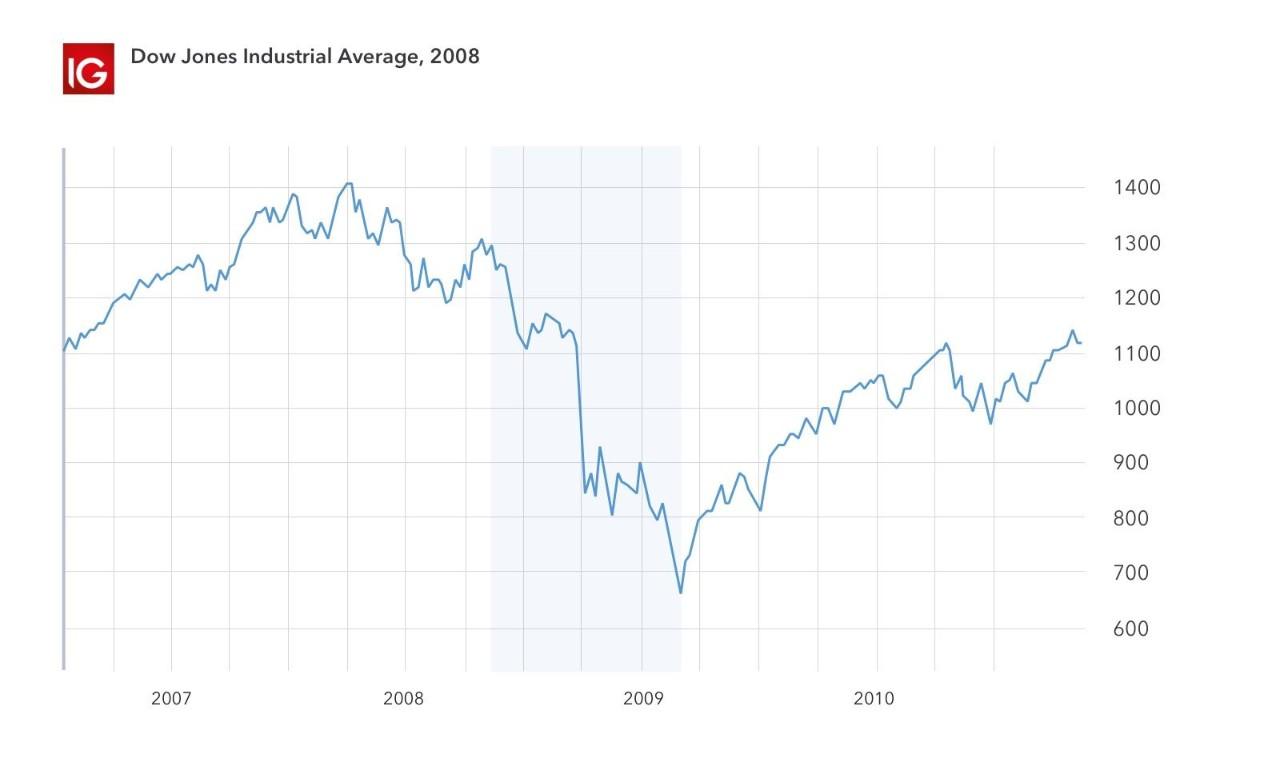

Some of the most significant stock market crashes in U.S. history include the crash in 1929 that preceded the Great Depression, the crash in 1987, known as Black Monday, the dotcom bubble crash in 2001, the 2008 crash related to the Financial Crisis, and the 2020 crash following the outbreak of COVID.Disclosure. According to Stocks Bonds, Bills and Inflation (SBBI), 2021 Summary Edition (Page 192) from Roger G. Ibbotson and James Harrington, there have been 11 crashes resulting in losses of 25% or more since 1870. This includes four with losses of greater than 50% and a fifth with a loss of just under 50%.Bear Stearns' failure was not enough by itself to cause the stock market to crash — it kept rising, to 14,164 points on Oct. 9, 2007 — but by September 2008, the major stock indexes had lost almost 20% of their value. The Dow didn't reach its lowest point, which was 54% below its peak, until March 6, 2009.

What year was the worst stock market : From their peaks in October 2007 until their closing lows in early March 2009, the Dow Jones Industrial Average, Nasdaq Composite and S&P 500 all suffered declines of over 50%, marking the worst stock market crash since the Great Depression era.

Does the stock market crash every 7 years

Since 1900, the market has had a pattern of crashing every seven to eight years, according to Morningstar and Investopedia.

Has the S&P 500 ever lost money : In 2002, the fallout from frenzied investments in internet technology companies and the subsequent implosion of the dot-com bubble caused the S&P 500 to drop 23.4%. And in 2008, the collapse of the U.S. housing market and the subsequent global financial crisis caused the S&P 500 to fall 38.5%.

