you don't need a permit to work in any EU country, either for an employer or as a self-employed person. if you meet certain conditions, you can live in the country where you work.Self-employed, total (% of total employment) (modeled ILO estimate) – Country Ranking

Rank

Country

Value

1

Niger

95.06

2

Central African Republic

93.16

3

Chad

92.61

4

Guinea

91.89

Visa for people aged 16 or over who seek to engage in self-employed activity in Spain. To obtain a self-employed work visa, it is first necessary to obtain an initial residence and self-employed work permit. For this reason, the procedure comprises two stages.

Can I move to Portugal if I am self-employed : To enter Portugal for self-employed work for a period of less than a year, you must have a valid temporary stay visa. For longer periods, you must obtain a residence visa. The residence visa does not automatically grant you a right of residence. Once in Portugal, you must apply for a residence permit.

Which country is best for own business

The United States of America, with its vast market and innovative culture, is one of the best countries to start a new business. The entrepreneurial spirit in the U.S. is a significant driver of its status as a leading economy.

Which country is best to start your own business : Exploring the best countries to start up a company in, continent by continent

Singapore. Singapore is one the wealthiest countries in the world.

India.

China.

Philippines.

Vietnam.

Malaysia.

Ireland.

Germany.

To carry out independent activities in Italy, you must obtain: an authorisation for self –employed work and a visa before you enter Italy; a residence permit within eight days of entering Italy. To operate as a self-employed person in Spain, you must first obtain the following: A work and residence permit (This is not the same permission needed to work as an employee for a firm). The residence permit will be granted together with the work permit. A self-employment work and residence visa.

Which European country is easiest to start a business

1. The Netherlands. The Netherlands is routinely ranked among the easiest countries to start a business in Europe. The Netherlands is one of the biggest economies of the word and is renowned for its open economy, transparent corporate procedures, and multilingual workforce.Nordic countries are still on the top of the list: Denmark, Sweden, Norway and Finland, followed by Switzerland, UK and Germany. Estonia, Lithuania and Georgia are outstanding exceptions among the post-Soviet countries.To operate as a self-employed person in Spain, you must first obtain the following: A work and residence permit (This is not the same permission needed to work as an employee for a firm). The residence permit will be granted together with the work permit. A self-employment work and residence visa. You can! You can work full-time or part-time and also generate income from self-employment on the side. If you have a side job in which you're self-employed, you might need to pay taxes on that income. The amount you'll have to pay depends on your total income from all sources.

How much tax does a self-employed person pay in Spain : 21%

Freelance tax in Spain extends to the Impuesto sobre el Valor Añadido (IVA), or value-added tax. Like other businesses, freelancers must pay 21%, irrespective of annual turnover. Although, some goods and services such as educational services, artistic endeavors, and some forms of independent writing are exempt.

What is the cheapest country in Europe to start a business : The Cheapest European Countries to Incorporate a Company

Bulgaria. Business Structures: Bulgaria offers various business structures, with limited liability companies (OOD) being a popular choice for small and medium-sized enterprises (SMEs).

Romania.

Lithuania.

Estonia.

Latvia.

Which country is best to earn money in Europe

The highest paying countries in 2022 were Switzerland (€106,839), Iceland (€81,942), Luxembourg (€79,903), Norway (€74,506) and Belgium (€70,297), whereas the lowest payers were Bulgaria (€12,923), Romania(€14,500), Croatia(€17,842), Hungary(€18,274) and Poland (€18,114). If your annual earnings from self-employment in Germany are more than the tax-free allowance (as of 2024: €11,604), you'll need to pay income tax (Einkommensteuer) — no matter whether you're a freelancer or run a company. Like with any income tax, the amount you'll need to pay depends on the size of your income.Self-employed income tax in Germany

2024 tax bracket Annual income

Tax rate

Up to €11,604

0%

€11,605–66,760

14–42%

€66,761–277,825

42%

€277,826 and above

45%

Is Spain good for self-employed : Essentially, anyone can become a freelancer or self-employed in Spain. Being an autónomo allows you to carry out your profession or run your own business as if it were a company, but at a much lower cost and with less administration. For these reasons, Spain has attracted many entrepreneurs over the decades.

