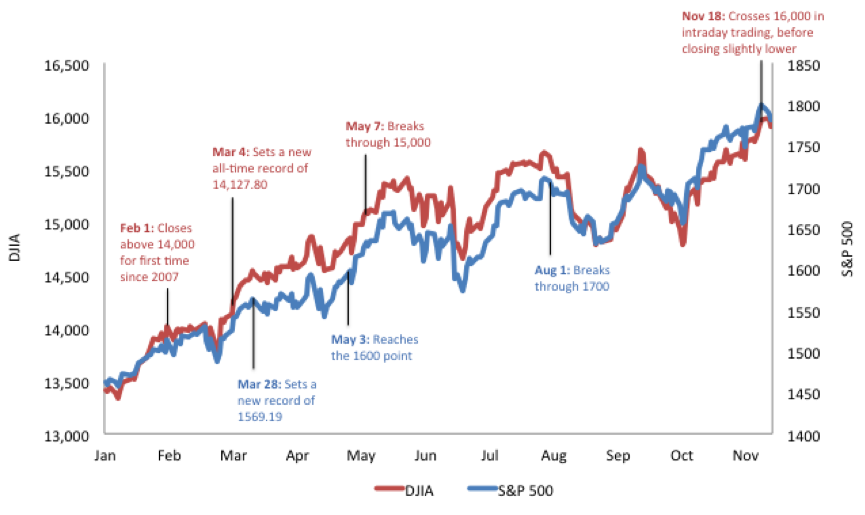

HOW DIFFERENT ARE THE DOW AND THE S&P 500 Their performances have historically tracked relatively closely with each other, but the S&P 500 has been better recently. Its 27.5% rise for the last 12 months easily tops the 19.7% gain for the Dow.The Dow, for example, has higher weightings in financials, healthcare, consumer discretionary, and industrials than the S&P 500 and Nasdaq Composite, but lower weightings in high-growth sectors like tech and communications (with the latter including Alphabet, Meta Platforms, Netflix, and other growth stocks).In terms of index construction, both The Dow and the S&P 500 track large-cap U.S. stocks. The Dow's components are large and well-known companies that are often described as blue chips. The S&P 500 tracks top companies in leading industries in the large-cap segment of the market as well.

Does S&P own Dow Jones : The index is maintained by S&P Dow Jones Indices, an entity majority-owned by S&P Global. Its components are selected by a committee.

Why is S&P better than Dow

Depending on the economy, and the state of the markets, one index may produce higher returns than the others do. For example, in rising markets, the S&P 500 can produce higher gains compared to the Dow due to the presence of more sectors and small-cap stocks in its portfolio.

Should I invest in Dow Nasdaq or S&P 500 : So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.

S&P 500 Index Versus Nasdaq 100 Performance

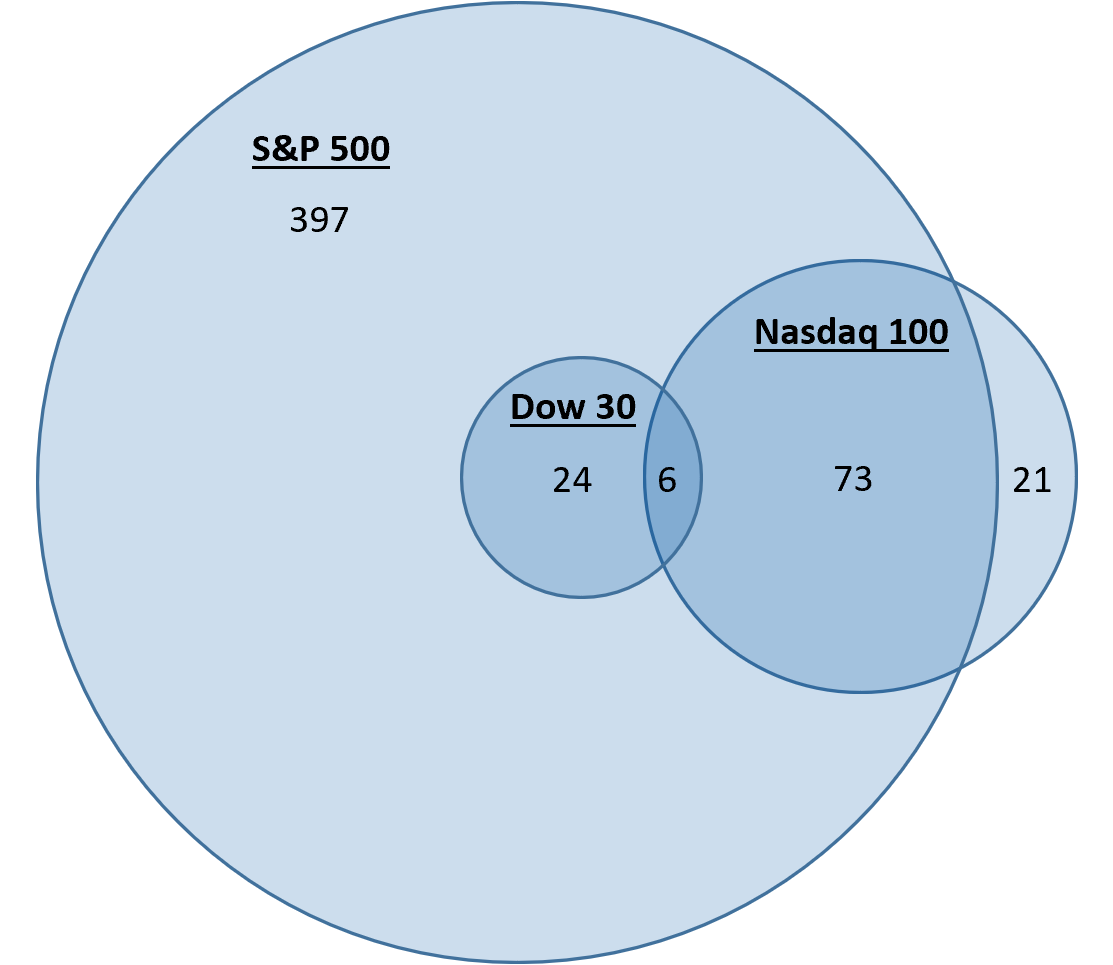

Nasdaq 100 has outperformed S&P by a wide margin. The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%. The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).

