Traders work on the floor of the New York Stock Exchange during morning trading on May 17, 2024 in New York City. Passing major milestones such as the 40,000 barrier the Dow Jones Industrial Average eclipsed this week makes for a nice headline, but market experts do not take much else from the move.The Dow Jones Target 2025 Index is designed to measure total portfolios of stocks, bonds, and cash that automatically adjust over time to reduce potential risk as an investor's target maturity date approaches.Case in point: The Dow hit 30,000 for the first time on November 24, 2020. Crossing 40,000 today, May 16, 2024, gives it a 33.333333333333% return in a little under three and a half years.

Will the stock market ever reach $40,000 : The Dow Jones Industrial Average reaching 40,000 was a milestone for investors last week, but a top Wall Street forecaster sees even bigger gains ahead, thanks to earnings.

How high will Dow go in 2024

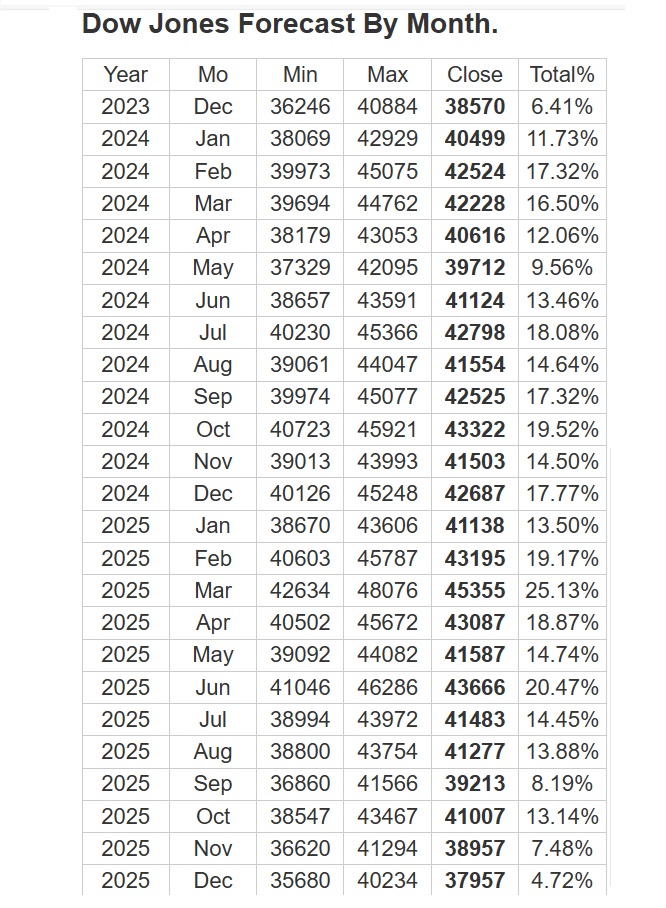

The agency forecasted Dow Jones will close in 2024 at 38818 points. The updated Dow Jones price prediction for the next 5 years is for the index to trade around 45,000 points.

Where will the Dow be in 2027 : The Dow Jones Industrial Average, an index that has astonished with its ascent over the past decade, likely will continue to astonish through the 2020s, rising to 50,000 by 2027.

The Dow industrials surpassed the 37000 level intraday for the first time on record Wednesday. The blue-chip index hit its last thousand-point milestone, 36000, in November 2021. The Dow crossed its latest 10,000 point threshold briefly on Thursday and closed above 40,000 Friday — at 40,003.59 to be exact. It took about three and a half years to make the leap from 30,000 points, which it first crossed in November 2020.

How much will stocks grow in 20 years

5-year, 10-year, 20-year and 30-year S&P 500 returns

Period (start-of-year to end-of-2023)

Average annual S&P 500 return

15 years (2009-2023)

12.63%

20 years (2004-2023)

9.00%

25 years (1999-2023)

7.18%

30 years (1994-2023)

9.67%

When a stock's price falls to zero, a shareholder's holdings in this stock become worthless. Major stock exchanges actually delist shares once they fall below specific price values. The New York Stock exchange (NYSE), for instance, will remove stocks if the share price remains below one dollar for 30 consecutive days.To some investors, this might seem unlikely. The Dow Jones Industrial Average, an index that has astonished with its ascent over the past decade, likely will continue to astonish through the 2020s, rising to 50,000 by 2027. Yardeni Research's chief investment strategist, Ed Yardeni, told clients in a note that the Dow Jones Industrial Average is on track for a 50% rise to 60,000 by 2030, and the S&P 500 could climb to 8,000, thanks to earnings.

