What is the Criteria for Inclusion in the S&P 500 Index

Minimum Market Capitalization of $8.2 billion.

Structured as Corporation Based in the U.S. with Common Stock in Capitalization.

Listed on an Eligible U.S. Exchange (e.g. NYSE, NASDAQ)

The easiest way to invest in the S&P 500

The simplest way to invest in the index is through S&P 500 index funds or ETFs that replicate the index. You can purchase these in a taxable brokerage account, or if you're investing for retirement, in a 401(k) or IRA, which come with added tax benefits.S&P 500 ETF Components

#

Company

Symbol

1

Microsoft Corp

MSFT

2

Apple Inc.

AAPL

3

Nvidia Corp

NVDA

4

Amazon.com Inc

AMZN

What is the S&P 500 for dummies : The S&P 500 is a stock market index that measures the performance of about 500 companies in the U.S. It includes companies across 11 sectors to offer a picture of the health of the U.S. stock market and the broader economy.

Can you invest in the S&P 500 from Europe

How to buy the S&P 500. You can't directly invest in the S&P 500 because it's an index, but you can invest in one of the many funds that use it as a benchmark and follow its composition and performance. As a Belgian investor, you can buy shares in an ETF (Exchange Traded Fund) that tracks the performance of the S&P 500 …

Does S&P 500 pay me annually : Does the S&P 500 Pay Dividends The S&P 500 is an index, so it does not pay dividends; however, there are mutual funds and exchange-traded funds (ETFs) that track the index, which you can invest in. If the companies in these funds pay dividends, you'll receive yours based on how many shares of the funds you hold.

Investing only in the S&P 500 does not provide the broad diversification that minimizes risk. Economic downturns and bear markets can still deliver large losses. The past performance of the S&P 500 is not a guarantee of future performance (yeap, and we'll get back to that!) The S&P 500 Index features 500 leading U.S. publicly traded companies, with a primary emphasis on market capitalization.

Is the S&P 500 only stocks

The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).You can't directly invest in the index itself, but you can buy individual stocks of S&P 500 companies, or buy a S&P 500 index fund through a mutual fund or ETF. The latter is ideal for beginner investors since they provide broad market exposure and diversification at a low cost.Key Takeaways. The S&P 500 Index features 500 leading U.S. publicly traded companies, with a primary emphasis on market capitalization. The best S&P 500 ETF by 1-year fund return as of 30.04.24

1

BNP Paribas Easy S&P 500 UCITS ETF EUR

+27.10%

2

Amundi S&P 500 II UCITS ETF Acc

+26.52%

3

Amundi S&P 500 II UCITS ETF EUR Dist

+26.52%

Can I invest in S&P 500 from anywhere in the world : By utilizing options such as trading S&P 500 CFDs or investing in S&P 500 ETFs, UAE traders and investors can easily participate in the index's potential growth and enjoy the benefits of diversification. With region's brokers like amana, people from almost anywhere in the world can tap into the S&P 500 Index.

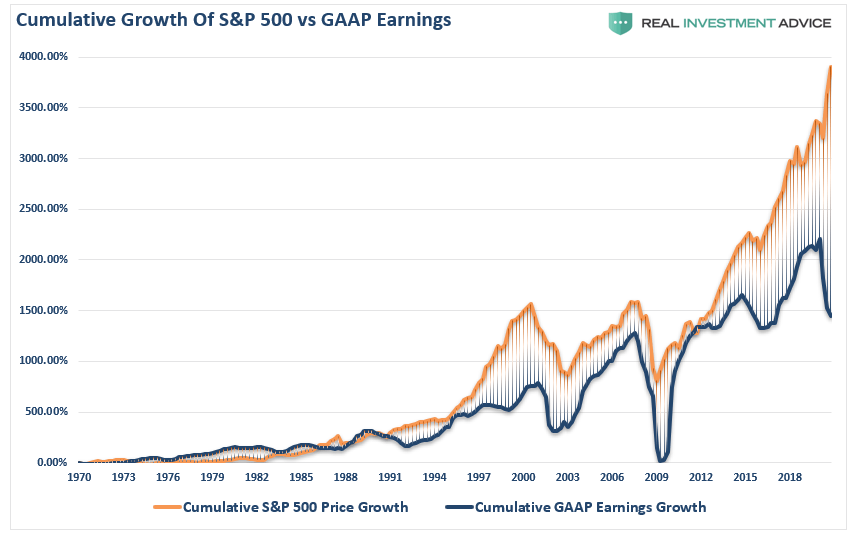

Is S and P 500 good investment : Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds.

