Answer and Explanation: Matching principle, also known as hedging or matching approach, is a type of technique that is used to improve the efficiency of a company. It implies that fixed assets and permanent working capital should be financed (or matched) by long term funds such as equity, debentures or term loan.The Hedging Approach to working capital financing is based upon the concept of bifurcation of total working capital needs into permanent working capital and temporary working capital. As the name itself suggests, the life duration of current assets and the maturity period of the sources of funds are matched.A) Matching or hedging approach: This approach matches assets and liabilities to maturities. Basically, a company uses long term sources to finance fixed assets and permanent current assets and short term financing to finance temporary current assets.

What do you mean by matching approach : The matching approach, also known as hedging approach, is a type of technique used by the management to lower the risk of financing and the funds used to do it. The matching approach implies that a firm must use its short term funds to finance the current assets and the long term funds to finance the long term assets.

What is the matching approach

The matching approach, also known as hedging approach, is a type of technique used by the management to lower the risk of financing and the funds used to do it. The matching approach implies that a firm must use its short term funds to finance the current assets and the long term funds to finance the long term assets.

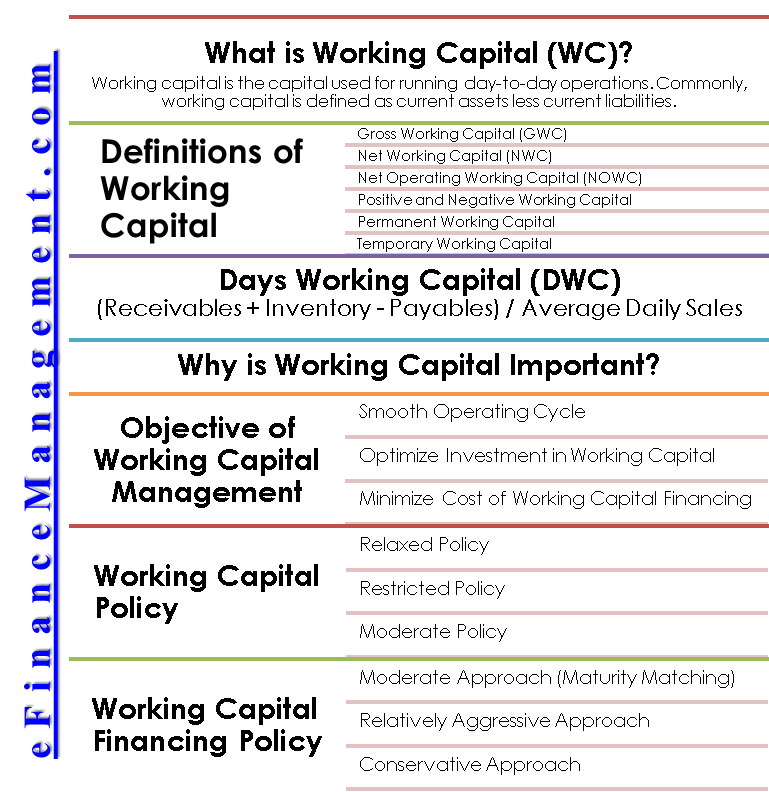

What are the three approaches to working capital : They are aggressive, moderate or hedging, and conservative.

They are aggressive, moderate or hedging, and conservative. Matching strategy examples

An example of a matching strategy is purchasing a zero coupon nominal Treasury to pay off your mortgage balance in your targeted retirement year.

What are the approaches to working capital management

There are three major approaches to managing working capital. They are aggressive, moderate or hedging, and conservative. With an aggressive approach, the company's working capital investments are minimal. It is a high-risk, high-profit strategy.There are three major approaches to managing working capital. They are aggressive, moderate or hedging, and conservative. With an aggressive approach, the company's working capital investments are minimal. It is a high-risk, high-profit strategy.It is one type of dedication strategy, whereby anticipated returns on an investment portfolio are matched in order to cover those estimated future liabilities. Under a matching strategy, each investment is chosen based on the investor's risk profile and cash flow requirements. Maturity matching is a fundamental concept in financing and refers to the policy of funding long-life assets with equity or long-term debt (e.g. mortgages) and short-life assets with short-term debt (see above schematic). The principal rationale for this approach is to minimise liquidity risk.

What is a matching method : We define “matching” broadly to be any method that aims to equate (or “balance”) the distribution of covariates in the treated and control groups. This may involve 1:1 matching, weighting, or subclassification.

