Australia Australia and Chile: Dominating Global Lithium Supply

Rank

Country

Mine production 2022E (tonnes)

1

🇦🇺 Australia

61,000

2

🇨🇱 Chile

39,000

3

🇨🇳 China

19,000

4

🇦🇷 Argentina

6,200

Best lithium stocks

Ticker

Company

Performance (1 Year)

ENS

Enersys

9.02%

QS

QuantumScape Corp

-22.57%

RIVN

Rivian Automotive Inc

-30.58%

SQM

Sociedad Quimica Y Minera de Chile S.A. ADR

-32.29%

According to Blackridge Research & Consulting's recent study on the global lithium-ion battery market, China-based CATL was the largest lithium-ion battery manufacturer in 2021, with the highest market share. CATL plans to ramp up lithium-ion battery production in the future.

Which lithium company does Tesla use : Ganfeng Lithium

At the end of 2021, Tesla inked a fresh three year lithium supply deal with top lithium producer Ganfeng Lithium (OTC Pink:GNENF,SZSE:002460).

Which country is no 1 in lithium

Chile

In nature, lithium occurs only in compounds due to its high reactivity. Chile has the largest lithium reserves worldwide by a large margin. Australia comes in second, with reserves estimated at 6.2 million metric tons in 2023.

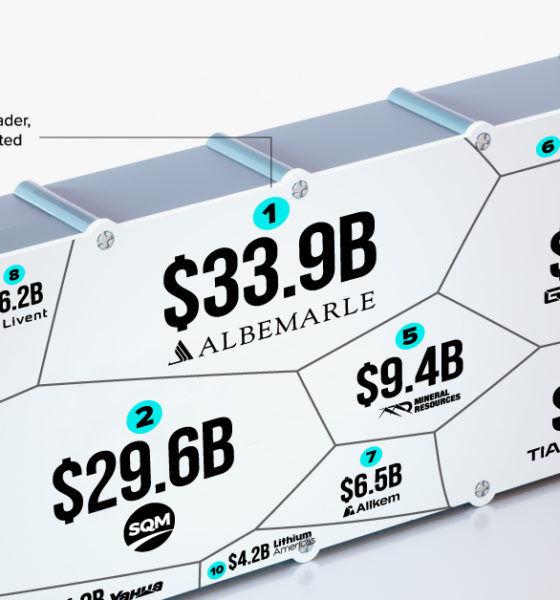

Who sells the most lithium : North Carolina-based Albemarle is not only the largest lithium company by market cap, but also the top lithium producer in the world with over 7,000 employees globally.

The decision to invest in the lithium industry begins with one compelling data point: Global battery cell demand for lithium will soar nearly seven-fold by 2030, according to McKinsey Battery Insights. Are lithium stocks a good investment Yes, the Global X Lithium & Battery Tech ETF (LIT), which invests in a diversified basket of roughly 40 different lithium stocks, has beat the return of the S&P 500 over the past five years.

Who is the king of lithium

Nearly a decade ago, Albemarle spent $6 Billion to buy NJ lithium producer Rockwood. They bet that demand for lithium, the lightest of all metals discovered in 1817, was poised to take off as a key component in batteries. They were right. Albemarle is now the world's most valuable lithium producer.Australia

International context. Australia is the global leader in lithium production, with five mines accounting for nearly half of the lithium production in 2022. Brine operations in Chile and Argentina and mines in China accounted for most of the remaining forecasted production in 2022.TDK Corp

TDK Corp, a key supplier for Apple Inc., has unveiled a breakthrough in smartphone battery technology by introducing small-sized lithium-ion batteries with silicon electrodes. Ganfeng Lithium

Tesla does not rely on a single supplier for lithium; instead, it diversifies its sources. At the end of 2021, Tesla signed a three-year lithium supply agreement with Ganfeng Lithium, a leading lithium producer based in China. Major mining companies like Livent and Albemarle also have supply contracts with Tesla.

Who are the top lithium companies : Best Lithium Stocks of May 2024

Stock (ticker)

Market Cap

Ganfeng Lithium Group Co., Ltd. (GNENF)

$9.6 billion

Mineral Resources Limited (MALRY)

$9.3 billion

Pilbara Minerals Limited (PILBF)

$7.9 billion

Arcadium Lithium PLC (ALTM)

$5.0 billion

Who has the most lithium in Europe : The Czech village of Cinovec is sitting on a buried treasure: Europe's largest deposit of lithium. Exploration has shown that the ground around Cinovec — which is situated about 100 kilometers (62 miles) northwest of Prague, close to the Czech-German border — holds 3–5% of the world's total lithium reserves.

