If at any time before such date, the closing bid price of the Company's Shares closes at or above $1.00 per share for a minimum of 10 consecutive business days, Nasdaq will provide written notification that the Company has achieved compliance with the minimum bid requirement, and the matter would be resolved.Under certain circumstances, to ensure that the company can sustain long-term compliance, Nasdaq may require the closing bid price to equal or to exceed the $1.00 minimum bid price requirement for more than 10 consecutive business days before determining that a company complies.NASDAQ Listing Requirements

Requirement

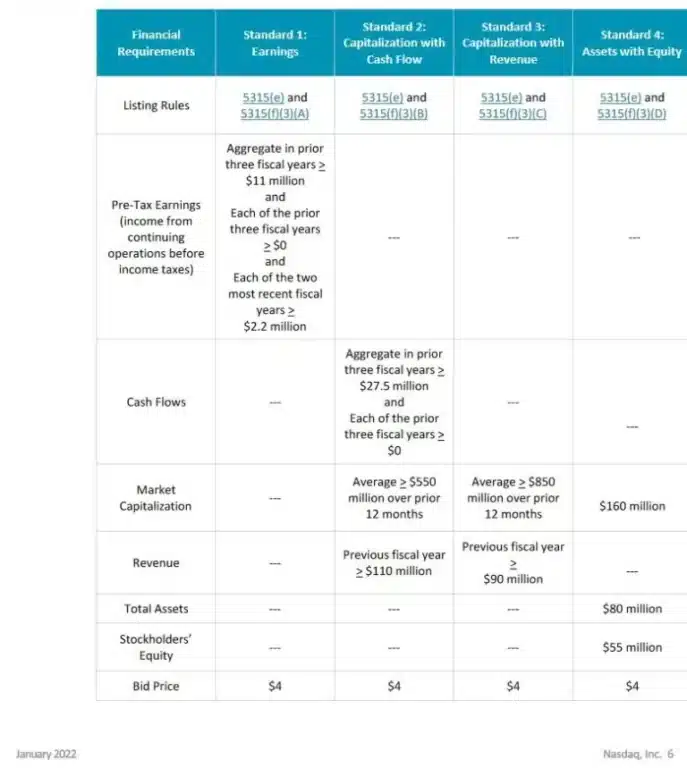

Income Standard

Total Assets/ Total Revenue Standard

Total Assets and Total Revenue (in latest fiscal year or in two of last three fiscal years)

–

$75mm and $75mm

Publicly Held Shares

1.1mm

1.1mm

Market Value of Publicly Held Shares

$8mm

$20mm

Bid Price

$4

$4

What is the minimum free float for Nasdaq : Nasdaq Capital Market companies are required to meet a net income standard of at least $750,000, a minimum public float of 1,000,000 shares, at least 300 shareholders, and a share bid price of at least $4 (with certain exceptions).

What is the minimum price to buy a stock

There is no minimum amount that you need to trade in the stock market.

What is the Nasdaq 20% rule : Nasdaq 20% Rule: Stockholder Approval Requirements for Securities Offerings | Practical Law. An overview of the so-called Nasdaq 20% rule requiring stockholder approval before a listed company can issue twenty percent or more of its outstanding common stock or voting power.

30 consecutive trading days

For example, on the New York Stock Exchange (NYSE), if a security's price closed below $1.00 for 30 consecutive trading days, that exchange would initiate the delisting process. Minimum application

As per SEBI guidelines, every applicant needs to invest a minimum amount in the IPO of a company. This minimum amount can range from INR 10,000 to 15,000.

What happens if a stock goes below $1

When a stock's price falls to zero, a shareholder's holdings in this stock become worthless. Major stock exchanges actually delist shares once they fall below specific price values. The New York Stock exchange (NYSE), for instance, will remove stocks if the share price remains below one dollar for 30 consecutive days.A security must meet the applicable closing price requirement for at least five consecutive business days prior to approval.With CommSec Share Trading, your initial purchase of any particular shareholding must be at least $500 worth of shares, known as a 'minimum marketable parcel of shares'. After your intial purchase has been made, you are able to purchase smaller amounts of shares to top up existing shareholdings. Fractional shares are less than one whole share of a company. With Cash App, you can buy fractional shares of a company's stock for as little as $1. An investment portfolio is a collection of all your financial investments.

How long can a stock stay below $1 on Nasdaq : For example, on the Nasdaq, the delisting process is set in motion when a company trades for 30 consecutive business days below the minimum closing bid price requirement or less than the required market value.

