The S&P 500 is maintained by S&P Dow Jones Indices, a joint venture majority-owned by S&P Global, and its components are selected by a committee.McGraw-Hill, a publishing house, acquired Standard & Poor's Corp., owner of the S&P 500 index, in 1966. Today, the S&P 500 is maintained by S&P Dow Jones Indices—a joint venture owned by S&P Global (previously McGraw Hill Financial), CME Group, and News Corp.

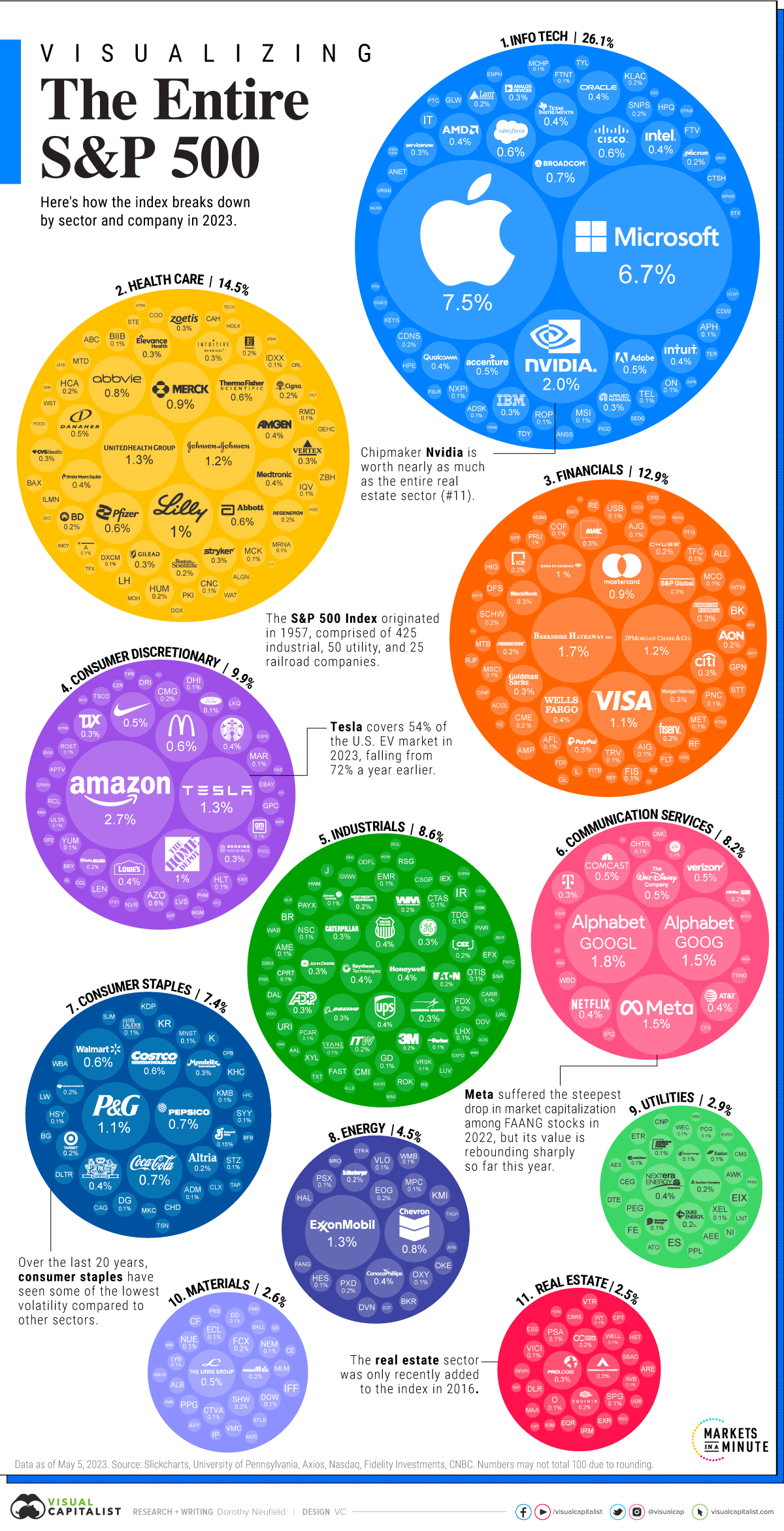

What stocks are holding up the S&P 500 : S&P 500 companies by weight

Key points. The S&P 500 index is often used as a proxy for the broader U.S. stock market.