Is the Dow Jones the S&P 500

The S&P 500—founded in 1860, the S&P stands for Standard & Poor's—often co-stars with the Dow in financial market wrap-ups. This index also tracks big U.S.-based companies, but it uses 500 of them compared to the Dow's 30.The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100. Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky. S&P 500 index funds or ETFs will track the performance of the S&P 500, which means when the S&P 500 does well, your investment will, too. (The opposite is also true, of course.)

Should I invest in S and P index : S&P 500 index funds can help you instantly diversify your portfolio by providing exposure to some of the biggest companies in the U.S. Index funds in general are fairly inexpensive compared with other types of mutual funds, making them an attractive option for most investors.

Is S&P still worth it : In fact, research shows it's actually harder to lose money with the S&P 500 than it is to make money if you keep a long-term outlook. Analysts at Crestmont Research examined the S&P 500's historic performance to determine how often it was able to earn positive returns in a 20-year period.

Why is S&P 500 better

The S&P is a float-weighted index, meaning the market capitalizations of the companies in the index are adjusted by the number of shares available for public trading. Because of its depth and diversity, the S&P 500 is widely considered one of the best gauges of large U.S. stocks, and even the entire equities market. But there is one main distinction between these two indexes: The S&P 500 has 500 of the largest companies, which is why some investors believe it provides a more accurate picture of the economy. The Dow Jones, on the other hand, is composed of 30 blue-chip companies.The US 30, also called the Dow Jones Industrial Average (DJIA), measures the performance of 30 large American public companies.

Is S and P 500 the same as total stock : Pretty much by definition, the S&P 500 is made up of large-cap companies. A total market index is mostly large-cap stocks, but by definition includes all the mid-cap and small-cap stocks as well.

Antwort What is the Dow Jones vs S&P? Weitere Antworten – Is the Dow or S&P better

HOW DIFFERENT ARE THE DOW AND THE S&P 500 Their performances have historically tracked relatively closely with each other, but the S&P 500 has been better recently. Its 27.5% rise for the last 12 months easily tops the 19.7% gain for the Dow.The Dow, for example, has higher weightings in financials, healthcare, consumer discretionary, and industrials than the S&P 500 and Nasdaq Composite, but lower weightings in high-growth sectors like tech and communications (with the latter including Alphabet, Meta Platforms, Netflix, and other growth stocks).In terms of index construction, both The Dow and the S&P 500 track large-cap U.S. stocks. The Dow's components are large and well-known companies that are often described as blue chips. The S&P 500 tracks top companies in leading industries in the large-cap segment of the market as well.

Does S&P own Dow Jones : The index is maintained by S&P Dow Jones Indices, an entity majority-owned by S&P Global. Its components are selected by a committee.

Why is S&P better than Dow

Depending on the economy, and the state of the markets, one index may produce higher returns than the others do. For example, in rising markets, the S&P 500 can produce higher gains compared to the Dow due to the presence of more sectors and small-cap stocks in its portfolio.

Should I invest in Dow Nasdaq or S&P 500 : So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.

S&P 500 Index Versus Nasdaq 100 Performance

Nasdaq 100 has outperformed S&P by a wide margin. The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%.

The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).

Is the Dow Jones the S&P 500

The S&P 500—founded in 1860, the S&P stands for Standard & Poor's—often co-stars with the Dow in financial market wrap-ups. This index also tracks big U.S.-based companies, but it uses 500 of them compared to the Dow's 30.The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).So, if you are looking to own a more diversified basket of stocks, the S&P 500 will be the right fit for you. However, those who are comfortable with the slightly higher risk for the extra returns that investing in Nasdaq 100 based fund might generate will be better off with Nasdaq 100.

Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky. S&P 500 index funds or ETFs will track the performance of the S&P 500, which means when the S&P 500 does well, your investment will, too. (The opposite is also true, of course.)

Should I invest in S and P index : S&P 500 index funds can help you instantly diversify your portfolio by providing exposure to some of the biggest companies in the U.S. Index funds in general are fairly inexpensive compared with other types of mutual funds, making them an attractive option for most investors.

Is S&P still worth it : In fact, research shows it's actually harder to lose money with the S&P 500 than it is to make money if you keep a long-term outlook. Analysts at Crestmont Research examined the S&P 500's historic performance to determine how often it was able to earn positive returns in a 20-year period.

Why is S&P 500 better

The S&P is a float-weighted index, meaning the market capitalizations of the companies in the index are adjusted by the number of shares available for public trading. Because of its depth and diversity, the S&P 500 is widely considered one of the best gauges of large U.S. stocks, and even the entire equities market.

But there is one main distinction between these two indexes: The S&P 500 has 500 of the largest companies, which is why some investors believe it provides a more accurate picture of the economy. The Dow Jones, on the other hand, is composed of 30 blue-chip companies.The US 30, also called the Dow Jones Industrial Average (DJIA), measures the performance of 30 large American public companies.

Is S and P 500 the same as total stock : Pretty much by definition, the S&P 500 is made up of large-cap companies. A total market index is mostly large-cap stocks, but by definition includes all the mid-cap and small-cap stocks as well.