The ECB's interest rate decisions can also influence exchange rates, which, in turn, impact businesses engaged in international trade. The recent announcement of unchanged interest rates led to a decline in the euro against the US dollar and British pound.Policy rates

By using monetary policy to control the cost of borrowing, the ECB influences how much consumers and businesses are able to spend and invest. This in turn affects the prices of products and services. This means the ECB influences prices and inflation through interest rates.Disadvantages of External Commercial Borrowing

The company could develop a lax attitude as the funds are available at lower rates. Companies could borrow excessively due to this and it could eventually lead to higher debt on the company's balance sheet, thereby adversely affecting financial ratios.

Why does ECB have negative interest rate : The ECB does not set negative interest rates in the spirit of “punishing” savers. Rather, it does so to encourage households and businesses to spend more or invest, with a view to stimulating the economy and ensuring that inflation returns to its medium-term target of 2% on a lasting basis.

What is a disadvantage of inflation

As inflation causes a decrease in the value of a currency, individuals may require more money to satisfy their needs. Inflation also increases the cost of living, making it difficult for people to save. A high inflation rate may affect older people more as they typically depend on their savings.

What happens if ECB increases interest rates : Conversely, a higher interest rate can slow down inflation. With less money available on the market, every single euro increases in value. Consumer prices fall and, therefore, inflation decreases.

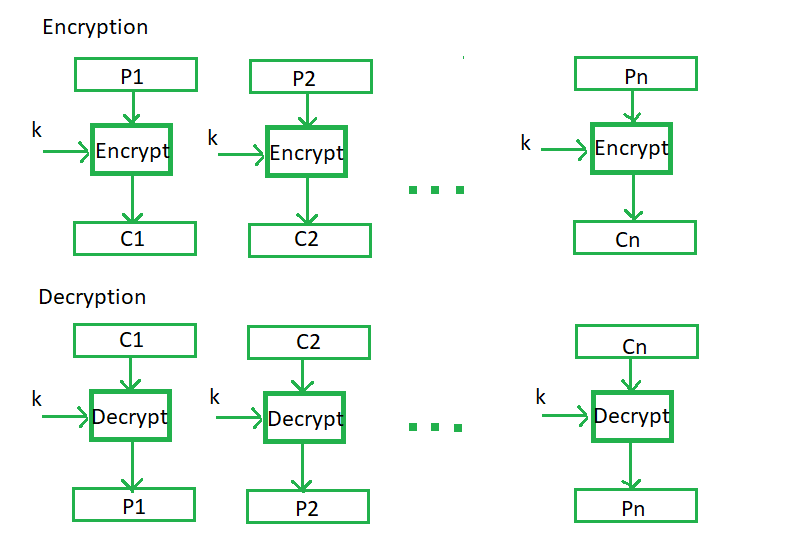

The disadvantage of this method is a lack of diffusion. Because ECB encrypts identical plaintext blocks into identical ciphertext blocks, it does not hide data patterns well. ECB is not recommended for use in cryptographic protocols." AES ECB (Electronic Codebook) encryption mode is vulnerable due to its nature and lack of diffusion. These vulnerabilities stem from the fact that identical plaintext blocks produce identical ciphertext blocks, regardless of their position in the message or the encryption key used.

What are the weaknesses of ECB

The message is divided into blocks, and each block is encrypted separately. ECB is not recommended for use in cryptographic protocols: the disadvantage of this method is a lack of diffusion, wherein it fails to hide data patterns when it encrypts identical plaintext blocks into identical ciphertext blocks.Because ECB encrypts identical plaintext blocks into identical ciphertext blocks, it does not hide data patterns well. ECB is not recommended for use in cryptographic protocols." Another visual example (using different keys):5 Effects Of Rising Inflation Rates

Lost Purchasing Power. The most obvious impact of inflation is the loss of purchasing power.

Higher Interest Rates.

Higher Prices For Everything.

Economic Growth Slows.

Anti-Inflationary Measures Can Cause A Recession.

In an inflationary environment, unevenly rising prices inevitably reduce the purchasing power of some consumers, and this erosion of real income is the single biggest cost of inflation. Inflation can also distort purchasing power over time for recipients and payers of fixed interest rates.

Why is ECB negative interest rate : The ECB does not set negative interest rates in the spirit of “punishing” savers. Rather, it does so to encourage households and businesses to spend more or invest, with a view to stimulating the economy and ensuring that inflation returns to its medium-term target of 2% on a lasting basis.

What are the 3 ECB rates : In the Eurosystem, the three key ECB interest rates are: (1) the rate on the main refinancing operations, which determines the interest rate applied in the regular lending operations conducted by the Eurosystem to provide liquidity to the banking system; (2) the deposit rate, which is the rate banks receive for …

What is the disadvantage of ECB algorithm

There are some drawbacks to using ECB, including:

ECB uses simple substitution rather than an initialization vector or chaining.