Microsoft (MSFT) Index weight: 7.09%

Apple (AAPL) Index weight: 5.65%

Nvidia Corp. (NVDA)

Amazon.com Inc (AMZN)

Meta Platforms Class A (META)

Alphabet Class A (GOOGL)

Berkshire Hathaway Class B (BRK.B)

What is highest S&P has ever been

Price index

Category

All-time highs

All-time lows

Closing

5,308.15

Tuesday, January 3, 1950

Intraday

5,325.49

Tuesday, January 3, 1950

Is Tesla part of the S&P 500 : Tesla's sharp share-price decline so far this year is notable as the stock was the eighth-best performer in the S&P 500 for 2023, up 102%, according to Dow Jones Market Data.

80%

Institutions own about 78% of the market value of the U.S. broad-market Russell 3000 index, and 80% of the large-cap S&P 500 index. In dollars, that is about $21.7 trillion and $18 trillion, respectively. richest Americans

The richest Americans own the vast majority of the US stock market, according to Fed data. The top 10% of Americans held 93% of all stocks, the highest level ever recorded. Meanwhile, the bottom 50% of Americans held just 1% of all stocks in the third quarter of 2023.

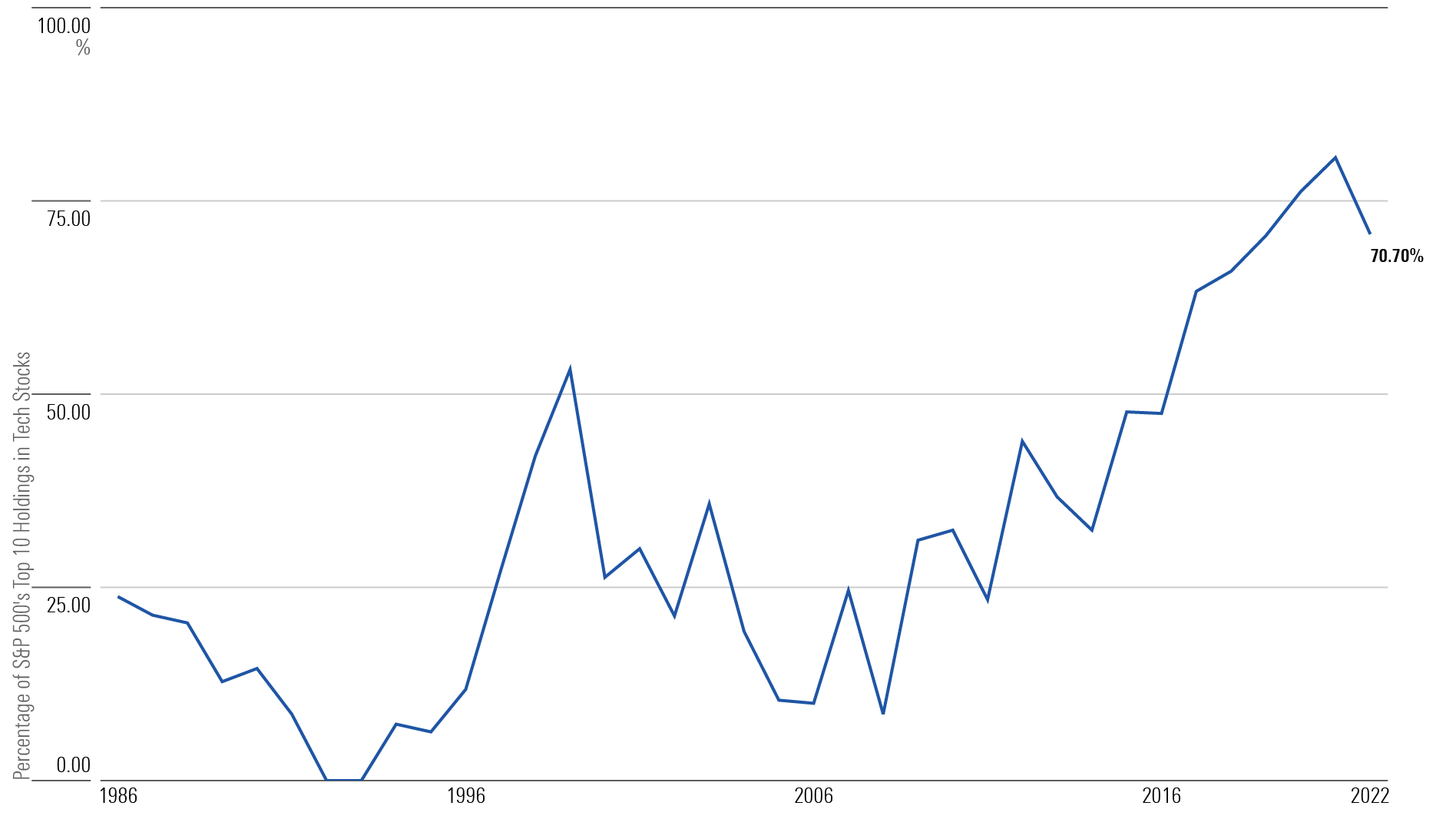

Is S&P 500 only American companies

All S&P 500 constituents must be American companies and they must have market caps of at least $14.6 billion. A company's stock must be "highly liquid" and have a public float of at least 10% of its shares outstanding.The Dow tracks 30 companies on US exchanges including blue-chip corporations such as Coca-Cola Co., Nike Inc., and McDonald's Corp. Almost all Dow stocks are included in the S&P 500, where they generally make up 25% to 30% of its market value.Dubbed the Magnificent Seven stocks, Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta Platforms and Tesla lived up to their name in 2023 with big gains. But the early part of the second quarter of 2024 showed a big divergence of returns. The average S&P 500 stock is as overvalued as the 'Magnificent Seven': Goldman. While this doesn't necessarily mean the rally is nearing its end, high valuations typically lead to weaker returns over the months ahead, according to…

