Monaco. Monaco's status as one of the world's best countries with no income tax has made it into a playground for the European elite.Bulgaria

The lowest tax rate on wages in the EU is set in Bulgaria and Romania – 10%. The highest taxes in Europe are paid by residents of Finland – here the collection can reach 56.5 % of profit.Denmark

Denmark is the European country with the highest top statutory income tax rate as of 2024, with the Nordic country having a top taxation band of 55.9 percent.

Are taxes in Europe higher than the US : In general, taxes in Europe vs US tend to be higher. When considering Denmark taxes vs US, the income tax can vary from 8 to 56.5 percent. In the case of German tax rates vs US, it can be anything from 9 to 45 percent plus a 5.5 percent solidarity surcharge if applicable.

What is the tax rate in the Czech Republic

Personal Income Tax

The progressive tax of 23% applies to personal income above the statutory limit, which has been set at 36 times the average monthly salary in 2024. Therefore, if an individual's income exceeds 36 times the average wage, they must pay 23% tax on this excess income instead of the basic 15% tax.

Is Italy a tax haven : The Flat Tax 100,000 for Residency Transfers to Italy. Italy continues to emerge as an attractive destination for high-net-worth individuals seeking significant tax advantages and a favorable economic climate.

Residents in Portugal for tax purposes are taxed on their worldwide income at progressive rates varying from 13.25% to 48% for 2024.

