According to modern studies, the § Top 10 tax havens include corporate-focused havens like the Netherlands, Singapore, Ireland, and the U.K., while Luxembourg, Hong Kong, the Cayman Islands, Bermuda, the British Virgin Islands, and Switzerland feature as both major traditional tax havens and major corporate tax havens.European countries like Luxembourg, Switzerland, and Monaco are renowned as tax havens due to their low tax rates and privacy laws. Luxembourg offers attractive tax treatments for international corporations and Switzerland is known for its banking secrecy and favorable tax regimes for foreign companies.Table of content. Luxembourg has earned a distinguished reputation as a tax haven due to its historical appeal to corporations and wealthy individuals since the 1960s. Rising as a prominent financial center for the offshore trade of European bonds, Luxembourg became a favored choice for entities seeking to issue deb.

Is Turkey a tax haven country : EU ambassadors signed off Wednesday on a new nine-country blacklist for tax havens that includes Panama and the U.S. Virgins Islands — but not Turkey.

Is Dubai tax-free

Is Dubai a tax-free country Yes, Dubai is a tax-free nation when it comes to imposing income tax on most of its citizens. However, if you own an oil business, there is a tax rate of 55%. There are entertainment taxes and import duties.

Is Germany a tax haven : Key Takeaways. Europe is home to many tax havens that provide favorable environments for taxation on capital gains, income, and corporations. England, Germany, and Ireland are among the top tax havens on the continent.

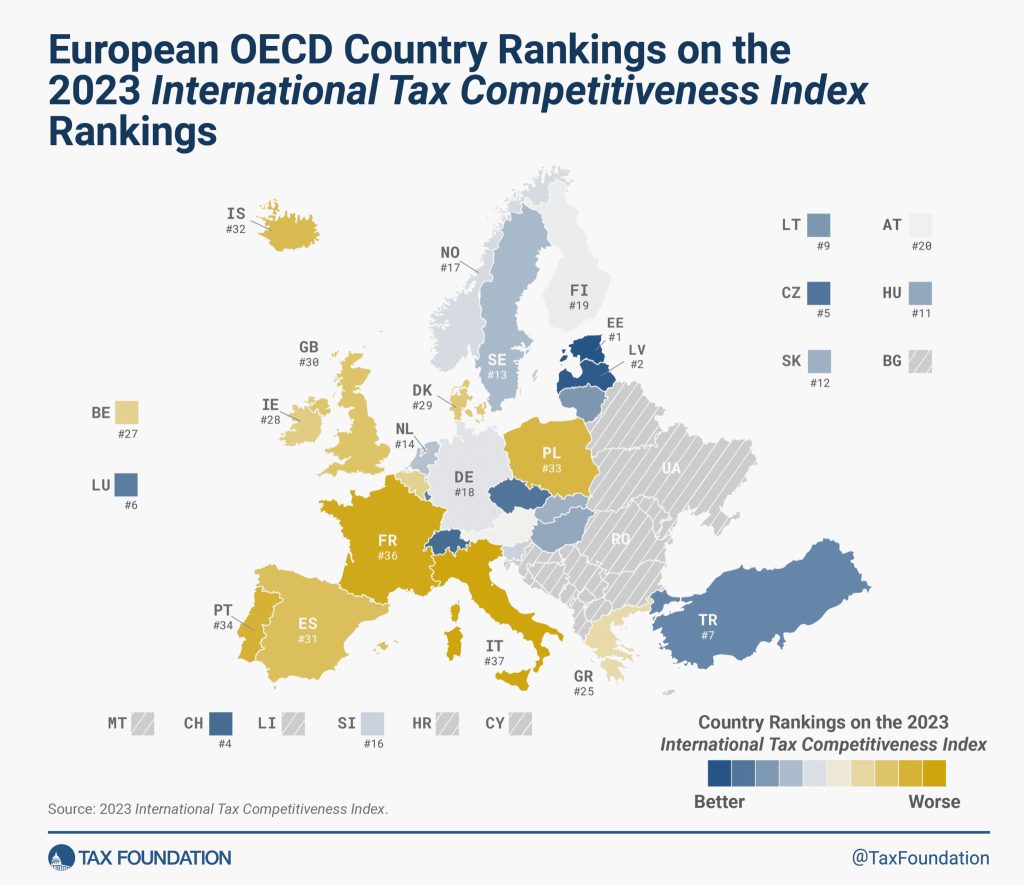

Among European OECD countries, the average statutory top personal income tax rate lies at 42.8 percent in 2024. Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top rates. Hungary (15 percent), Estonia (20 percent), and the Czech Republic (23 percent) have the lowest top rates. Yes, Dubai is a tax-free nation when it comes to imposing income tax on most of its citizens. However, if you own an oil business, there is a tax rate of 55%. There are entertainment taxes and import duties. Is Qatar a tax-free country

Is Monaco tax-free

The Bottom Line. Monaco has long been considered a tax haven because of its favorable personal and corporate tax rules. The country does not tax individuals on their income, and corporations within the country have favorable tax treatments.The Flat Tax 100,000 for Residency Transfers to Italy. Italy continues to emerge as an attractive destination for high-net-worth individuals seeking significant tax advantages and a favorable economic climate.The grey list contains a large number of different lists of jurisdictions in relation to which the EU Code of Conduct Group identified concerns during its screening process. Top roles such as CEO, cardiologist, and chief digital officer can earn anywhere from AED 75,000 to AED 400,000 monthly. Is 40,000 AED a good salary in Dubai Yes, a monthly income of 40,000 AED in Dubai is regarded as a high salary.