What is the 10 minute rule for Nasdaq : If the public announcement is made during Nasdaq market hours, the Company must notify MarketWatch at least ten minutes prior to the announcement.

What price is Nasdaq delisted

If a company can't maintain the minimum requirements to remain listed, Nasdaq will delist it. Failure of a company to meet a minimum closing bid price of at least $1 for 30 consecutive trading days can trigger delisting. When this happens Nasdaq issues a deficiency notice to the company. In the book-building method, the issuer announces a price range (e.g., Rs 75 to Rs 80) for the issue. The lower price of the price range is called the base price or floor price and the upper price of the price range is called the cap price or ceiling price.In an IPO, the price at which a company issues its shares to investors is referred to as the "cut-off price." The company decides it after analysing the demands of the investors for the shares. It is the actual issue price, which might be any amount within the specified price range.

What is the lowest a stock price can go : zero

No. A stock price can't go negative, or, that is, fall below zero. So an investor does not owe anyone money. They will, however, lose whatever money they invested in the stock if the stock falls to zero.

Antwort What is the minimum price requirement for Nasdaq? Weitere Antworten – What is the minimum price for Nasdaq

If at any time before such date, the closing bid price of the Company's Shares closes at or above $1.00 per share for a minimum of 10 consecutive business days, Nasdaq will provide written notification that the Company has achieved compliance with the minimum bid requirement, and the matter would be resolved.Under certain circumstances, to ensure that the company can sustain long-term compliance, Nasdaq may require the closing bid price to equal or to exceed the $1.00 minimum bid price requirement for more than 10 consecutive business days before determining that a company complies.NASDAQ Listing Requirements

What is the minimum free float for Nasdaq : Nasdaq Capital Market companies are required to meet a net income standard of at least $750,000, a minimum public float of 1,000,000 shares, at least 300 shareholders, and a share bid price of at least $4 (with certain exceptions).

What is the minimum price to buy a stock

There is no minimum amount that you need to trade in the stock market.

What is the Nasdaq 20% rule : Nasdaq 20% Rule: Stockholder Approval Requirements for Securities Offerings | Practical Law. An overview of the so-called Nasdaq 20% rule requiring stockholder approval before a listed company can issue twenty percent or more of its outstanding common stock or voting power.

30 consecutive trading days

For example, on the New York Stock Exchange (NYSE), if a security's price closed below $1.00 for 30 consecutive trading days, that exchange would initiate the delisting process.

Minimum application

As per SEBI guidelines, every applicant needs to invest a minimum amount in the IPO of a company. This minimum amount can range from INR 10,000 to 15,000.

What happens if a stock goes below $1

When a stock's price falls to zero, a shareholder's holdings in this stock become worthless. Major stock exchanges actually delist shares once they fall below specific price values. The New York Stock exchange (NYSE), for instance, will remove stocks if the share price remains below one dollar for 30 consecutive days.A security must meet the applicable closing price requirement for at least five consecutive business days prior to approval.With CommSec Share Trading, your initial purchase of any particular shareholding must be at least $500 worth of shares, known as a 'minimum marketable parcel of shares'. After your intial purchase has been made, you are able to purchase smaller amounts of shares to top up existing shareholdings.

Fractional shares are less than one whole share of a company. With Cash App, you can buy fractional shares of a company's stock for as little as $1. An investment portfolio is a collection of all your financial investments.

How long can a stock stay below $1 on Nasdaq : For example, on the Nasdaq, the delisting process is set in motion when a company trades for 30 consecutive business days below the minimum closing bid price requirement or less than the required market value.

What is the 10 minute rule for Nasdaq : If the public announcement is made during Nasdaq market hours, the Company must notify MarketWatch at least ten minutes prior to the announcement.

What price is Nasdaq delisted

If a company can't maintain the minimum requirements to remain listed, Nasdaq will delist it. Failure of a company to meet a minimum closing bid price of at least $1 for 30 consecutive trading days can trigger delisting. When this happens Nasdaq issues a deficiency notice to the company.

In the book-building method, the issuer announces a price range (e.g., Rs 75 to Rs 80) for the issue. The lower price of the price range is called the base price or floor price and the upper price of the price range is called the cap price or ceiling price.In an IPO, the price at which a company issues its shares to investors is referred to as the "cut-off price." The company decides it after analysing the demands of the investors for the shares. It is the actual issue price, which might be any amount within the specified price range.

What is the lowest a stock price can go : zero

No. A stock price can't go negative, or, that is, fall below zero. So an investor does not owe anyone money. They will, however, lose whatever money they invested in the stock if the stock falls to zero.