For each index, the final decision about which stocks to add is made by an S&P Dow Jones Indices committee: the Averages Committee in the case of The Dow and the U.S. Index Committee in the case of the S&P 500.The index includes 500 of the largest (not necessarily the 500 largest) companies whose stocks trade on the New York Stock Exchange (NYSE), Nasdaq, or Chicago Board Options Exchange (CBOE). Like popes and Oscar winners, the components of the S&P 500 are selected by a committee.S&P Dow Jones Indices

The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).

Who calculates S&P 500 : The S&P 500 is a stock market index that is meant to track the U.S. equity market. The index is made up of 500 of the largest public companies. It is float-adjusted and calculated using a proprietary index divisor developed by Standard & Poor's.

Who controls the s&P500

The S&P 500 is maintained by the S&P Index Committee, whose members include Standard and Poor's economists and index analysts. Committee oversight gives investors the benefit of Standard and Poor's depth of experience, research and analytic capabilities.

What influences the S&P 500 : The S&P 500 is continuously float-adjusted. The index recalculates when new shares are issued or when a company takes shares off the market through a buyback initiative. The publicly available shares of each company are multiplied by the market value of a single share to determine the company market caps.

Selection criteria

When considering the eligibility of a new addition, the committee assesses the company's merit using the following primary criteria: Market capitalization – Market capitalization must be greater than or equal to US$18.0 billion. Criteria for Inclusion in the S&P 500

The company should be from the U.S. Its market cap must be at least $8.2 billion. Its shares must be highly liquid. At least 50% of its outstanding shares must be available for public trading.

How does a company become part of the S&P 500

To be eligible for inclusion in the S&P 500, a company must: Be based in the U.S., with a significant share of its fixed assets and revenues in the U.S. However, some companies domiciled in overseas tax jurisdictions are considered American for listing purposes. Have an unadjusted market cap of at least $13.1 billion.The S&P 500 is maintained by S&P Dow Jones Indices, a joint venture majority-owned by S&P Global, and its components are selected by a committee.To be eligible for inclusion in the S&P 500, a company must: Be based in the U.S., with a significant share of its fixed assets and revenues in the U.S. However, some companies domiciled in overseas tax jurisdictions are considered American for listing purposes. Have an unadjusted market cap of at least $13.1 billion. To be eligible for inclusion in the S&P 500, a company must: Be based in the U.S., with a significant share of its fixed assets and revenues in the U.S. However, some companies domiciled in overseas tax jurisdictions are considered American for listing purposes. Have an unadjusted market cap of at least $13.1 billion.

Is S&P 500 only American companies : All S&P 500 constituents must be American companies and they must have market caps of at least $14.6 billion. A company's stock must be "highly liquid" and have a public float of at least 10% of its shares outstanding.

What are the criteria for S&P 500 inclusion : To be eligible for S&P 500 index inclusion, a company should be a U.S. company, have a market capitalization of at least USD 8.2 billion, be highly liquid, have a public float of at least 50% of its shares outstanding, and its most recent quarter's earnings and the sum of its trailing four consecutive quarters' …

How to predict S&P 500

(2021), the authors predict the monthly value of the S&P 500 index using the decision tree, RF, and feedforward neural network methods. They find that RF is 19% more accurate than a baseline model that uses linear regression. The S&P 500 tracks the market capitalization of the roughly 500 companies included in the index, measuring the value of the stock of those companies. Market cap is calculated by multiplying the number of stock shares a company has outstanding by its current stock price.The S&P 500 is a stock market index that measures the performance of about 500 companies in the U.S. It includes companies across 11 sectors to offer a picture of the health of the U.S. stock market and the broader economy.

Who manages the S&P 500 index : The S&P 500 is maintained by the S&P Index Committee, whose members include Standard and Poor's economists and index analysts. Committee oversight gives investors the benefit of Standard and Poor's depth of experience, research and analytic capabilities.

Antwort Who decides what companies are in the S&P 500? Weitere Antworten – Who decides what companies are in the S&P 500

Stock Selection

For each index, the final decision about which stocks to add is made by an S&P Dow Jones Indices committee: the Averages Committee in the case of The Dow and the U.S. Index Committee in the case of the S&P 500.The index includes 500 of the largest (not necessarily the 500 largest) companies whose stocks trade on the New York Stock Exchange (NYSE), Nasdaq, or Chicago Board Options Exchange (CBOE). Like popes and Oscar winners, the components of the S&P 500 are selected by a committee.S&P Dow Jones Indices

The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).

