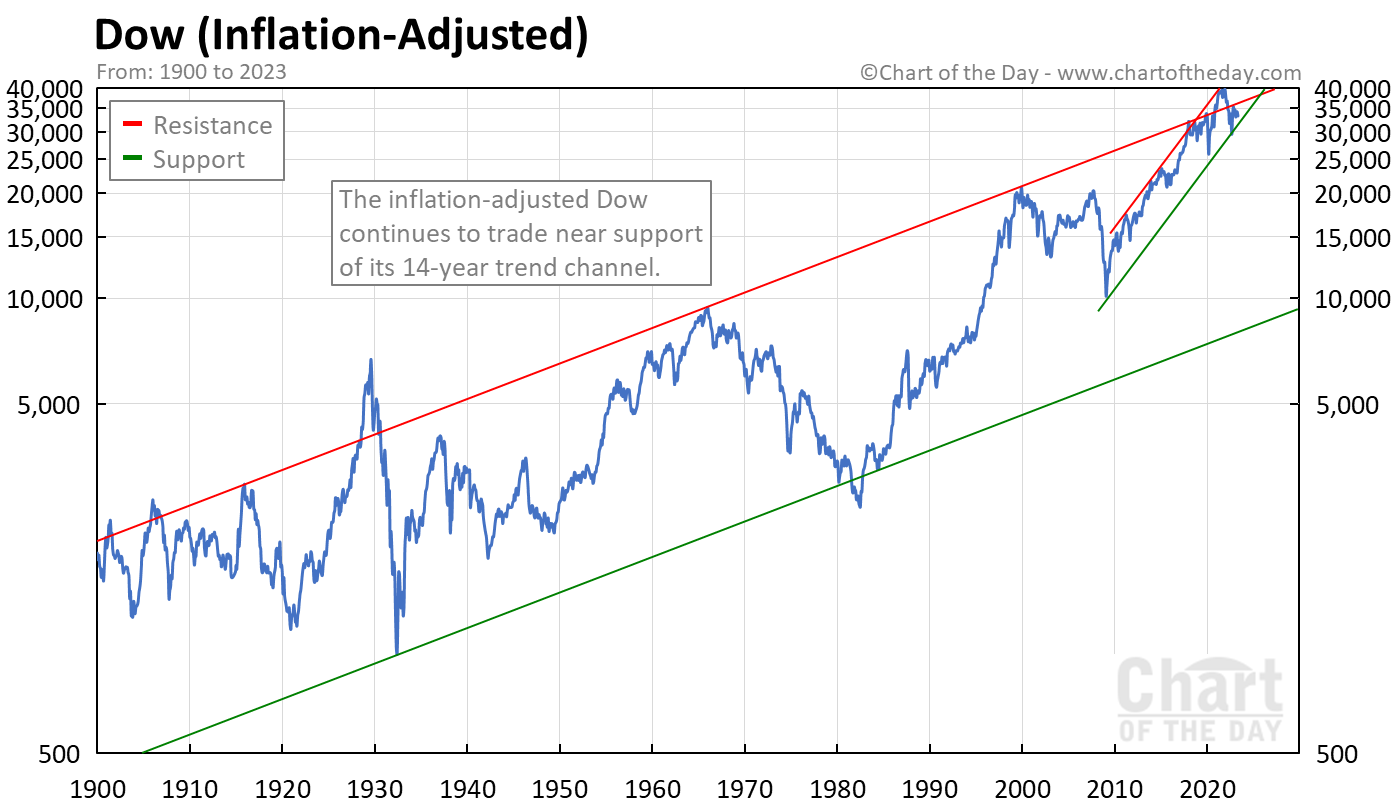

So far in 2024 (YTD), the S&P 500 index has returned an average 9.32%.Dow Jones – DJIA – 100 Year Historical Chart

Dow Jones Industrial Average – Historical Annual Data

Year

Average Closing Price

Annual % Change

2000

10,729.38

-6.17%

1999

10,481.56

25.22%

1998

8,630.76

16.10%

What is the standard deviation of the Dow Jones industrial average : Risk measures

Fund

Category average

R squared

+89.79

+83.21

Sharpe ratio

+0.46

+0.44

Standard deviation

18.32%

19.14%

What is the S&P 500 last 10 years return

Stock Market Average Yearly Return for the Last 10 Years

The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.

