Côte d'Ivoire citizens pay the highest income taxes in the world according to a survey by World Population Review.Denmark

Denmark is the European country with the highest top statutory income tax rate as of 2024, with the Nordic country having a top taxation band of 55.9 percent.Bulgaria

Bulgaria opens our list as the country that has one of the lowest tax rate in Europe. The country's 10% flat rate of personal income and corporate income taxes are among the lowest in the European Union.

Which country has the best tax system : 2023 Rankings

For the tenth year in a row, Estonia has the best tax code in the OECD. Its top score is driven by four positive features of its tax system. First, it has a 20 percent tax rate on corporate income that is only applied to distributed profits.

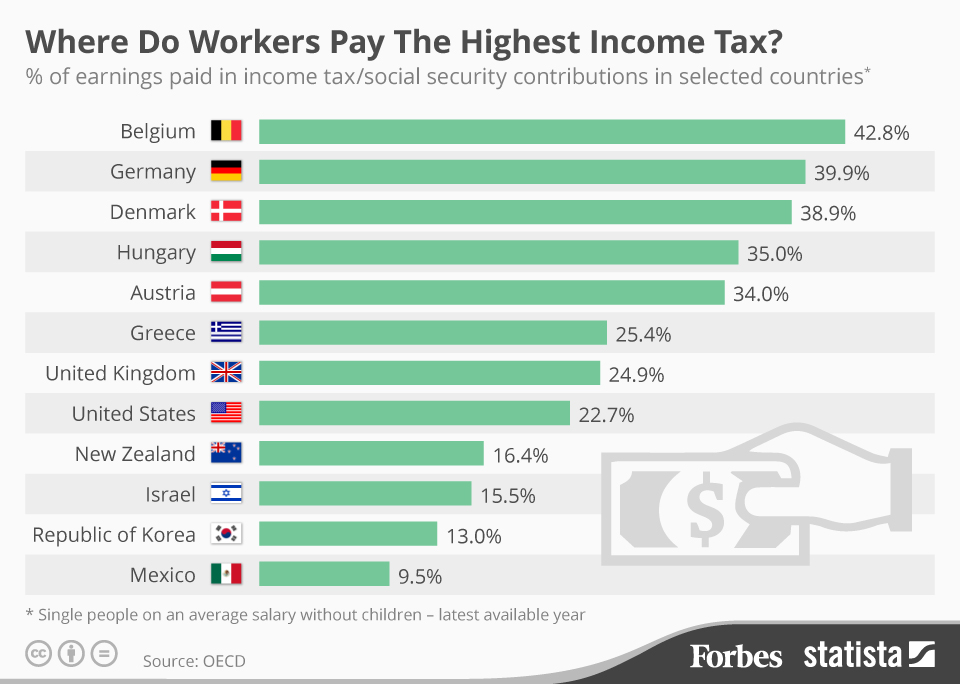

Where is tax the highest

The long-troubled West African country, Ivory Coast, has the highest income tax rate in the world. People living there are giving away a whopping 60% of their income to the government.

Who pays the most taxes : High-Income Taxpayers Paid the Majority of Federal Income Taxes. In 2021, the bottom half of taxpayers earned 10.4 percent of total AGI and paid 2.3 percent of all federal individual income taxes. The top 1 percent earned 26.3 percent of total AGI and paid 45.8 percent of all federal income taxes.

Are US taxes higher than in Europe As for who pays more in taxes, it depends on a particular country. The US has higher rates compared to Eastern European countries (Poland, Bulgaria, Romania, Hungary), but lower rates in contrast with Western European states (France, Germany, Denmark, and the UK). Hungary

The EU countries with the highest standard VAT rates are Hungary (27 percent), Croatia, Denmark, and Sweden (all at 25 percent). Luxembourg levies the lowest standard VAT rate at 17 percent, followed by Malta (18 percent), Cyprus, Germany, and Romania (all at 19 percent).