How much tax will I pay on S&P 500

If you have $1,000 invested in the S&P 500, you would receive $20 in dividends which would be taxable. However, if you're in the 10% or 15% tax bracket your tax rate on qualified dividends would be 0%. Remember that the exact tax you pay is tied to your tax rate and income. Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.What are the risks associated with investing in the S&P 500 The S&P 500 carries market risk, as its value fluctuates with overall market performance, as well as the performance of heavily weighted stocks and sectors.

Can non Americans invest in S&P 500 : How to invest in S&P500 Index as a non-US resident. As an investor, we cannot invest directly in the S&P500 index. Instead, the easiest way to invest in the S&P500 index is through investing in the S&P500 Exchange-Traded Funds (ETFs). An ETF is an instrument that mirrors the performance of an underlying index.

Antwort Who is eligible for the S&P 500? Weitere Antworten – How to qualify for S&P 500

What is the Criteria for Inclusion in the S&P 500 Index

The easiest way to invest in the S&P 500

The simplest way to invest in the index is through S&P 500 index funds or ETFs that replicate the index. You can purchase these in a taxable brokerage account, or if you're investing for retirement, in a 401(k) or IRA, which come with added tax benefits.S&P 500 ETF Components

What is the S&P 500 for dummies : The S&P 500 is a stock market index that measures the performance of about 500 companies in the U.S. It includes companies across 11 sectors to offer a picture of the health of the U.S. stock market and the broader economy.

Can you invest in the S&P 500 from Europe

How to buy the S&P 500. You can't directly invest in the S&P 500 because it's an index, but you can invest in one of the many funds that use it as a benchmark and follow its composition and performance. As a Belgian investor, you can buy shares in an ETF (Exchange Traded Fund) that tracks the performance of the S&P 500 …

Does S&P 500 pay me annually : Does the S&P 500 Pay Dividends The S&P 500 is an index, so it does not pay dividends; however, there are mutual funds and exchange-traded funds (ETFs) that track the index, which you can invest in. If the companies in these funds pay dividends, you'll receive yours based on how many shares of the funds you hold.

Investing only in the S&P 500 does not provide the broad diversification that minimizes risk. Economic downturns and bear markets can still deliver large losses. The past performance of the S&P 500 is not a guarantee of future performance (yeap, and we'll get back to that!)

