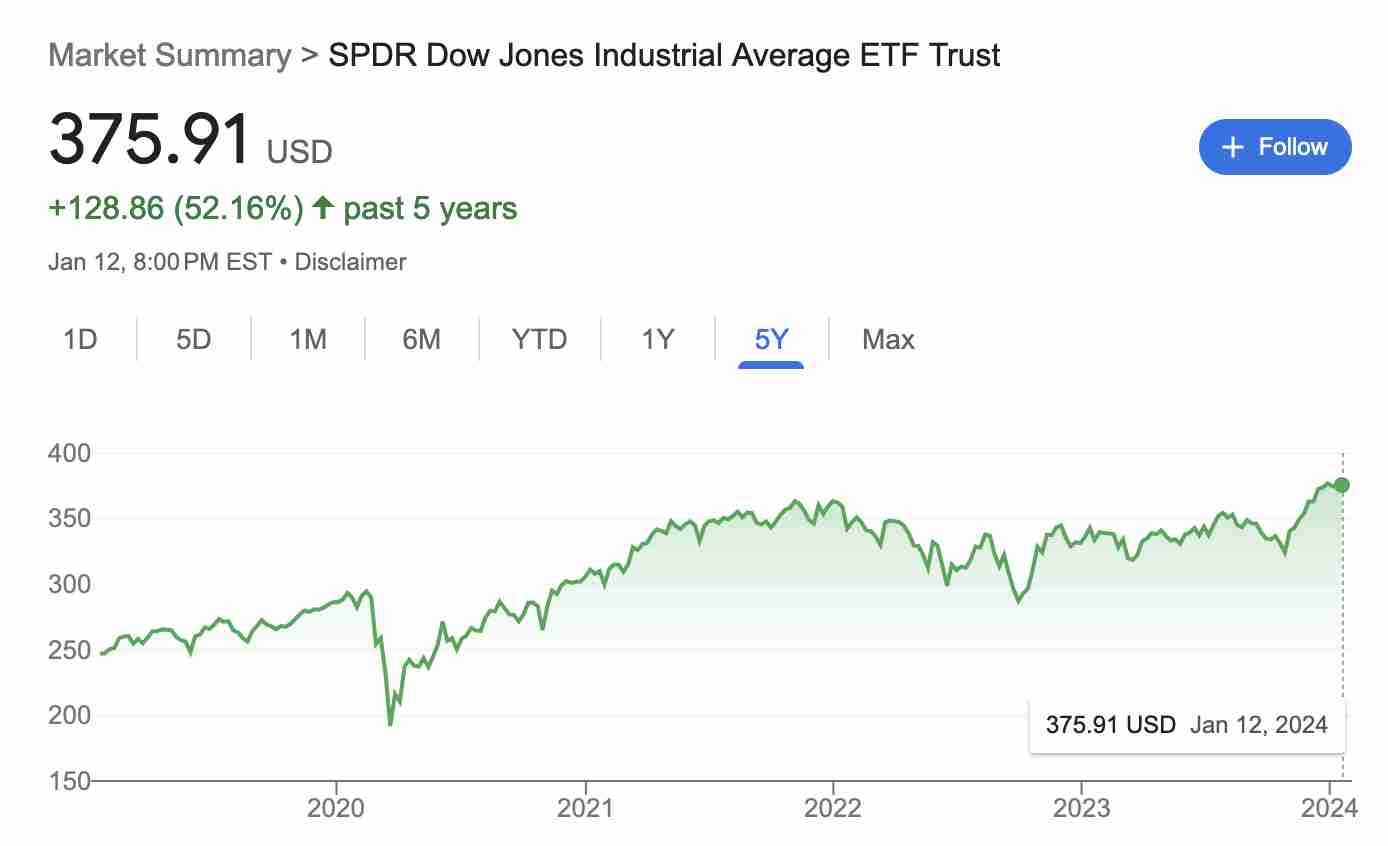

DIA SPDR Dow Jones Industrial Average ETF Trust Dow Jones Industrial Average (INDEXDJX DJI) – ETF Tracker

Symbol

ETF Name

Tax Form

DIA

SPDR Dow Jones Industrial Average ETF Trust

1099

Vanguard – Prospectus and reports. Online is the quickest, easiest, and most cost-effective way to transact with Vanguard. Lower costs may mean we can pass more savings on to you. SPDR® Dow Jones Industrial Average ETF Trust is offered by prospectus only.Can you buy Dow Jones stock You can't buy stock in the Dow Jones Industrial Average itself, but you can get exposure to the Dow and the companies included in the index. Your investment options include: Buy shares of all 30 companies included in the Dow Jones Industrial Average.