About 90% of investors lose money trading stocks. That's 9 out of every 10 people — both newbies and seasoned professionals — losing their hard earned dollars by trying to outsmart an unpredictable and extremely volatile machine. The market sees a greater than 80% chance of at least five rate cuts from current levels by the end of 2024. Investor optimism about the economic outlook has improved dramatically from a year ago, but there's still a risk that Fed policy tightening could tip the economy into a recession in 2024.

What was the worst market crash in history

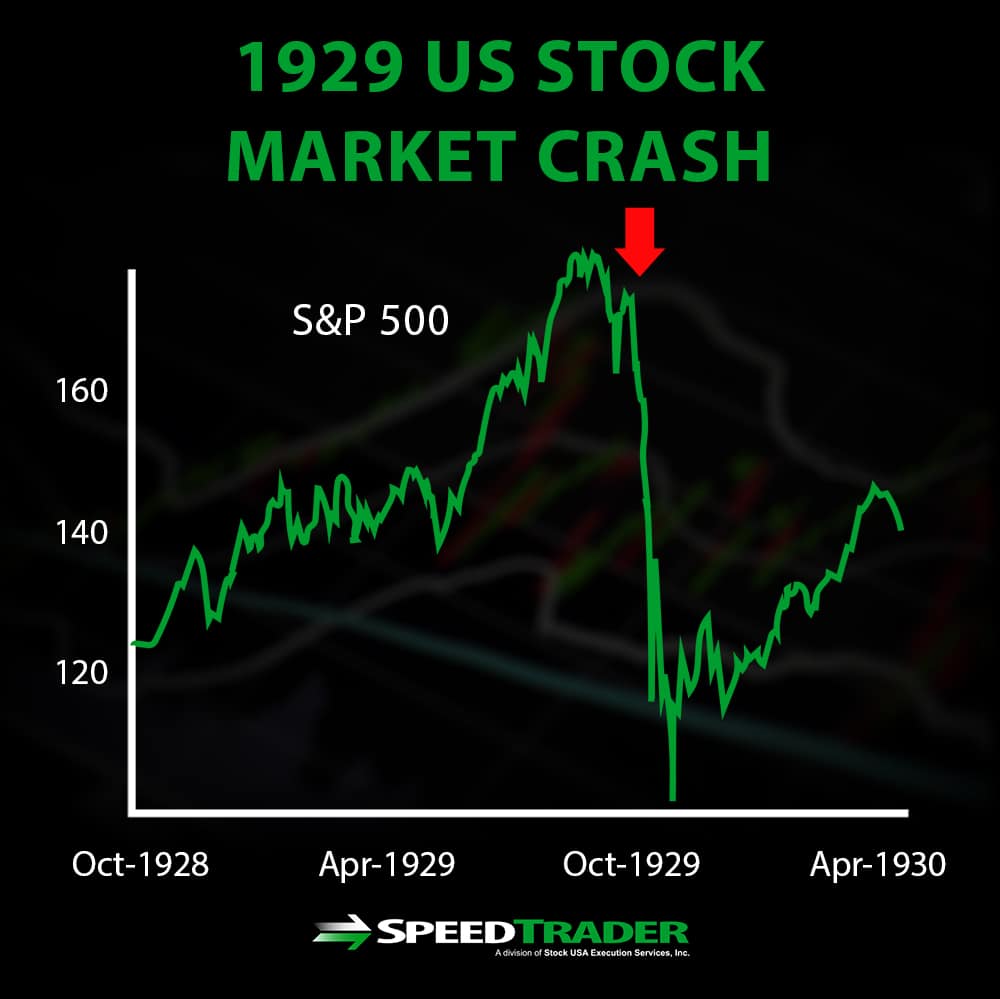

The Wall Street crash: 1929

The Wall Street crash of 1929 hit the New York Stock Exchange (NYSE) on 24 October. It is considered the most famous stock market crash of the 20th century, and the greatest crash in the history of the United States.As a whole, analysts are optimistic about the outlook for stock prices in 2024. The consensus analyst price target for the S&P 500 is 5,090, suggesting roughly 8.5% upside from current levels.Is a recession coming in 2024 While it is difficult to predict a recession in advance, the current state of the economy makes the possibility of a recession appear less likely in 2024. Your portfolio might lose value, but losing value is different than losing money. When stock prices fall, your investments are not worth as much. But the market will inevitably rebound, and when that happens, stock prices will increase once again — and your portfolio will regain the value it lost.

How much was $10,000 invested in the S&P 500 in 2000 : Think About This: $10,000 invested in the S&P 500 at the beginning of 2000 would have grown to $32,527 over 20 years — an average return of 6.07% per year.

Does the S&P 500 double every 7 years : How long has it historically taken a stock investment to double NYU business professor Aswath Damodaran has done the math. According to his math, since 1949 S&P 500 investments have doubled ten times, or an average of about seven years each time.

