Declines in consumer demand, financial panics, and misguided government policies caused economic output to fall in the United States, while the gold standard, which linked nearly all the countries of the world in a network of fixed currency exchange rates, played a key role in transmitting the American downturn to …By this we mean that share prices change because of supply and demand. If more people want to buy a stock (demand) than sell it (supply), then the price moves up. Conversely, if more people wanted to sell a stock than buy it, there would be greater supply than demand, and the price would fall.Stock market crash: Rising volatility in the market can be attributed to two major reasons — uncertainty due to ongoing Lok Sabha elections and the India VIX Index rising 70% in one month.

What caused the biggest stock market crash : There were many causes of the 1929 stock market crash, some of which included overinflated shares, growing bank loans, agricultural overproduction, panic selling, stocks purchased on margin, higher interest rates, and a negative media industry.

Who loses when stock market crash

Sometimes, however, the economy turns or an asset bubble pops—in which case, markets crash. Investors who experience a crash can lose money if they sell their positions, instead of waiting it out for a rise. Those who have purchased stock on margin may be forced to liquidate at a loss due to margin calls.

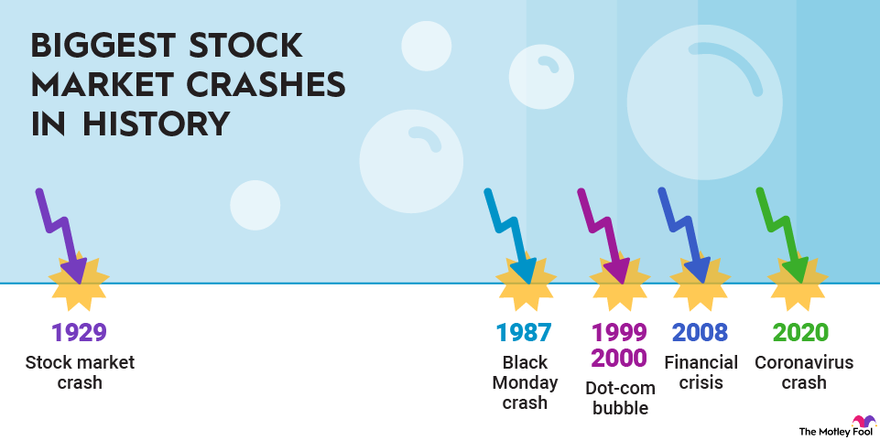

When was the last market crash : Some of the most significant stock market crashes in U.S. history include the crash in 1929 that preceded the Great Depression, the crash in 1987, known as Black Monday, the dotcom bubble crash in 2001, the 2008 crash related to the Financial Crisis, and the 2020 crash following the outbreak of COVID.

Stock market crash: Rising US dollar and Treasury yields, disappointing US retail sales data, falling Indian National Rupee (INR), and rising crude oil prices are some other reasons that have fueled the selling pressure in the Indian stock market. Faulty Numbers. Sometimes, there is a fundamental reason for a stock to fall after earnings are announced. For example, perhaps the company's gross margins have fallen dramatically from last quarter, or maybe its cash position has dwindled dramatically.

Can stocks go to zero

When a stock's price falls to zero, a shareholder's holdings in this stock become worthless. Major stock exchanges actually delist shares once they fall below specific price values.Stock market investors may be anxious, but as the old saying goes, "There's no need to panic." "While we maintain a positive view on the U.S. stock market in 2024, there are a range of risk factors that could derail the current bull market," Dilley says.The emotional aspect of trading often leads to irrational decisions like panic selling. When the market moves unfavourably, many traders, especially those who are inexperienced, tend to panic and exit their positions hastily. This panic selling often occurs at the worst possible time, leading to significant losses. Your portfolio might lose value, but losing value is different than losing money. When stock prices fall, your investments are not worth as much. But the market will inevitably rebound, and when that happens, stock prices will increase once again — and your portfolio will regain the value it lost.

Do 90% of people lose money in the stock market : About 90% of investors lose money trading stocks. That's 9 out of every 10 people — both newbies and seasoned professionals — losing their hard earned dollars by trying to outsmart an unpredictable and extremely volatile machine.

Can the stock market crash to zero : And while theoretically possible, the entire US stock market going to zero would be incredibly unlikely.

Have hundreds of stocks fallen below $1

Hundreds of stocks have broken the buck this year, following a slump in the once-hot market for buzzy startups seeking rapid growth. As of Friday, 557 stocks listed on U.S. exchanges were trading below $1 a share, up from fewer than a dozen in early 2021, according to Dow Jones Market Data. The market sees a greater than 80% chance of at least five rate cuts from current levels by the end of 2024. Investor optimism about the economic outlook has improved dramatically from a year ago, but there's still a risk that Fed policy tightening could tip the economy into a recession in 2024.For example, on the New York Stock Exchange (NYSE), if a security's price closed below $1.00 for 30 consecutive trading days, that exchange would initiate the delisting process.