Is there a 3X Dow ETF : The Daily Dow Jones Internet Bull and Bear 3X Shares seek daily investment results, before fees and expenses, of 300%, or 300% of the inverse (or opposite), of the performance of the Dow Jones Internet Composite Index.

Should I invest in Voo or Dia

VOO – Volatility Comparison. The current volatility for SPDR Dow Jones Industrial Average ETF (DIA) is 2.82%, while Vanguard S&P 500 ETF (VOO) has a volatility of 3.37%. This indicates that DIA experiences smaller price fluctuations and is considered to be less risky than VOO based on this measure.

What is the difference between DJ30 and sp500 : Key Takeaways. The DJIA tracks the stock prices of 30 of the biggest American companies. The S&P 500 tracks 500 large-cap American stocks. Both offer a big-picture view of the state of the stock markets in general.

SPDR Dow Jones Industrial Average ETF holds a Zacks ETF Rank of 1 (Strong Buy), which is based on expected asset class return, expense ratio, and momentum, among other factors. Because of this, DIA is an excellent option for investors seeking exposure to the Style Box – Large Cap Value segment of the market. 1 The easiest and most cost-effective avenue to trade the Dow Jones is through an exchange-traded fund (ETF). If you have limited capital but want to trade the Dow, DIA ETF options might be a good way to go, assuming you also understand the risks of options trading.

Should I invest in Dow Jones or S&P 500

If you want to capture gains of a broad swath of the market, then the S&P 500 is your best bet. However, if you are interested in a safe strategy that mirrors price movements of well-established blue-chip stocks, then the Dow is a good choice.Direxion Daily S&P500 Bull 3X Shares SPXL:NYSE Arca

Last Price

Today's Change

Prospectus

$129.55

+0.45 (0.35%)

As of close 05/10/2024

These funds can offer high returns, but they also come with high risk and expenses. Funds that offer 3x leverage are particularly risky because they require higher leverage to achieve their returns. Average Return

In the past year, QQQ returned a total of 37.34%, which is significantly higher than VOO's 29.53% return. Over the past 10 years, QQQ has had annualized average returns of 18.71% , compared to 12.94% for VOO. These numbers are adjusted for stock splits and include dividends.

Should I invest in S&P 500 or Dow : Because the S&P 500 contains hundreds of large companies and represents the lion's share of total stock market value, it is considered a much better gauge of how the market is performing, even though it excludes thousands of smaller and midsize companies.

Is it better to track the Dow Jones or S&P 500 : Because the S&P 500 contains hundreds of large companies and represents the lion's share of total stock market value, it is considered a much better gauge of how the market is performing, even though it excludes thousands of smaller and midsize companies.

Is US30 and DJ30 the same

The Wall Street 30, also known as US30, Dow Jones 30, DJ30, or simply the Dow, is one of the most widely recognized stock market indices in the world. Average Return. In the past year, QQQ returned a total of 39.07%, which is significantly higher than SPY's 30.74% return. Over the past 10 years, QQQ has had annualized average returns of 18.80% , compared to 12.91% for SPY. These numbers are adjusted for stock splits and include dividends.If you want to capture gains of a broad swath of the market, then the S&P 500 is your best bet. However, if you are interested in a safe strategy that mirrors price movements of well-established blue-chip stocks, then the Dow is a good choice.

Why can’t you invest in Dow Jones : The Dow Jones Industrial Average (DJIA) is an index reflecting the average price of the 30 stocks included in the measurement. Therefore, as it is simply a calculated average, you cannot invest in the index itself.