What is the tax rate in the Czech Republic

Personal Income Tax

The progressive tax of 23% applies to personal income above the statutory limit, which has been set at 36 times the average monthly salary in 2024. Therefore, if an individual's income exceeds 36 times the average wage, they must pay 23% tax on this excess income instead of the basic 15% tax.Ivory Coast. The country with beach resorts, rainforests, and a French-colonial legacy levies a massive 60% personal income tax – the highest in the world.Tax rate in Germany compared to the US. The tax rates in Germany are generally higher than those in the US. For example, the top marginal income tax rate in Germany is 45%, compared to 37% in the US. However, there are a number of deductions and credits available in Germany that can reduce the overall tax burden. Mumbai holds the record for the highest per capita civic tax at Rs 4,086, followed by Pune at Rs 2,635, Coimbatore at Rs 2,259, Ahmedabad at Rs 1,565, Madurai at Rs 784, Jabalpur at Rs 669, Surat at Rs 660, Rajkot at Rs 628, and Kota at Rs 28.

Who pays the highest tax rate in the world : Ivory Coast. The country with beach resorts, rainforests, and a French-colonial legacy levies a massive 60% personal income tax – the highest in the world.

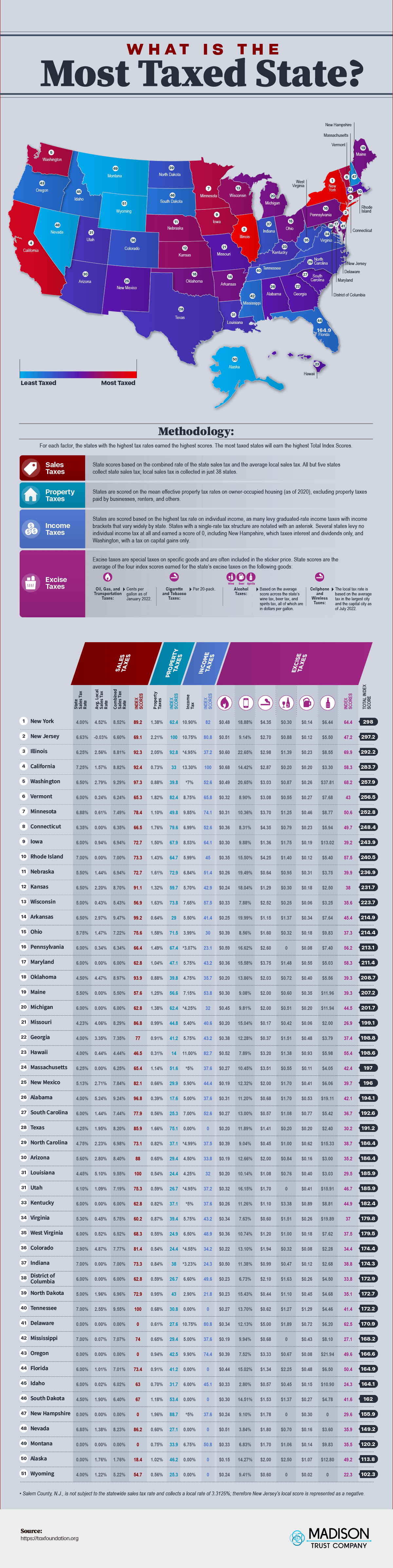

Who has the highest tax rate : Highest taxed states

California (13.3%)

Hawaii (11%)

New Jersey (10.75%)

Oregon (9.9%)

Minnesota (9.85%)

District of Columbia (8.95%)

New York (8.82%)

Vermont (8.75%)

Are UK taxes higher than EU

Read more (36.3%) and the OECD. Read more (34.1%). While UK taxes are higher than in most other English-speaking developed economies (such as Australia, Canada, New Zealand, Ireland and the United States), they are considerably lower than in most other western European countries (average tax revenue amongst the EU14. While the Euro has long been more valuable than the American dollar, the cost of living in the United States is significantly higher than across Europe on average. Basic expenses for a single adult with no children in the U.S. is $2,508 per month, compared to an average of $1,746 per month in Europe.21%

VAT Rates Czech Republic

VAT rate in Czech Republic is generally charged in a standard rate of 21% on supplies of goods and services. As provided under Article 47 on VAT Act, there are two reduced VAT rate in Czech Republic. A reduced VAT rate of 15% and 10%, both consolidated in 12% after 2024.

Which European country has the best tax purposes : We are using The Corporate Tax Haven Index 'Haven Score' 2021 results.

