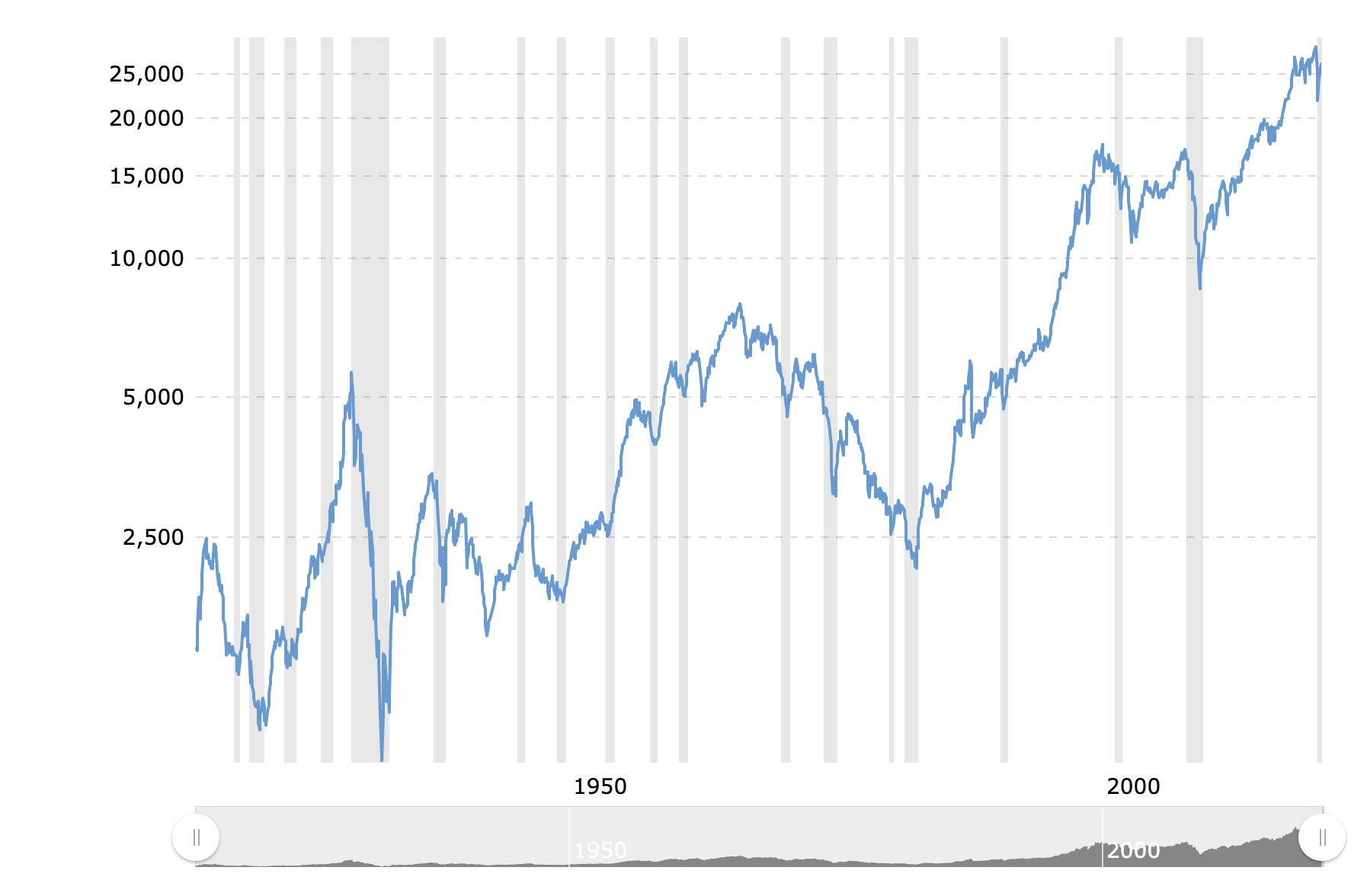

The company's best known indices are the S&P 500 and the Dow Jones Industrial Average (DJIA), which were created in 1957 and 1896, respectively. The company also manages the oldest index in use, the Dow Jones Transportation Index, created in 1882 by Charles Dow, the founder of The Wall Street Journal.The original Dow Jones Industrial Average was established for the first time in 1896. When the Dow was originally calculated, it contained just 12 companies, compared to the 30 big-names that are listed today.Index Components

CAT. Caterpillar Inc. $356.27. 1.58%

JPM. JPMorgan Chase & Co. $204.79. 1.15%

BA. Boeing Co. $184.95. 1.09%

WMT. Walmart Inc. $64.65. 1.00%

CVX. Chevron Corp. $162.67. 0.98%

DOW. Dow Inc. $59.19. 0.83%

GS. Goldman Sachs Group Inc. $467.72. 0.69%

UNH. UnitedHealth Group Inc. $524.63. 0.64%

What makes up the Dow Jones : The Dow Jones Industrial Average (DJIA) measures the daily price movements of 30 large American companies on the Nasdaq and the New York Stock Exchange. The components are chosen from all the major sectors of the economy, with the exception of the transportation and utility industries.

What are the top 3 US indices

United States Indices

Name

Last

High

Dow Jones

40,003.59

40,010.88

NYSE Composite

18,220.8

18,226.8

NYSE Market Composite

4,868.2

4,892.2

Nasdaq

16,685.97

16,726.41

What are the 2 main market indexes : The S&P 500 and Dow Jones Industrial Average are the top large-cap indexes. Notable mid-cap indexes include the S&P Mid-Cap 400, the Russell Midcap, and the Wilshire US Mid-Cap Index. In small-caps, the Russell 2000 is an index of the 2,000 smallest stocks from the Russell 3000.

