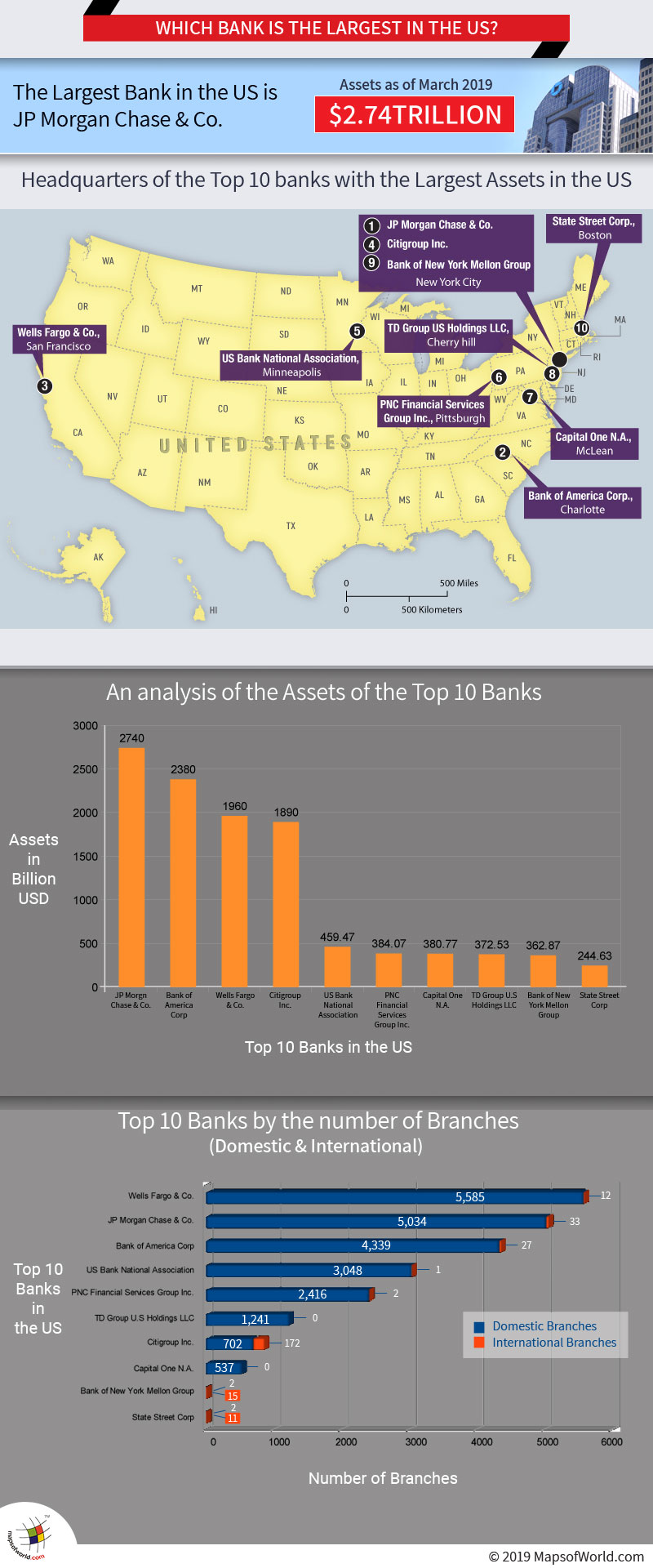

The nation's biggest banks include both traditional retail banks and investment banks. While Chase, Bank of America, Wells Fargo and Citi stand out as big banks, U.S. Bank, PNC Bank, Goldman Sachs, Truist Bank, Capital One and TD Bank round out the 10 largest banks in the U.S.What Is the Richest Bank in America JPMorgan Chase is the richest bank in the U.S., based on Federal Reserve data for consolidated assets. It has over $3.3 trillion in total assets, more than any bank in the country.

What are the big four banks in the US : The “big four banks” in the United States are JPMorgan Chase, Bank of America, Wells Fargo, and Citibank. These banks are not only the largest in the United States, but also rank among the top banks worldwide by market capitalization, with JPMorgan Chase being the most valuable bank in the world.

Which bank is safest in the USA

JPMorgan Chase, the financial institution that owns Chase Bank, topped our experts' list because it's designated as the world's most systemically important bank on the 2023 G-SIB list. This designation means it has the highest loss absorbency requirements of any bank, providing more protection against financial crisis.

What is the strongest U.S. Bank : JPMorgan Chase is the top largest bank in the US, with a balance sheet total of $3.31 trillion.

Which of the Big Four is the best bank for saving

Rank

Big Four Bank

Household deposits (billion)

1

CBA

$388.466

2

Westpac

$301.516

3

NAB

$201.982

4

ANZ

$171.563

22. 4. 2024 JP Morgan Private Bank

“J.P. Morgan Private Bank is the more elite program serving ultra-high-net-worth individuals,” Naghibi said. “It offers comprehensive services in savings, checking and retirement account management.