What is the 10-year average return on the Nasdaq : Average returns

Period

Average annualised return

Total return

Last year

35.7%

35.7%

Last 5 years

19.3%

141.7%

Last 10 years

21.0%

574.9%

In short, the average stock market return since the S&P 500's inception in 1926 through 2018 is approximately 10-11%. When adjusted for inflation, it's closer to about 7%. [Since we're talking citations in this post: Investopedia.] Stock Market Average Yearly Return for the Last 10 Years

The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.

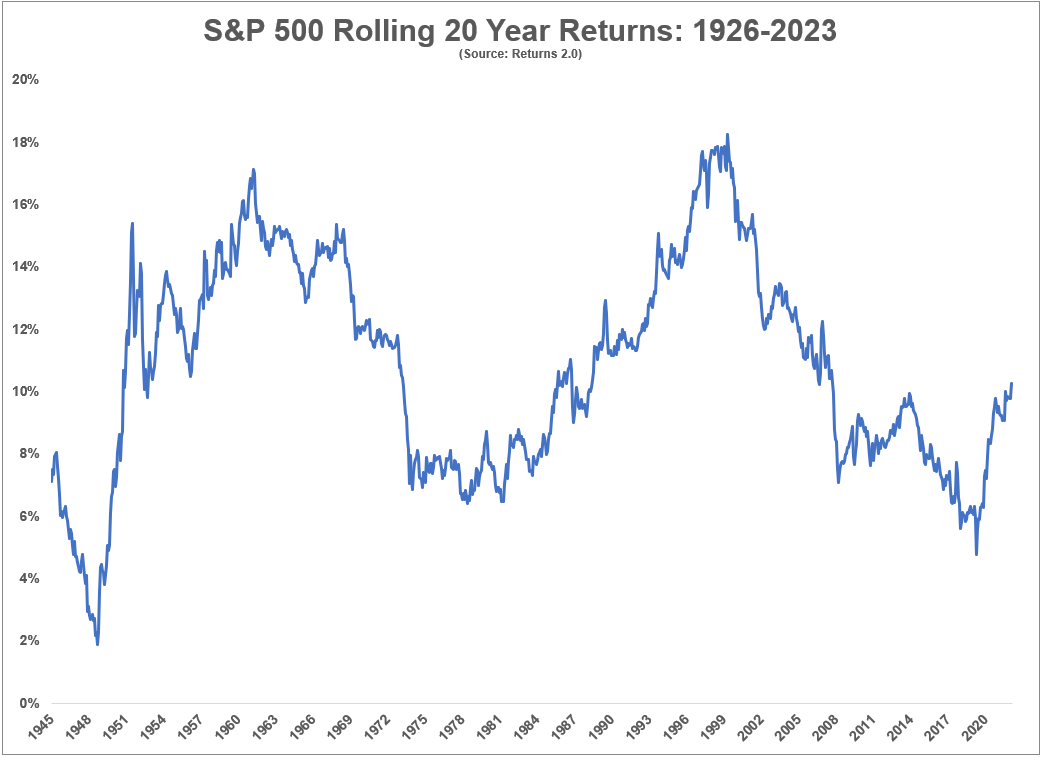

What is the 20-year return of the stock market

Stock Market Average Yearly Return for the Last 20 Years

The historical average yearly return of the S&P 500 is 9.88% over the last 20 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 20-year average stock market return (including dividends) is 7.13%.The Nasdaq Composite had the strongest 20-year performance after rising 687%, or 10.9% annually. The Fidelity Nasdaq Composite ETF is one way to invest in the index.The Nasdaq Composite had the strongest 20-year performance after rising 687%, or 10.9% annually. The Fidelity Nasdaq Composite ETF is one way to invest in the index. Average returns

Period

Average annualised return

Total return

Last year

35.7%

35.7%

Last 5 years

19.3%

141.7%

Last 10 years

21.0%

574.9%

What is the average return of the sp500 for the last 100 years : 10.62%

The US stock market has a long history of producing double-digit yearly returns. The average yearly return for the S&P 500 is 10.62% over the last 100 years. In this article, you'll find statistics on the average stock market performance over the last 5, 10, 20, 30, 50, 100, and 150 years.

