The table below lists the S&P 500's top sectors by weighting as of April 22, 2024. The information technology, financials, healthcare, and consumer discretionary sectors carry a cumulative weight of about 66%.S&P 500 ETF Components

#

Company

Symbol

1

Microsoft Corp

MSFT

2

Apple Inc.

AAPL

3

Nvidia Corp

NVDA

4

Amazon.com Inc

AMZN

Sector*

Microsoft Corp. Symbol. MSFT. Sector* Information Technology.

Apple Inc. Symbol. AAPL. Sector*

Nvidia Corp. Symbol. NVDA. Sector*

Amazon.com Inc. Symbol. AMZN. Sector*

Alphabet Inc A. Symbol. GOOGL. Sector*

Meta Platforms, Inc. Class A. Symbol. META.

Alphabet Inc C. Symbol. GOOG. Sector*

Berkshire Hathaway B. Symbol. BRK.B. Sector*

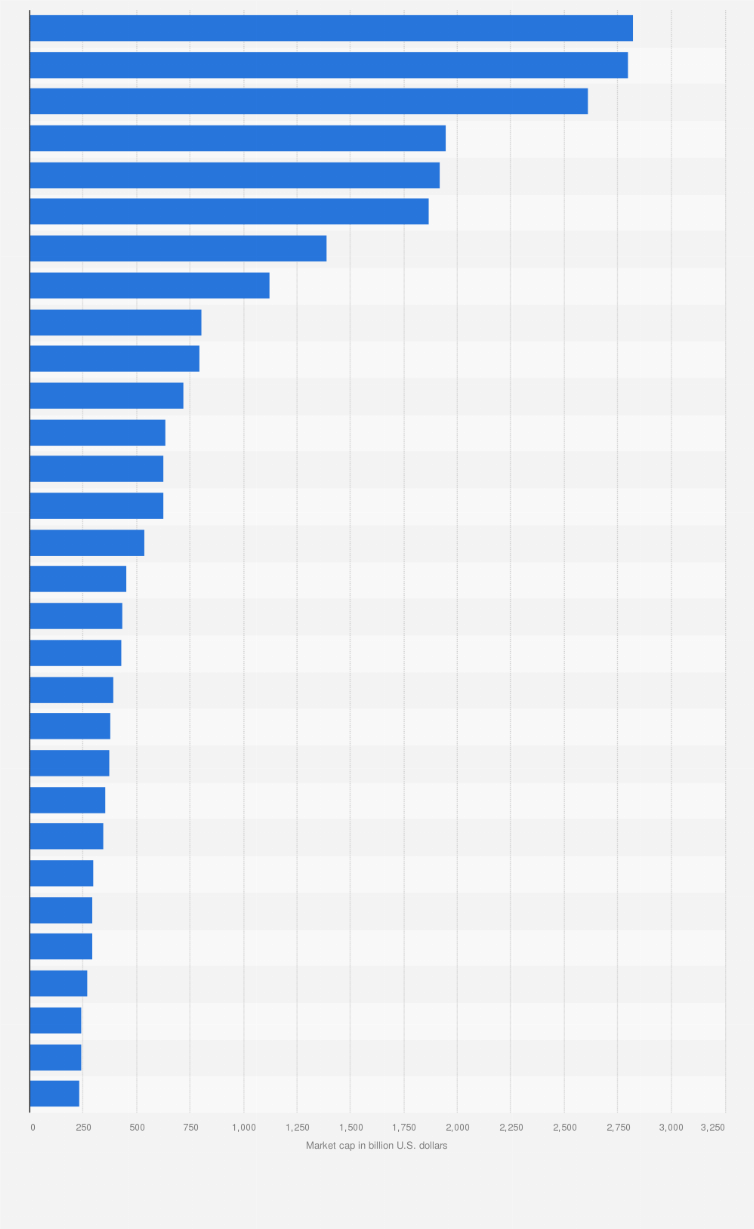

Which companies dominate S&P 500 : The seven megacap stocks — Microsoft (MSFT), Apple (AAPL), Nvidia (NVDA), Alphabet (GOOG), Amazon.com (AMZN), Meta (META) and Tesla (TSLA) — account for 29.7% of the S&P 500 as of April 17, says Datatrek Research. That's up from the group's 27.9% weight in the S&P 500 in 2023.

Which sector has the biggest market

Healthcare. The Indian healthcare sector is one of the largest sectors in terms of both revenue & employment.

What industry is S&P Global in : financial intelligence solutions

S&P Global Inc (SPGI) is a provider of financial intelligence solutions. It offers credit ratings, benchmarks, data, and digital and traditional financial research and analytical tools to the capital and commodity markets globally.

Other companies in the S&P 500's top 10 list include NVIDIA, Alphabet, Berkshire Hathaway, Meta (formerly Facebook), UnitedHealth, and Tesla.

Apple (AAPL) Index Weighting: 7.10% Market Cap: $2.75 trillion.

Microsoft (MSFT) Index Weighting: 6.51%

Amazon (AMZN) Index Weighting: 3.24%

NVIDIA (NVDA)

A Sector View

Sector

Percent of S&P 500 Index

Information Technology

27.48%

Health Care

14.58%

Consumer Discretionary

11.18%

Communication Services

10.90%

What are the sector weights of the S&P 500

Sector Breakdown

Information Technology. 29.2%

Financials. 13.1%

Health Care. 12.3%

Consumer Discretionary. 10.3%

Communication Services. 9.1%

Industrials. 8.8%

Consumer Staples.