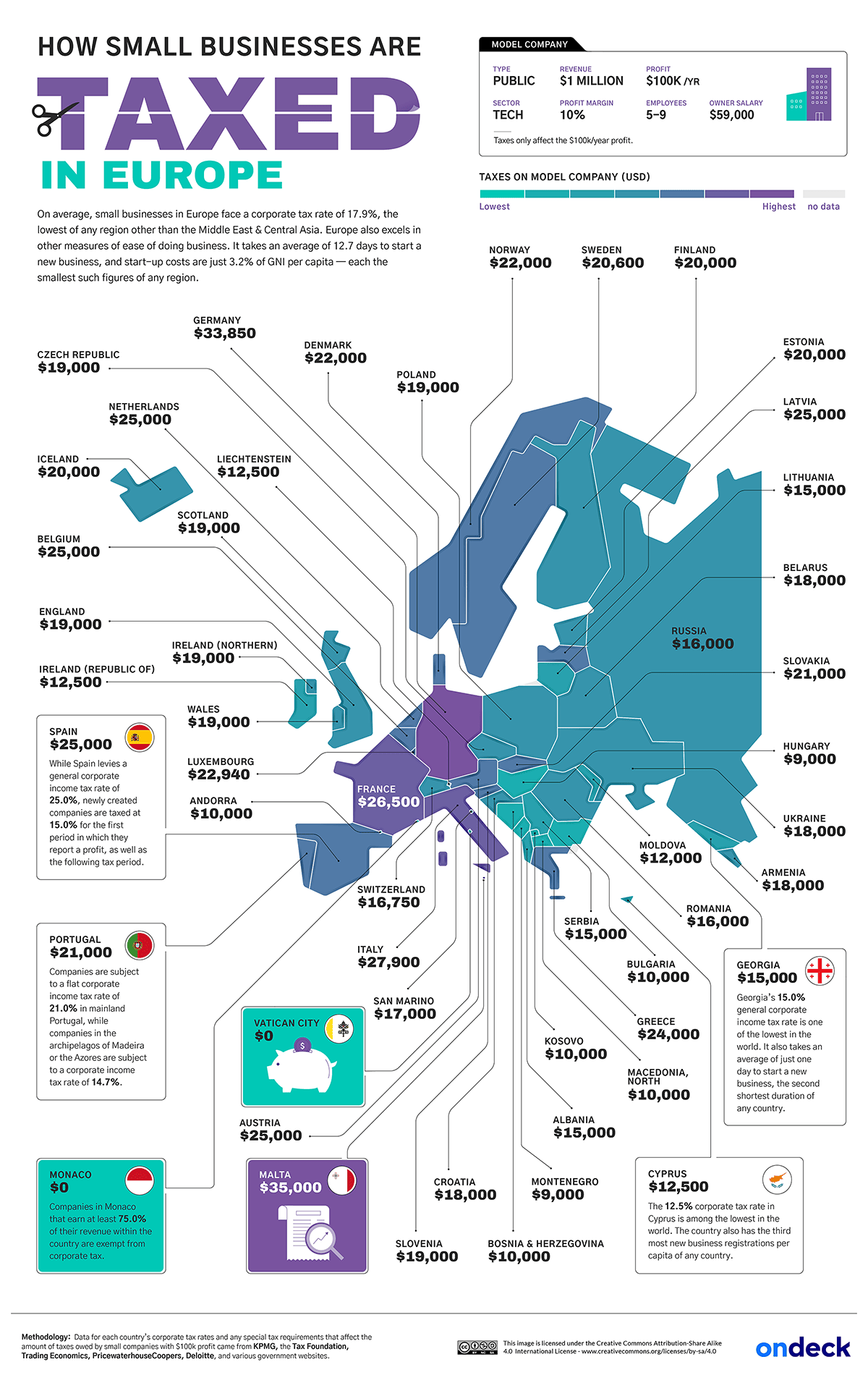

Among the countries with the lowest tax rates in the world are Malta, Cyprus, Andorra, Montenegro and Singapore. Aside from zero income tax, in Antigua and Barbuda, individuals are also free from paying taxes on wealth, capital gains, and inheritance.

What country has the best tax

According to Tax Foundation, Estonia's top score in 2023 is driven mainly by four positive features of its tax code: It has no corporate income tax on reinvested and retained profits (and a 14-20 per cent corporate income tax rate on distributed profits; to be changed to unified 22 per cent from January 1, 2025).Among the countries with the lowest tax rates in the world are Malta, Cyprus, Andorra, Montenegro and Singapore. Aside from zero income tax, in Antigua and Barbuda, individuals are also free from paying taxes on wealth, capital gains, and inheritance.Ivory Coast

1. Ivory Coast. The country with beach resorts, rainforests, and a French-colonial legacy levies a massive 60% personal income tax – the highest in the world.

Prague, the capital city, stands as the epicenter of economic activity in the Czech Republic. The average salary in Prague is significantly higher than the national average, with figures often surpassing 50,000 CZK (approximately €1,971) per month.

Is there tax free in Prague : Tourists from outside the EU can save up to 21% Value Added Tax (VAT) on purchases. Not all shops offer the tax free facility, so look out for a "Tax Free" sign in the shop window, or ask at the shop counter. To qualify, your total purchases in one day in one store must exceed 2001 CZK.

Is Greece a tax haven : In general, Greek tax rates are about as high as in other EU countries. But new tax residents can qualify for one of the three preferential tax regimes and significantly lessen their tax burden. Is Greece a tax haven Taxes in Greece are about as high as in other European Union countries.

Is Croatia a tax haven

UPDATED: 23.04. 2024.

We are often asked about Croatia's tax system, which makes sense. Taxes are a big concern for most people, and most of us want to pay as little as possible. Croatia is not a tax haven or shelter.

Up to € 12,450, the tax rate is 19%. From €12,450 to €20,200, the tax rate is 24%. From €20,200 to €35,200, the tax rate is 30%. From €35,200 to €60,000, the tax rate is 37%.The personal income tax rate is 9—45%, while corporate tax is flat at 22%. Additional taxes on “luxury” are imposed on wealthy individuals and companies with large turnovers. Is Greece tax-friendly In general, Greek tax rates are about as high as in other EU countries.

Is Italy a low tax country : The income tax is progressive and varies from 23 to 43%. Inheritance and gift taxes in Italy are among the lowest in Europe — the rate is between 4 and 8%. The main taxes for companies in Italy are corporate income tax of 24%, regional production tax of around 3,9%, and 22% VAT.

