Single family properties are usually the least risky investment property type. They are typically less expensive and easier to manage than other property types, making them ideal for first-time investors.In real estate, the liquidity refers to how quickly and easily a property can be sold in the market without significantly affecting its price. High liquidity means a property can be sold quickly due to high demand, favorable market conditions, or the property's attractiveness to a wide range of buyers.One of the main disadvantages of direct investing is that it requires a significant amount of time and energy (sweat equity) if you plan to be successful. You have to deal with tenant issues, maintenance emergencies, and your liability if there are any accidents on the property.

Is real estate a good investment in the Philippines : Real estate continues to appreciate in value

While real estate may be considerably low right now as compared to previous years, the Bangko Sentral ng Pilipinas (BSP) predicts a strong rebound of as much as 7.8% in 2021. This means now is a good time to invest in land and property.

What is the biggest risk of real estate

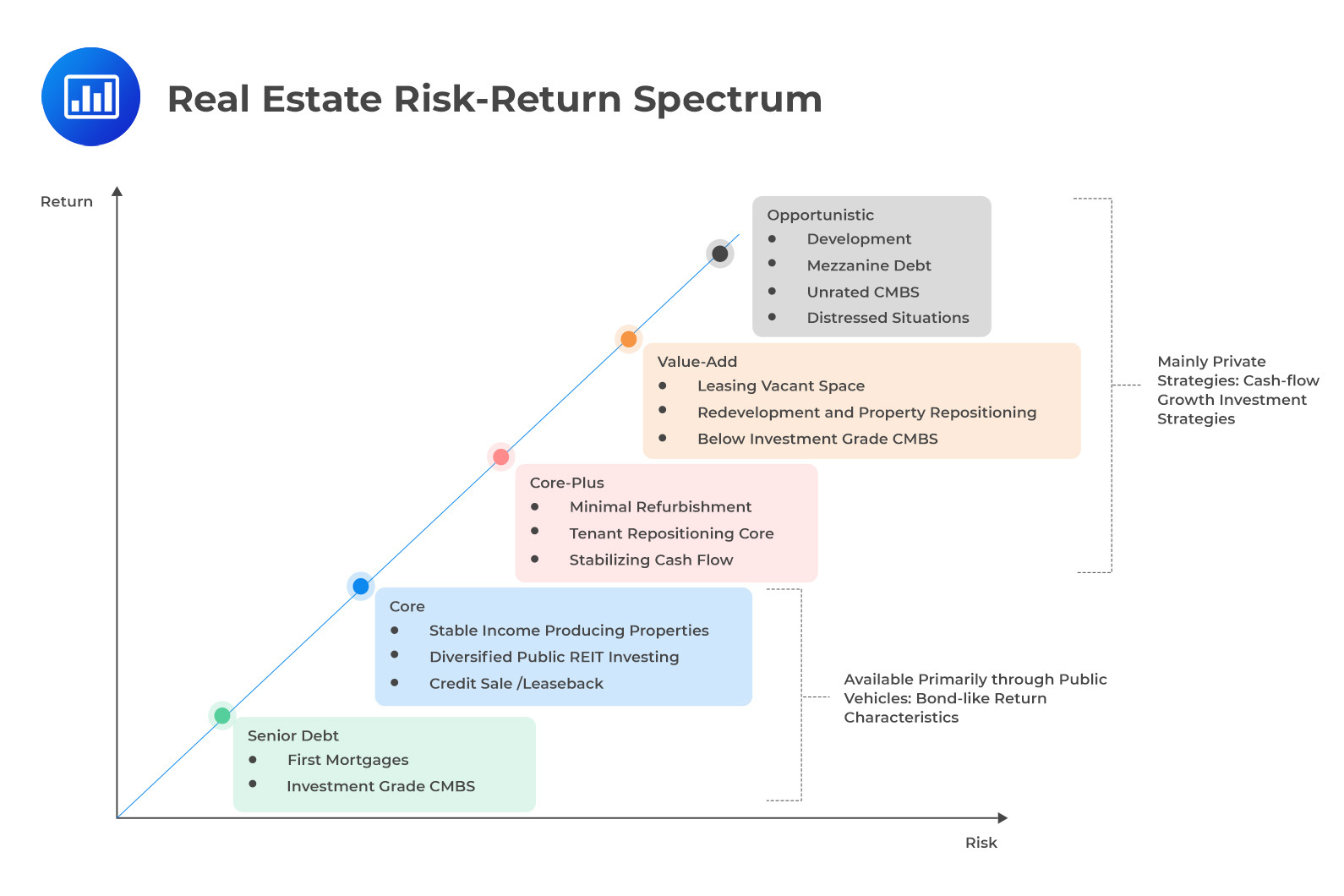

Real estate investing can be lucrative but it's important to understand the risks. Key risks include bad locations, negative cash flows, high vacancies, and problematic tenants.

What is low-risk in real estate : The BRRRR method is low-risk because investors can focus on adding value to the property they buy through renovations, which allows them to rent it out at a decent rate. From there, they can refinance to recover a lot of the capital they've spent.

