The FTSE Developed Europe index tracks large and mid cap stocks from developed countries in Europe. The MSCI Europe index tracks the leading stocks from 15 European industrial countries. The STOXX® Europe 600 index tracks the 600 largest European companies.Amundi Prime All Country World UCITS ETF

Amundi has launched the cheapest All Country World ETF in Europe, with a total expense ratio of 0.07%. Listed on Xetra, the Amundi Prime All Country World UCITS ETF (WEBG) offers diversified exposure to developed and emerging markets.The iShares line combines foreign and domestic to varying degrees. Some of the funds have a lot of domestic, while others emphasize foreign. The WisdomTree line is all foreign. By virtue of its dividend weighting, most of its funds tend to skew to certain countries such as the UK and Australia.

What is the largest index in Europe : Largest stock indices in Europe

Among the various pan-European indices, the Stoxx Europe 600 has the broadest diversification. It includes 600 stocks, representing large, mid, and small-capitalization companies from 17 European countries.

Which European index Fund is best

Here are the best Europe Stock funds

SPDR® Portfolio Europe ETF.

Xtrackers MSCI Europe Hedged Equity ETF.

iShares MSCI Europe Small-Cap ETF.

JPMorgan BetaBuilders Europe ETF.

iShares Core MSCI Europe ETF.

Vanguard FTSE Europe ETF.

WisdomTree Europe SmallCap Dividend ETF.

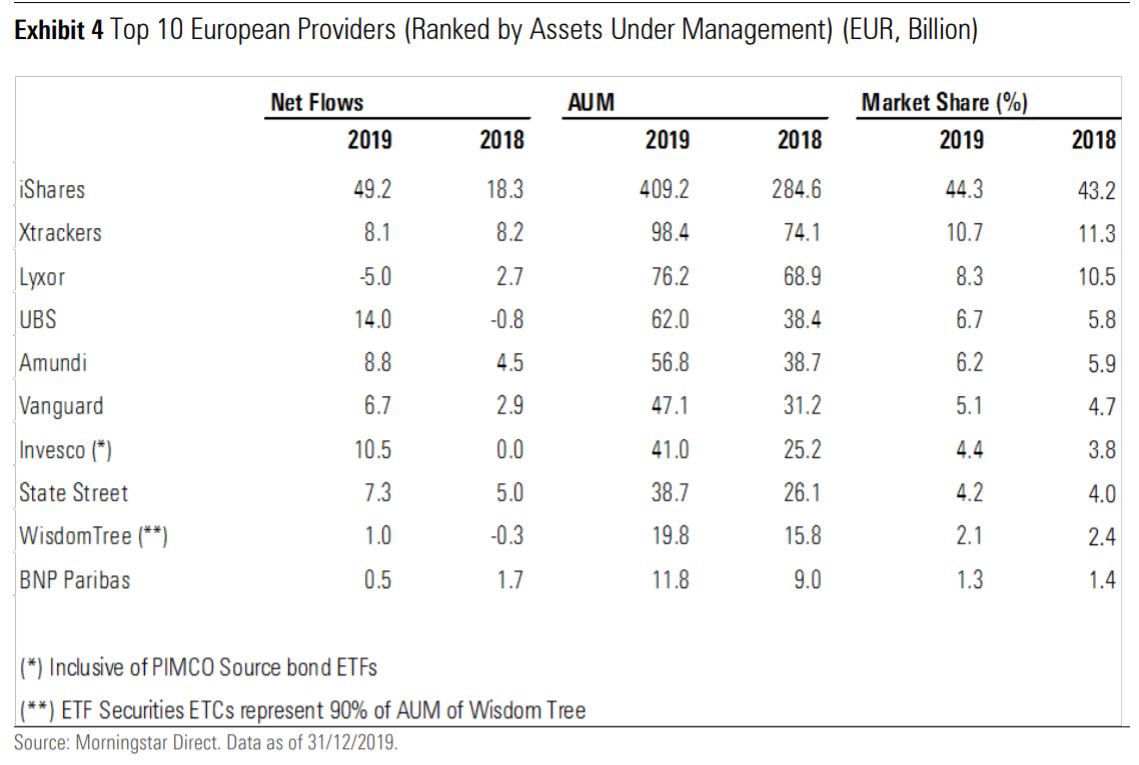

What is the largest ETF in Europe : The largest ETF promoter in Europe—iShares (€709.4 bn)—accounted for 45.37% of the overall assets under management, far ahead of the number-two promoter—Amundi ETF (€207.4 bn)—and the number-three promoter—Xtrackers (€162.3 bn).

Here are the best Europe Stock funds

SPDR® Portfolio Europe ETF.

Xtrackers MSCI Europe Hedged Equity ETF.

iShares MSCI Europe Small-Cap ETF.

JPMorgan BetaBuilders Europe ETF.

iShares Core MSCI Europe ETF.

Vanguard FTSE Europe ETF.

WisdomTree Europe SmallCap Dividend ETF.

While both funds pay semiannual distributions, Vanguard's VSO ETF attracts a notably lower management fee compared with iShares' ISO, at 0.30% per annum versus 0.55% per annum. In addition, it has also outperformed its smaller rival since inception, as well as over three and five-year timeframes.

