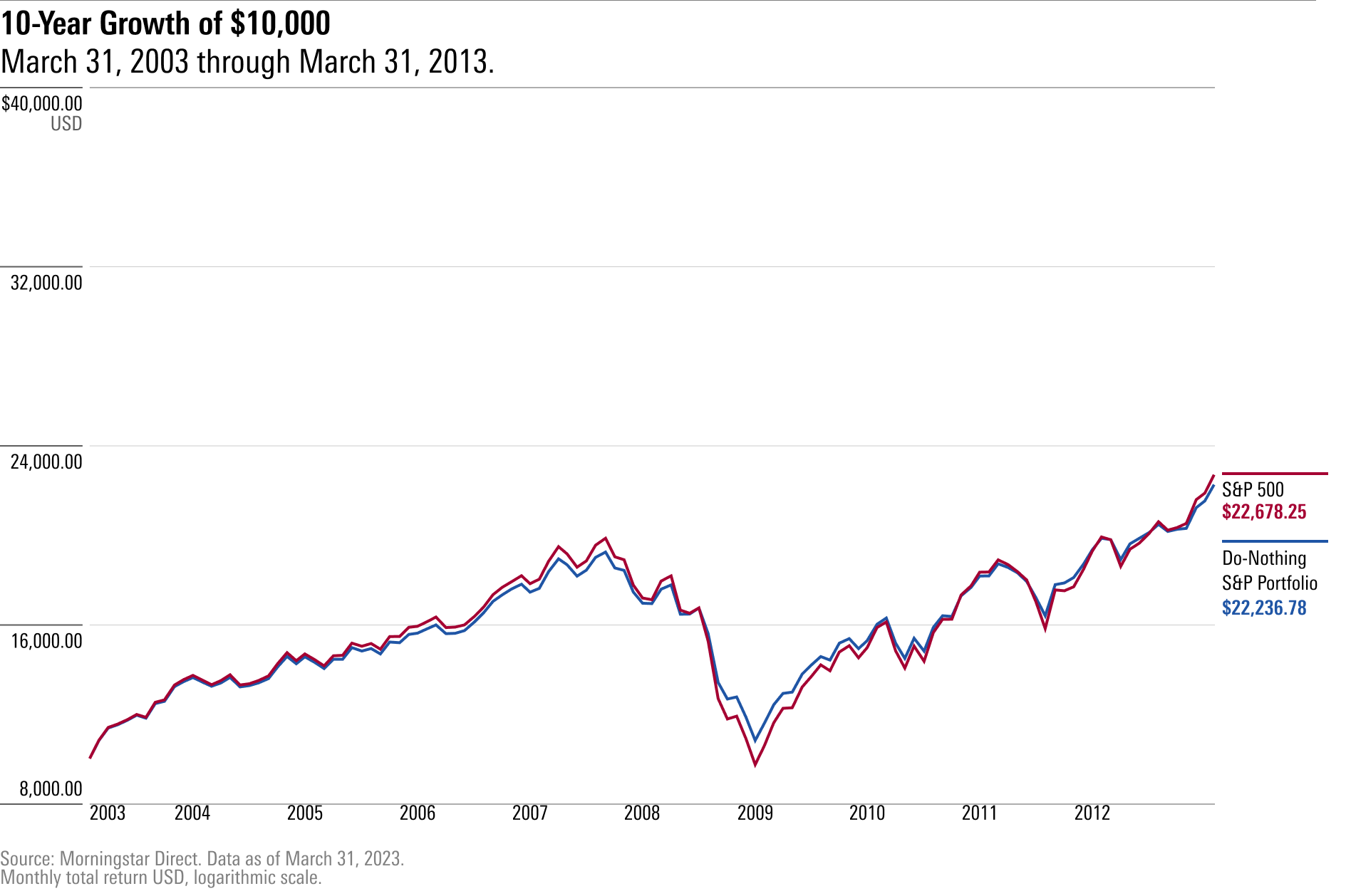

And there's one ETF that specializes in those stocks. That's the Invesco S&P 500 GARP ETF (NYSEMKT: SPGP), which has beaten the S&P 500 in seven of the last 10 years and has steadily outperformed it over the last decade, as you can see from the chart below.The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.10 funds that beat the S&P 500 by over 20% in 2023

Fund

2023 performance (%)

5yr performance (%)

BlackRock GF US Growth

52.68

92.91

MS INVF US Insight

52.26

34.65

Sands Capital US Select Growth Fund

51.3

76.97

Natixis Loomis Sayles US Growth Equity

49.56

111.67

Which is the best S&P 500 ETF :

SPY, VOO and IVV are among the most popular S&P 500 ETFs.

These three S&P 500 ETFs are quite similar, but may sometimes diverge in terms of costs or daily returns.

Investors generally only need one S&P 500 ETF.

What is the inverse ETF of S&P 500

"Inverse ETFs are a tool to hedge a stock portfolio," John DeYonker, head of investor relations at Titan Global Capital Management, states in a 2022 article about these bear funds. "If the S&P 500 is your benchmark, and it goes up 1%, then your hedge will go down 1% and vice versa.

What ETF doubles the S&P 500 : The Direxion Daily S&P 500® Bull 2X Shares seeks daily investment results, before fees and expenses, of 200% of the performance of the S&P 500® Index.

Yes, you may be able to beat the market, but with investment fees, taxes, and human emotion working against you, you're more likely to do so through luck than skill. If you can merely match the S&P 500, minus a small fee, you'll be doing better than most investors. Real assets have outperformed the S&P 500 for the past 30 years, without a single negative year. Even when investing in the real asset index on its worst day ever, one year later, that investment would yield a positive return of 1.5%.