Real estate is generally considered a moderate to high-risk industry. While it offers the potential for returns, factors such as market dynamics, economic conditions, and changes in supply and demand can affect rental income and property values. Different property types have varying degrees of liquidity. Residential properties, especially those in high-demand rental markets, tend to be the most liquid due to the constant need for housing. Commercial properties, such as office spaces and retail centers, can also be relatively liquid in desirable locations.

What is the biggest disadvantage of real estate

Disadvantages of investing in real estate

Long Grid. You can expect the return from the real estate fund ideally after a long time.

Unpredictable Market. Real estate has a very unpredictable market.

Higher Transaction Cost.

Bad Location.

High maintenance Requirement.

High Vacancy Rates.

Negative Cash Flow.

Low Liquidity Funds.

Best Places to Invest in Property 2024 For Capital Growth

According to Savills Residential Forecast, the best places to invest in property in the UK for capital growth are Wales, Scotland, and the North of England. They predict that all of these areas will experience average growth of over 20% by 2028.1) Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world. 2) Buy land, they're not making it anymore. 3) Ninety percent of all millionaires become so through owning real estate. Top Challenges

Housing affordability.

Maintaining sufficient inventory.

Keeping up with technology.

Profitability.

Rising costs in the industry.

Local or regional economic conditions.

What investments are riskier than property : Shares investments are more volatile, and generally returns more over time, than property investments. Therefore, we can say that while the shares are riskier than property, the returns were also greater.

What is the safest type of real estate investment : Here are the best low risk real estate investment types:

Long-Term Rental Properties.

Short-Term Rental Properties.

Buy-and-Hold Real Estate.

Multi-Family Homes.

What is the biggest threat to real estate

Economic uncertainty and market volatility are two of the most significant risks that real estate investors face. The current global economic climate has created an unpredictable future for people who are buying or selling homes. Property investment is an exciting venture that can potentially provide multiple benefits, such as producing consistent rental income, capital appreciation over time, and tax advantages. However, it is critical to recognize that property investment, like any other investment, is not entirely risk-free.Cash

Cash is the most liquid of assets, while tangible items are less liquid. The two main types of liquidity are market liquidity and accounting liquidity.

What is the hardest part of real estate : The 9 Hardest Parts of Being a Real Estate Agent

Antwort What is the riskiest type of real estate? Weitere Antworten – Which type of property has the lowest risk associated

Single family properties are usually the least risky investment property type. They are typically less expensive and easier to manage than other property types, making them ideal for first-time investors.In real estate, the liquidity refers to how quickly and easily a property can be sold in the market without significantly affecting its price. High liquidity means a property can be sold quickly due to high demand, favorable market conditions, or the property's attractiveness to a wide range of buyers.One of the main disadvantages of direct investing is that it requires a significant amount of time and energy (sweat equity) if you plan to be successful. You have to deal with tenant issues, maintenance emergencies, and your liability if there are any accidents on the property.

Is real estate a good investment in the Philippines : Real estate continues to appreciate in value

While real estate may be considerably low right now as compared to previous years, the Bangko Sentral ng Pilipinas (BSP) predicts a strong rebound of as much as 7.8% in 2021. This means now is a good time to invest in land and property.

What is the biggest risk of real estate

Real estate investing can be lucrative but it's important to understand the risks. Key risks include bad locations, negative cash flows, high vacancies, and problematic tenants.

What is low-risk in real estate : The BRRRR method is low-risk because investors can focus on adding value to the property they buy through renovations, which allows them to rent it out at a decent rate. From there, they can refinance to recover a lot of the capital they've spent.

Real estate is generally considered a moderate to high-risk industry. While it offers the potential for returns, factors such as market dynamics, economic conditions, and changes in supply and demand can affect rental income and property values.

Different property types have varying degrees of liquidity. Residential properties, especially those in high-demand rental markets, tend to be the most liquid due to the constant need for housing. Commercial properties, such as office spaces and retail centers, can also be relatively liquid in desirable locations.

What is the biggest disadvantage of real estate

Disadvantages of investing in real estate

Best Places to Invest in Property 2024 For Capital Growth

According to Savills Residential Forecast, the best places to invest in property in the UK for capital growth are Wales, Scotland, and the North of England. They predict that all of these areas will experience average growth of over 20% by 2028.1) Real estate cannot be lost or stolen, nor can it be carried away. Purchased with common sense, paid for in full, and managed with reasonable care, it is about the safest investment in the world. 2) Buy land, they're not making it anymore. 3) Ninety percent of all millionaires become so through owning real estate.

Top Challenges

What investments are riskier than property : Shares investments are more volatile, and generally returns more over time, than property investments. Therefore, we can say that while the shares are riskier than property, the returns were also greater.

What is the safest type of real estate investment : Here are the best low risk real estate investment types:

What is the biggest threat to real estate

Economic uncertainty and market volatility are two of the most significant risks that real estate investors face. The current global economic climate has created an unpredictable future for people who are buying or selling homes.

Property investment is an exciting venture that can potentially provide multiple benefits, such as producing consistent rental income, capital appreciation over time, and tax advantages. However, it is critical to recognize that property investment, like any other investment, is not entirely risk-free.Cash

Cash is the most liquid of assets, while tangible items are less liquid. The two main types of liquidity are market liquidity and accounting liquidity.

What is the hardest part of real estate : The 9 Hardest Parts of Being a Real Estate Agent