Should I pull my money out of the stock market in 2024 : Stay the course

Pulling your money out of the market when stocks are down will only hurt you in the long run. “In this environment, investors should remain fully diversified across multiple asset classes and regions, and in line with one's financial goals and risk tolerance,” Mukherjee said.

Antwort What makes the stock market crash? Weitere Antworten – What are the 3 main causes of the stock market crash

Declines in consumer demand, financial panics, and misguided government policies caused economic output to fall in the United States, while the gold standard, which linked nearly all the countries of the world in a network of fixed currency exchange rates, played a key role in transmitting the American downturn to …By this we mean that share prices change because of supply and demand. If more people want to buy a stock (demand) than sell it (supply), then the price moves up. Conversely, if more people wanted to sell a stock than buy it, there would be greater supply than demand, and the price would fall.Stock market crash: Rising volatility in the market can be attributed to two major reasons — uncertainty due to ongoing Lok Sabha elections and the India VIX Index rising 70% in one month.

What caused the biggest stock market crash : There were many causes of the 1929 stock market crash, some of which included overinflated shares, growing bank loans, agricultural overproduction, panic selling, stocks purchased on margin, higher interest rates, and a negative media industry.

Who loses when stock market crash

Sometimes, however, the economy turns or an asset bubble pops—in which case, markets crash. Investors who experience a crash can lose money if they sell their positions, instead of waiting it out for a rise. Those who have purchased stock on margin may be forced to liquidate at a loss due to margin calls.

When was the last market crash : Some of the most significant stock market crashes in U.S. history include the crash in 1929 that preceded the Great Depression, the crash in 1987, known as Black Monday, the dotcom bubble crash in 2001, the 2008 crash related to the Financial Crisis, and the 2020 crash following the outbreak of COVID.

Stock market crash: Rising US dollar and Treasury yields, disappointing US retail sales data, falling Indian National Rupee (INR), and rising crude oil prices are some other reasons that have fueled the selling pressure in the Indian stock market.

Faulty Numbers. Sometimes, there is a fundamental reason for a stock to fall after earnings are announced. For example, perhaps the company's gross margins have fallen dramatically from last quarter, or maybe its cash position has dwindled dramatically.

Can stocks go to zero

When a stock's price falls to zero, a shareholder's holdings in this stock become worthless. Major stock exchanges actually delist shares once they fall below specific price values.Stock market investors may be anxious, but as the old saying goes, "There's no need to panic." "While we maintain a positive view on the U.S. stock market in 2024, there are a range of risk factors that could derail the current bull market," Dilley says.The emotional aspect of trading often leads to irrational decisions like panic selling. When the market moves unfavourably, many traders, especially those who are inexperienced, tend to panic and exit their positions hastily. This panic selling often occurs at the worst possible time, leading to significant losses.

Your portfolio might lose value, but losing value is different than losing money. When stock prices fall, your investments are not worth as much. But the market will inevitably rebound, and when that happens, stock prices will increase once again — and your portfolio will regain the value it lost.

Do 90% of people lose money in the stock market : About 90% of investors lose money trading stocks. That's 9 out of every 10 people — both newbies and seasoned professionals — losing their hard earned dollars by trying to outsmart an unpredictable and extremely volatile machine.

Can the stock market crash to zero : And while theoretically possible, the entire US stock market going to zero would be incredibly unlikely.

Have hundreds of stocks fallen below $1

Hundreds of stocks have broken the buck this year, following a slump in the once-hot market for buzzy startups seeking rapid growth. As of Friday, 557 stocks listed on U.S. exchanges were trading below $1 a share, up from fewer than a dozen in early 2021, according to Dow Jones Market Data.

The market sees a greater than 80% chance of at least five rate cuts from current levels by the end of 2024. Investor optimism about the economic outlook has improved dramatically from a year ago, but there's still a risk that Fed policy tightening could tip the economy into a recession in 2024.For example, on the New York Stock Exchange (NYSE), if a security's price closed below $1.00 for 30 consecutive trading days, that exchange would initiate the delisting process.

Should I pull my money out of the stock market in 2024 : Stay the course

Pulling your money out of the market when stocks are down will only hurt you in the long run. “In this environment, investors should remain fully diversified across multiple asset classes and regions, and in line with one's financial goals and risk tolerance,” Mukherjee said.