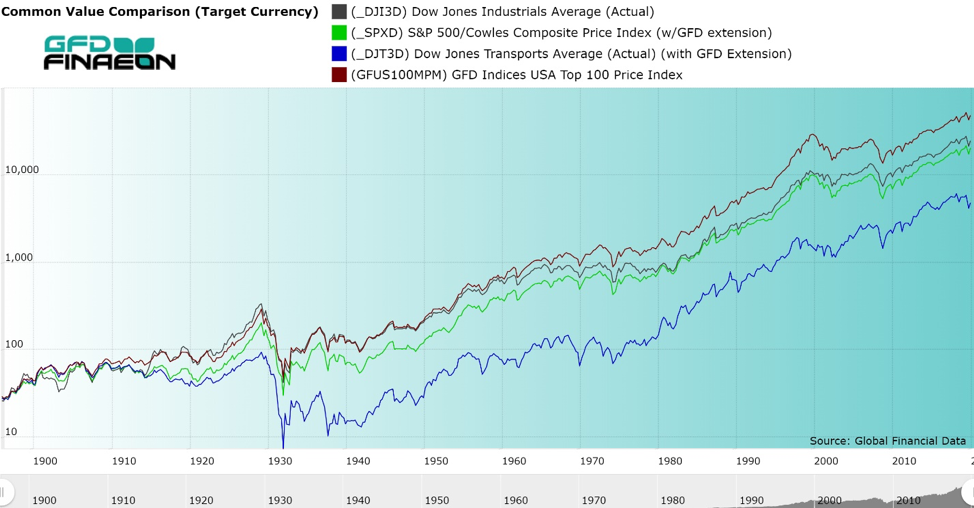

HOW DIFFERENT ARE THE DOW AND THE S&P 500 Their performances have historically tracked relatively closely with each other, but the S&P 500 has been better recently. Its 27.5% rise for the last 12 months easily tops the 19.7% gain for the Dow.The Dow, for example, has higher weightings in financials, healthcare, consumer discretionary, and industrials than the S&P 500 and Nasdaq Composite, but lower weightings in high-growth sectors like tech and communications (with the latter including Alphabet, Meta Platforms, Netflix, and other growth stocks).A key difference between The Dow and the S&P 500 is the method used to weight the constituent stocks of each index. The Dow is price-weighted. This means that price changes in the highest-priced stocks have greater impact on the index level than price changes in the lower-priced stocks.

What is one advantage the S&P 500 has in comparison to the Dow Jones Industrial Average DJIA ) : The S&P500 is considered less volatile than the DJIA.

Why is S&P 500 better than DJIA

Because the S&P 500 contains hundreds of large companies and represents the lion's share of total stock market value, it is considered a much better gauge of how the market is performing, even though it excludes thousands of smaller and midsize companies.

Should I invest in Dow Nasdaq or S&P 500 : So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.

The Nasdaq-100 is heavily allocated towards top-performing industries such as Technology, Consumer Discretionary, and Health Care, which have helped the Nasdaq-100 outperform the S&P 500 by a wide margin between December 31, 2007, and March 31, 2023. The index is maintained by S&P Dow Jones Indices, an entity majority-owned by S&P Global. Its components are selected by a committee.

Why is S&P 500 better

The S&P is a float-weighted index, meaning the market capitalizations of the companies in the index are adjusted by the number of shares available for public trading. Because of its depth and diversity, the S&P 500 is widely considered one of the best gauges of large U.S. stocks, and even the entire equities market.The CAGR returns have been in the range of 23-40%. The significantly higher allocation towards FAANG stocks has ensured that Nasdaq 100 has outperformed S&P 500 index by a wide margin.The S&P is a float-weighted index, meaning the market capitalizations of the companies in the index are adjusted by the number of shares available for public trading. Because of its depth and diversity, the S&P 500 is widely considered one of the best gauges of large U.S. stocks, and even the entire equities market. The S&P 500 is considered a better reflection of the market's performance across all sectors compared to the Nasdaq Composite and the Dow. The downside to having more sectors included in the index is that the S&P 500 tends to be more volatile than the Dow.

Is it good to invest in Dow Jones : In general, the benefits of investing in the Dow Jones Industrial Average outweigh the disadvantages. Consistent long-term returns: the Dow Jones has a long history of strong performance, with an average annual return of around 10% since its inception in 1896.

What is better than s&p500 : The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.