ECB is not good to use with small block sizes — say, for blocks smaller than 40 bits — and identical encryption modes.

Each mode of operation has its pros and cons. For example, Electronic Code Book (ECB) mode is the simplest mode of operation. With ECB, each block is encrypted completely independently. The downside of this is that blocks with the same plaintext produce the same ciphertext.Of the five DES modes, ECB is the simplest and weakest, because repeating plaintext generates repeating ciphertext. As a result, anyone can easily derive the secret keys to break the encryption and decrypt the ciphertext. ECB may also leave obvious plaintext patterns in the resulting ciphertext.

Why is ECB weak : Of the five DES modes, ECB is the simplest and weakest, because repeating plaintext generates repeating ciphertext. As a result, anyone can easily derive the secret keys to break the encryption and decrypt the ciphertext. ECB may also leave obvious plaintext patterns in the resulting ciphertext.

Antwort What is the weakness of ECB mode? Weitere Antworten – What is the impact of ECB

The ECB's interest rate decisions can also influence exchange rates, which, in turn, impact businesses engaged in international trade. The recent announcement of unchanged interest rates led to a decline in the euro against the US dollar and British pound.Policy rates

By using monetary policy to control the cost of borrowing, the ECB influences how much consumers and businesses are able to spend and invest. This in turn affects the prices of products and services. This means the ECB influences prices and inflation through interest rates.Disadvantages of External Commercial Borrowing

The company could develop a lax attitude as the funds are available at lower rates. Companies could borrow excessively due to this and it could eventually lead to higher debt on the company's balance sheet, thereby adversely affecting financial ratios.

Why does ECB have negative interest rate : The ECB does not set negative interest rates in the spirit of “punishing” savers. Rather, it does so to encourage households and businesses to spend more or invest, with a view to stimulating the economy and ensuring that inflation returns to its medium-term target of 2% on a lasting basis.

What is a disadvantage of inflation

As inflation causes a decrease in the value of a currency, individuals may require more money to satisfy their needs. Inflation also increases the cost of living, making it difficult for people to save. A high inflation rate may affect older people more as they typically depend on their savings.

What happens if ECB increases interest rates : Conversely, a higher interest rate can slow down inflation. With less money available on the market, every single euro increases in value. Consumer prices fall and, therefore, inflation decreases.

The disadvantage of this method is a lack of diffusion. Because ECB encrypts identical plaintext blocks into identical ciphertext blocks, it does not hide data patterns well. ECB is not recommended for use in cryptographic protocols."

AES ECB (Electronic Codebook) encryption mode is vulnerable due to its nature and lack of diffusion. These vulnerabilities stem from the fact that identical plaintext blocks produce identical ciphertext blocks, regardless of their position in the message or the encryption key used.

What are the weaknesses of ECB

The message is divided into blocks, and each block is encrypted separately. ECB is not recommended for use in cryptographic protocols: the disadvantage of this method is a lack of diffusion, wherein it fails to hide data patterns when it encrypts identical plaintext blocks into identical ciphertext blocks.Because ECB encrypts identical plaintext blocks into identical ciphertext blocks, it does not hide data patterns well. ECB is not recommended for use in cryptographic protocols." Another visual example (using different keys):5 Effects Of Rising Inflation Rates

In an inflationary environment, unevenly rising prices inevitably reduce the purchasing power of some consumers, and this erosion of real income is the single biggest cost of inflation. Inflation can also distort purchasing power over time for recipients and payers of fixed interest rates.

Why is ECB negative interest rate : The ECB does not set negative interest rates in the spirit of “punishing” savers. Rather, it does so to encourage households and businesses to spend more or invest, with a view to stimulating the economy and ensuring that inflation returns to its medium-term target of 2% on a lasting basis.

What are the 3 ECB rates : In the Eurosystem, the three key ECB interest rates are: (1) the rate on the main refinancing operations, which determines the interest rate applied in the regular lending operations conducted by the Eurosystem to provide liquidity to the banking system; (2) the deposit rate, which is the rate banks receive for …

What is the disadvantage of ECB algorithm

There are some drawbacks to using ECB, including:

Each mode of operation has its pros and cons. For example, Electronic Code Book (ECB) mode is the simplest mode of operation. With ECB, each block is encrypted completely independently. The downside of this is that blocks with the same plaintext produce the same ciphertext.Of the five DES modes, ECB is the simplest and weakest, because repeating plaintext generates repeating ciphertext. As a result, anyone can easily derive the secret keys to break the encryption and decrypt the ciphertext. ECB may also leave obvious plaintext patterns in the resulting ciphertext.

Why is ECB weak : Of the five DES modes, ECB is the simplest and weakest, because repeating plaintext generates repeating ciphertext. As a result, anyone can easily derive the secret keys to break the encryption and decrypt the ciphertext. ECB may also leave obvious plaintext patterns in the resulting ciphertext.