Can the Dow hit $40,000 : The Dow crossed its latest 10,000 point threshold briefly on Thursday and closed above 40,000 Friday — at 40,003.59 to be exact. It took about three and a half years to make the leap from 30,000 points, which it first crossed in November 2020.

Has the Dow ever hit $37,000 : Dow All-Time Highs

By the end of 2023, the previous high, registered in January 2022, had been surpassed, and the 37,000 mark had been breached. The Dow then climbed above 38,000 in January 2024. 1 The index reached a new all-time high on May 16, 2024, surpassing 40,000 for the first time.

What if I invested $1000 in S&P 500 10 years ago

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498. Its stock price today is $150.93, which is an increase of 5,911% during this period. If you had invested $1,000 in Google stock on Aug. 19, 2004, today, you would have $60,107.When a stock's price falls to zero, a shareholder's holdings in this stock become worthless. Major stock exchanges actually delist shares once they fall below specific price values.

Can a stock go back up to zero : Can a stock ever rebound after it has gone to zero Yes, but unlikely. A more typical example is the corporate shell gets zeroed and a new company is vended [sold] into the shell (the legal entity that remains after the bankruptcy) and the company begins trading again.

Antwort What will the Dow be in 2025? Weitere Antworten – Will the Dow hit $40,000 in 2024

Traders work on the floor of the New York Stock Exchange during morning trading on May 17, 2024 in New York City. Passing major milestones such as the 40,000 barrier the Dow Jones Industrial Average eclipsed this week makes for a nice headline, but market experts do not take much else from the move.The Dow Jones Target 2025 Index is designed to measure total portfolios of stocks, bonds, and cash that automatically adjust over time to reduce potential risk as an investor's target maturity date approaches.Case in point: The Dow hit 30,000 for the first time on November 24, 2020. Crossing 40,000 today, May 16, 2024, gives it a 33.333333333333% return in a little under three and a half years.

Will the stock market ever reach $40,000 : The Dow Jones Industrial Average reaching 40,000 was a milestone for investors last week, but a top Wall Street forecaster sees even bigger gains ahead, thanks to earnings.

How high will Dow go in 2024

The agency forecasted Dow Jones will close in 2024 at 38818 points. The updated Dow Jones price prediction for the next 5 years is for the index to trade around 45,000 points.

Where will the Dow be in 2027 : The Dow Jones Industrial Average, an index that has astonished with its ascent over the past decade, likely will continue to astonish through the 2020s, rising to 50,000 by 2027.

The Dow industrials surpassed the 37000 level intraday for the first time on record Wednesday. The blue-chip index hit its last thousand-point milestone, 36000, in November 2021.

The Dow crossed its latest 10,000 point threshold briefly on Thursday and closed above 40,000 Friday — at 40,003.59 to be exact. It took about three and a half years to make the leap from 30,000 points, which it first crossed in November 2020.

How much will stocks grow in 20 years

5-year, 10-year, 20-year and 30-year S&P 500 returns

When a stock's price falls to zero, a shareholder's holdings in this stock become worthless. Major stock exchanges actually delist shares once they fall below specific price values. The New York Stock exchange (NYSE), for instance, will remove stocks if the share price remains below one dollar for 30 consecutive days.To some investors, this might seem unlikely. The Dow Jones Industrial Average, an index that has astonished with its ascent over the past decade, likely will continue to astonish through the 2020s, rising to 50,000 by 2027.

Yardeni Research's chief investment strategist, Ed Yardeni, told clients in a note that the Dow Jones Industrial Average is on track for a 50% rise to 60,000 by 2030, and the S&P 500 could climb to 8,000, thanks to earnings.

Can the Dow hit $40,000 : The Dow crossed its latest 10,000 point threshold briefly on Thursday and closed above 40,000 Friday — at 40,003.59 to be exact. It took about three and a half years to make the leap from 30,000 points, which it first crossed in November 2020.

Has the Dow ever hit $37,000 : Dow All-Time Highs

By the end of 2023, the previous high, registered in January 2022, had been surpassed, and the 37,000 mark had been breached. The Dow then climbed above 38,000 in January 2024. 1 The index reached a new all-time high on May 16, 2024, surpassing 40,000 for the first time.

What if I invested $1000 in S&P 500 10 years ago

Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

Its stock price today is $150.93, which is an increase of 5,911% during this period. If you had invested $1,000 in Google stock on Aug. 19, 2004, today, you would have $60,107.When a stock's price falls to zero, a shareholder's holdings in this stock become worthless. Major stock exchanges actually delist shares once they fall below specific price values.

Can a stock go back up to zero : Can a stock ever rebound after it has gone to zero Yes, but unlikely. A more typical example is the corporate shell gets zeroed and a new company is vended [sold] into the shell (the legal entity that remains after the bankruptcy) and the company begins trading again.