What happens if you lose 100% of your stock

When a stock's price falls to zero, a shareholder's holdings in this stock become worthless. Major stock exchanges actually delist shares once they fall below specific price values. However, the harsh reality is that the vast majority of day traders lose money. In fact, studies have shown that a staggering 97% of day traders end up in the red. This statistic is not only staggering, but it's also incredibly disheartening for those who are considering day trading as a means of making a living.Stay the course

Pulling your money out of the market when stocks are down will only hurt you in the long run. “In this environment, investors should remain fully diversified across multiple asset classes and regions, and in line with one's financial goals and risk tolerance,” Mukherjee said.

Where to invest now in 2024 : Overview: Best investments in 2024

High-yield savings accounts. Overview: A high-yield online savings account pays you interest on your cash balance.

Antwort When was the last stock market crash? Weitere Antworten – When was the last time we had a market crash

Some of the most significant stock market crashes in U.S. history include the crash in 1929 that preceded the Great Depression, the crash in 1987, known as Black Monday, the dotcom bubble crash in 2001, the 2008 crash related to the Financial Crisis, and the 2020 crash following the outbreak of COVID.Disclosure. According to Stocks Bonds, Bills and Inflation (SBBI), 2021 Summary Edition (Page 192) from Roger G. Ibbotson and James Harrington, there have been 11 crashes resulting in losses of 25% or more since 1870. This includes four with losses of greater than 50% and a fifth with a loss of just under 50%.Bear Stearns' failure was not enough by itself to cause the stock market to crash — it kept rising, to 14,164 points on Oct. 9, 2007 — but by September 2008, the major stock indexes had lost almost 20% of their value. The Dow didn't reach its lowest point, which was 54% below its peak, until March 6, 2009.

What year was the worst stock market : From their peaks in October 2007 until their closing lows in early March 2009, the Dow Jones Industrial Average, Nasdaq Composite and S&P 500 all suffered declines of over 50%, marking the worst stock market crash since the Great Depression era.

Does the stock market crash every 7 years

Since 1900, the market has had a pattern of crashing every seven to eight years, according to Morningstar and Investopedia.

Has the S&P 500 ever lost money : In 2002, the fallout from frenzied investments in internet technology companies and the subsequent implosion of the dot-com bubble caused the S&P 500 to drop 23.4%. And in 2008, the collapse of the U.S. housing market and the subsequent global financial crisis caused the S&P 500 to fall 38.5%.

About 90% of investors lose money trading stocks. That's 9 out of every 10 people — both newbies and seasoned professionals — losing their hard earned dollars by trying to outsmart an unpredictable and extremely volatile machine.

The market sees a greater than 80% chance of at least five rate cuts from current levels by the end of 2024. Investor optimism about the economic outlook has improved dramatically from a year ago, but there's still a risk that Fed policy tightening could tip the economy into a recession in 2024.

What was the worst market crash in history

The Wall Street crash: 1929

The Wall Street crash of 1929 hit the New York Stock Exchange (NYSE) on 24 October. It is considered the most famous stock market crash of the 20th century, and the greatest crash in the history of the United States.As a whole, analysts are optimistic about the outlook for stock prices in 2024. The consensus analyst price target for the S&P 500 is 5,090, suggesting roughly 8.5% upside from current levels.Is a recession coming in 2024 While it is difficult to predict a recession in advance, the current state of the economy makes the possibility of a recession appear less likely in 2024.

Your portfolio might lose value, but losing value is different than losing money. When stock prices fall, your investments are not worth as much. But the market will inevitably rebound, and when that happens, stock prices will increase once again — and your portfolio will regain the value it lost.

How much was $10,000 invested in the S&P 500 in 2000 : Think About This: $10,000 invested in the S&P 500 at the beginning of 2000 would have grown to $32,527 over 20 years — an average return of 6.07% per year.

Does the S&P 500 double every 7 years : How long has it historically taken a stock investment to double NYU business professor Aswath Damodaran has done the math. According to his math, since 1949 S&P 500 investments have doubled ten times, or an average of about seven years each time.

What happens if you lose 100% of your stock

When a stock's price falls to zero, a shareholder's holdings in this stock become worthless. Major stock exchanges actually delist shares once they fall below specific price values.

However, the harsh reality is that the vast majority of day traders lose money. In fact, studies have shown that a staggering 97% of day traders end up in the red. This statistic is not only staggering, but it's also incredibly disheartening for those who are considering day trading as a means of making a living.Stay the course

Pulling your money out of the market when stocks are down will only hurt you in the long run. “In this environment, investors should remain fully diversified across multiple asset classes and regions, and in line with one's financial goals and risk tolerance,” Mukherjee said.

Where to invest now in 2024 : Overview: Best investments in 2024