Cyprus.

Netherlands.

Malta.

Ireland. Best for research and development startups.

Luxembourg. Best for foreign investors.

Estonia. Best for digital nomads and solopreneurs.

Antwort Where are the highest taxes in the country? Weitere Antworten – Which country has the highest taxes

Côte d'Ivoire citizens pay the highest income taxes in the world according to a survey by World Population Review.Denmark

Denmark is the European country with the highest top statutory income tax rate as of 2024, with the Nordic country having a top taxation band of 55.9 percent.Bulgaria

Bulgaria opens our list as the country that has one of the lowest tax rate in Europe. The country's 10% flat rate of personal income and corporate income taxes are among the lowest in the European Union.

Which country has the best tax system : 2023 Rankings

For the tenth year in a row, Estonia has the best tax code in the OECD. Its top score is driven by four positive features of its tax system. First, it has a 20 percent tax rate on corporate income that is only applied to distributed profits.

Where is tax the highest

The long-troubled West African country, Ivory Coast, has the highest income tax rate in the world. People living there are giving away a whopping 60% of their income to the government.

Who pays the most taxes : High-Income Taxpayers Paid the Majority of Federal Income Taxes. In 2021, the bottom half of taxpayers earned 10.4 percent of total AGI and paid 2.3 percent of all federal individual income taxes. The top 1 percent earned 26.3 percent of total AGI and paid 45.8 percent of all federal income taxes.

Are US taxes higher than in Europe As for who pays more in taxes, it depends on a particular country. The US has higher rates compared to Eastern European countries (Poland, Bulgaria, Romania, Hungary), but lower rates in contrast with Western European states (France, Germany, Denmark, and the UK).

Hungary

The EU countries with the highest standard VAT rates are Hungary (27 percent), Croatia, Denmark, and Sweden (all at 25 percent). Luxembourg levies the lowest standard VAT rate at 17 percent, followed by Malta (18 percent), Cyprus, Germany, and Romania (all at 19 percent).

What is the tax rate in the Czech Republic

Personal Income Tax

The progressive tax of 23% applies to personal income above the statutory limit, which has been set at 36 times the average monthly salary in 2024. Therefore, if an individual's income exceeds 36 times the average wage, they must pay 23% tax on this excess income instead of the basic 15% tax.Ivory Coast. The country with beach resorts, rainforests, and a French-colonial legacy levies a massive 60% personal income tax – the highest in the world.Tax rate in Germany compared to the US. The tax rates in Germany are generally higher than those in the US. For example, the top marginal income tax rate in Germany is 45%, compared to 37% in the US. However, there are a number of deductions and credits available in Germany that can reduce the overall tax burden.

Mumbai holds the record for the highest per capita civic tax at Rs 4,086, followed by Pune at Rs 2,635, Coimbatore at Rs 2,259, Ahmedabad at Rs 1,565, Madurai at Rs 784, Jabalpur at Rs 669, Surat at Rs 660, Rajkot at Rs 628, and Kota at Rs 28.

Who pays the highest tax rate in the world : Ivory Coast. The country with beach resorts, rainforests, and a French-colonial legacy levies a massive 60% personal income tax – the highest in the world.

Who has the highest tax rate : Highest taxed states

Are UK taxes higher than EU

Read more (36.3%) and the OECD. Read more (34.1%). While UK taxes are higher than in most other English-speaking developed economies (such as Australia, Canada, New Zealand, Ireland and the United States), they are considerably lower than in most other western European countries (average tax revenue amongst the EU14.

While the Euro has long been more valuable than the American dollar, the cost of living in the United States is significantly higher than across Europe on average. Basic expenses for a single adult with no children in the U.S. is $2,508 per month, compared to an average of $1,746 per month in Europe.21%

VAT Rates Czech Republic

VAT rate in Czech Republic is generally charged in a standard rate of 21% on supplies of goods and services. As provided under Article 47 on VAT Act, there are two reduced VAT rate in Czech Republic. A reduced VAT rate of 15% and 10%, both consolidated in 12% after 2024.

Which European country has the best tax purposes : We are using The Corporate Tax Haven Index 'Haven Score' 2021 results.