Antwort Which ETF tracks Dow Jones? Weitere Antworten – Which ETF tracks Dow

DIA SPDR Dow Jones Industrial Average ETF Trust

Dow Jones Industrial Average (INDEXDJX DJI) – ETF Tracker

Vanguard – Prospectus and reports. Online is the quickest, easiest, and most cost-effective way to transact with Vanguard. Lower costs may mean we can pass more savings on to you. SPDR® Dow Jones Industrial Average ETF Trust is offered by prospectus only.Can you buy Dow Jones stock You can't buy stock in the Dow Jones Industrial Average itself, but you can get exposure to the Dow and the companies included in the index. Your investment options include: Buy shares of all 30 companies included in the Dow Jones Industrial Average.

Is there a 3X Dow ETF : The Daily Dow Jones Internet Bull and Bear 3X Shares seek daily investment results, before fees and expenses, of 300%, or 300% of the inverse (or opposite), of the performance of the Dow Jones Internet Composite Index.

Should I invest in Voo or Dia

VOO – Volatility Comparison. The current volatility for SPDR Dow Jones Industrial Average ETF (DIA) is 2.82%, while Vanguard S&P 500 ETF (VOO) has a volatility of 3.37%. This indicates that DIA experiences smaller price fluctuations and is considered to be less risky than VOO based on this measure.

What is the difference between DJ30 and sp500 : Key Takeaways. The DJIA tracks the stock prices of 30 of the biggest American companies. The S&P 500 tracks 500 large-cap American stocks. Both offer a big-picture view of the state of the stock markets in general.

SPDR Dow Jones Industrial Average ETF holds a Zacks ETF Rank of 1 (Strong Buy), which is based on expected asset class return, expense ratio, and momentum, among other factors. Because of this, DIA is an excellent option for investors seeking exposure to the Style Box – Large Cap Value segment of the market.

1 The easiest and most cost-effective avenue to trade the Dow Jones is through an exchange-traded fund (ETF). If you have limited capital but want to trade the Dow, DIA ETF options might be a good way to go, assuming you also understand the risks of options trading.

Should I invest in Dow Jones or S&P 500

If you want to capture gains of a broad swath of the market, then the S&P 500 is your best bet. However, if you are interested in a safe strategy that mirrors price movements of well-established blue-chip stocks, then the Dow is a good choice.Direxion Daily S&P500 Bull 3X Shares SPXL:NYSE Arca

These funds can offer high returns, but they also come with high risk and expenses. Funds that offer 3x leverage are particularly risky because they require higher leverage to achieve their returns.

Average Return

In the past year, QQQ returned a total of 37.34%, which is significantly higher than VOO's 29.53% return. Over the past 10 years, QQQ has had annualized average returns of 18.71% , compared to 12.94% for VOO. These numbers are adjusted for stock splits and include dividends.

Should I invest in S&P 500 or Dow : Because the S&P 500 contains hundreds of large companies and represents the lion's share of total stock market value, it is considered a much better gauge of how the market is performing, even though it excludes thousands of smaller and midsize companies.

Is it better to track the Dow Jones or S&P 500 : Because the S&P 500 contains hundreds of large companies and represents the lion's share of total stock market value, it is considered a much better gauge of how the market is performing, even though it excludes thousands of smaller and midsize companies.

Is US30 and DJ30 the same

The Wall Street 30, also known as US30, Dow Jones 30, DJ30, or simply the Dow, is one of the most widely recognized stock market indices in the world.

Average Return. In the past year, QQQ returned a total of 39.07%, which is significantly higher than SPY's 30.74% return. Over the past 10 years, QQQ has had annualized average returns of 18.80% , compared to 12.91% for SPY. These numbers are adjusted for stock splits and include dividends.If you want to capture gains of a broad swath of the market, then the S&P 500 is your best bet. However, if you are interested in a safe strategy that mirrors price movements of well-established blue-chip stocks, then the Dow is a good choice.

Why can’t you invest in Dow Jones : The Dow Jones Industrial Average (DJIA) is an index reflecting the average price of the 30 stocks included in the measurement. Therefore, as it is simply a calculated average, you cannot invest in the index itself.