Will lithium run out in 2025

The world could face a shortage for lithium as demand for the metal ramps up, with some analysts forecasting that it could come as soon as 2025. Others, however, see a longer time frame before that shortfall hits. BMI, a Fitch Solutions research unit, was among those that predict a lithium supply deficit by 2025. Due to the increasing use of electric vehicles (EVs) in China, Europe, and the United States (with a projected 40% electrification of light vehicles by 2030) and a growing demand for grid storage applications, the global need for lithium is set to surge.Lithium Stocks. Gold is the evergreen choice as a hedge against inflation and weak markets. In contrast, battery metals may offer unique growth opportunities in the current market.

What country is richest in lithium : Chile

Lithium reserves by country

Chile has the largest lithium reserves worldwide by a large margin. Australia comes in second, with reserves estimated at 6.2 million metric tons in 2023. Mineral reserves are defined as those minerals that were extractable or producible at the time of estimate.

Antwort What is the number 1 lithium company? Weitere Antworten – Who is the biggest lithium producer in the world

Australia

Australia and Chile: Dominating Global Lithium Supply

Best lithium stocks

According to Blackridge Research & Consulting's recent study on the global lithium-ion battery market, China-based CATL was the largest lithium-ion battery manufacturer in 2021, with the highest market share. CATL plans to ramp up lithium-ion battery production in the future.

Which lithium company does Tesla use : Ganfeng Lithium

At the end of 2021, Tesla inked a fresh three year lithium supply deal with top lithium producer Ganfeng Lithium (OTC Pink:GNENF,SZSE:002460).

Which country is no 1 in lithium

Chile

In nature, lithium occurs only in compounds due to its high reactivity. Chile has the largest lithium reserves worldwide by a large margin. Australia comes in second, with reserves estimated at 6.2 million metric tons in 2023.

Who sells the most lithium : North Carolina-based Albemarle is not only the largest lithium company by market cap, but also the top lithium producer in the world with over 7,000 employees globally.

The decision to invest in the lithium industry begins with one compelling data point: Global battery cell demand for lithium will soar nearly seven-fold by 2030, according to McKinsey Battery Insights.

Are lithium stocks a good investment Yes, the Global X Lithium & Battery Tech ETF (LIT), which invests in a diversified basket of roughly 40 different lithium stocks, has beat the return of the S&P 500 over the past five years.

Who is the king of lithium

Nearly a decade ago, Albemarle spent $6 Billion to buy NJ lithium producer Rockwood. They bet that demand for lithium, the lightest of all metals discovered in 1817, was poised to take off as a key component in batteries. They were right. Albemarle is now the world's most valuable lithium producer.Australia

International context. Australia is the global leader in lithium production, with five mines accounting for nearly half of the lithium production in 2022. Brine operations in Chile and Argentina and mines in China accounted for most of the remaining forecasted production in 2022.TDK Corp

TDK Corp, a key supplier for Apple Inc., has unveiled a breakthrough in smartphone battery technology by introducing small-sized lithium-ion batteries with silicon electrodes.

Ganfeng Lithium

Tesla does not rely on a single supplier for lithium; instead, it diversifies its sources. At the end of 2021, Tesla signed a three-year lithium supply agreement with Ganfeng Lithium, a leading lithium producer based in China. Major mining companies like Livent and Albemarle also have supply contracts with Tesla.

Who are the top lithium companies : Best Lithium Stocks of May 2024

Who has the most lithium in Europe : The Czech village of Cinovec is sitting on a buried treasure: Europe's largest deposit of lithium. Exploration has shown that the ground around Cinovec — which is situated about 100 kilometers (62 miles) northwest of Prague, close to the Czech-German border — holds 3–5% of the world's total lithium reserves.

Will lithium run out in 2025

The world could face a shortage for lithium as demand for the metal ramps up, with some analysts forecasting that it could come as soon as 2025. Others, however, see a longer time frame before that shortfall hits. BMI, a Fitch Solutions research unit, was among those that predict a lithium supply deficit by 2025.

Due to the increasing use of electric vehicles (EVs) in China, Europe, and the United States (with a projected 40% electrification of light vehicles by 2030) and a growing demand for grid storage applications, the global need for lithium is set to surge.Lithium Stocks. Gold is the evergreen choice as a hedge against inflation and weak markets. In contrast, battery metals may offer unique growth opportunities in the current market.

What country is richest in lithium : Chile

Lithium reserves by country

Chile has the largest lithium reserves worldwide by a large margin. Australia comes in second, with reserves estimated at 6.2 million metric tons in 2023. Mineral reserves are defined as those minerals that were extractable or producible at the time of estimate.