The S&P 500 is an index, so it can't be traded directly. Those who want to invest in the companies that comprise the S&P must invest in a mutual fund or exchange-traded fund (ETF) that tracks the index, such as the Vanguard 500 ETF (VOO).The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.The S&P 500 Index (SPX), formerly called the Composite Index (and later Standard & Poor's Composite Index), had been launched on a small scale in 1923.

What is the symbol for the S&P 500 index : The ticker for the S&P 500 index is ^GSPC, but it cannot be traded. SPX and SPY represent options on the S&P 500 index, and they are traded in the market.

Is sp500 the same as spx500

SPX is a symbol referring to the S&P 500 index, which consists of the largest 500 publicly traded companies, as measured by market capitalization. Investors can't directly invest in SPX, but they can invest in ETFs or index funds that are designed to track the performance of the index.

Is the S and P 500 the Dow Jones : But there is one main distinction between these two indexes: The S&P 500 has 500 of the largest companies, which is why some investors believe it provides a more accurate picture of the economy. The Dow Jones, on the other hand, is composed of 30 blue-chip companies.

Standard & Poor’s 500 Index

The S&P 500 Index (Standard & Poor's 500 Index) is a market-capitalization-weighted index of the 500 leading publicly traded companies in the U.S. The S&P 500 hit a new all-time high on May 15, 2024. The S&P 500 is a stock market index composed of about 500 publicly traded companies. You cannot directly invest in the index itself. You can buy individual stocks of companies in the S&P 500, or buy an S&P 500 index fund or ETF.

What does S&P stand for ______________

Standard & Poor’s 500 Index

The S&P 500 Index (Standard & Poor's 500 Index) is a market-capitalization-weighted index of the 500 leading publicly traded companies in the U.S.The US100 Index tracks the US100 stock exchange, a US-based exchange. This means it tracks the stocks listed in an exchange that's been active since 1971. Based on trading volume and market capitalisation, US100 is among the largest exchanges in the world.While an S&P 500 index fund is the most popular index fund, they also exist for different industries, countries and even investment styles. So you need to consider what exactly you want to invest in and why it might hold opportunity: Location: Consider the geographic location of the investments. The S and P 500, also known as the US 500, can be used as a live indicator for the strength of US equities.

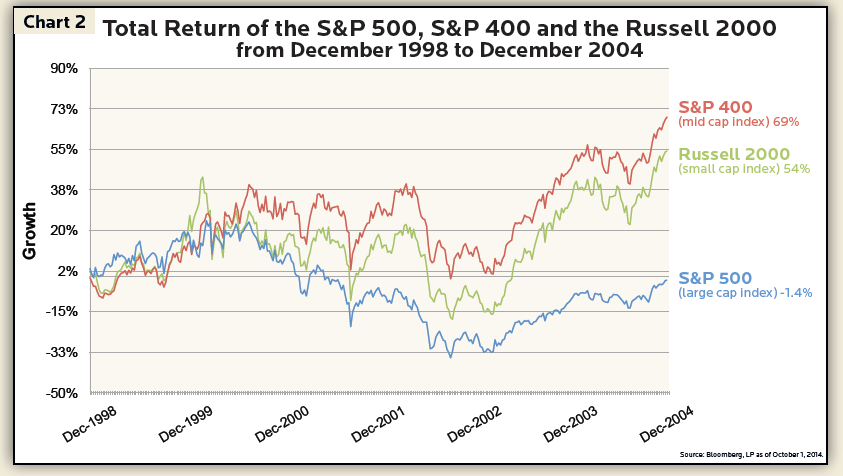

Is S and P 500 the same as total stock : Pretty much by definition, the S&P 500 is made up of large-cap companies. A total market index is mostly large-cap stocks, but by definition includes all the mid-cap and small-cap stocks as well.

Is US500 the same as S&P 500 : The US500 (S&P 500) is a market capitalization weighted index of the 500 largest publically traded companies in the U.S. It is also float adjusted, meaning the weight of each individual company is determined by a combination of market capitalization and the number of shares outstanding.

Is S&P 500 the same as S&P Global

All holdings in the S&P500 are US-listed companies, whereas the Global 100 Index can offer exposure to companies not listed in the United States. You can't directly invest in the S&P 500 because it's an index, but you can invest in one of the many funds that use it as a benchmark and follow its composition and performance.In terms of sector diversification, the S&P Global 100 Index has a broader sector mix than that of the S&P 500. The top 10 holdings span across not just I.T. but also Consumer Discretionary, Energy, Health Care, Consumer Staples, and Financials, as of 30 June 2022.

Is the S&P 500 a fund : While an S&P 500 index fund is the most popular index fund, they also exist for different industries, countries and even investment styles.