Is iShares owned by BlackRock

As part of BlackRock, iShares ETFs offer investors everywhere access to high quality, high value investment opportunities.The Stoxx 600

The Stoxx 600 seeks to offer broader exposure to European companies. Thus, it's often cited as a close European alternative to Standard & Poor's 500 Index (S&P 500). The S&P 500 is a broadly diversified index consisting of the 500 largest companies in the US.Largest ETFs: Top 100 ETFs By Assets

Symbol

Name

AUM

SPY

SPDR S&P 500 ETF Trust

$524,809,000.00

IVV

iShares Core S&P 500 ETF

$462,306,000.00

VOO

Vanguard S&P 500 ETF

$454,109,000.00

VTI

Vanguard Total Stock Market ETF

$398,371,000.00

Vanguard is the world's second-largest investment company or brokerage firm, offering a range of active and passive options, as well as a competitive fee structure and other attractive selling points. BlackRock, Inc. is the world's largest investment firm and asset manager.

What is the number 1 ETF to buy : Top U.S. market-cap index ETFs

Fund (ticker)

YTD performance

Expense ratio

Vanguard S&P 500 ETF (VOO)

7.7 percent

0.03 percent

SPDR S&P 500 ETF Trust (SPY)

7.6 percent

0.095 percent

iShares Core S&P 500 ETF (IVV)

7.7 percent

0.03 percent

Invesco QQQ Trust (QQQ)

5.8 percent

0.20 percent

Are iShares good or bad : Ultimately, Blackrock's iShares ETF offerings are so comprehensive and well-regarded that most investors should be able to find a fund that suits their goals. To learn more about our rating and review methodology and editorial process, check out our guide on how Forbes Advisor rates investing products.

Which is better, BlackRock or blackstone

You may want to consider BlackRock if you're looking for a more traditional investment firm. The Blackstone Group caters mostly to high-net-worth individuals and exclusively manages alternative assets. If you require a more exclusive approach to investing, this could be a good fit.

The best S&P 500 ETF by 1-year fund return as of 30.04.24

1

BNP Paribas Easy S&P 500 UCITS ETF EUR

+27.10%

2

Amundi S&P 500 II UCITS ETF Acc

+26.52%

3

Amundi S&P 500 II UCITS ETF EUR Dist

+26.52%

As an investor, we cannot invest directly in the S&P500 index. Instead, the easiest way to invest in the S&P500 index is through investing in the S&P500 Exchange-Traded Funds (ETFs). An ETF is an instrument that mirrors the performance of an underlying index. Similar to stocks, ETFs are also traded in the stock market.

What is the #1 ETF : Top U.S. market-cap index ETFs

Antwort What is the largest European ETF? Weitere Antworten – What is the difference between MSCI Europe and FTSE Developed Europe

The FTSE Developed Europe index tracks large and mid cap stocks from developed countries in Europe. The MSCI Europe index tracks the leading stocks from 15 European industrial countries. The STOXX® Europe 600 index tracks the 600 largest European companies.Amundi Prime All Country World UCITS ETF

Amundi has launched the cheapest All Country World ETF in Europe, with a total expense ratio of 0.07%. Listed on Xetra, the Amundi Prime All Country World UCITS ETF (WEBG) offers diversified exposure to developed and emerging markets.The iShares line combines foreign and domestic to varying degrees. Some of the funds have a lot of domestic, while others emphasize foreign. The WisdomTree line is all foreign. By virtue of its dividend weighting, most of its funds tend to skew to certain countries such as the UK and Australia.

What is the largest index in Europe : Largest stock indices in Europe

Among the various pan-European indices, the Stoxx Europe 600 has the broadest diversification. It includes 600 stocks, representing large, mid, and small-capitalization companies from 17 European countries.

Which European index Fund is best

Here are the best Europe Stock funds

What is the largest ETF in Europe : The largest ETF promoter in Europe—iShares (€709.4 bn)—accounted for 45.37% of the overall assets under management, far ahead of the number-two promoter—Amundi ETF (€207.4 bn)—and the number-three promoter—Xtrackers (€162.3 bn).

Here are the best Europe Stock funds

While both funds pay semiannual distributions, Vanguard's VSO ETF attracts a notably lower management fee compared with iShares' ISO, at 0.30% per annum versus 0.55% per annum. In addition, it has also outperformed its smaller rival since inception, as well as over three and five-year timeframes.

Is iShares owned by BlackRock

As part of BlackRock, iShares ETFs offer investors everywhere access to high quality, high value investment opportunities.The Stoxx 600

The Stoxx 600 seeks to offer broader exposure to European companies. Thus, it's often cited as a close European alternative to Standard & Poor's 500 Index (S&P 500). The S&P 500 is a broadly diversified index consisting of the 500 largest companies in the US.Largest ETFs: Top 100 ETFs By Assets

Vanguard is the world's second-largest investment company or brokerage firm, offering a range of active and passive options, as well as a competitive fee structure and other attractive selling points. BlackRock, Inc. is the world's largest investment firm and asset manager.

What is the number 1 ETF to buy : Top U.S. market-cap index ETFs

Are iShares good or bad : Ultimately, Blackrock's iShares ETF offerings are so comprehensive and well-regarded that most investors should be able to find a fund that suits their goals. To learn more about our rating and review methodology and editorial process, check out our guide on how Forbes Advisor rates investing products.

Which is better, BlackRock or blackstone

You may want to consider BlackRock if you're looking for a more traditional investment firm. The Blackstone Group caters mostly to high-net-worth individuals and exclusively manages alternative assets. If you require a more exclusive approach to investing, this could be a good fit.

The best S&P 500 ETF by 1-year fund return as of 30.04.24

As an investor, we cannot invest directly in the S&P500 index. Instead, the easiest way to invest in the S&P500 index is through investing in the S&P500 Exchange-Traded Funds (ETFs). An ETF is an instrument that mirrors the performance of an underlying index. Similar to stocks, ETFs are also traded in the stock market.

What is the #1 ETF : Top U.S. market-cap index ETFs