Which Bank Stocks Are Most at Risk of a Liquidity Crisis

Zions Bancorp NA. (ZION)

Signature Bank. (SBNY)

Huntington Bancshares Inc. (HBAN)

SVB Financial Group. (SIVBQ)

First Republic Bank. (FRCB)

These Banks Are the Most Vulnerable

First Republic Bank (FRC) . Above average liquidity risk and high capital risk.

Huntington Bancshares (HBAN) . Above average capital risk.

KeyCorp (KEY) . Above average capital risk.

Comerica (CMA) .

Truist Financial (TFC) .

Cullen/Frost Bankers (CFR) .

Zions Bancorporation (ZION) .

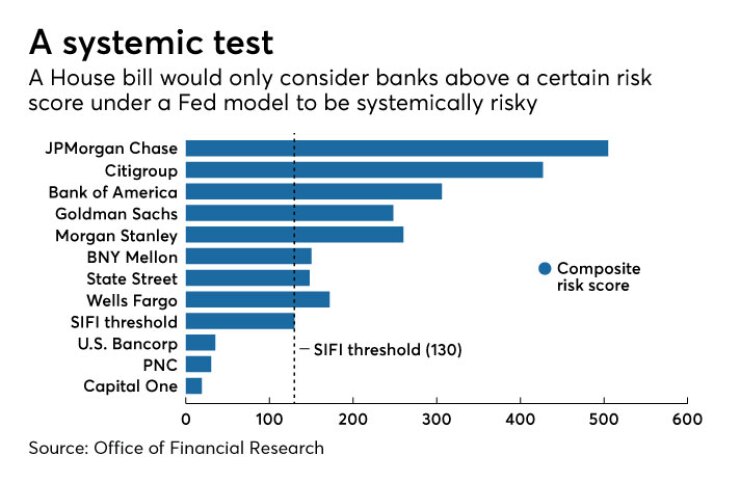

Companies Considered Too Big to Fail

Bank of America Corp.

The Bank of New York Mellon Corp.

Citigroup Inc.

The Goldman Sachs Group Inc.

JPMorgan Chase & Co.

Morgan Stanley.

State Street Corp.

Wells Fargo & Co.

What are the top 3 bank risks : The major risks faced by banks include credit, operational, market, and liquidity risks. Prudent risk management can help banks improve profits as they sustain fewer losses on loans and investments.

How many US banks are in danger

Consulting firm Klaros Group analyzed about 4,000 U.S. banks and found 282 banks face the dual threat of commercial real estate loans and potential losses tied to higher interest rates. The majority of those banks are smaller lenders with less than $10 billion in assets.

Which bank is safest in the USA : JPMorgan Chase, the financial institution that owns Chase Bank, topped our experts' list because it's designated as the world's most systemically important bank on the 2023 G-SIB list. This designation means it has the highest loss absorbency requirements of any bank, providing more protection against financial crisis.

About the FDIC:

Bank NameBank

CityCity

Closing DateClosing

First Republic Bank

San Francisco

May 1, 2023

Signature Bank

New York

March 12, 2023

Silicon Valley Bank

Santa Clara

March 10, 2023

Almena State Bank

Almena

October 23, 2020

State regulators closed Republic First Bank in April 2024, marking the first bank failure of the year. Fulton Bank entered into an agreement with the FDIC to purchase most of Republic First's $6 billion in assets and to assume most of its $4 billion in deposit liabilities.

What US banks are least likely to fail

Summary: Safest Banks In The U.S. Of May 2024

Bank

Forbes Advisor Rating

ATM Network

Chase Bank

5.0

16,000+ Chase ATMs

Bank of America

4.2

15,000+ ATMs in the U.S.

Wells Fargo Bank

4.0

11,000

Citi®

4.0

65,000

Republic First Bank reported unrealized securities losses in excess of its equity as early as June 2022. State regulators closed Republic First Bank in April 2024, marking the first bank failure of the year.The news: Last Friday, Pennsylvania financial regulators seized and shut down Philadelphia-based Republic First Bank in the first FDIC-insured bank failure of 2024. Summary: Safest Banks In The U.S. Of May 2024

Bank

Forbes Advisor Rating

Learn More

Chase Bank

5.0

Learn More Read Our Full Review

Bank of America

4.2

Wells Fargo Bank

4.0

Learn More Read Our Full Review

Citi®

4.0

Which banks are most likely to fail : Historically, small banks are more likely to fail than large banks because they concentrate on regional lending, have fewer revenue streams to diversify risk and possess less capital to absorb losses. However, robust regulatory oversight and FDIC insurance help mitigate the risk to depositors.