The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization. The DJIA is a price-weighted index that measures the daily price fluctuations of the 30 prominent American companies listed on the Nasdaq and NYSE. A price-weighted index means that stocks with higher share prices carry more weight in the index.

What is the Dow Jones vs Nasdaq

The Dow does include stocks on both the NYSE as well as the Nasdaq, whereas any Nasdaq indexes will include only stocks listed on Nasdaq exchanges. Investors can gain exposure to both the Dow and the Nasdaq by investing in index funds that track the indexes. S&P Dow Jones Indices.Components of the Dow Jones

#

Company

Weight

1

Unitedhealth Group Inc

8.57587

2

Goldman Sachs Group Inc

7.642226

3

Microsoft Corp

6.926076

4

Caterpillar Inc

5.770003

There are several differences between how stocks are included in the Dow versus the S&P 500. The DJIA is a price-weighted index that is composed of 30 blue-chip companies. These constituents are added by a special Dow committee. The S&P 500, on the other hand, is weighted by market capitalization. Overview. Dow provides a diversified portfolio of specialty chemicals, advanced materials, agroscience and plastics products to customers in approximately 160 countries and in sectors such as electronics, water, energy, coatings and agriculture.

What are the top 4 indexes : Major Market Indexes

Market Index

Symbol

As Of:

NASDAQ Composite Index

COMP

5/17/2024 5:15 PM

NYSE Composite Index

NYA

5/17/2024 5:59 PM

S&P 500 Index

SPX

5/17/2024 5:21 PM

S&P MidCap 400

MID

5/17/2024 5:21 PM

Which US index is more important : "The Dow" actually refers to the Dow Jones Industrial Average (DJIA), an important index that many people follow in order to get an indication of how well the overall stock market is performing. The DJIA is not the same as Dow Jones and Company, a firm that is owned by News Corp.

What are the top 3 indexes

Most popular indexes: Standard and Poor's 500 (S&P 500) Dow Jones Industrial Average. Nasdaq Composite. The Dow Jones U.S. Total Stock Market Index, a member of the Dow Jones Total Stock Market Indices family, is designed to measure all U.S. equity issues with readily available prices.The S&P 500 is considered a better reflection of the market's performance across all sectors compared to the Nasdaq Composite and the Dow. The downside to having more sectors included in the index is that the S&P 500 tends to be more volatile than the Dow.

Is S and P 500 the same as total stock : Pretty much by definition, the S&P 500 is made up of large-cap companies. A total market index is mostly large-cap stocks, but by definition includes all the mid-cap and small-cap stocks as well.

Antwort What is the main Dow Jones index? Weitere Antworten – What are the three Dow Jones indices

The company's best known indices are the S&P 500 and the Dow Jones Industrial Average (DJIA), which were created in 1957 and 1896, respectively. The company also manages the oldest index in use, the Dow Jones Transportation Index, created in 1882 by Charles Dow, the founder of The Wall Street Journal.The original Dow Jones Industrial Average was established for the first time in 1896. When the Dow was originally calculated, it contained just 12 companies, compared to the 30 big-names that are listed today.Index Components

What makes up the Dow Jones : The Dow Jones Industrial Average (DJIA) measures the daily price movements of 30 large American companies on the Nasdaq and the New York Stock Exchange. The components are chosen from all the major sectors of the economy, with the exception of the transportation and utility industries.

What are the top 3 US indices

United States Indices

What are the 2 main market indexes : The S&P 500 and Dow Jones Industrial Average are the top large-cap indexes. Notable mid-cap indexes include the S&P Mid-Cap 400, the Russell Midcap, and the Wilshire US Mid-Cap Index. In small-caps, the Russell 2000 is an index of the 2,000 smallest stocks from the Russell 3000.

The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.

The DJIA is a price-weighted index that measures the daily price fluctuations of the 30 prominent American companies listed on the Nasdaq and NYSE. A price-weighted index means that stocks with higher share prices carry more weight in the index.

What is the Dow Jones vs Nasdaq

The Dow does include stocks on both the NYSE as well as the Nasdaq, whereas any Nasdaq indexes will include only stocks listed on Nasdaq exchanges. Investors can gain exposure to both the Dow and the Nasdaq by investing in index funds that track the indexes. S&P Dow Jones Indices.Components of the Dow Jones

There are several differences between how stocks are included in the Dow versus the S&P 500. The DJIA is a price-weighted index that is composed of 30 blue-chip companies. These constituents are added by a special Dow committee. The S&P 500, on the other hand, is weighted by market capitalization.

Overview. Dow provides a diversified portfolio of specialty chemicals, advanced materials, agroscience and plastics products to customers in approximately 160 countries and in sectors such as electronics, water, energy, coatings and agriculture.

What are the top 4 indexes : Major Market Indexes

Which US index is more important : "The Dow" actually refers to the Dow Jones Industrial Average (DJIA), an important index that many people follow in order to get an indication of how well the overall stock market is performing. The DJIA is not the same as Dow Jones and Company, a firm that is owned by News Corp.

What are the top 3 indexes

Most popular indexes: Standard and Poor's 500 (S&P 500) Dow Jones Industrial Average. Nasdaq Composite.

The Dow Jones U.S. Total Stock Market Index, a member of the Dow Jones Total Stock Market Indices family, is designed to measure all U.S. equity issues with readily available prices.The S&P 500 is considered a better reflection of the market's performance across all sectors compared to the Nasdaq Composite and the Dow. The downside to having more sectors included in the index is that the S&P 500 tends to be more volatile than the Dow.

Is S and P 500 the same as total stock : Pretty much by definition, the S&P 500 is made up of large-cap companies. A total market index is mostly large-cap stocks, but by definition includes all the mid-cap and small-cap stocks as well.