The S&P 500 Index (Standard & Poor's 500 Index) is a market-capitalization-weighted index of the 500 leading publicly traded companies in the U.S.Standard & Poor’s 500 Index

What Is the S&P 500 Index The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

What does s & p stand for : Standard & Poor’s

Standard & Poor's (S&P) is a company well known around the world as a creator of financial market indices—widely used as investment benchmarks—a data source, and an issuer of credit ratings for companies and debt obligations. It's perhaps best-known for the popular and often-cited S&P 500 Index.

What is an S and P 500 index fund

An S&P 500 index fund is a fund that tracks the S&P 500 — a market index that measures the performance of about 500 U.S. companies. Index funds by definition aim to mirror a particular market index, whether that is the Dow Jones Industrial Average, the Nasdaq Composite Index or the S&P 500.

Is spx500 same as S&P 500 : Bottom Line. SPX is a symbol referring to the S&P 500 index, which consists of the largest 500 publicly traded companies, as measured by market capitalization. Investors can't directly invest in SPX, but they can invest in ETFs or index funds that are designed to track the performance of the index.

The S&P 500's value is calculated based on the market cap of each company, which is equal to the share price of the company multiplied by the total number of shares outstanding. The share count is adjusted to consider only the shares available to be traded in the open markets. The P/E ratio can be described as the ratio between current share price and per-share earnings. Earnings in the S&P 500 are calculated using the 12-month earnings per share or “current” earnings. A higher P/E ratio suggests that investors expect higher earnings growth in the future.

Is S&P Global the same as S&P 500

In terms of sector diversification, the S&P Global 100 Index has a broader sector mix than that of the S&P 500. The top 10 holdings span across not just I.T. but also Consumer Discretionary, Energy, Health Care, Consumer Staples, and Financials, as of 30 June 2022.The price of the S&P 500 index that you see quoted – for example, 4,301.56 – is measured in points, not dollars. That's the weighted average value of all the index's components. As the component stocks move up or down, the index rises or falls according to the calculation.The S&P 500 isn't a company itself, but rather a list of companies — otherwise known as an index. So while you can't buy S&P 500 stock, you can buy shares in an index that tracks the S&P 500. Top S&P 500 index funds in 2024

Fund (ticker)

5-year annual returns

Expense ratio

SPDR S&P 500 ETF Trust (SPY)

14.5%

0.095%

iShares Core S&P 500 ETF (IVV)

14.5%

0.03%

Schwab S&P 500 Index (SWPPX)

14.5%

0.02%

Vanguard 500 Index Fund (VFIAX)

14.5%

0.04%

Why is it called standard and poor : S&P Global (formerly Standard & Poor's), which sponsors a number of other market indexes—and also operates one of the “Big Three” credit rating agencies—traces its roots to an investment information service begun in 1860 by Henry Varnum Poor. In 1941, Poor's original company, Poor's Publishing, merged with Standard…

What is the S&P 500 index fund symbol : The S&P 500 index, or Standard & Poor's 500, is a very important index that tracks the performance of the stocks of 500 large-cap companies in the U.S. The ticker symbol for the S&P 500 index is ^GSPC. The series of letters represents the performance of the 500 stocks listed on the S&P.

