The worst stock market crash in history started in 1929 and was one of the catalysts of the Great Depression. The crash abruptly ended a period known as the Roaring Twenties, during which the economy expanded significantly and the stock market boomed.The 1987 stock market crash, or Black Monday, is known for being the largest single-day percentage decline in U.S. stock market history. On Oct. 19, the Dow fell 22.6 percent, a shocking drop of 508 points. The crash was somewhat of an isolated incident and didn't have anywhere near the impact that the 1929 crash did.Since 1900, the market has had a pattern of crashing every seven to eight years, according to Morningstar and Investopedia.

What was the longest market downturn : The crash of 1929

Began – August 1929.

Ended – November 1932.

Duration – 33 months.

Percentage decline from top to bottom – 79%

Is 20% a market crash

A bear market is a pullback of at least a 20% decline from a recent high.

Has the S&P 500 ever lost money : In 2002, the fallout from frenzied investments in internet technology companies and the subsequent implosion of the dot-com bubble caused the S&P 500 to drop 23.4%. And in 2008, the collapse of the U.S. housing market and the subsequent global financial crisis caused the S&P 500 to fall 38.5%.

Your portfolio might lose value, but losing value is different than losing money. When stock prices fall, your investments are not worth as much. But the market will inevitably rebound, and when that happens, stock prices will increase once again — and your portfolio will regain the value it lost. Is a recession coming in 2024 While it is difficult to predict a recession in advance, the current state of the economy makes the possibility of a recession appear less likely in 2024.

How often do stocks drop 10%

Stock market corrections are not uncommon

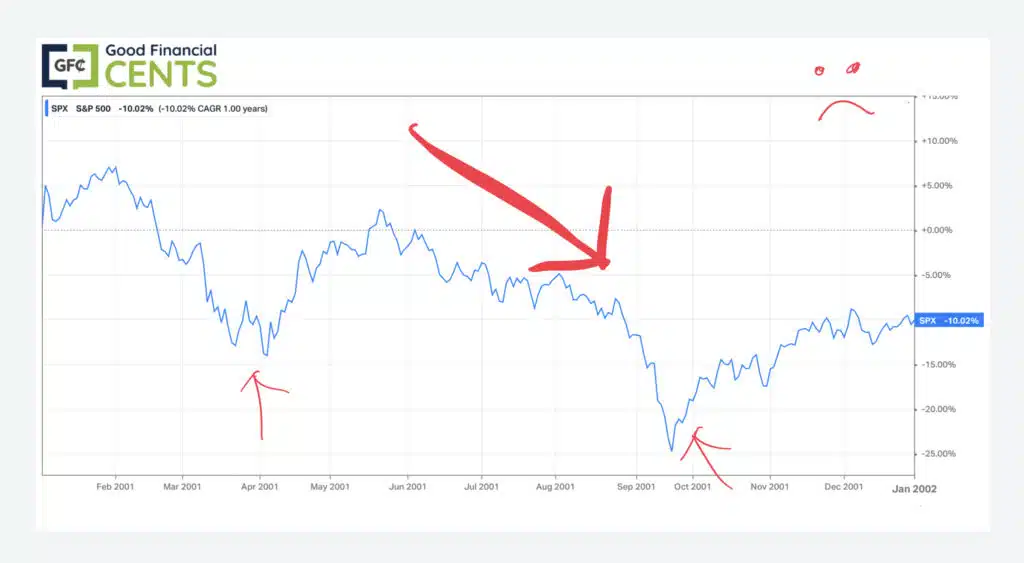

As you can see in the chart below, a decline of at least 10% occurred in 10 out of 20 years, or 50% of the time, with an average pullback of 15%. And in two additional years, the decline was just short of 10%.Largest percentage changes

Some sources (including the file Highlights/Lowlights of The Dow on the Dow Jones website) show a loss of −24.39% (from 71.42 to 54.00) on December 12, 1914, placing that day atop the list of largest percentage losses.With stock indexes at all-time highs, it seems we are in the midst of a new bull market. While much of the market's recent gains have come from a handful of stocks, the rally has begun to broaden in recent months. Expectations of an earnings rebound in 2024 suggest earnings could continue to drive the market higher. The market sees a greater than 80% chance of at least five rate cuts from current levels by the end of 2024. Investor optimism about the economic outlook has improved dramatically from a year ago, but there's still a risk that Fed policy tightening could tip the economy into a recession in 2024.

How long did it take S&P 500 to recover from 2008 : Starting with the “tech wreck” in 2000, inflation totaled 35.7%, prolonging the real recovery in purchasing power an additional seven years and nine months. The bounce-back from the 2008 crash took five and a half years, but an additional half year to regain your purchasing power.

How much was $10,000 invested in the S&P 500 in 2000 : Think About This: $10,000 invested in the S&P 500 at the beginning of 2000 would have grown to $32,527 over 20 years — an average return of 6.07% per year.