Who calculates S&P 500 : The S&P 500 is a stock market index that is meant to track the U.S. equity market. The index is made up of 500 of the largest public companies. It is float-adjusted and calculated using a proprietary index divisor developed by Standard & Poor's.

Who controls the s&P500

The S&P 500 is maintained by the S&P Index Committee, whose members include Standard and Poor's economists and index analysts. Committee oversight gives investors the benefit of Standard and Poor's depth of experience, research and analytic capabilities.

What influences the S&P 500 : The S&P 500 is continuously float-adjusted. The index recalculates when new shares are issued or when a company takes shares off the market through a buyback initiative. The publicly available shares of each company are multiplied by the market value of a single share to determine the company market caps.

Selection criteria

When considering the eligibility of a new addition, the committee assesses the company's merit using the following primary criteria: Market capitalization – Market capitalization must be greater than or equal to US$18.0 billion.

Criteria for Inclusion in the S&P 500

The company should be from the U.S. Its market cap must be at least $8.2 billion. Its shares must be highly liquid. At least 50% of its outstanding shares must be available for public trading.

How does a company become part of the S&P 500

To be eligible for inclusion in the S&P 500, a company must: Be based in the U.S., with a significant share of its fixed assets and revenues in the U.S. However, some companies domiciled in overseas tax jurisdictions are considered American for listing purposes. Have an unadjusted market cap of at least $13.1 billion.The S&P 500 is maintained by S&P Dow Jones Indices, a joint venture majority-owned by S&P Global, and its components are selected by a committee.To be eligible for inclusion in the S&P 500, a company must: Be based in the U.S., with a significant share of its fixed assets and revenues in the U.S. However, some companies domiciled in overseas tax jurisdictions are considered American for listing purposes. Have an unadjusted market cap of at least $13.1 billion.

To be eligible for inclusion in the S&P 500, a company must: Be based in the U.S., with a significant share of its fixed assets and revenues in the U.S. However, some companies domiciled in overseas tax jurisdictions are considered American for listing purposes. Have an unadjusted market cap of at least $13.1 billion.

Is S&P 500 only American companies : All S&P 500 constituents must be American companies and they must have market caps of at least $14.6 billion. A company's stock must be "highly liquid" and have a public float of at least 10% of its shares outstanding.

What are the criteria for S&P 500 inclusion : To be eligible for S&P 500 index inclusion, a company should be a U.S. company, have a market capitalization of at least USD 8.2 billion, be highly liquid, have a public float of at least 50% of its shares outstanding, and its most recent quarter's earnings and the sum of its trailing four consecutive quarters' …

How to predict S&P 500

(2021), the authors predict the monthly value of the S&P 500 index using the decision tree, RF, and feedforward neural network methods. They find that RF is 19% more accurate than a baseline model that uses linear regression.

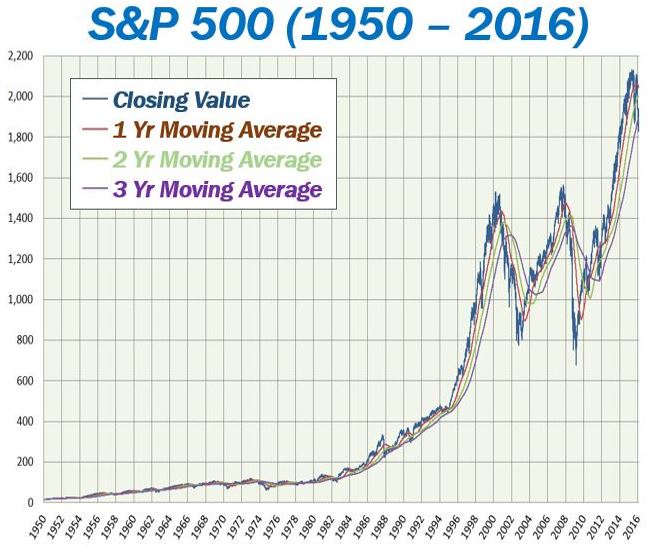

The S&P 500 tracks the market capitalization of the roughly 500 companies included in the index, measuring the value of the stock of those companies. Market cap is calculated by multiplying the number of stock shares a company has outstanding by its current stock price.The S&P 500 is a stock market index that measures the performance of about 500 companies in the U.S. It includes companies across 11 sectors to offer a picture of the health of the U.S. stock market and the broader economy.

Who manages the S&P 500 index : The S&P 500 is maintained by the S&P Index Committee, whose members include Standard and Poor's economists and index analysts. Committee oversight gives investors the benefit of Standard and Poor's depth of experience, research and analytic capabilities.