Antwort What place in Europe has no taxes? Weitere Antworten – Which European country has no tax

Monaco. Monaco's status as one of the world's best countries with no income tax has made it into a playground for the European elite.Bulgaria

The lowest tax rate on wages in the EU is set in Bulgaria and Romania – 10%. The highest taxes in Europe are paid by residents of Finland – here the collection can reach 56.5 % of profit.Denmark

Denmark is the European country with the highest top statutory income tax rate as of 2024, with the Nordic country having a top taxation band of 55.9 percent.

Are taxes in Europe higher than the US : In general, taxes in Europe vs US tend to be higher. When considering Denmark taxes vs US, the income tax can vary from 8 to 56.5 percent. In the case of German tax rates vs US, it can be anything from 9 to 45 percent plus a 5.5 percent solidarity surcharge if applicable.

What is the tax rate in the Czech Republic

Personal Income Tax

The progressive tax of 23% applies to personal income above the statutory limit, which has been set at 36 times the average monthly salary in 2024. Therefore, if an individual's income exceeds 36 times the average wage, they must pay 23% tax on this excess income instead of the basic 15% tax.

Is Italy a tax haven : The Flat Tax 100,000 for Residency Transfers to Italy. Italy continues to emerge as an attractive destination for high-net-worth individuals seeking significant tax advantages and a favorable economic climate.

Residents in Portugal for tax purposes are taxed on their worldwide income at progressive rates varying from 13.25% to 48% for 2024.

Among the countries with the lowest tax rates in the world are Malta, Cyprus, Andorra, Montenegro and Singapore. Aside from zero income tax, in Antigua and Barbuda, individuals are also free from paying taxes on wealth, capital gains, and inheritance.

What country has the best tax

According to Tax Foundation, Estonia's top score in 2023 is driven mainly by four positive features of its tax code: It has no corporate income tax on reinvested and retained profits (and a 14-20 per cent corporate income tax rate on distributed profits; to be changed to unified 22 per cent from January 1, 2025).Among the countries with the lowest tax rates in the world are Malta, Cyprus, Andorra, Montenegro and Singapore. Aside from zero income tax, in Antigua and Barbuda, individuals are also free from paying taxes on wealth, capital gains, and inheritance.Ivory Coast

1. Ivory Coast. The country with beach resorts, rainforests, and a French-colonial legacy levies a massive 60% personal income tax – the highest in the world.

Prague, the capital city, stands as the epicenter of economic activity in the Czech Republic. The average salary in Prague is significantly higher than the national average, with figures often surpassing 50,000 CZK (approximately €1,971) per month.

Is there tax free in Prague : Tourists from outside the EU can save up to 21% Value Added Tax (VAT) on purchases. Not all shops offer the tax free facility, so look out for a "Tax Free" sign in the shop window, or ask at the shop counter. To qualify, your total purchases in one day in one store must exceed 2001 CZK.

Is Greece a tax haven : In general, Greek tax rates are about as high as in other EU countries. But new tax residents can qualify for one of the three preferential tax regimes and significantly lessen their tax burden. Is Greece a tax haven Taxes in Greece are about as high as in other European Union countries.

Is Croatia a tax haven

UPDATED: 23.04. 2024.

We are often asked about Croatia's tax system, which makes sense. Taxes are a big concern for most people, and most of us want to pay as little as possible. Croatia is not a tax haven or shelter.

Up to € 12,450, the tax rate is 19%. From €12,450 to €20,200, the tax rate is 24%. From €20,200 to €35,200, the tax rate is 30%. From €35,200 to €60,000, the tax rate is 37%.The personal income tax rate is 9—45%, while corporate tax is flat at 22%. Additional taxes on “luxury” are imposed on wealthy individuals and companies with large turnovers. Is Greece tax-friendly In general, Greek tax rates are about as high as in other EU countries.

Is Italy a low tax country : The income tax is progressive and varies from 23 to 43%. Inheritance and gift taxes in Italy are among the lowest in Europe — the rate is between 4 and 8%. The main taxes for companies in Italy are corporate income tax of 24%, regional production tax of around 3,9%, and 22% VAT.