An ETF that tracks a broad market index such as the S&P 500 is likely to be less volatile than an ETF that tracks a specific industry or sector, such as an oil services ETF. Therefore, it is vital to be aware of the fund's focus and what types of investments it includes.The ETFs shortlisted in this post have expense ratios that are fractions of a percent, making them suitable for day trading.

Vanguard S&P 500 ETF (VOO)

iShares Core S&P 500 ETF (IVV)

Vanguard Total Stock Market Index Fund ETF (VTI)

Schwab U.S. TIPS ETF (SCHP)

SPDR S&P 500 ETF Trust (SPY)

Top sector ETFs

Fund (ticker)

YTD performance

Expense ratio

Vanguard Information Technology ETF (VGT)

4.8 percent

0.10 percent

Financial Select Sector SPDR Fund (XLF)

8.8 percent

0.09 percent

Energy Select Sector SPDR Fund (XLE)

15.9 percent

0.09 percent

Industrial Select Sector SPDR Fund (XLI)

8.7 percent

0.09 percent

What is a low volatility ETF : Low Volatility ETFs invest in securities with low volatility characteristics. These funds tend to have relatively stable share prices, and higher than average yields.

Is QQQ or spy more volatile

SPY – Volatility Comparison. Invesco QQQ (QQQ) has a higher volatility of 4.84% compared to SPDR S&P 500 ETF (SPY) at 3.37%. This indicates that QQQ's price experiences larger fluctuations and is considered to be riskier than SPY based on this measure.

Is VOO or VTI more volatile : VTI – Volatility Comparison. Vanguard S&P 500 ETF (VOO) and Vanguard Total Stock Market ETF (VTI) have volatilities of 3.92% and 3.98%, respectively, indicating that both stocks experience similar levels of price fluctuations.

The largest Aggressive ETF is the iShares Core Aggressive Allocation ETF AOA with $1.91B in assets. In the last trailing year, the best-performing Aggressive ETF was EAOA at 19.60%. The most recent ETF launched in the Aggressive space was the iShares ESG Aware Aggressive Allocation ETF EAOA on 06/12/20. Most Popular ETFs: Top 100 ETFs By Trading Volume

Symbol

Name

Avg Daily Share Volume (3mo)

SQQQ

ProShares UltraPro Short QQQ

138,898,109

TQQQ

ProShares UltraPro QQQ

69,254,852

SPY

SPDR S&P 500 ETF Trust

68,385,469

SOXL

Direxion Daily Semiconductor Bull 3x Shares

68,098,602

What is the biggest risk in ETF

market risk

The single biggest risk in ETFs is market risk.Top 100 Highest Dividend Yield ETFs