What is the most secure bank in America : JPMorgan Chase, the financial institution that owns Chase Bank, topped our experts' list because it's designated as the world's most systemically important bank on the 2023 G-SIB list. This designation means it has the highest loss absorbency requirements of any bank, providing more protection against financial crisis.

Which is the safest bank

JPMorgan Chase, the financial institution that owns Chase Bank, topped our experts' list because it's designated as the world's most systemically important bank on the 2023 G-SIB list. This designation means it has the highest loss absorbency requirements of any bank, providing more protection against financial crisis. JPMorgan Chase, the financial institution that owns Chase Bank, topped our experts' list because it's designated as the world's most systemically important bank on the 2023 G-SIB list. This designation means it has the highest loss absorbency requirements of any bank, providing more protection against financial crisis.Attorney General Paxton joined a multistate investigation into Bank of America Corporation, Wells Fargo & Company, Morgan Stanley & Co. LLC, JPMorgan Chase & Co., The Goldman Sachs Group, Inc., and Citigroup Inc.

Are US banks at risk : Other banks in the country could be at risk of failure as unrealized securities losses reached $478 billion, the most recently available data shows. Already, 40 banks with more than $1 billion in assets reported unrealized security losses greater than 50% of their equity capital.

Antwort Which banks in US are at risk? Weitere Antworten – Which banks are high risk

Which Bank Stocks Are Most at Risk of a Liquidity Crisis

These Banks Are the Most Vulnerable

Companies Considered Too Big to Fail

What are the top 3 bank risks : The major risks faced by banks include credit, operational, market, and liquidity risks. Prudent risk management can help banks improve profits as they sustain fewer losses on loans and investments.

How many US banks are in danger

Consulting firm Klaros Group analyzed about 4,000 U.S. banks and found 282 banks face the dual threat of commercial real estate loans and potential losses tied to higher interest rates. The majority of those banks are smaller lenders with less than $10 billion in assets.

Which bank is safest in the USA : JPMorgan Chase, the financial institution that owns Chase Bank, topped our experts' list because it's designated as the world's most systemically important bank on the 2023 G-SIB list. This designation means it has the highest loss absorbency requirements of any bank, providing more protection against financial crisis.

About the FDIC:

State regulators closed Republic First Bank in April 2024, marking the first bank failure of the year. Fulton Bank entered into an agreement with the FDIC to purchase most of Republic First's $6 billion in assets and to assume most of its $4 billion in deposit liabilities.

What US banks are least likely to fail

Summary: Safest Banks In The U.S. Of May 2024

Republic First Bank reported unrealized securities losses in excess of its equity as early as June 2022. State regulators closed Republic First Bank in April 2024, marking the first bank failure of the year.The news: Last Friday, Pennsylvania financial regulators seized and shut down Philadelphia-based Republic First Bank in the first FDIC-insured bank failure of 2024.

Summary: Safest Banks In The U.S. Of May 2024

Which banks are most likely to fail : Historically, small banks are more likely to fail than large banks because they concentrate on regional lending, have fewer revenue streams to diversify risk and possess less capital to absorb losses. However, robust regulatory oversight and FDIC insurance help mitigate the risk to depositors.

What is the most secure bank in America : JPMorgan Chase, the financial institution that owns Chase Bank, topped our experts' list because it's designated as the world's most systemically important bank on the 2023 G-SIB list. This designation means it has the highest loss absorbency requirements of any bank, providing more protection against financial crisis.

Which is the safest bank

JPMorgan Chase, the financial institution that owns Chase Bank, topped our experts' list because it's designated as the world's most systemically important bank on the 2023 G-SIB list. This designation means it has the highest loss absorbency requirements of any bank, providing more protection against financial crisis.

JPMorgan Chase, the financial institution that owns Chase Bank, topped our experts' list because it's designated as the world's most systemically important bank on the 2023 G-SIB list. This designation means it has the highest loss absorbency requirements of any bank, providing more protection against financial crisis.Attorney General Paxton joined a multistate investigation into Bank of America Corporation, Wells Fargo & Company, Morgan Stanley & Co. LLC, JPMorgan Chase & Co., The Goldman Sachs Group, Inc., and Citigroup Inc.

Are US banks at risk : Other banks in the country could be at risk of failure as unrealized securities losses reached $478 billion, the most recently available data shows. Already, 40 banks with more than $1 billion in assets reported unrealized security losses greater than 50% of their equity capital.