What is the S&P 500 in simple terms

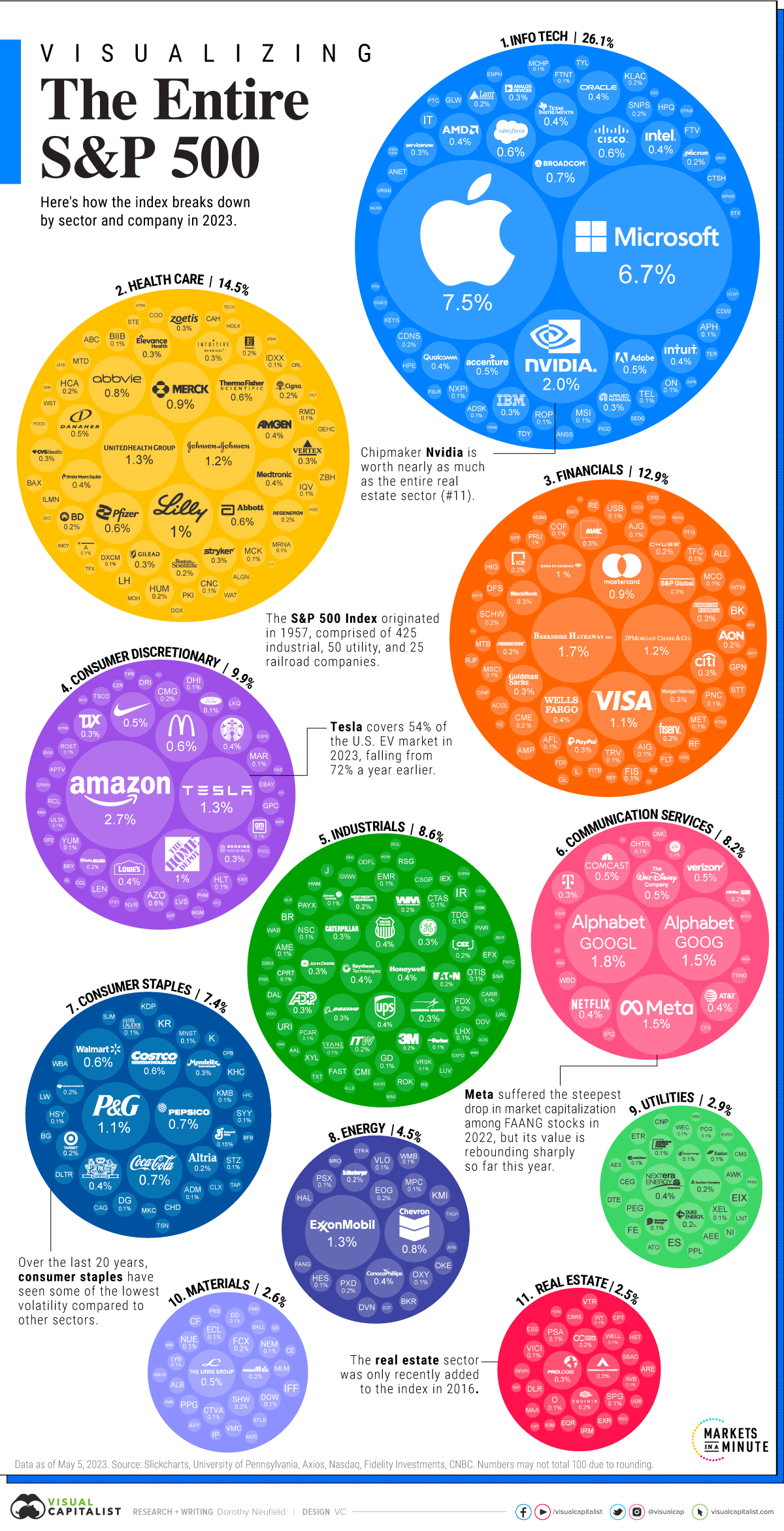

The S&P 500 is a stock market index that measures the performance of about 500 companies in the U.S. It includes companies across 11 sectors to offer a picture of the health of the U.S. stock market and the broader economy. S&P 500 P/E Ratio Forward Estimate is at a current level of 20.68, down from 21.37 last quarter and down from 23.84 one year ago. This is a change of -3.20% from last quarter and -13.24% from one year ago.PE Ratio (TTM) for the S&P 500 was 27.559 as of 2024-05-17, according to GuruFocus. Historically, PE Ratio (TTM) for the S&P 500 reached a record high of 131.391 and a record low of 5.31, the median value is 17.895. Typical value range is from 19.94 to 28.12.

Is spgi better than spy : SPY – Performance Comparison. In the year-to-date period, SPGI achieves a -1.83% return, which is significantly lower than SPY's 9.92% return. Over the past 10 years, SPGI has outperformed SPY with an annualized return of 19.79%, while SPY has yielded a comparatively lower 12.64% annualized return.

