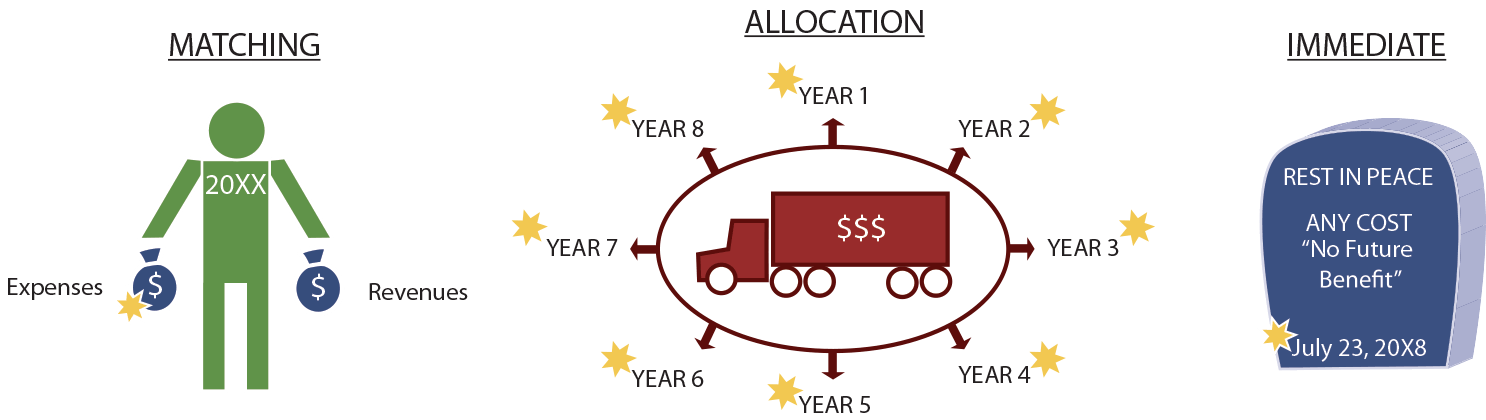

The matching principle links expenses to the related revenues, while the revenue recognition principle requires revenue to be recognized when it's earned. They ensure accurate financial reporting by recognizing revenue in the period it's earned and linking expenses to the revenues they generate.What is the Matching Principle The matching principle is an accounting concept that dictates that companies report expenses at the same time as the revenues they are related to. Revenues and expenses are matched on the income statement for a period of time (e.g., a year, quarter, or month).The matching principle is part of the Generally Accepted Accounting Principles (GAAP), based on the cause-and-effect relationship between spending and earning. It requires that any business expenses incurred must be recorded in the same period as related revenues.

What is the matching principle of depreciation : According to the matching principle, the purchase price of a fixed asset is not related to the accounting period because the benefit derived from its use will be spread over a number of years. Therefore, only depreciation related to the accounting period is considered for determination of profit.

What are the benefits of the matching principle

The benefits of the matching principle include gaining an accurate reflection of the financial position of a company's operations by ensuring costs are allocated to revenue that will be generated due to the cost.

Which statement best describes the matching principle : d. Revenue of the period is matched with expenses required to create those revenues. This is the correct option. Examples are the cost of goods sold, bad debts, and warranty expenses that are recorded in the same period as the related sales revenue is recorded.

The purpose of the matching principle is to maintain consistency across a business's income statements and balance sheets. Here's how it works: Expenses are recorded on the income statement in the same period that related revenues are earned. The expense recognition principle states that companies should recognize expenses at the same time as matching revenues. The expense recognition principle is a generally accepted accounting principle (GAAP) within the U.S., established by the Financial Accounting Standards Board (FASB).

What is the objective matching principle

Matching principle requires that the incurred expenses during the period should be recorded in the same period of its related revenues were earned.The matching principle is part of the Generally Accepted Accounting Principles (GAAP), based on the cause-and-effect relationship between spending and earning. It requires that any business expenses incurred must be recorded in the same period as related revenues.Overview of depreciation

Accumulated Historical Cost

The original or deemed cost of the asset plus additions, minus partial disposals.

Useful Life

The estimated period over which a depreciable asset is expected to be used, or the benefits represented by the asset are expected to be derived.

The main advantage of matching concept is that it allows matching revenue with the expenses to calculate the net profit but it have several disadvantages also the main disadvantage is that sometimes it is very difficult to estimate the actual profit received or benefits received and benefits likely to be received in …

What is the main objective of matching : The goal of matching is to reduce bias for the estimated treatment effect in an observational-data study, by finding, for every treated unit, one (or more) non-treated unit(s) with similar observable characteristics against which the covariates are balanced out.