Should I invest in Total market or S&P 500

You can't go wrong with either the Vanguard Total Stock Market ETF or the Vanguard S&P 500 ETF. Both offer very low expense ratios and turnover rates, and the difference in their tracking errors is negligible. The overlap in their holdings ensures that you'll get very similar returns going forward. S&P Global McGraw-Hill, a publishing house, acquired Standard & Poor's Corp., owner of the S&P 500 index, in 1966. Today, the S&P 500 is maintained by S&P Dow Jones Indices—a joint venture owned by S&P Global (previously McGraw Hill Financial), CME Group, and News Corp.So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.

What if I invested $1000 in S&P 500 10 years ago : Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.

Antwort What is the Dow Jones vs SP 500? Weitere Antworten – Is the Dow or S&P better

HOW DIFFERENT ARE THE DOW AND THE S&P 500 Their performances have historically tracked relatively closely with each other, but the S&P 500 has been better recently. Its 27.5% rise for the last 12 months easily tops the 19.7% gain for the Dow.The Dow, for example, has higher weightings in financials, healthcare, consumer discretionary, and industrials than the S&P 500 and Nasdaq Composite, but lower weightings in high-growth sectors like tech and communications (with the latter including Alphabet, Meta Platforms, Netflix, and other growth stocks).A key difference between The Dow and the S&P 500 is the method used to weight the constituent stocks of each index. The Dow is price-weighted. This means that price changes in the highest-priced stocks have greater impact on the index level than price changes in the lower-priced stocks.

What is one advantage the S&P 500 has in comparison to the Dow Jones Industrial Average DJIA ) : The S&P500 is considered less volatile than the DJIA.

Why is S&P 500 better than DJIA

Because the S&P 500 contains hundreds of large companies and represents the lion's share of total stock market value, it is considered a much better gauge of how the market is performing, even though it excludes thousands of smaller and midsize companies.

Should I invest in Dow Nasdaq or S&P 500 : So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.

The Nasdaq-100 is heavily allocated towards top-performing industries such as Technology, Consumer Discretionary, and Health Care, which have helped the Nasdaq-100 outperform the S&P 500 by a wide margin between December 31, 2007, and March 31, 2023.

The index is maintained by S&P Dow Jones Indices, an entity majority-owned by S&P Global. Its components are selected by a committee.

Why is S&P 500 better

The S&P is a float-weighted index, meaning the market capitalizations of the companies in the index are adjusted by the number of shares available for public trading. Because of its depth and diversity, the S&P 500 is widely considered one of the best gauges of large U.S. stocks, and even the entire equities market.The CAGR returns have been in the range of 23-40%. The significantly higher allocation towards FAANG stocks has ensured that Nasdaq 100 has outperformed S&P 500 index by a wide margin.The S&P is a float-weighted index, meaning the market capitalizations of the companies in the index are adjusted by the number of shares available for public trading. Because of its depth and diversity, the S&P 500 is widely considered one of the best gauges of large U.S. stocks, and even the entire equities market.

:max_bytes(150000):strip_icc()/GettyImages-496030068-29ec863cca36413ab111277d250fe964.jpg)

The S&P 500 is considered a better reflection of the market's performance across all sectors compared to the Nasdaq Composite and the Dow. The downside to having more sectors included in the index is that the S&P 500 tends to be more volatile than the Dow.

Is it good to invest in Dow Jones : In general, the benefits of investing in the Dow Jones Industrial Average outweigh the disadvantages. Consistent long-term returns: the Dow Jones has a long history of strong performance, with an average annual return of around 10% since its inception in 1896.

What is better than s&p500 : The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.

Should I invest in Total market or S&P 500

You can't go wrong with either the Vanguard Total Stock Market ETF or the Vanguard S&P 500 ETF. Both offer very low expense ratios and turnover rates, and the difference in their tracking errors is negligible. The overlap in their holdings ensures that you'll get very similar returns going forward.

S&P Global

McGraw-Hill, a publishing house, acquired Standard & Poor's Corp., owner of the S&P 500 index, in 1966. Today, the S&P 500 is maintained by S&P Dow Jones Indices—a joint venture owned by S&P Global (previously McGraw Hill Financial), CME Group, and News Corp.So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.

What if I invested $1000 in S&P 500 10 years ago : Over the past decade, you would have done even better, as the S&P 500 posted an average annual return of a whopping 12.68%. Here's how much your account balance would be now if you were invested over the past 10 years: $1,000 would grow to $3,300. $5,000 would grow to $16,498.