Antwort What is the full form of the S&P 500 index? Weitere Antworten – What is the full form of S&P 500

The S&P 500 Index (Standard & Poor's 500 Index) is a market-capitalization-weighted index of the 500 leading publicly traded companies in the U.S.Standard & Poor’s 500 Index

What Is the S&P 500 Index The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.

What does s & p stand for : Standard & Poor’s

Standard & Poor's (S&P) is a company well known around the world as a creator of financial market indices—widely used as investment benchmarks—a data source, and an issuer of credit ratings for companies and debt obligations. It's perhaps best-known for the popular and often-cited S&P 500 Index.

What is an S and P 500 index fund

An S&P 500 index fund is a fund that tracks the S&P 500 — a market index that measures the performance of about 500 U.S. companies. Index funds by definition aim to mirror a particular market index, whether that is the Dow Jones Industrial Average, the Nasdaq Composite Index or the S&P 500.

Is spx500 same as S&P 500 : Bottom Line. SPX is a symbol referring to the S&P 500 index, which consists of the largest 500 publicly traded companies, as measured by market capitalization. Investors can't directly invest in SPX, but they can invest in ETFs or index funds that are designed to track the performance of the index.

The S&P 500's value is calculated based on the market cap of each company, which is equal to the share price of the company multiplied by the total number of shares outstanding. The share count is adjusted to consider only the shares available to be traded in the open markets.

The P/E ratio can be described as the ratio between current share price and per-share earnings. Earnings in the S&P 500 are calculated using the 12-month earnings per share or “current” earnings. A higher P/E ratio suggests that investors expect higher earnings growth in the future.

Is S&P Global the same as S&P 500

In terms of sector diversification, the S&P Global 100 Index has a broader sector mix than that of the S&P 500. The top 10 holdings span across not just I.T. but also Consumer Discretionary, Energy, Health Care, Consumer Staples, and Financials, as of 30 June 2022.The price of the S&P 500 index that you see quoted – for example, 4,301.56 – is measured in points, not dollars. That's the weighted average value of all the index's components. As the component stocks move up or down, the index rises or falls according to the calculation.The S&P 500 isn't a company itself, but rather a list of companies — otherwise known as an index. So while you can't buy S&P 500 stock, you can buy shares in an index that tracks the S&P 500.

Top S&P 500 index funds in 2024

Why is it called standard and poor : S&P Global (formerly Standard & Poor's), which sponsors a number of other market indexes—and also operates one of the “Big Three” credit rating agencies—traces its roots to an investment information service begun in 1860 by Henry Varnum Poor. In 1941, Poor's original company, Poor's Publishing, merged with Standard…

What is the S&P 500 index fund symbol : The S&P 500 index, or Standard & Poor's 500, is a very important index that tracks the performance of the stocks of 500 large-cap companies in the U.S. The ticker symbol for the S&P 500 index is ^GSPC. The series of letters represents the performance of the 500 stocks listed on the S&P.

What is the S&P 500 in simple terms

The S&P 500 is a stock market index that measures the performance of about 500 companies in the U.S. It includes companies across 11 sectors to offer a picture of the health of the U.S. stock market and the broader economy.

S&P 500 P/E Ratio Forward Estimate is at a current level of 20.68, down from 21.37 last quarter and down from 23.84 one year ago. This is a change of -3.20% from last quarter and -13.24% from one year ago.PE Ratio (TTM) for the S&P 500 was 27.559 as of 2024-05-17, according to GuruFocus. Historically, PE Ratio (TTM) for the S&P 500 reached a record high of 131.391 and a record low of 5.31, the median value is 17.895. Typical value range is from 19.94 to 28.12.

Is spgi better than spy : SPY – Performance Comparison. In the year-to-date period, SPGI achieves a -1.83% return, which is significantly lower than SPY's 9.92% return. Over the past 10 years, SPGI has outperformed SPY with an annualized return of 19.79%, while SPY has yielded a comparatively lower 12.64% annualized return.