What is the Big 6 bank

The Big Six refers to the major banks of Canada. The list includes the TD, Royal Bank, the Bank of Montreal, Scotiabank, CIBC, and the National Bank. A Schedule II bank is a subsidiary of a foreign bank that is authorized to accept deposits within Canada and is regulated by the federal Bank Act.Which Bank Stocks Are Most at Risk of a Liquidity Crisis

Zions Bancorp NA. (ZION)

Signature Bank. (SBNY)

Huntington Bancshares Inc. (HBAN)

SVB Financial Group. (SIVBQ)

First Republic Bank. (FRCB)

Learn what they are so you can improve your eligibility when you present yourself to lenders.

Capacity. To evaluate capacity, or your ability to repay a loan, lenders look at revenue, expenses, cash flow and repayment timing in your business plan.

Capital.

Collateral.

Conditions.

Character.

He holds traditional investments, such as real estate and shares in other companies. Bezos has funded several education projects through the Bezos Family Foundation.

Can you have a billion dollars in a bank account : Conceivably, yes, it is possible, although that would be unusual. This is assuming the bank would even allow such a thing. The implication is that the owner of that account does not understand finance and the risk of putting everything in one basket. Firstly, simply sitting on so much liquidity is problematic.

What are the big 5 banks called : What are the five largest banks in the U.S. The five largest banks in the U.S., according to domestic assets, are Chase, Bank of America, Wells Fargo Bank, Citibank and U.S. Bank.

What bank will fail in 2024

Republic First Bank reported unrealized securities losses in excess of its equity as early as June 2022. State regulators closed Republic First Bank in April 2024, marking the first bank failure of the year. New Zealand Bank Codes

Bank Name

Bank Code

Branch Range

TSB Bank

15

1501 – 1599

Westpac Bank

03

0301 – 0399

The Co-operative Bank

11

1101 – 1199

SBS Bank

03

0311 – 0315

How the Ultra-Wealthy Invest

Rank

Asset

Average Proportion of Total Wealth

1

Primary and Secondary Homes

32%

2

Equities

18%

3

Commercial Property

14%

4

Bonds

12%

Do billionaires give away money : The ultra-wealthy claim the lion's share of the hundreds of billions in annual tax subsidies to incentivize charitable giving. Yet most donations by the ultra-wealthy flow to private foundations and donor-advised funds (DAFs), intermediaries controlled by these donors.

Antwort What is the top 10 bank in the US? Weitere Antworten – Which is the No. 1 bank of the USA

Chase Bank

Biggest Banks in the U.S.

The nation's biggest banks include both traditional retail banks and investment banks. While Chase, Bank of America, Wells Fargo and Citi stand out as big banks, U.S. Bank, PNC Bank, Goldman Sachs, Truist Bank, Capital One and TD Bank round out the 10 largest banks in the U.S.What Is the Richest Bank in America JPMorgan Chase is the richest bank in the U.S., based on Federal Reserve data for consolidated assets. It has over $3.3 trillion in total assets, more than any bank in the country.

What are the big four banks in the US : The “big four banks” in the United States are JPMorgan Chase, Bank of America, Wells Fargo, and Citibank. These banks are not only the largest in the United States, but also rank among the top banks worldwide by market capitalization, with JPMorgan Chase being the most valuable bank in the world.

Which bank is safest in the USA

JPMorgan Chase, the financial institution that owns Chase Bank, topped our experts' list because it's designated as the world's most systemically important bank on the 2023 G-SIB list. This designation means it has the highest loss absorbency requirements of any bank, providing more protection against financial crisis.

What is the strongest U.S. Bank : JPMorgan Chase is the top largest bank in the US, with a balance sheet total of $3.31 trillion.

Which of the Big Four is the best bank for saving

22. 4. 2024

JP Morgan Private Bank

“J.P. Morgan Private Bank is the more elite program serving ultra-high-net-worth individuals,” Naghibi said. “It offers comprehensive services in savings, checking and retirement account management.

What is the Big 6 bank

The Big Six refers to the major banks of Canada. The list includes the TD, Royal Bank, the Bank of Montreal, Scotiabank, CIBC, and the National Bank. A Schedule II bank is a subsidiary of a foreign bank that is authorized to accept deposits within Canada and is regulated by the federal Bank Act.Which Bank Stocks Are Most at Risk of a Liquidity Crisis

Learn what they are so you can improve your eligibility when you present yourself to lenders.

He holds traditional investments, such as real estate and shares in other companies. Bezos has funded several education projects through the Bezos Family Foundation.

Can you have a billion dollars in a bank account : Conceivably, yes, it is possible, although that would be unusual. This is assuming the bank would even allow such a thing. The implication is that the owner of that account does not understand finance and the risk of putting everything in one basket. Firstly, simply sitting on so much liquidity is problematic.

What are the big 5 banks called : What are the five largest banks in the U.S. The five largest banks in the U.S., according to domestic assets, are Chase, Bank of America, Wells Fargo Bank, Citibank and U.S. Bank.

What bank will fail in 2024

Republic First Bank reported unrealized securities losses in excess of its equity as early as June 2022. State regulators closed Republic First Bank in April 2024, marking the first bank failure of the year.

New Zealand Bank Codes

How the Ultra-Wealthy Invest

Do billionaires give away money : The ultra-wealthy claim the lion's share of the hundreds of billions in annual tax subsidies to incentivize charitable giving. Yet most donations by the ultra-wealthy flow to private foundations and donor-advised funds (DAFs), intermediaries controlled by these donors.