Will the S&P 500 ever hit $5,000

Yet, while some strategists see reasons for cheer, others see a market top. On Thursday, the S&P 500 crossed the 5000 mark during intraday trading for the first time, and on Friday it ended above that level, notching its tenth record close of 2024 at 5,026. About 90% of investors lose money trading stocks. That's 9 out of every 10 people — both newbies and seasoned professionals — losing their hard earned dollars by trying to outsmart an unpredictable and extremely volatile machine.Stock market investors may be anxious, but as the old saying goes, "There's no need to panic." "While we maintain a positive view on the U.S. stock market in 2024, there are a range of risk factors that could derail the current bull market," Dilley says.

How long do recessions last : According to the National Bureau of Economic Research (NBER), the average length of recessions since World War II has been approximately 11 months. But the exact length of a recession is difficult to predict. In general, a recession lasts anywhere from six to 18 months.

Antwort What was the biggest market crash in history? Weitere Antworten – What was the biggest market crash in the world

1929 stock market crash

The worst stock market crash in history started in 1929 and was one of the catalysts of the Great Depression. The crash abruptly ended a period known as the Roaring Twenties, during which the economy expanded significantly and the stock market boomed.The 1987 stock market crash, or Black Monday, is known for being the largest single-day percentage decline in U.S. stock market history. On Oct. 19, the Dow fell 22.6 percent, a shocking drop of 508 points. The crash was somewhat of an isolated incident and didn't have anywhere near the impact that the 1929 crash did.Since 1900, the market has had a pattern of crashing every seven to eight years, according to Morningstar and Investopedia.

What was the longest market downturn : The crash of 1929

Is 20% a market crash

A bear market is a pullback of at least a 20% decline from a recent high.

Has the S&P 500 ever lost money : In 2002, the fallout from frenzied investments in internet technology companies and the subsequent implosion of the dot-com bubble caused the S&P 500 to drop 23.4%. And in 2008, the collapse of the U.S. housing market and the subsequent global financial crisis caused the S&P 500 to fall 38.5%.

Your portfolio might lose value, but losing value is different than losing money. When stock prices fall, your investments are not worth as much. But the market will inevitably rebound, and when that happens, stock prices will increase once again — and your portfolio will regain the value it lost.

Is a recession coming in 2024 While it is difficult to predict a recession in advance, the current state of the economy makes the possibility of a recession appear less likely in 2024.

How often do stocks drop 10%

Stock market corrections are not uncommon

As you can see in the chart below, a decline of at least 10% occurred in 10 out of 20 years, or 50% of the time, with an average pullback of 15%. And in two additional years, the decline was just short of 10%.Largest percentage changes

Some sources (including the file Highlights/Lowlights of The Dow on the Dow Jones website) show a loss of −24.39% (from 71.42 to 54.00) on December 12, 1914, placing that day atop the list of largest percentage losses.With stock indexes at all-time highs, it seems we are in the midst of a new bull market. While much of the market's recent gains have come from a handful of stocks, the rally has begun to broaden in recent months. Expectations of an earnings rebound in 2024 suggest earnings could continue to drive the market higher.

The market sees a greater than 80% chance of at least five rate cuts from current levels by the end of 2024. Investor optimism about the economic outlook has improved dramatically from a year ago, but there's still a risk that Fed policy tightening could tip the economy into a recession in 2024.

How long did it take S&P 500 to recover from 2008 : Starting with the “tech wreck” in 2000, inflation totaled 35.7%, prolonging the real recovery in purchasing power an additional seven years and nine months. The bounce-back from the 2008 crash took five and a half years, but an additional half year to regain your purchasing power.

How much was $10,000 invested in the S&P 500 in 2000 : Think About This: $10,000 invested in the S&P 500 at the beginning of 2000 would have grown to $32,527 over 20 years — an average return of 6.07% per year.

Will the S&P 500 ever hit $5,000

Yet, while some strategists see reasons for cheer, others see a market top. On Thursday, the S&P 500 crossed the 5000 mark during intraday trading for the first time, and on Friday it ended above that level, notching its tenth record close of 2024 at 5,026.

About 90% of investors lose money trading stocks. That's 9 out of every 10 people — both newbies and seasoned professionals — losing their hard earned dollars by trying to outsmart an unpredictable and extremely volatile machine.Stock market investors may be anxious, but as the old saying goes, "There's no need to panic." "While we maintain a positive view on the U.S. stock market in 2024, there are a range of risk factors that could derail the current bull market," Dilley says.

How long do recessions last : According to the National Bureau of Economic Research (NBER), the average length of recessions since World War II has been approximately 11 months. But the exact length of a recession is difficult to predict. In general, a recession lasts anywhere from six to 18 months.