What are the top 5 ETFs to buy

7 Best ETFs to Buy Now

ETF

Expense Ratio

Year-to-date Performance

iShares Semiconductor ETF (SOXX)

0.35%

14.9%

Simplify Interest Rate Hedge ETF (PFIX)

0.50%

22.9%

WisdomTree Japan Hedged Equity Fund (DXJ)

0.48%

23.8%

Invesco S&P 500 Momentum ETF (SPMO)

0.13%

20.9%

On the other hand, the Euro Stoxx 50 – considered as the equivalent of the U.S. index S&P 500 – is probably the most followed index in the eurozone and includes 50 stocks from blue-chip companies leaders in their sectors of operation.S&P 500 Index (INDEXSP INX) – ETF Tracker

Symbol

ETF Name

Inception

SPY

SPDR S&P 500 ETF Trust

1993-01-22

IVV

iShares Core S&P 500 ETF

2000-05-15

VOO

Vanguard S&P 500 ETF

2010-09-07

SPLG

SPDR Portfolio S&P 500 ETF

2005-11-08

They also compound losses in volatile, upward-trending markets. Indeed, inverse ETFs tend to decline in value over time regardless of whether the underlying market is rising or falling. Because of this, inverse ETFs are complex products meant for active traders, not long-term buy-and-hold investments.

What fund matches the S&P 500 : Compare the best S&P 500 index funds

FUND

TICKER

TOTAL ASSETS

Fidelity 500 Index Fund

FXAIX

$512.4 billion

Vanguard 500 Index Fund Admiral Shares

VFIAX

$1.1 trillion

Schwab S&P 500 Index Fund

SWPPX

$88.2 billion

State Street S&P 500 Index Fund Class N

SVSPX

$1.4 billion

What percent of investors beat sp500 : Key Points. Less than 10% of active large-cap fund managers have outperformed the S&P 500 over the last 15 years. The biggest drag on investment returns is unavoidable, but you can minimize it if you're smart. Here's what to look for when choosing a simple investment that can beat the Wall Street pros.

Do day traders beat sp500

You may have heard stories of people becoming successful day traders after minimal effort, and although that looks incredibly enticing, the reality is that most day traders end up losing money over the long run. Berkshire Hathaway

A big cash pile protects the above-average core operations of this stellar company. Warren Buffett has an incredible track record of outperforming the S&P 500. At the start of every Berkshire Hathaway (BRK. A 0.68%) (BRK.1. VanEck Semiconductor ETF

10-year return: 24.37%

Assets under management: $10.9B.

Expense ratio: 0.35%

As of date: November 30, 2023.

Which index ETF has the highest return : 100 Highest 5 Year ETF Returns

Antwort Which index beats S&P 500? Weitere Antworten – Which ETF is beating the S&P 500

And there's one ETF that specializes in those stocks. That's the Invesco S&P 500 GARP ETF (NYSEMKT: SPGP), which has beaten the S&P 500 in seven of the last 10 years and has steadily outperformed it over the last decade, as you can see from the chart below.The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.10 funds that beat the S&P 500 by over 20% in 2023

Which is the best S&P 500 ETF :

What is the inverse ETF of S&P 500

"Inverse ETFs are a tool to hedge a stock portfolio," John DeYonker, head of investor relations at Titan Global Capital Management, states in a 2022 article about these bear funds. "If the S&P 500 is your benchmark, and it goes up 1%, then your hedge will go down 1% and vice versa.

What ETF doubles the S&P 500 : The Direxion Daily S&P 500® Bull 2X Shares seeks daily investment results, before fees and expenses, of 200% of the performance of the S&P 500® Index.

Yes, you may be able to beat the market, but with investment fees, taxes, and human emotion working against you, you're more likely to do so through luck than skill. If you can merely match the S&P 500, minus a small fee, you'll be doing better than most investors.

Real assets have outperformed the S&P 500 for the past 30 years, without a single negative year. Even when investing in the real asset index on its worst day ever, one year later, that investment would yield a positive return of 1.5%.

What are the top 5 ETFs to buy

7 Best ETFs to Buy Now

On the other hand, the Euro Stoxx 50 – considered as the equivalent of the U.S. index S&P 500 – is probably the most followed index in the eurozone and includes 50 stocks from blue-chip companies leaders in their sectors of operation.S&P 500 Index (INDEXSP INX) – ETF Tracker

They also compound losses in volatile, upward-trending markets. Indeed, inverse ETFs tend to decline in value over time regardless of whether the underlying market is rising or falling. Because of this, inverse ETFs are complex products meant for active traders, not long-term buy-and-hold investments.

What fund matches the S&P 500 : Compare the best S&P 500 index funds

What percent of investors beat sp500 : Key Points. Less than 10% of active large-cap fund managers have outperformed the S&P 500 over the last 15 years. The biggest drag on investment returns is unavoidable, but you can minimize it if you're smart. Here's what to look for when choosing a simple investment that can beat the Wall Street pros.

Do day traders beat sp500

You may have heard stories of people becoming successful day traders after minimal effort, and although that looks incredibly enticing, the reality is that most day traders end up losing money over the long run.

Berkshire Hathaway

A big cash pile protects the above-average core operations of this stellar company. Warren Buffett has an incredible track record of outperforming the S&P 500. At the start of every Berkshire Hathaway (BRK. A 0.68%) (BRK.1. VanEck Semiconductor ETF

Which index ETF has the highest return : 100 Highest 5 Year ETF Returns