So, what counts as a “good” dividend payout ratio Generally speaking, a dividend payout ratio of 30-50% is considered healthy, while anything over 50% could be unsustainable.How Is the Payout Ratio Calculated The payout ratio shows the proportion of earnings a company pays its shareholders in the form of dividends, expressed as a percentage of the company's total earnings. The calculation is derived by dividing the total dividends being paid out by the net income generated.Realty Income Corporation's payout ratio is 289.08% which means that 289.08% of the company's earnings are paid out as dividends.

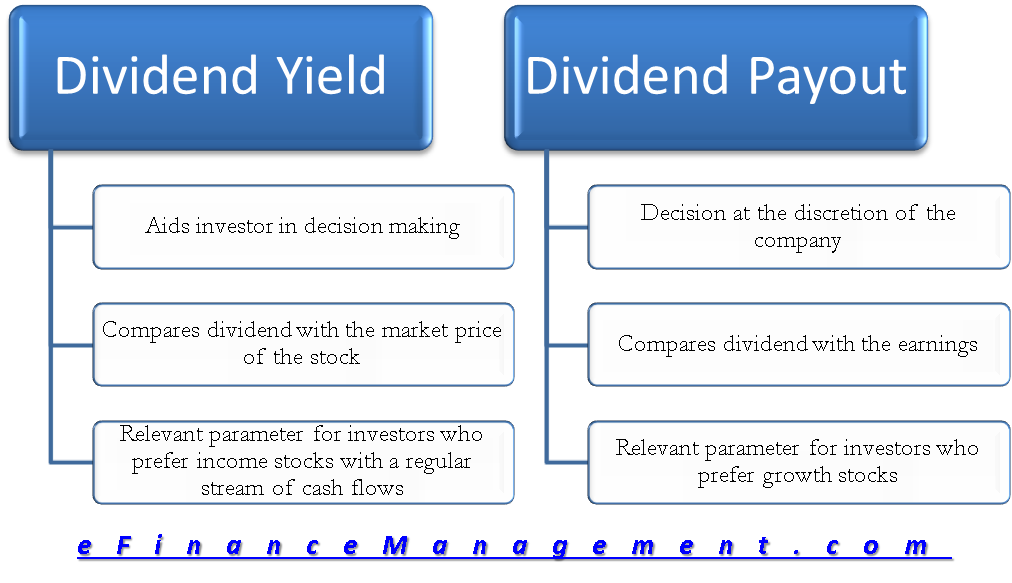

What is the difference between payout ratio and dividend yield : The dividend payout ratio shows the percentage of earnings paid out to shareholders in dividends. It is calculated by dividing total dividend payments by net income. The dividend yield shows the annual dividend income earned per share as a percentage of the current stock price.

Is a 7% dividend good

What Is a Good Dividend Yield Yields from 2% to 6% are generally considered to be a good dividend yield, but there are plenty of factors to consider when deciding if a stock's yield makes it a good investment. Your own investment goals should also play a big role in deciding what a good dividend yield is for you.

What is a 0 dividend payout ratio : The dividend payout ratio is 0% for companies that do not pay dividends and 100% for companies that pay out their entire net income as dividends. Several considerations go into interpreting the dividend payout ratio—most importantly the company's level of maturity.

The dividend payout ratio is one metric that can be used to determine how much a company pays out to its shareholders in relation to the overall earnings it generates. For example, if a company has an EPS (earnings per share) of $1.00 and pays out dividends of $0.80, its dividend payout ratio would be 80%. Some companies pay out 100% of their net income, while others choose to use a portion to reinvest in the company and pay off debts. For instance, if a company's annual net earnings are $5M and its total annual dividend payments equal $3M, the dividend payout ratio is 60%.

How often does O pay dividends

every month

Realty Income has an annual dividend of $3.15 per share, with a forward yield of 5.73%. The dividend is paid every month and the next ex-dividend date is Jun 3, 2024.Realty Income (O 0.14%) is often considered a stable long-term investment for conservative income investors. It's one of the world's largest real estate investment trusts (REITs), and its tenants include large retailers like Walgreens, 7-Eleven, Dollar General, Dollar Tree, and Walmart.Fast Fact. A company that pays out greater than 50% of its earnings in the form of dividends may not raise its dividends as much as a company with a lower dividend payout ratio. Thus, investors prefer a company that pays out less of its earnings in the form of dividends. A payout ratio over 100 may indicate that the dividend is in jeopardy, because no company can continue to pay out more than it earns indefinitely. A very high payout ratio can be a sign to investigate further, but it's not necessarily a signal to run screaming.

Is O stock a buy or sell : The consensus among 7 Wall Street analysts covering (NYSE: O) stock is to Buy O stock. Out of 7 analysts, 2 (28.57%) are recommending O as a Strong Buy, 3 (42.86%) are recommending O as a Buy, 2 (28.57%) are recommending O as a Hold, 0 (0%) are recommending O as a Sell, and 0 (0%) are recommending O as a Strong Sell.

Is 5% a good dividend : Yields from 2% to 6% are generally considered to be a good dividend yield, but there are plenty of factors to consider when deciding if a stock's yield makes it a good investment.