Is 8000 AED a good salary in Dubai : However, if you choose to live alone in an inexpensive area, don't eat out too often, and maintain ordinary spending habits, you can live a very comfortable life with AED 5000-8000 (USD 1,360 – 2,180) per month including rent.

Is the US a tax haven : This means the US receives tax and asset information for American assets and income abroad, but does not share information about what happens in the United States with other countries. In other words, it has become attractive as a tax haven.

Who pays the highest tax in the world

Ivory Coast. The country with beach resorts, rainforests, and a French-colonial legacy levies a massive 60% personal income tax – the highest in the world. Bulgaria

The lowest tax rate on wages in the EU is set in Bulgaria and Romania – 10%. The highest taxes in Europe are paid by residents of Finland – here the collection can reach 56.5 % of profit.There is currently no personal income tax in the United Arab Emirates. As such, there are no individual tax registration or reporting obligations.

Is Qatar tax-free : Qatar operates a territorial taxation system, which means an individual is taxable in Qatar if one has generated qualifying Qatar-source income, regardless of one's tax residence. Income tax is not imposed on employed individuals' salaries, wages, and allowances.

Antwort What is the most famous tax haven in the world? Weitere Antworten – What is the biggest tax haven in the world

the British Virgin Islands

According to modern studies, the § Top 10 tax havens include corporate-focused havens like the Netherlands, Singapore, Ireland, and the U.K., while Luxembourg, Hong Kong, the Cayman Islands, Bermuda, the British Virgin Islands, and Switzerland feature as both major traditional tax havens and major corporate tax havens.European countries like Luxembourg, Switzerland, and Monaco are renowned as tax havens due to their low tax rates and privacy laws. Luxembourg offers attractive tax treatments for international corporations and Switzerland is known for its banking secrecy and favorable tax regimes for foreign companies.Table of content. Luxembourg has earned a distinguished reputation as a tax haven due to its historical appeal to corporations and wealthy individuals since the 1960s. Rising as a prominent financial center for the offshore trade of European bonds, Luxembourg became a favored choice for entities seeking to issue deb.

:max_bytes(150000):strip_icc()/GettyImages-1451455631-809e8cb865b54f7ebc6f880184a2b07d.jpg)

Is Turkey a tax haven country : EU ambassadors signed off Wednesday on a new nine-country blacklist for tax havens that includes Panama and the U.S. Virgins Islands — but not Turkey.

Is Dubai tax-free

Is Dubai a tax-free country Yes, Dubai is a tax-free nation when it comes to imposing income tax on most of its citizens. However, if you own an oil business, there is a tax rate of 55%. There are entertainment taxes and import duties.

Is Germany a tax haven : Key Takeaways. Europe is home to many tax havens that provide favorable environments for taxation on capital gains, income, and corporations. England, Germany, and Ireland are among the top tax havens on the continent.

Among European OECD countries, the average statutory top personal income tax rate lies at 42.8 percent in 2024. Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top rates. Hungary (15 percent), Estonia (20 percent), and the Czech Republic (23 percent) have the lowest top rates.

Yes, Dubai is a tax-free nation when it comes to imposing income tax on most of its citizens. However, if you own an oil business, there is a tax rate of 55%. There are entertainment taxes and import duties. Is Qatar a tax-free country

Is Monaco tax-free

The Bottom Line. Monaco has long been considered a tax haven because of its favorable personal and corporate tax rules. The country does not tax individuals on their income, and corporations within the country have favorable tax treatments.The Flat Tax 100,000 for Residency Transfers to Italy. Italy continues to emerge as an attractive destination for high-net-worth individuals seeking significant tax advantages and a favorable economic climate.The grey list contains a large number of different lists of jurisdictions in relation to which the EU Code of Conduct Group identified concerns during its screening process.

Top roles such as CEO, cardiologist, and chief digital officer can earn anywhere from AED 75,000 to AED 400,000 monthly. Is 40,000 AED a good salary in Dubai Yes, a monthly income of 40,000 AED in Dubai is regarded as a high salary.

Is 8000 AED a good salary in Dubai : However, if you choose to live alone in an inexpensive area, don't eat out too often, and maintain ordinary spending habits, you can live a very comfortable life with AED 5000-8000 (USD 1,360 – 2,180) per month including rent.

Is the US a tax haven : This means the US receives tax and asset information for American assets and income abroad, but does not share information about what happens in the United States with other countries. In other words, it has become attractive as a tax haven.

Who pays the highest tax in the world

Ivory Coast. The country with beach resorts, rainforests, and a French-colonial legacy levies a massive 60% personal income tax – the highest in the world.

Bulgaria

The lowest tax rate on wages in the EU is set in Bulgaria and Romania – 10%. The highest taxes in Europe are paid by residents of Finland – here the collection can reach 56.5 % of profit.There is currently no personal income tax in the United Arab Emirates. As such, there are no individual tax registration or reporting obligations.

Is Qatar tax-free : Qatar operates a territorial taxation system, which means an individual is taxable in Qatar if one has generated qualifying Qatar-source income, regardless of one's tax residence. Income tax is not imposed on employed individuals' salaries, wages, and allowances.