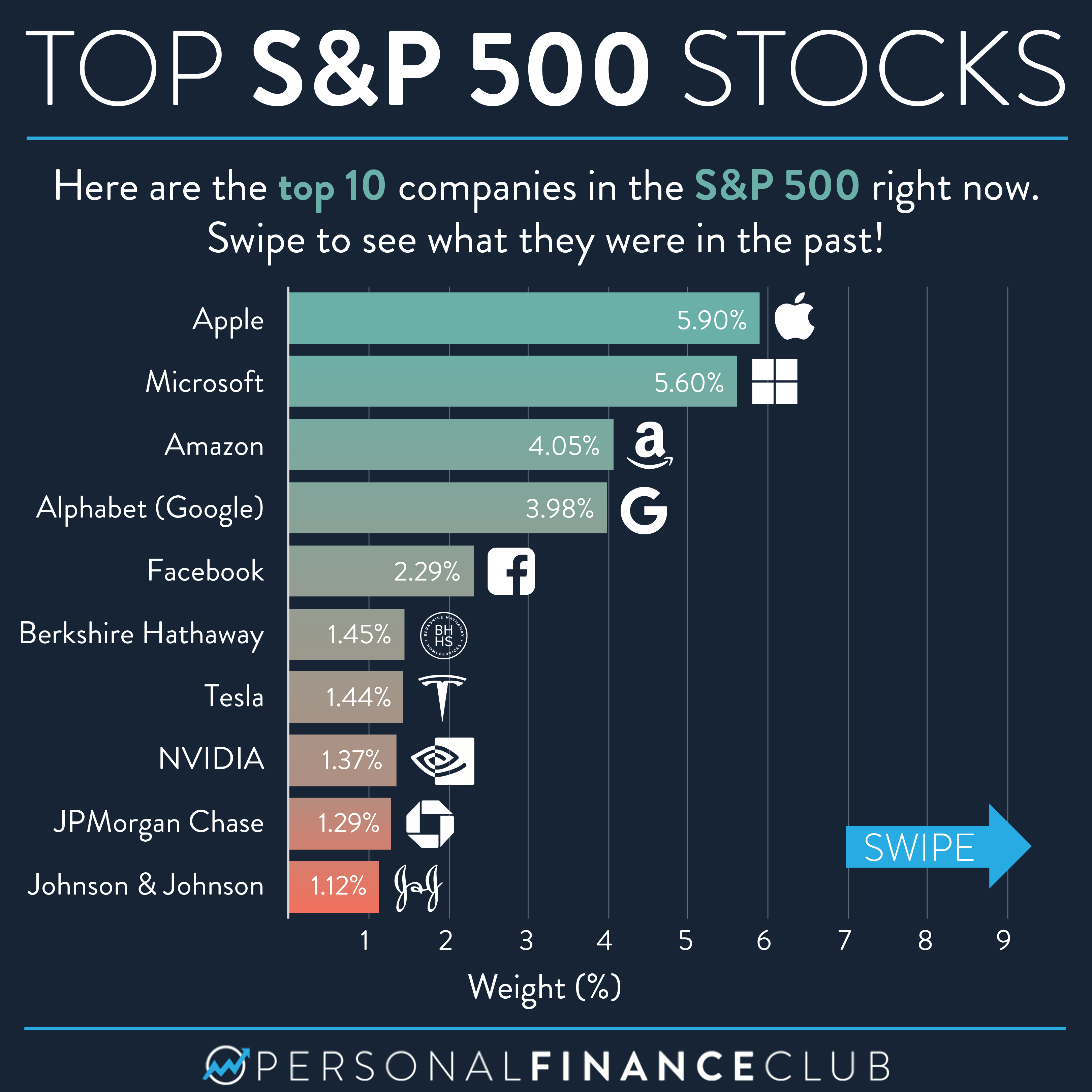

The S&P 500 Index features 500 leading U.S. publicly traded companies, with a primary emphasis on market capitalization.

Is the S&P 500 only stocks

The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).You can't directly invest in the index itself, but you can buy individual stocks of S&P 500 companies, or buy a S&P 500 index fund through a mutual fund or ETF. The latter is ideal for beginner investors since they provide broad market exposure and diversification at a low cost.Key Takeaways. The S&P 500 Index features 500 leading U.S. publicly traded companies, with a primary emphasis on market capitalization.

The best S&P 500 ETF by 1-year fund return as of 30.04.24

Can I invest in S&P 500 from anywhere in the world : By utilizing options such as trading S&P 500 CFDs or investing in S&P 500 ETFs, UAE traders and investors can easily participate in the index's potential growth and enjoy the benefits of diversification. With region's brokers like amana, people from almost anywhere in the world can tap into the S&P 500 Index.

Is S and P 500 good investment : Over time, the S&P 500 has delivered strong returns to investors. Those who remained invested enjoyed the benefits of compounding, or the process of earning returns on the returns you've already accumulated. “Since 1970, it has delivered an average 11% return per year, including dividends,” said Reynolds.

How much tax will I pay on S&P 500

If you have $1,000 invested in the S&P 500, you would receive $20 in dividends which would be taxable. However, if you're in the 10% or 15% tax bracket your tax rate on qualified dividends would be 0%. Remember that the exact tax you pay is tied to your tax rate and income.

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.What are the risks associated with investing in the S&P 500 The S&P 500 carries market risk, as its value fluctuates with overall market performance, as well as the performance of heavily weighted stocks and sectors.

Can non Americans invest in S&P 500 : How to invest in S&P500 Index as a non-US resident. As an investor, we cannot invest directly in the S&P500 index. Instead, the easiest way to invest in the S&P500 index is through investing in the S&P500 Exchange-Traded Funds (ETFs). An ETF is an instrument that mirrors the performance of an underlying index.