What is a good 10-year return on stocks : 5-year, 10-year, 20-year and 30-year S&P 500 returns

Period (start-of-year to end-of-2023)

Average annual S&P 500 return

5 years (2019-2023)

15.36%

10 years (2014-2023)

11.02%

15 years (2009-2023)

12.63%

20 years (2004-2023)

9.00%

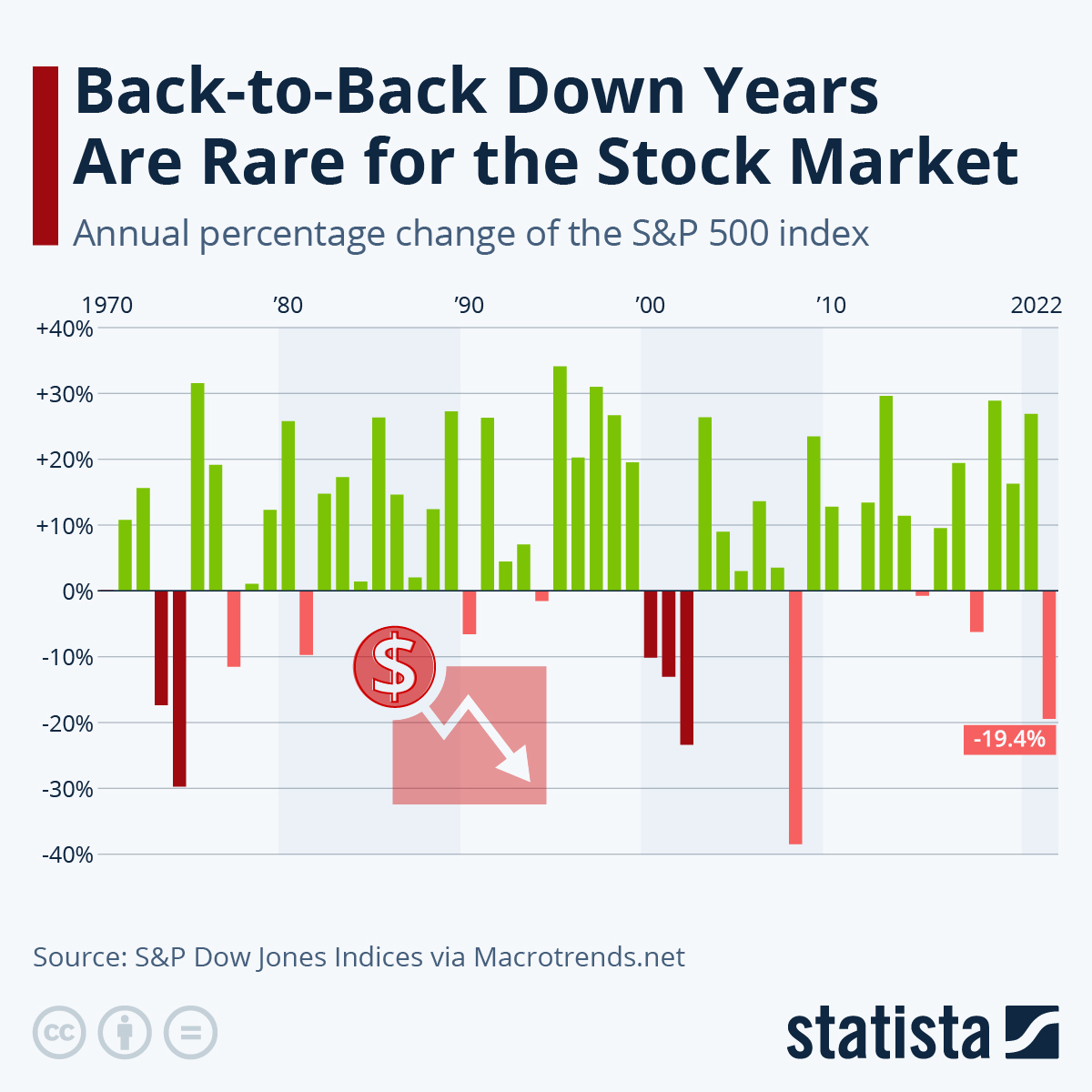

Is 20% return possible

Relatively safer investments may see less volatility in an average year, but if you have a long enough timeline, you have the potential to earn that 20% return eventually. Getting a 12% return on investment requires taking on higher risks, such as investing in equity mutual funds, individual stocks, or alternative assets such as real estate or peer-to-peer lending platforms. It's important to have a long-term investment horizon and diversify your portfolio to manage risks.Ten Year Stock Price Total Return for SPDR S&P 500 ETF Trust is calculated as follows: Last Close Price [ 523.30 ] / Adj Prior Close Price [ 156.61 ] (-) 1 (=) Total Return [ 234.1% ] Prior price dividend adjustment factor is 0.84.

What is the average 100 year stock market return : The average yearly return of the S&P 500 is 10.62% over the last 100 years, as of the end of April 2024. This assumes dividends are reinvested. Dividends account for about 40% of the total gain over this period. Adjusted for inflation, the 100-year average stock market return (including dividends) is 7.44%.

Antwort What is the Dow Jones average return last 10 years? Weitere Antworten – What is the 10 year average return on the Dow Jones

Average returns

Annual returns

So far in 2024 (YTD), the S&P 500 index has returned an average 9.32%.Dow Jones – DJIA – 100 Year Historical Chart

What is the standard deviation of the Dow Jones industrial average : Risk measures

What is the S&P 500 last 10 years return

Stock Market Average Yearly Return for the Last 10 Years

The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.

What is the 10-year average return on the Nasdaq : Average returns

In short, the average stock market return since the S&P 500's inception in 1926 through 2018 is approximately 10-11%. When adjusted for inflation, it's closer to about 7%. [Since we're talking citations in this post: Investopedia.]

Stock Market Average Yearly Return for the Last 10 Years