Has the S&P ever hit 4000 : April 1, 2021: The S&P 500 index reaches 4,000 points, closing at 4,019.87. February 9, 2024: The S&P 500 index reaches 5,000 points, closing at 5,026.61.

Has the S&P 500 ever lost money : In 2002, the fallout from frenzied investments in internet technology companies and the subsequent implosion of the dot-com bubble caused the S&P 500 to drop 23.4%. And in 2008, the collapse of the U.S. housing market and the subsequent global financial crisis caused the S&P 500 to fall 38.5%.

Why was Tesla kicked out of the S&P 500

In recent years, Telsa has been accused of allowing racial discrimination and poor working conditions at its Fremont Factory, as well as lacking a low carbon strategy and codes of business conduct. The claims are so troubling that Tesla was removed from the widely accepted S&P 500 ESG Index. As one industry source told ETF Stream: “Tesla's performance is not justified. The huge discretion involved in the S&P 500 means companies such as this will not be included due to potential reputational damage.”The five largest shareholders/investors in each of Vanguard's funds vary depending on the specific fund. However, some of the largest shareholders in Vanguard's funds include BlackRock, State Street, Bank of New York Mellon, Charles Schwab, and Fidelity.

What does BlackRock own : Latest Holdings, Performance, AUM (from 13F, 13D)

BlackRock Inc.'s top holdings are Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , NVIDIA Corporation (US:NVDA) , Amazon.com, Inc. (US:AMZN) , and Meta Platforms, Inc. (US:META) .