Symbol

Name

Dividend Yield

QRMI

Global X NASDAQ 100 Risk Managed Income ETF

12.32%

YMAX

YieldMax Universe Fund of Option Income ETFs

12.30%

XRMI

Global X S&P 500 Risk Managed Income ETF

12.28%

RYLD

Global X Russell 2000 Covered Call ETF

12.26%

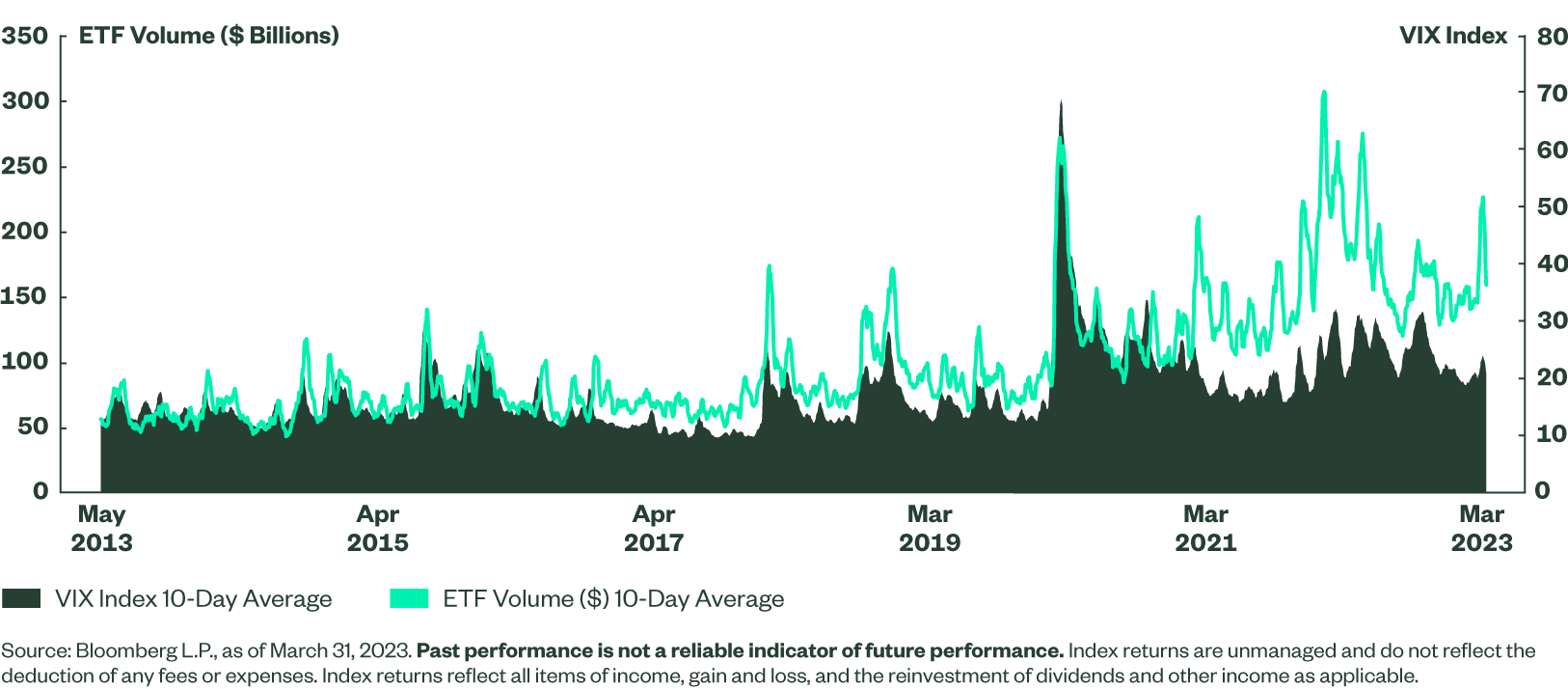

For over a decade, iShares minimum volatility ETFs have generated benchmark-like returns with less risk across global equity building blocks. Since inception, USMV, EFAV, & EEMV have generated similar returns to their respective benchmarks with less risk. Morningstar as of 12/31/2023. Minimizing risk with broad-market funds

SPDR S&P 500 ETF Trust (SPY 0.13%)

Vanguard S&P 500 ETF (VOO 0.12%)

iShares Core S&P 500 ETF (IVV 0.14%)

Vanguard Total Stock Market ETF (VTI 0.09%)

Schwab U.S. Broad Market ETF (SCHB 0.08%)

iShares Core S&P Total U.S. Stock Market ETF (ITOT 0.11%)

Should I buy SPY or QQQ : The table demonstrates that the difference between SPY and QQQ is that the S&P 500 Index and SPY ETF provide much better options for diversification across economic sectors. Despite this, the tech sector accounts for over a third of assets in this fund and is actually 3 times more than the second largest sector.

Is QQQ better than VOO : Average Return

In the past year, QQQ returned a total of 35.63%, which is significantly higher than VOO's 28.53% return. Over the past 10 years, QQQ has had annualized average returns of 18.84% , compared to 13.03% for VOO. These numbers are adjusted for stock splits and include dividends.