The historical average yearly return of the S&P 500 is 12.58% over the last 10 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 10-year average stock market return (including dividends) is 9.52%.

What is the 20-year return of the stock market

Stock Market Average Yearly Return for the Last 20 Years

The historical average yearly return of the S&P 500 is 9.88% over the last 20 years, as of the end of April 2024. This assumes dividends are reinvested. Adjusted for inflation, the 20-year average stock market return (including dividends) is 7.13%.The Nasdaq Composite had the strongest 20-year performance after rising 687%, or 10.9% annually. The Fidelity Nasdaq Composite ETF is one way to invest in the index.The Nasdaq Composite had the strongest 20-year performance after rising 687%, or 10.9% annually. The Fidelity Nasdaq Composite ETF is one way to invest in the index.

Average returns

What is the average return of the sp500 for the last 100 years : 10.62%

The US stock market has a long history of producing double-digit yearly returns. The average yearly return for the S&P 500 is 10.62% over the last 100 years. In this article, you'll find statistics on the average stock market performance over the last 5, 10, 20, 30, 50, 100, and 150 years.

What is a good 10-year return on stocks : 5-year, 10-year, 20-year and 30-year S&P 500 returns

Is 20% return possible

Relatively safer investments may see less volatility in an average year, but if you have a long enough timeline, you have the potential to earn that 20% return eventually.

Getting a 12% return on investment requires taking on higher risks, such as investing in equity mutual funds, individual stocks, or alternative assets such as real estate or peer-to-peer lending platforms. It's important to have a long-term investment horizon and diversify your portfolio to manage risks.Ten Year Stock Price Total Return for SPDR S&P 500 ETF Trust is calculated as follows: Last Close Price [ 523.30 ] / Adj Prior Close Price [ 156.61 ] (-) 1 (=) Total Return [ 234.1% ] Prior price dividend adjustment factor is 0.84.

What is the average 100 year stock market return : The average yearly return of the S&P 500 is 10.62% over the last 100 years, as of the end of April 2024. This assumes dividends are reinvested. Dividends account for about 40% of the total gain over this period. Adjusted for inflation, the 100-year average stock market return (including dividends) is 7.44%.