Antwort Which European country is best for self employed people? Weitere Antworten – Can I be self-employed in Europe

you don't need a permit to work in any EU country, either for an employer or as a self-employed person. if you meet certain conditions, you can live in the country where you work.Self-employed, total (% of total employment) (modeled ILO estimate) – Country Ranking

Visa for people aged 16 or over who seek to engage in self-employed activity in Spain. To obtain a self-employed work visa, it is first necessary to obtain an initial residence and self-employed work permit. For this reason, the procedure comprises two stages.

Can I move to Portugal if I am self-employed : To enter Portugal for self-employed work for a period of less than a year, you must have a valid temporary stay visa. For longer periods, you must obtain a residence visa. The residence visa does not automatically grant you a right of residence. Once in Portugal, you must apply for a residence permit.

Which country is best for own business

The United States of America, with its vast market and innovative culture, is one of the best countries to start a new business. The entrepreneurial spirit in the U.S. is a significant driver of its status as a leading economy.

Which country is best to start your own business : Exploring the best countries to start up a company in, continent by continent

To carry out independent activities in Italy, you must obtain: an authorisation for self –employed work and a visa before you enter Italy; a residence permit within eight days of entering Italy.

To operate as a self-employed person in Spain, you must first obtain the following: A work and residence permit (This is not the same permission needed to work as an employee for a firm). The residence permit will be granted together with the work permit. A self-employment work and residence visa.