Energy. 4.1%

All S&P 500 constituents must be American companies and they must have market caps of at least $14.6 billion. A company's stock must be "highly liquid" and have a public float of at least 10% of its shares outstanding.The mega-cap leaders dubbed the “Magnificent Seven” have outperformed the stock market for several years. However, 2023 was quite impressive for the seven tech-focused US companies—Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla. Here are the the top 10 biggest industries for billionaires in 2023:

#1. Finance & Investments. 372 billionaires | 14% of list.

#2. Manufacturing. 324 billionaires | 12% of list.

#3. Technology. 313 billionaires | 12% of list.

#4. Fashion & Retail.

#5. Food & Beverage.

#6. Healthcare.

#7. Real Estate.

#8. Diversified.

Which sector dominates the economy : In highly developed countries with a high income, the tertiary sector dominates the total output of the economy.

What industry is S&P 500 in : S&P 500 Sectors and the Market Cycle

Sector

Weight

Type

Information Technology

26.1%

Cyclical

Health Care

14.5%

Defensive

Financials

12.9%

Cyclical

Consumer Discretionary

9.9%

Cyclical

What are the industry sectors of sp500

Overview of the S&P sectors

Information Technology. The information technology – IT – sector consists of companies that develop or distribute technological items or services, and includes internet companies.

Health Care.

Financials.

Consumer Discretionary.

Communication Services.

Industrials.

Consumer Staples.

Energy.

Thanks to the surging popularity of its index funds, Vanguard is now the No. 1 owner of 330 stocks in the S&P 500, or two-thirds of the world's most important collection of stocks, says an Investor's Business Daily analysis of data from S&P Global Market Intelligence and MarketSmith.The best performing Sector in the last 10 years is Information Technology, that granded a +19.94% annualized return. The worst is Energy, with a +4.01% annualized return in the last 10 years. The main S&P 500 Sectors can be easily replicated by ETFs.

Who are the largest shareholders of spy : Top Investors

Largest shareholders include Jane Street Group, Llc, 1832 Asset Management L.P., Optiver Holding B.V., Optiver Holding B.V., Citadel Advisors Llc, IMC-Chicago, LLC, Jpmorgan Chase & Co, Simplex Trading, Llc, Belvedere Trading LLC, and Jane Street Group, Llc . PNC FINANCIAL SERVICES GROUP, INC.

Antwort What is the largest industry in the S&P 500? Weitere Antworten – What are the largest sectors in the S&P 500

Top Sectors in the S&P 500

The table below lists the S&P 500's top sectors by weighting as of April 22, 2024. The information technology, financials, healthcare, and consumer discretionary sectors carry a cumulative weight of about 66%.S&P 500 ETF Components

Sector*

Which companies dominate S&P 500 : The seven megacap stocks — Microsoft (MSFT), Apple (AAPL), Nvidia (NVDA), Alphabet (GOOG), Amazon.com (AMZN), Meta (META) and Tesla (TSLA) — account for 29.7% of the S&P 500 as of April 17, says Datatrek Research. That's up from the group's 27.9% weight in the S&P 500 in 2023.

Which sector has the biggest market

Healthcare. The Indian healthcare sector is one of the largest sectors in terms of both revenue & employment.

What industry is S&P Global in : financial intelligence solutions

S&P Global Inc (SPGI) is a provider of financial intelligence solutions. It offers credit ratings, benchmarks, data, and digital and traditional financial research and analytical tools to the capital and commodity markets globally.

Other companies in the S&P 500's top 10 list include NVIDIA, Alphabet, Berkshire Hathaway, Meta (formerly Facebook), UnitedHealth, and Tesla.

A Sector View

What are the sector weights of the S&P 500

Sector Breakdown

All S&P 500 constituents must be American companies and they must have market caps of at least $14.6 billion. A company's stock must be "highly liquid" and have a public float of at least 10% of its shares outstanding.The mega-cap leaders dubbed the “Magnificent Seven” have outperformed the stock market for several years. However, 2023 was quite impressive for the seven tech-focused US companies—Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla.

Here are the the top 10 biggest industries for billionaires in 2023:

Which sector dominates the economy : In highly developed countries with a high income, the tertiary sector dominates the total output of the economy.

What industry is S&P 500 in : S&P 500 Sectors and the Market Cycle

What are the industry sectors of sp500

Overview of the S&P sectors

Thanks to the surging popularity of its index funds, Vanguard is now the No. 1 owner of 330 stocks in the S&P 500, or two-thirds of the world's most important collection of stocks, says an Investor's Business Daily analysis of data from S&P Global Market Intelligence and MarketSmith.The best performing Sector in the last 10 years is Information Technology, that granded a +19.94% annualized return. The worst is Energy, with a +4.01% annualized return in the last 10 years. The main S&P 500 Sectors can be easily replicated by ETFs.

Who are the largest shareholders of spy : Top Investors

Largest shareholders include Jane Street Group, Llc, 1832 Asset Management L.P., Optiver Holding B.V., Optiver Holding B.V., Citadel Advisors Llc, IMC-Chicago, LLC, Jpmorgan Chase & Co, Simplex Trading, Llc, Belvedere Trading LLC, and Jane Street Group, Llc . PNC FINANCIAL SERVICES GROUP, INC.