The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.If you want to capture gains of a broad swath of the market, then the S&P 500 is your best bet. However, if you are interested in a safe strategy that mirrors price movements of well-established blue-chip stocks, then the Dow is a good choice.In terms of index construction, both The Dow and the S&P 500 track large-cap U.S. stocks. The Dow's components are large and well-known companies that are often described as blue chips. The S&P 500 tracks top companies in leading industries in the large-cap segment of the market as well.

Is there an overlap between the S&P 500 and the Nasdaq : The S&P500 and the NASDAQ are both indices of stocks and there's a lot of overlap between the 2. Many of the top 10 stocks are the same, so if you're invested in both, you may not be as diversified as you think.

Are all Nasdaq 100 companies in the S&P 500

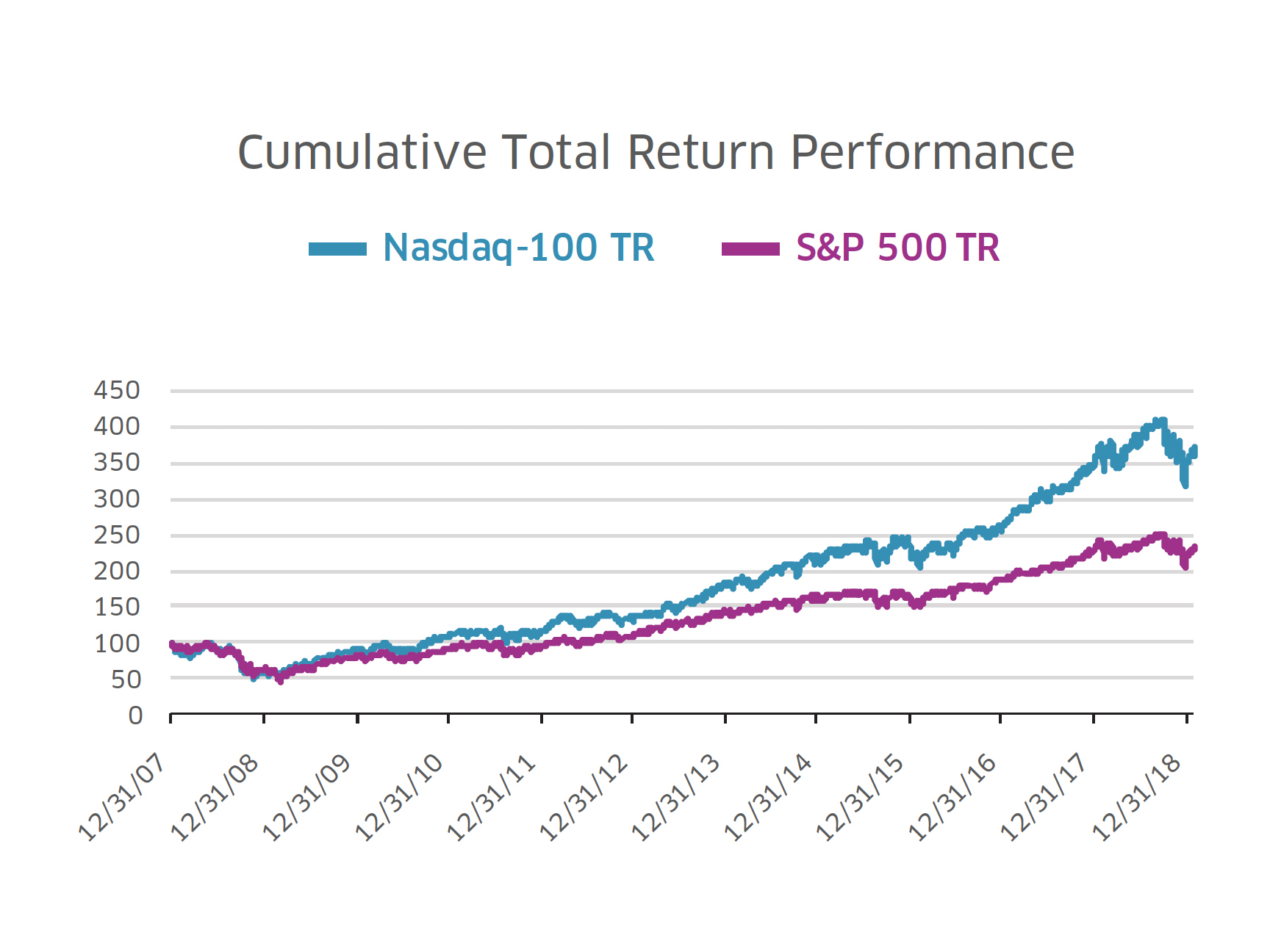

The Nasdaq-100 is quite different than the S&P 500

But all of the largest companies in the Nasdaq-100 are also included in the S&P 500 index, including Apple, Microsoft, Amazon, Alphabet, Facebook, and (now) Tesla.

What does S&P 500 stand for : Standard & Poor’s 500 Index

The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

The S&P 500 is generally considered one of the most reliable indicators of the overall health and direction of the US stock market. Investors and analysts use the S&P 500 as a benchmark to gauge the performance of their investment portfolios, as well as the general state of the US economy. A better bet would be to buy an ETF that is focused on generating dividend income. A good option is Schwab U.S. Dividend Equity ETF, which offers a yield that's nearly three times the size of what you'd collect from an S&P 500 tracking ETF.