Which European country is easiest to start a business

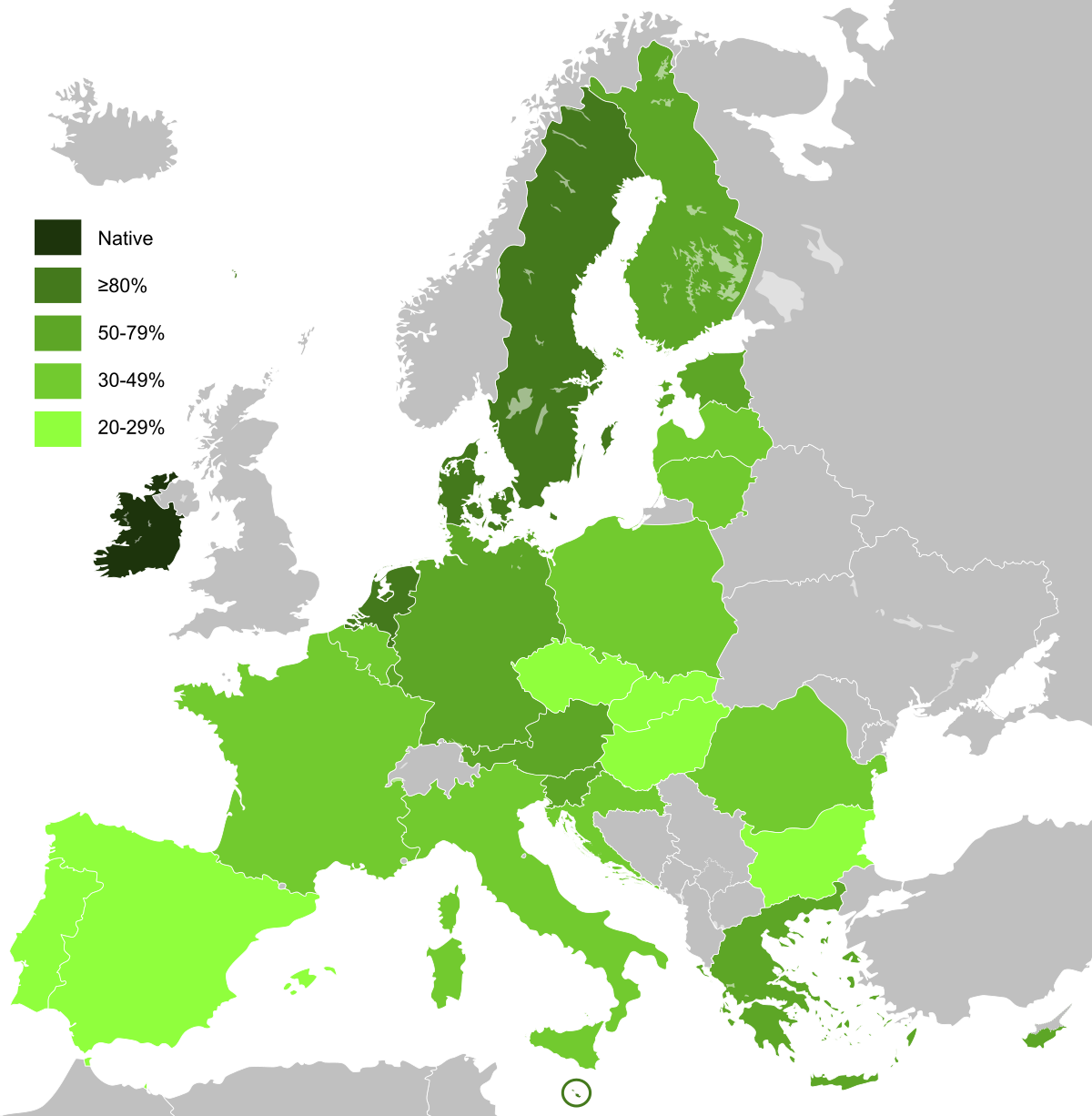

1. The Netherlands. The Netherlands is routinely ranked among the easiest countries to start a business in Europe. The Netherlands is one of the biggest economies of the word and is renowned for its open economy, transparent corporate procedures, and multilingual workforce.Nordic countries are still on the top of the list: Denmark, Sweden, Norway and Finland, followed by Switzerland, UK and Germany. Estonia, Lithuania and Georgia are outstanding exceptions among the post-Soviet countries.To operate as a self-employed person in Spain, you must first obtain the following: A work and residence permit (This is not the same permission needed to work as an employee for a firm). The residence permit will be granted together with the work permit. A self-employment work and residence visa.

You can! You can work full-time or part-time and also generate income from self-employment on the side. If you have a side job in which you're self-employed, you might need to pay taxes on that income. The amount you'll have to pay depends on your total income from all sources.

How much tax does a self-employed person pay in Spain : 21%

Freelance tax in Spain extends to the Impuesto sobre el Valor Añadido (IVA), or value-added tax. Like other businesses, freelancers must pay 21%, irrespective of annual turnover. Although, some goods and services such as educational services, artistic endeavors, and some forms of independent writing are exempt.

What is the cheapest country in Europe to start a business : The Cheapest European Countries to Incorporate a Company

Which country is best to earn money in Europe

The highest paying countries in 2022 were Switzerland (€106,839), Iceland (€81,942), Luxembourg (€79,903), Norway (€74,506) and Belgium (€70,297), whereas the lowest payers were Bulgaria (€12,923), Romania(€14,500), Croatia(€17,842), Hungary(€18,274) and Poland (€18,114).

If your annual earnings from self-employment in Germany are more than the tax-free allowance (as of 2024: €11,604), you'll need to pay income tax (Einkommensteuer) — no matter whether you're a freelancer or run a company. Like with any income tax, the amount you'll need to pay depends on the size of your income.Self-employed income tax in Germany

Is Spain good for self-employed : Essentially, anyone can become a freelancer or self-employed in Spain. Being an autónomo allows you to carry out your profession or run your own business as if it were a company, but at a much lower cost and with less administration. For these reasons, Spain has attracted many entrepreneurs over the decades.