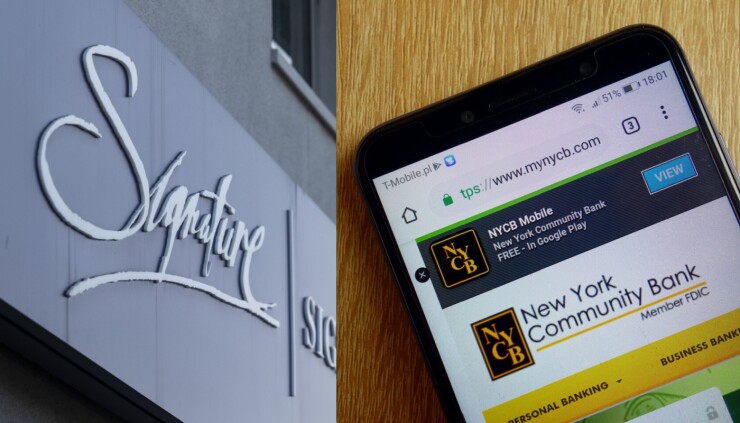

On March 20, 2023, New York Community Bancorp agreed to purchase $38.3 billion of Signature Bank's assets, while $60 billion remained in receivership with the FDIC. Signature Bank's branches currently operate under a subsidiary of New York Community Bank known as Flagstar Bank.NYCB subsidiary Flagstar Bank acquired Signature on March 19, 2023, a week after the Federal Deposit Insurance Corp. (FDIC) assumed control of the failed bank on March 12.Signature Bank was shut down by federal regulators on March 12, 2023. The bank's failure resulted from regulator concern about depositors withdrawing large amounts of money after the failure of Silicon Valley Bank (SVB) and the fear of continued contagion.

Who is the owner of Signature Bank : Otti, a former Group Managing Director/Chief Executive Officer of the erstwhile Diamond Bank Plc, is the founder and promoter of Signature Bank, which formally opened its doors to business on Monday, November 21, 2022 in Abuja, Nigeria's Federal Capital Territory.

Who is next after Signature Bank

Flagstar Bank

After the failure of Signature Bank on March 12, the FDIC temporarily took over the bank's deposits and worked to find a new institution to acquire it. The FDIC announced today that Flagstar Bank, a subsidiary of New York Community Bancorp., will acquire Signature's deposits and branches.

What is the short name for Signature Bank : SBNY

SBNY: Signature Bank – Stock Price, Quote and News – CNBC.

On Monday, Signature Bank's 40 branches will begin operating as Flagstar Bank. Signature customers won't need to make any changes to do their banking Monday. New York Community Bank bought substantially all of Signature's deposits and a total of $38.4 billion worth of the company's assets. In case you don't remember, Signature Bank had gotten shipwrecked in March 2023, alongside the other infamous "crypto-deposit banks", Silvergate Bank and First Republic Bank. Its stock had to be considered worthless, at least by conventional wisdom.

Can I still send money to Signature Bank

You may continue to send your payments to the same payment address with checks made payable to Signature Bank. You will receive a letter advising you of any changes.Depositors and borrowers will automatically become customers of Signature Bridge Bank, N.A. and will continue to have uninterrupted customer service and access to their funds by ATM, debit cards, and writing checks in the same manner as before.In their announcement, regulators stated Signature Bank was closed in order to protect depositors and the FDIC was appointed as receiver of the bank. The bank had more than $110 billion in assets and nearly $89 billion in deposits at the end of 2022, according to the New York Department of Financial Services. Blackstone Affiliate

The Federal Deposit Insurance Corporation, as receiver of the failed Signature Bridge Bank, N.A. (FDIC–Receiver), said Thursday that a Blackstone affiliate won the bidding for a $16.8-billion portfolio of Signature commercial real estate loans.

Why bank signature change : This situation could arise due to factors like old-age-related mobility issues, failure to remember the signature with the bank, poor health or an accident causing the person to lose hand functions, etc. However, banks have established procedures to change the signature or suggest options for verification.

Is Signature Bank safe : On March 12, 2023, Signature Bank, New York, NY, was closed by the New York State Department of Financial Services and the Federal Deposit Insurance Corporation (FDIC) was named Receiver. No advance notice is given to the public when a financial institution is closed.

What happened with Flagstar Bank

After Congress in 2018 relaxed rules for banks with between $50 billion and $250 billion in assets, it became easier to get bank deals done. Then in April 2021, under CEO Thomas Cangemi, NYCB announced its big move: merging Flagstar into NYCB's New York subsidiary, creating a lender with $87 billion in assets. "The merging of NYCB's and Flagstar's operating systems—soon to be followed by Signature Bank—and national rebranding is an important inflection point in our history.IS MY MONEY SAFE Yes! No one lost any money on deposit as a result of this transaction. Depositors of Signature Bridge Bank, N.A., will automatically become depositors of Flagstar Bank, N.A. Customers whose accounts are associated with the digital banking business should reach out to Flagstar Bank, N.A.