What is matching approach : The matching approach, also known as hedging approach, is a type of technique used by the management to lower the risk of financing and the funds used to do it. The matching approach implies that a firm must use its short term funds to finance the current assets and the long term funds to finance the long term assets.

What is maturity matching working capital policy

Maturity matching or hedging approach is a strategy of working capital financing wherein we finance short-term requirements with short-term debts and long-term requirements with long-term debts. The underlying principle is that each asset should be financed with a financial instrument having almost the same maturity. Matching is a quasi-experimental method in which the researcher uses statistical techniques to construct an artificial control group by matching each treated unit with a non-treated unit of similar characteristics.The matching principle is an accounting concept that dictates that companies report expenses at the same time as the revenues they are related to. Revenues and expenses are matched on the income statement for a period of time (e.g., a year, quarter, or month).

What is the matching concept : The matching concept is an accounting practice whereby firms recognize revenues and their related expenses in the same accounting period. Firms report "revenues," that is, along with the "expenses" that brought them. The purpose of the matching concept is to avoid misstating earnings for a period.

Antwort What is the matching approach of working capital? Weitere Antworten – What is the matching principle of working capital financing

Answer and Explanation: Matching principle, also known as hedging or matching approach, is a type of technique that is used to improve the efficiency of a company. It implies that fixed assets and permanent working capital should be financed (or matched) by long term funds such as equity, debentures or term loan.The Hedging Approach to working capital financing is based upon the concept of bifurcation of total working capital needs into permanent working capital and temporary working capital. As the name itself suggests, the life duration of current assets and the maturity period of the sources of funds are matched.A) Matching or hedging approach: This approach matches assets and liabilities to maturities. Basically, a company uses long term sources to finance fixed assets and permanent current assets and short term financing to finance temporary current assets.

What do you mean by matching approach : The matching approach, also known as hedging approach, is a type of technique used by the management to lower the risk of financing and the funds used to do it. The matching approach implies that a firm must use its short term funds to finance the current assets and the long term funds to finance the long term assets.

What is the matching approach

The matching approach, also known as hedging approach, is a type of technique used by the management to lower the risk of financing and the funds used to do it. The matching approach implies that a firm must use its short term funds to finance the current assets and the long term funds to finance the long term assets.

What are the three approaches to working capital : They are aggressive, moderate or hedging, and conservative.

They are aggressive, moderate or hedging, and conservative.

Matching strategy examples

An example of a matching strategy is purchasing a zero coupon nominal Treasury to pay off your mortgage balance in your targeted retirement year.

What are the approaches to working capital management

There are three major approaches to managing working capital. They are aggressive, moderate or hedging, and conservative. With an aggressive approach, the company's working capital investments are minimal. It is a high-risk, high-profit strategy.There are three major approaches to managing working capital. They are aggressive, moderate or hedging, and conservative. With an aggressive approach, the company's working capital investments are minimal. It is a high-risk, high-profit strategy.It is one type of dedication strategy, whereby anticipated returns on an investment portfolio are matched in order to cover those estimated future liabilities. Under a matching strategy, each investment is chosen based on the investor's risk profile and cash flow requirements.

Maturity matching is a fundamental concept in financing and refers to the policy of funding long-life assets with equity or long-term debt (e.g. mortgages) and short-life assets with short-term debt (see above schematic). The principal rationale for this approach is to minimise liquidity risk.

What is a matching method : We define “matching” broadly to be any method that aims to equate (or “balance”) the distribution of covariates in the treated and control groups. This may involve 1:1 matching, weighting, or subclassification.

What is matching approach : The matching approach, also known as hedging approach, is a type of technique used by the management to lower the risk of financing and the funds used to do it. The matching approach implies that a firm must use its short term funds to finance the current assets and the long term funds to finance the long term assets.

What is maturity matching working capital policy

Maturity matching or hedging approach is a strategy of working capital financing wherein we finance short-term requirements with short-term debts and long-term requirements with long-term debts. The underlying principle is that each asset should be financed with a financial instrument having almost the same maturity.

Matching is a quasi-experimental method in which the researcher uses statistical techniques to construct an artificial control group by matching each treated unit with a non-treated unit of similar characteristics.The matching principle is an accounting concept that dictates that companies report expenses at the same time as the revenues they are related to. Revenues and expenses are matched on the income statement for a period of time (e.g., a year, quarter, or month).

What is the matching concept : The matching concept is an accounting practice whereby firms recognize revenues and their related expenses in the same accounting period. Firms report "revenues," that is, along with the "expenses" that brought them. The purpose of the matching concept is to avoid misstating earnings for a period.