What is the S and P 500 market called

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.The index is maintained by S&P Dow Jones Indices, an entity majority-owned by S&P Global. Its components are selected by a committee.The Dow®, S&P 500®, and Nasdaq are examples of stock market indices. A stock market index measures the performance of a collection of stocks. Yes, but only if you are referring to the NASDAQ 100 or any index that tracks the Nasdaq or some portion of it. The NASDAQ is a stock exchange where companies can be listed. The S&P 500 is an index that tracks 500 of the largest publicly listed companies.

Are companies in the Dow also in the S&P 500 : The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).

Can a company be in both the S&P 500 and the Nasdaq : Because nearly half of the exchange by weight is made up of tech companies, the Nasdaq is widely considered a better gauge for the technology industry. Some of these companies may also be included on the Dow, the S&P 500, or both.

What is the s&p500 PE

The S&P 500 PE Ratio is the price to earnings ratio of the constituents of the S&P 500. The S&P 500 includes the 500 largest companies in the United States and can be viewed as a gauge for how the United States stock market is performing. The Dow Jones Industrial Average

What Is the Meaning of Dow in the Stock Market The Dow Jones Industrial Average, or the Dow for short, is one way of measuring the stock market's overall direction. It includes the prices of 30 of the most actively traded stocks. When the Dow goes up, it is considered bullish, and most stocks usually do well.Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

Why doesn’t everyone invest in the S&P 500 : The S&P 500 is a market cap-weighted index that tends to lean towards large US growth stocks. Significant research has found that small and value companies outperform large growth stocks over the long term. Therefore, you are overweighting one area of the market which has had lower returns over the long term.

Antwort What is the Dow vs Nasdaq vs S&P 500? Weitere Antworten – What is the Dow vs S&P 500 vs Nasdaq

The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.If you want to capture gains of a broad swath of the market, then the S&P 500 is your best bet. However, if you are interested in a safe strategy that mirrors price movements of well-established blue-chip stocks, then the Dow is a good choice.In terms of index construction, both The Dow and the S&P 500 track large-cap U.S. stocks. The Dow's components are large and well-known companies that are often described as blue chips. The S&P 500 tracks top companies in leading industries in the large-cap segment of the market as well.

Is there an overlap between the S&P 500 and the Nasdaq : The S&P500 and the NASDAQ are both indices of stocks and there's a lot of overlap between the 2. Many of the top 10 stocks are the same, so if you're invested in both, you may not be as diversified as you think.

Are all Nasdaq 100 companies in the S&P 500

The Nasdaq-100 is quite different than the S&P 500

But all of the largest companies in the Nasdaq-100 are also included in the S&P 500 index, including Apple, Microsoft, Amazon, Alphabet, Facebook, and (now) Tesla.

What does S&P 500 stand for : Standard & Poor’s 500 Index

The S&P 500 Index, or Standard & Poor's 500 Index, is a market-capitalization-weighted index of 500 leading publicly traded companies in the U.S.

The S&P 500 is generally considered one of the most reliable indicators of the overall health and direction of the US stock market. Investors and analysts use the S&P 500 as a benchmark to gauge the performance of their investment portfolios, as well as the general state of the US economy.

A better bet would be to buy an ETF that is focused on generating dividend income. A good option is Schwab U.S. Dividend Equity ETF, which offers a yield that's nearly three times the size of what you'd collect from an S&P 500 tracking ETF.

What is the S and P 500 market called

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States.The index is maintained by S&P Dow Jones Indices, an entity majority-owned by S&P Global. Its components are selected by a committee.The Dow®, S&P 500®, and Nasdaq are examples of stock market indices. A stock market index measures the performance of a collection of stocks.

:max_bytes(150000):strip_icc()/GettyImages-496030068-29ec863cca36413ab111277d250fe964.jpg)

Yes, but only if you are referring to the NASDAQ 100 or any index that tracks the Nasdaq or some portion of it. The NASDAQ is a stock exchange where companies can be listed. The S&P 500 is an index that tracks 500 of the largest publicly listed companies.

Are companies in the Dow also in the S&P 500 : The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).

Can a company be in both the S&P 500 and the Nasdaq : Because nearly half of the exchange by weight is made up of tech companies, the Nasdaq is widely considered a better gauge for the technology industry. Some of these companies may also be included on the Dow, the S&P 500, or both.

What is the s&p500 PE

The S&P 500 PE Ratio is the price to earnings ratio of the constituents of the S&P 500. The S&P 500 includes the 500 largest companies in the United States and can be viewed as a gauge for how the United States stock market is performing.

The Dow Jones Industrial Average

What Is the Meaning of Dow in the Stock Market The Dow Jones Industrial Average, or the Dow for short, is one way of measuring the stock market's overall direction. It includes the prices of 30 of the most actively traded stocks. When the Dow goes up, it is considered bullish, and most stocks usually do well.Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

Why doesn’t everyone invest in the S&P 500 : The S&P 500 is a market cap-weighted index that tends to lean towards large US growth stocks. Significant research has found that small and value companies outperform large growth stocks over the long term. Therefore, you are overweighting one area of the market which has had lower returns over the long term.