Antwort Who is top holding sp500? Weitere Antworten – Who is at the top of the S&P 500

Microsoft Corp

S&P 500 ETF Components

The S&P 500 is maintained by S&P Dow Jones Indices, a joint venture majority-owned by S&P Global, and its components are selected by a committee.McGraw-Hill, a publishing house, acquired Standard & Poor's Corp., owner of the S&P 500 index, in 1966. Today, the S&P 500 is maintained by S&P Dow Jones Indices—a joint venture owned by S&P Global (previously McGraw Hill Financial), CME Group, and News Corp.

What stocks are holding up the S&P 500 : S&P 500 companies by weight

What is highest S&P has ever been

Price index

Is Tesla part of the S&P 500 : Tesla's sharp share-price decline so far this year is notable as the stock was the eighth-best performer in the S&P 500 for 2023, up 102%, according to Dow Jones Market Data.

80%

Institutions own about 78% of the market value of the U.S. broad-market Russell 3000 index, and 80% of the large-cap S&P 500 index. In dollars, that is about $21.7 trillion and $18 trillion, respectively.

richest Americans

The richest Americans own the vast majority of the US stock market, according to Fed data. The top 10% of Americans held 93% of all stocks, the highest level ever recorded. Meanwhile, the bottom 50% of Americans held just 1% of all stocks in the third quarter of 2023.

Is S&P 500 only American companies

All S&P 500 constituents must be American companies and they must have market caps of at least $14.6 billion. A company's stock must be "highly liquid" and have a public float of at least 10% of its shares outstanding.The Dow tracks 30 companies on US exchanges including blue-chip corporations such as Coca-Cola Co., Nike Inc., and McDonald's Corp. Almost all Dow stocks are included in the S&P 500, where they generally make up 25% to 30% of its market value.Dubbed the Magnificent Seven stocks, Apple, Microsoft, Google parent Alphabet, Amazon, Nvidia, Meta Platforms and Tesla lived up to their name in 2023 with big gains. But the early part of the second quarter of 2024 showed a big divergence of returns.

The average S&P 500 stock is as overvalued as the 'Magnificent Seven': Goldman. While this doesn't necessarily mean the rally is nearing its end, high valuations typically lead to weaker returns over the months ahead, according to…

Has the S&P ever hit 4000 : April 1, 2021: The S&P 500 index reaches 4,000 points, closing at 4,019.87. February 9, 2024: The S&P 500 index reaches 5,000 points, closing at 5,026.61.

Has the S&P 500 ever lost money : In 2002, the fallout from frenzied investments in internet technology companies and the subsequent implosion of the dot-com bubble caused the S&P 500 to drop 23.4%. And in 2008, the collapse of the U.S. housing market and the subsequent global financial crisis caused the S&P 500 to fall 38.5%.

Why was Tesla kicked out of the S&P 500

In recent years, Telsa has been accused of allowing racial discrimination and poor working conditions at its Fremont Factory, as well as lacking a low carbon strategy and codes of business conduct. The claims are so troubling that Tesla was removed from the widely accepted S&P 500 ESG Index.

As one industry source told ETF Stream: “Tesla's performance is not justified. The huge discretion involved in the S&P 500 means companies such as this will not be included due to potential reputational damage.”The five largest shareholders/investors in each of Vanguard's funds vary depending on the specific fund. However, some of the largest shareholders in Vanguard's funds include BlackRock, State Street, Bank of New York Mellon, Charles Schwab, and Fidelity.

What does BlackRock own : Latest Holdings, Performance, AUM (from 13F, 13D)

BlackRock Inc.'s top holdings are Microsoft Corporation (US:MSFT) , Apple Inc. (US:AAPL) , NVIDIA Corporation (US:NVDA) , Amazon.com, Inc. (US:AMZN) , and Meta Platforms, Inc. (US:META) .