float, adequate liquidity, and company type—that determine whether a security is eligible for inclusion.

Can anyone invest in S&P 500 : The S&P 500 is a stock market index composed of about 500 publicly traded companies. You cannot directly invest in the index itself. You can buy individual stocks of companies in the S&P 500, or buy an S&P 500 index fund or ETF. Index funds typically carry less risk than individual stocks.

The selection process for the S&P 500 is governed by quantitative criteria—including financial viability, public float, adequate liquidity, and company type—that determine whether a security is eligible for inclusion.

How is the S&P 500 selected

The selection process for the S&P 500 is governed by quantitative criteria—including financial viability, public float, adequate liquidity, and company type—that determine whether a security is eligible for inclusion.There are never any guarantees when investing, but an S&P 500 index fund is about as close as you can get to guaranteed positive long-term returns. In fact, analysts at Crestmont Research examined the S&P 500's rolling 20-year total returns to find out how many of those periods resulted in positive total gains.The S&P 500 is a stock market index that measures the performance of about 500 companies in the U.S. It includes companies across 11 sectors to offer a picture of the health of the U.S. stock market and the broader economy.

The S&P 1500, or S&P Composite 1500 Index, is a stock market index of US stocks made by Standard & Poor's. It includes all stocks in the S&P 500, S&P 400, and S&P 600. This index covers approximately 90% of the market capitalization of U.S. stocks and is a broad measure of the U.S. equity market.

How do they pick stocks for the S&P 500 : The S&P 500 contains 505 common stocks (in some cases, companies have issued more than one class of shares) selected based on market capitalization, or the total value of a company's shares outstanding.

How to become a millionaire with the S&P 500 : Over its history, the S&P 500 has generated an average annual return of 9%, including re-invested dividends. At that rate, even a middle-class income is enough to become a millionaire over time. $500 a month, for example, is less than 10% of the median U.S. household's monthly income.

How to invest in S&P 500 as a foreigner

How to invest in S&P500 Index as a non-US resident. As an investor, we cannot invest directly in the S&P500 index. Instead, the easiest way to invest in the S&P500 index is through investing in the S&P500 Exchange-Traded Funds (ETFs). An ETF is an instrument that mirrors the performance of an underlying index.

How to buy the S&P 500. You can't directly invest in the S&P 500 because it's an index, but you can invest in one of the many funds that use it as a benchmark and follow its composition and performance. As a Belgian investor, you can buy shares in an ETF (Exchange Traded Fund) that tracks the performance of the S&P 500 …For each index, the final decision about which stocks to add is made by an S&P Dow Jones Indices committee: the Averages Committee in the case of The Dow and the U.S. Index Committee in the case of the S&P 500.

How is the S&P 500 allocated : The S&P 500's value is calculated based on the market cap of each company, adjusted to consider only the number of shares that are traded publicly. However, each company in the S&P 500 is given a specific weighting, obtained by dividing the company's individual market cap by the S&P 500's total market cap.