The USDJPY price is stable – Forecast today – 10-05-2024

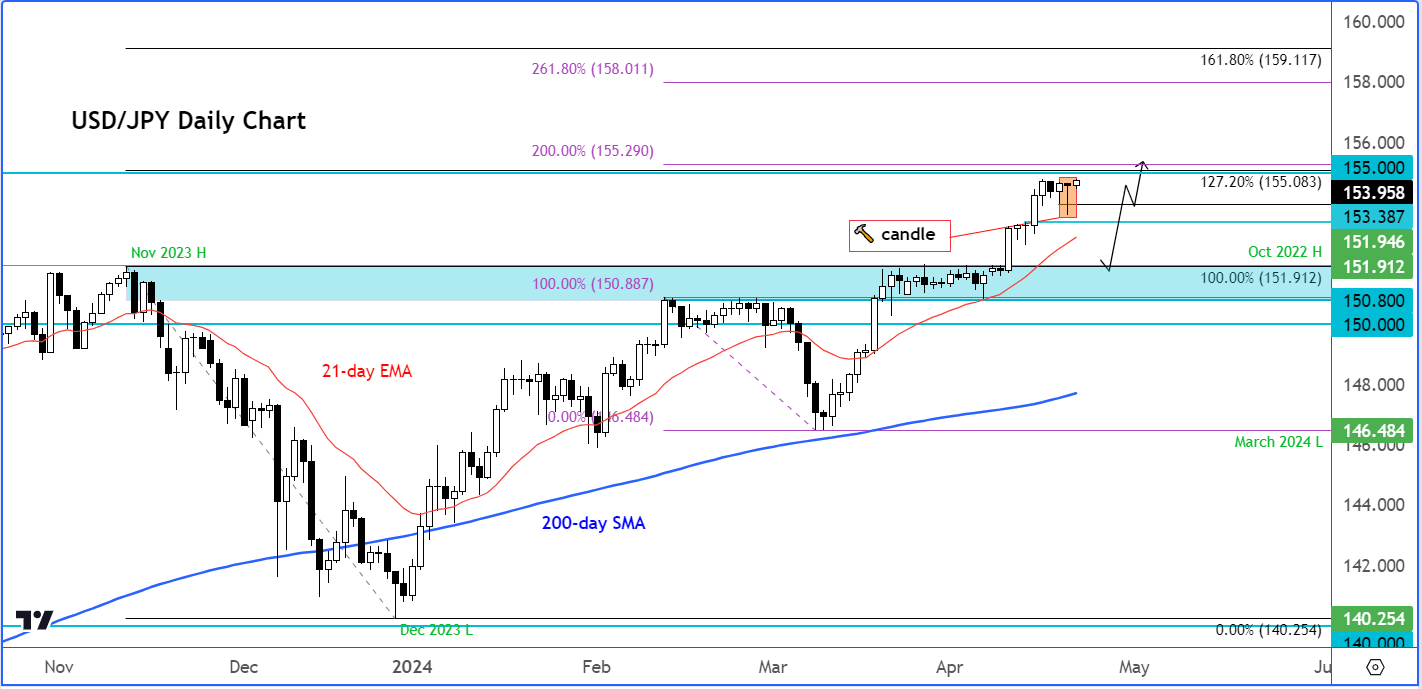

USDJPY Price Analysis Expected Scenario The USDJPY price settles around the 155.50 level and begins to provide slight positive trades at today's open.bullish

The bullish trend is currently very strong on USD/JPY. As long as the price remains above the support at , you could try to… The bullish trend is currently very strong on USD/JPY.This is because people can borrow Yen more cheaply to buy higher-yielding dollars. Generally, higher interest rates increase the value of a country's currency. Thus increasing interest rates in the U.S. (accompanied by lower Treasuries prices), often causes the USD to strengthen relative to the JPY.

Is it a good time to convert USD to yen : The ideal time to trade USD/JPY is generally at between 12:00 to 15:00 Greenwich Mean Time (GMT), when market activity is at its highest level.

How much is a dollar to a yen in 2024

What was the average US Dollar to Japanese Yen exchange rate in 2024 The average US Dollar to Japanese Yen exchange rate in 2024 was 1 US Dollar = 150.46 Japanese Yen.

What is the best time frame to trade USD JPY : History shows that the best window of opportunity for trading this pair is from 12:00 to 15:00 GMT. That's when the pair sees the greatest liquidity and volatility.

For years the JPY was overvalued on a PPP basis. Now it is undervalued by a significant amount. With inflation running higher in the US than in Japan even at the same exchange rate the gap with PPP will grow. EUR/USD is predicted to reach 1.05 in June 2024 and September 2024, 1.09 in December 2024 and 1.12 in March 2025. USD/JPY is expected to hit 155 in June 2024, 154 in September 2024, 153 in December 2024 and 152 in March 2025.

Why is JPY collapsing

The yen's tumble in value since 2022 has stemmed mainly from the gap between domestic and foreign interest rates, along with a growing trade deficit. But the rate differential has stopped widening for now, and the trade deficit is shrinking.During 2025, the US dollar / Japanese yen rate is predicted to be in the range from 162 to 177, showing signs of steady growth.In three months, the US Dollar-Japanese Yen exchange rate is expected to be at 153.5189. In six months the projected rate is at 151.4719. ING, a Dutch bank, forecasted in early April 2024 that the USD/JPY would reach around 138 by the end of 2024 and fluctuate within the range of 140 to 142 in 2025. Bank of America forecasted that USD/JPY would reach 160 in 2024 but decrease to 136 – 147 in 2025.