Is SPY better than VOO

Over the long run, they do compound—those fee differences—and investors have been putting a lot more money into VOO versus SPY. That is the reason why we view VOO slightly better than SPY. And that is just the basic approach, which is the lower the investor can pay, the better the investment is. 7 risky leveraged ETFs to watch:

Exchange-traded funds (ETFs) are one of the safer types of investments out there, as they require less effort than investing in individual stocks while also increasing diversification.

Why is ETF not a good investment : ETFs are subject to market fluctuation and the risks of their underlying investments. ETFs are subject to management fees and other expenses. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund.

Antwort Which ETF is most volatile? Weitere Antworten – Are ETFs more volatile

Underlying Fluctuations and Risks

An ETF that tracks a broad market index such as the S&P 500 is likely to be less volatile than an ETF that tracks a specific industry or sector, such as an oil services ETF. Therefore, it is vital to be aware of the fund's focus and what types of investments it includes.The ETFs shortlisted in this post have expense ratios that are fractions of a percent, making them suitable for day trading.

Top sector ETFs

What is a low volatility ETF : Low Volatility ETFs invest in securities with low volatility characteristics. These funds tend to have relatively stable share prices, and higher than average yields.

Is QQQ or spy more volatile

SPY – Volatility Comparison. Invesco QQQ (QQQ) has a higher volatility of 4.84% compared to SPDR S&P 500 ETF (SPY) at 3.37%. This indicates that QQQ's price experiences larger fluctuations and is considered to be riskier than SPY based on this measure.

Is VOO or VTI more volatile : VTI – Volatility Comparison. Vanguard S&P 500 ETF (VOO) and Vanguard Total Stock Market ETF (VTI) have volatilities of 3.92% and 3.98%, respectively, indicating that both stocks experience similar levels of price fluctuations.

The largest Aggressive ETF is the iShares Core Aggressive Allocation ETF AOA with $1.91B in assets. In the last trailing year, the best-performing Aggressive ETF was EAOA at 19.60%. The most recent ETF launched in the Aggressive space was the iShares ESG Aware Aggressive Allocation ETF EAOA on 06/12/20.

Most Popular ETFs: Top 100 ETFs By Trading Volume

What is the biggest risk in ETF

market risk

The single biggest risk in ETFs is market risk.Top 100 Highest Dividend Yield ETFs

For over a decade, iShares minimum volatility ETFs have generated benchmark-like returns with less risk across global equity building blocks. Since inception, USMV, EFAV, & EEMV have generated similar returns to their respective benchmarks with less risk. Morningstar as of 12/31/2023.

:max_bytes(150000):strip_icc()/dotdash_Final_Trading_Volatile_Stocks_With_Technical_Indicators_Nov_2020-03-823a5a555de94fe7b0ae40a0fd687810.jpg)

Minimizing risk with broad-market funds

Should I buy SPY or QQQ : The table demonstrates that the difference between SPY and QQQ is that the S&P 500 Index and SPY ETF provide much better options for diversification across economic sectors. Despite this, the tech sector accounts for over a third of assets in this fund and is actually 3 times more than the second largest sector.

Is QQQ better than VOO : Average Return

In the past year, QQQ returned a total of 35.63%, which is significantly higher than VOO's 28.53% return. Over the past 10 years, QQQ has had annualized average returns of 18.84% , compared to 13.03% for VOO. These numbers are adjusted for stock splits and include dividends.

Is SPY better than VOO

Over the long run, they do compound—those fee differences—and investors have been putting a lot more money into VOO versus SPY. That is the reason why we view VOO slightly better than SPY. And that is just the basic approach, which is the lower the investor can pay, the better the investment is.

7 risky leveraged ETFs to watch:

Vanguard S&P 500 ETF

Exchange-traded funds (ETFs) are one of the safer types of investments out there, as they require less effort than investing in individual stocks while also increasing diversification.

Why is ETF not a good investment : ETFs are subject to market fluctuation and the risks of their underlying investments. ETFs are subject to management fees and other expenses. Unlike mutual funds, ETF shares are bought and sold at market price, which may be higher or lower than their NAV, and are not individually redeemed from the fund.