Antwort What is the S&P 500 listed as? Weitere Antworten – What is the S&P 500 classified as

The S&P 500 is an index, so it can't be traded directly. Those who want to invest in the companies that comprise the S&P must invest in a mutual fund or exchange-traded fund (ETF) that tracks the index, such as the Vanguard 500 ETF (VOO).The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.The S&P 500 Index (SPX), formerly called the Composite Index (and later Standard & Poor's Composite Index), had been launched on a small scale in 1923.

What is the symbol for the S&P 500 index : The ticker for the S&P 500 index is ^GSPC, but it cannot be traded. SPX and SPY represent options on the S&P 500 index, and they are traded in the market.

Is sp500 the same as spx500

SPX is a symbol referring to the S&P 500 index, which consists of the largest 500 publicly traded companies, as measured by market capitalization. Investors can't directly invest in SPX, but they can invest in ETFs or index funds that are designed to track the performance of the index.

Is the S and P 500 the Dow Jones : But there is one main distinction between these two indexes: The S&P 500 has 500 of the largest companies, which is why some investors believe it provides a more accurate picture of the economy. The Dow Jones, on the other hand, is composed of 30 blue-chip companies.

Standard & Poor’s 500 Index

The S&P 500 Index (Standard & Poor's 500 Index) is a market-capitalization-weighted index of the 500 leading publicly traded companies in the U.S.

The S&P 500 hit a new all-time high on May 15, 2024. The S&P 500 is a stock market index composed of about 500 publicly traded companies. You cannot directly invest in the index itself. You can buy individual stocks of companies in the S&P 500, or buy an S&P 500 index fund or ETF.

What does S&P stand for ______________

Standard & Poor’s 500 Index

The S&P 500 Index (Standard & Poor's 500 Index) is a market-capitalization-weighted index of the 500 leading publicly traded companies in the U.S.The US100 Index tracks the US100 stock exchange, a US-based exchange. This means it tracks the stocks listed in an exchange that's been active since 1971. Based on trading volume and market capitalisation, US100 is among the largest exchanges in the world.While an S&P 500 index fund is the most popular index fund, they also exist for different industries, countries and even investment styles. So you need to consider what exactly you want to invest in and why it might hold opportunity: Location: Consider the geographic location of the investments.

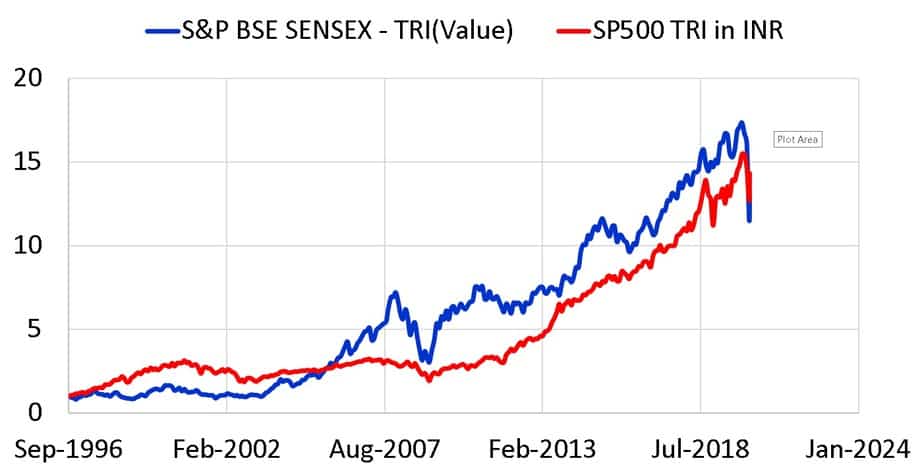

The S and P 500, also known as the US 500, can be used as a live indicator for the strength of US equities.

Is S and P 500 the same as total stock : Pretty much by definition, the S&P 500 is made up of large-cap companies. A total market index is mostly large-cap stocks, but by definition includes all the mid-cap and small-cap stocks as well.

Is US500 the same as S&P 500 : The US500 (S&P 500) is a market capitalization weighted index of the 500 largest publically traded companies in the U.S. It is also float adjusted, meaning the weight of each individual company is determined by a combination of market capitalization and the number of shares outstanding.

Is S&P 500 the same as S&P Global

All holdings in the S&P500 are US-listed companies, whereas the Global 100 Index can offer exposure to companies not listed in the United States.

You can't directly invest in the S&P 500 because it's an index, but you can invest in one of the many funds that use it as a benchmark and follow its composition and performance.In terms of sector diversification, the S&P Global 100 Index has a broader sector mix than that of the S&P 500. The top 10 holdings span across not just I.T. but also Consumer Discretionary, Energy, Health Care, Consumer Staples, and Financials, as of 30 June 2022.

Is the S&P 500 a fund : While an S&P 500 index fund is the most popular index fund, they also exist for different industries, countries and even investment styles.