What happens to my Signature Bank shares : New York state regulators took control of Signature Bank Sunday, effectively wiping out shareholders. All depositors will be made whole, but shareholders and some unsecured debt-holders will not be protected, according to a statement by federal regulators.

Antwort What is the new name for Signature Bank? Weitere Antworten – What is Signature Bank now called

On March 20, 2023, New York Community Bancorp agreed to purchase $38.3 billion of Signature Bank's assets, while $60 billion remained in receivership with the FDIC. Signature Bank's branches currently operate under a subsidiary of New York Community Bank known as Flagstar Bank.NYCB subsidiary Flagstar Bank acquired Signature on March 19, 2023, a week after the Federal Deposit Insurance Corp. (FDIC) assumed control of the failed bank on March 12.Signature Bank was shut down by federal regulators on March 12, 2023. The bank's failure resulted from regulator concern about depositors withdrawing large amounts of money after the failure of Silicon Valley Bank (SVB) and the fear of continued contagion.

Who is the owner of Signature Bank : Otti, a former Group Managing Director/Chief Executive Officer of the erstwhile Diamond Bank Plc, is the founder and promoter of Signature Bank, which formally opened its doors to business on Monday, November 21, 2022 in Abuja, Nigeria's Federal Capital Territory.

Who is next after Signature Bank

Flagstar Bank

After the failure of Signature Bank on March 12, the FDIC temporarily took over the bank's deposits and worked to find a new institution to acquire it. The FDIC announced today that Flagstar Bank, a subsidiary of New York Community Bancorp., will acquire Signature's deposits and branches.

What is the short name for Signature Bank : SBNY

SBNY: Signature Bank – Stock Price, Quote and News – CNBC.

On Monday, Signature Bank's 40 branches will begin operating as Flagstar Bank. Signature customers won't need to make any changes to do their banking Monday. New York Community Bank bought substantially all of Signature's deposits and a total of $38.4 billion worth of the company's assets.

In case you don't remember, Signature Bank had gotten shipwrecked in March 2023, alongside the other infamous "crypto-deposit banks", Silvergate Bank and First Republic Bank. Its stock had to be considered worthless, at least by conventional wisdom.

Can I still send money to Signature Bank

You may continue to send your payments to the same payment address with checks made payable to Signature Bank. You will receive a letter advising you of any changes.Depositors and borrowers will automatically become customers of Signature Bridge Bank, N.A. and will continue to have uninterrupted customer service and access to their funds by ATM, debit cards, and writing checks in the same manner as before.In their announcement, regulators stated Signature Bank was closed in order to protect depositors and the FDIC was appointed as receiver of the bank. The bank had more than $110 billion in assets and nearly $89 billion in deposits at the end of 2022, according to the New York Department of Financial Services.

Blackstone Affiliate

The Federal Deposit Insurance Corporation, as receiver of the failed Signature Bridge Bank, N.A. (FDIC–Receiver), said Thursday that a Blackstone affiliate won the bidding for a $16.8-billion portfolio of Signature commercial real estate loans.

Why bank signature change : This situation could arise due to factors like old-age-related mobility issues, failure to remember the signature with the bank, poor health or an accident causing the person to lose hand functions, etc. However, banks have established procedures to change the signature or suggest options for verification.

Is Signature Bank safe : On March 12, 2023, Signature Bank, New York, NY, was closed by the New York State Department of Financial Services and the Federal Deposit Insurance Corporation (FDIC) was named Receiver. No advance notice is given to the public when a financial institution is closed.

What happened with Flagstar Bank

After Congress in 2018 relaxed rules for banks with between $50 billion and $250 billion in assets, it became easier to get bank deals done. Then in April 2021, under CEO Thomas Cangemi, NYCB announced its big move: merging Flagstar into NYCB's New York subsidiary, creating a lender with $87 billion in assets.

"The merging of NYCB's and Flagstar's operating systems—soon to be followed by Signature Bank—and national rebranding is an important inflection point in our history.IS MY MONEY SAFE Yes! No one lost any money on deposit as a result of this transaction. Depositors of Signature Bridge Bank, N.A., will automatically become depositors of Flagstar Bank, N.A. Customers whose accounts are associated with the digital banking business should reach out to Flagstar Bank, N.A.

What happens to my Signature Bank shares : New York state regulators took control of Signature Bank Sunday, effectively wiping out shareholders. All depositors will be made whole, but shareholders and some unsecured debt-holders will not be protected, according to a statement by federal regulators.