What does 0 dividend mean

Zero-dividend preferred stock is preferred stock that does not pay out a dividend. Common stock is still subordinate to zero-dividend preferred stock. Zero-dividend preferred stock earns income from capital appreciation and may offer a one-time lump sum payment at the end of the investment term. If and when a company incurs losses, its payout ratio will go negative, which is a major red flag that the dividend is in danger of being cut. An ideal payout ratio is between 35% to 55%, a comfortable range which allows companies to continue raising dividends each year.A payout ratio over 100 may indicate that the dividend is in jeopardy, because no company can continue to pay out more than it earns indefinitely.

How is o dividend taxed : How dividends are taxed depends on your income, filing status and whether the dividend is qualified or nonqualified. Qualified dividends are taxed at 0%, 15% or 20% depending on taxable income and filing status. Nonqualified dividends are taxed as income at rates up to 37%.

Antwort What is the payout ratio for O stock? Weitere Antworten – What is a good dividend payout ratio

30-50%

So, what counts as a “good” dividend payout ratio Generally speaking, a dividend payout ratio of 30-50% is considered healthy, while anything over 50% could be unsustainable.How Is the Payout Ratio Calculated The payout ratio shows the proportion of earnings a company pays its shareholders in the form of dividends, expressed as a percentage of the company's total earnings. The calculation is derived by dividing the total dividends being paid out by the net income generated.Realty Income Corporation's payout ratio is 289.08% which means that 289.08% of the company's earnings are paid out as dividends.

What is the difference between payout ratio and dividend yield : The dividend payout ratio shows the percentage of earnings paid out to shareholders in dividends. It is calculated by dividing total dividend payments by net income. The dividend yield shows the annual dividend income earned per share as a percentage of the current stock price.

Is a 7% dividend good

What Is a Good Dividend Yield Yields from 2% to 6% are generally considered to be a good dividend yield, but there are plenty of factors to consider when deciding if a stock's yield makes it a good investment. Your own investment goals should also play a big role in deciding what a good dividend yield is for you.

What is a 0 dividend payout ratio : The dividend payout ratio is 0% for companies that do not pay dividends and 100% for companies that pay out their entire net income as dividends. Several considerations go into interpreting the dividend payout ratio—most importantly the company's level of maturity.

The dividend payout ratio is one metric that can be used to determine how much a company pays out to its shareholders in relation to the overall earnings it generates. For example, if a company has an EPS (earnings per share) of $1.00 and pays out dividends of $0.80, its dividend payout ratio would be 80%.

Some companies pay out 100% of their net income, while others choose to use a portion to reinvest in the company and pay off debts. For instance, if a company's annual net earnings are $5M and its total annual dividend payments equal $3M, the dividend payout ratio is 60%.

How often does O pay dividends

every month

Realty Income has an annual dividend of $3.15 per share, with a forward yield of 5.73%. The dividend is paid every month and the next ex-dividend date is Jun 3, 2024.Realty Income (O 0.14%) is often considered a stable long-term investment for conservative income investors. It's one of the world's largest real estate investment trusts (REITs), and its tenants include large retailers like Walgreens, 7-Eleven, Dollar General, Dollar Tree, and Walmart.Fast Fact. A company that pays out greater than 50% of its earnings in the form of dividends may not raise its dividends as much as a company with a lower dividend payout ratio. Thus, investors prefer a company that pays out less of its earnings in the form of dividends.

A payout ratio over 100 may indicate that the dividend is in jeopardy, because no company can continue to pay out more than it earns indefinitely. A very high payout ratio can be a sign to investigate further, but it's not necessarily a signal to run screaming.

Is O stock a buy or sell : The consensus among 7 Wall Street analysts covering (NYSE: O) stock is to Buy O stock. Out of 7 analysts, 2 (28.57%) are recommending O as a Strong Buy, 3 (42.86%) are recommending O as a Buy, 2 (28.57%) are recommending O as a Hold, 0 (0%) are recommending O as a Sell, and 0 (0%) are recommending O as a Strong Sell.

Is 5% a good dividend : Yields from 2% to 6% are generally considered to be a good dividend yield, but there are plenty of factors to consider when deciding if a stock's yield makes it a good investment.

What does 0 dividend mean

Zero-dividend preferred stock is preferred stock that does not pay out a dividend. Common stock is still subordinate to zero-dividend preferred stock. Zero-dividend preferred stock earns income from capital appreciation and may offer a one-time lump sum payment at the end of the investment term.

If and when a company incurs losses, its payout ratio will go negative, which is a major red flag that the dividend is in danger of being cut. An ideal payout ratio is between 35% to 55%, a comfortable range which allows companies to continue raising dividends each year.A payout ratio over 100 may indicate that the dividend is in jeopardy, because no company can continue to pay out more than it earns indefinitely.

How is o dividend taxed : How dividends are taxed depends on your income, filing status and whether the dividend is qualified or nonqualified. Qualified dividends are taxed at 0%, 15% or 20% depending on taxable income and filing status. Nonqualified dividends are taxed as income at rates up to 37%.