What is the matching principle best demonstrated by : Answer and Explanation: The accounting principle of matching is best demonstrated by: b. Associating effort (expense) with accomplishment (revenue). The matching principle requires any expenses associated with revenue to be recorded in the same period.

What does the matching principle apply only to

applies only to situations in which a cash receipt occurs before revenue is recognized. Example of the revenue recognition principle

Once their tax return has been completed, you forward a copy of your invoice to your client, who has agreed to pay the bill within the next 30 days (net 30). You can recognize the revenue immediately, since the services have already been delivered.The core principle of IFRS 15 is that revenue is recognised when the goods or services are transferred to the customer, at the transaction price. Revenue is recognised in accordance with that core principle by applying a 5-step model as shown below.

What is the recognition principle in accounting : The revenue recognition principle, a key feature of accrual-basis accounting, dictates that companies recognize revenue as it is earned, not when they receive payment. Accurate revenue recognition is essential because it directly affects the integrity and consistency of a company's financial reporting.

Antwort What is the matching and recognition principle? Weitere Antworten – What is the difference between matching principle and recognition principle

The matching principle links expenses to the related revenues, while the revenue recognition principle requires revenue to be recognized when it's earned. They ensure accurate financial reporting by recognizing revenue in the period it's earned and linking expenses to the revenues they generate.What is the Matching Principle The matching principle is an accounting concept that dictates that companies report expenses at the same time as the revenues they are related to. Revenues and expenses are matched on the income statement for a period of time (e.g., a year, quarter, or month).The matching principle is part of the Generally Accepted Accounting Principles (GAAP), based on the cause-and-effect relationship between spending and earning. It requires that any business expenses incurred must be recorded in the same period as related revenues.

What is the matching principle of depreciation : According to the matching principle, the purchase price of a fixed asset is not related to the accounting period because the benefit derived from its use will be spread over a number of years. Therefore, only depreciation related to the accounting period is considered for determination of profit.

What are the benefits of the matching principle

The benefits of the matching principle include gaining an accurate reflection of the financial position of a company's operations by ensuring costs are allocated to revenue that will be generated due to the cost.

Which statement best describes the matching principle : d. Revenue of the period is matched with expenses required to create those revenues. This is the correct option. Examples are the cost of goods sold, bad debts, and warranty expenses that are recorded in the same period as the related sales revenue is recorded.

The purpose of the matching principle is to maintain consistency across a business's income statements and balance sheets. Here's how it works: Expenses are recorded on the income statement in the same period that related revenues are earned.

The expense recognition principle states that companies should recognize expenses at the same time as matching revenues. The expense recognition principle is a generally accepted accounting principle (GAAP) within the U.S., established by the Financial Accounting Standards Board (FASB).

What is the objective matching principle

Matching principle requires that the incurred expenses during the period should be recorded in the same period of its related revenues were earned.The matching principle is part of the Generally Accepted Accounting Principles (GAAP), based on the cause-and-effect relationship between spending and earning. It requires that any business expenses incurred must be recorded in the same period as related revenues.Overview of depreciation

The main advantage of matching concept is that it allows matching revenue with the expenses to calculate the net profit but it have several disadvantages also the main disadvantage is that sometimes it is very difficult to estimate the actual profit received or benefits received and benefits likely to be received in …

What is the main objective of matching : The goal of matching is to reduce bias for the estimated treatment effect in an observational-data study, by finding, for every treated unit, one (or more) non-treated unit(s) with similar observable characteristics against which the covariates are balanced out.

What is the matching principle best demonstrated by : Answer and Explanation: The accounting principle of matching is best demonstrated by: b. Associating effort (expense) with accomplishment (revenue). The matching principle requires any expenses associated with revenue to be recorded in the same period.

What does the matching principle apply only to

applies only to situations in which a cash receipt occurs before revenue is recognized.

Example of the revenue recognition principle

Once their tax return has been completed, you forward a copy of your invoice to your client, who has agreed to pay the bill within the next 30 days (net 30). You can recognize the revenue immediately, since the services have already been delivered.The core principle of IFRS 15 is that revenue is recognised when the goods or services are transferred to the customer, at the transaction price. Revenue is recognised in accordance with that core principle by applying a 5-step model as shown below.

What is the recognition principle in accounting : The revenue recognition principle, a key feature of accrual-basis accounting, dictates that companies recognize revenue as it is earned, not when they receive payment. Accurate revenue recognition is essential because it directly affects the integrity and consistency of a company's financial reporting.