Why is the Japanese yen falling : The yen's tumble in value since 2022 has stemmed mainly from the gap between domestic and foreign interest rates, along with a growing trade deficit. But the rate differential has stopped widening for now, and the trade deficit is shrinking.

What is the prediction for the JPY to USD exchange rate : Japanese Yen is expected to rise by 2.93% against the US Dollar by the end of 2024, as the USD/JPY rate is expected to reach ¥ 160.97.

What is the JPY exchange rate forecast

The SGD to JPY exchange rate is forecasted to increase by 0.40% in the next 24 hours, rising from the current rate of ¥ 116.05 to ¥ 116.51. Currently, the sentiment in the SGD/JPY market is estimated to be bullish. They still anticipate an early recovery in the strength of the JPY. ING, a Dutch bank, forecasted in early April 2024 that the USD/JPY would reach around 138 by the end of 2024 and fluctuate within the range of 140 to 142 in 2025.Still, momentum appears to be against any substantial strengthening of the yen in the foreseeable future. During its intervention in 2022, Japanese authorities spent more than $60bn of its foreign exchange reserves to prop up the yen – only to see it continue its slide.

How high will rates go in 2024 : NAR: Rates Will Decline to 6.5% The National Association of Realtors expects mortgage rates will average 6.8% in the first quarter of 2024, rising to 7.1% in the second quarter, according to its latest Quarterly U.S. Economic Forecast.

Antwort What will USD to JPY be in 2024? Weitere Antworten – What is the prediction of USD JPY

The USDJPY price is stable – Forecast today – 10-05-2024

USDJPY Price Analysis Expected Scenario The USDJPY price settles around the 155.50 level and begins to provide slight positive trades at today's open.bullish

The bullish trend is currently very strong on USD/JPY. As long as the price remains above the support at , you could try to… The bullish trend is currently very strong on USD/JPY.This is because people can borrow Yen more cheaply to buy higher-yielding dollars. Generally, higher interest rates increase the value of a country's currency. Thus increasing interest rates in the U.S. (accompanied by lower Treasuries prices), often causes the USD to strengthen relative to the JPY.

Is it a good time to convert USD to yen : The ideal time to trade USD/JPY is generally at between 12:00 to 15:00 Greenwich Mean Time (GMT), when market activity is at its highest level.

How much is a dollar to a yen in 2024

What was the average US Dollar to Japanese Yen exchange rate in 2024 The average US Dollar to Japanese Yen exchange rate in 2024 was 1 US Dollar = 150.46 Japanese Yen.

What is the best time frame to trade USD JPY : History shows that the best window of opportunity for trading this pair is from 12:00 to 15:00 GMT. That's when the pair sees the greatest liquidity and volatility.

For years the JPY was overvalued on a PPP basis. Now it is undervalued by a significant amount. With inflation running higher in the US than in Japan even at the same exchange rate the gap with PPP will grow.

EUR/USD is predicted to reach 1.05 in June 2024 and September 2024, 1.09 in December 2024 and 1.12 in March 2025. USD/JPY is expected to hit 155 in June 2024, 154 in September 2024, 153 in December 2024 and 152 in March 2025.

Why is JPY collapsing

The yen's tumble in value since 2022 has stemmed mainly from the gap between domestic and foreign interest rates, along with a growing trade deficit. But the rate differential has stopped widening for now, and the trade deficit is shrinking.During 2025, the US dollar / Japanese yen rate is predicted to be in the range from 162 to 177, showing signs of steady growth.In three months, the US Dollar-Japanese Yen exchange rate is expected to be at 153.5189. In six months the projected rate is at 151.4719.

ING, a Dutch bank, forecasted in early April 2024 that the USD/JPY would reach around 138 by the end of 2024 and fluctuate within the range of 140 to 142 in 2025. Bank of America forecasted that USD/JPY would reach 160 in 2024 but decrease to 136 – 147 in 2025.

Why is the Japanese yen falling : The yen's tumble in value since 2022 has stemmed mainly from the gap between domestic and foreign interest rates, along with a growing trade deficit. But the rate differential has stopped widening for now, and the trade deficit is shrinking.

What is the prediction for the JPY to USD exchange rate : Japanese Yen is expected to rise by 2.93% against the US Dollar by the end of 2024, as the USD/JPY rate is expected to reach ¥ 160.97.

What is the JPY exchange rate forecast

The SGD to JPY exchange rate is forecasted to increase by 0.40% in the next 24 hours, rising from the current rate of ¥ 116.05 to ¥ 116.51. Currently, the sentiment in the SGD/JPY market is estimated to be bullish.

They still anticipate an early recovery in the strength of the JPY. ING, a Dutch bank, forecasted in early April 2024 that the USD/JPY would reach around 138 by the end of 2024 and fluctuate within the range of 140 to 142 in 2025.Still, momentum appears to be against any substantial strengthening of the yen in the foreseeable future. During its intervention in 2022, Japanese authorities spent more than $60bn of its foreign exchange reserves to prop up the yen – only to see it continue its slide.

How high will rates go in 2024 : NAR: Rates Will Decline to 6.5% The National Association of Realtors expects mortgage rates will average 6.8% in the first quarter of 2024, rising to 7.1% in the second quarter, according to its latest Quarterly U.S. Economic Forecast.