The Total Stock Market fund tracks the CRSP US Total Market Index, which captures practically every investable U.S. stock in the market. The S&P 500 ETF tracks the S&P 500, which is a collection of about 500 of the largest U.S. companies that have been consistently profitable for at least a year.The S&P 500 has a market capitalization of $43.792 trillion dollars. The total market cap is calculated by summing the market capitalization of every company in the index. Each company's calculated market cap is based on the outstanding float share count.approximately 80%

It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $43 trillion as of January 2024.

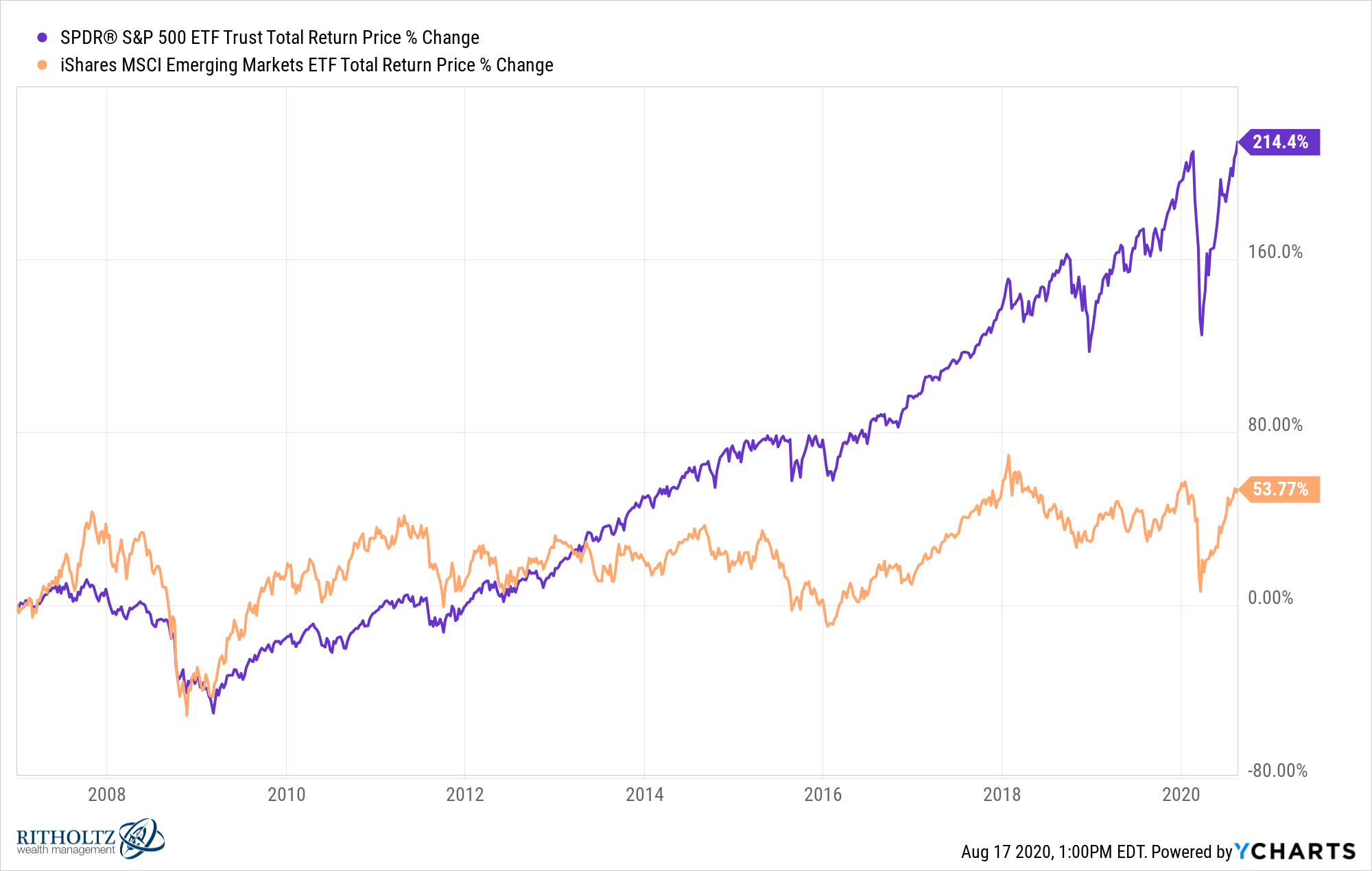

Should I invest in Total market and S&P 500 : S&P 500 and total stock market index funds and ETFs are great ways for investors interested in using a passive investment strategy to own a broadly diversified basket of U.S. stocks. As a bonus, these index funds often charge some of the lowest fees in the investing marketplace.

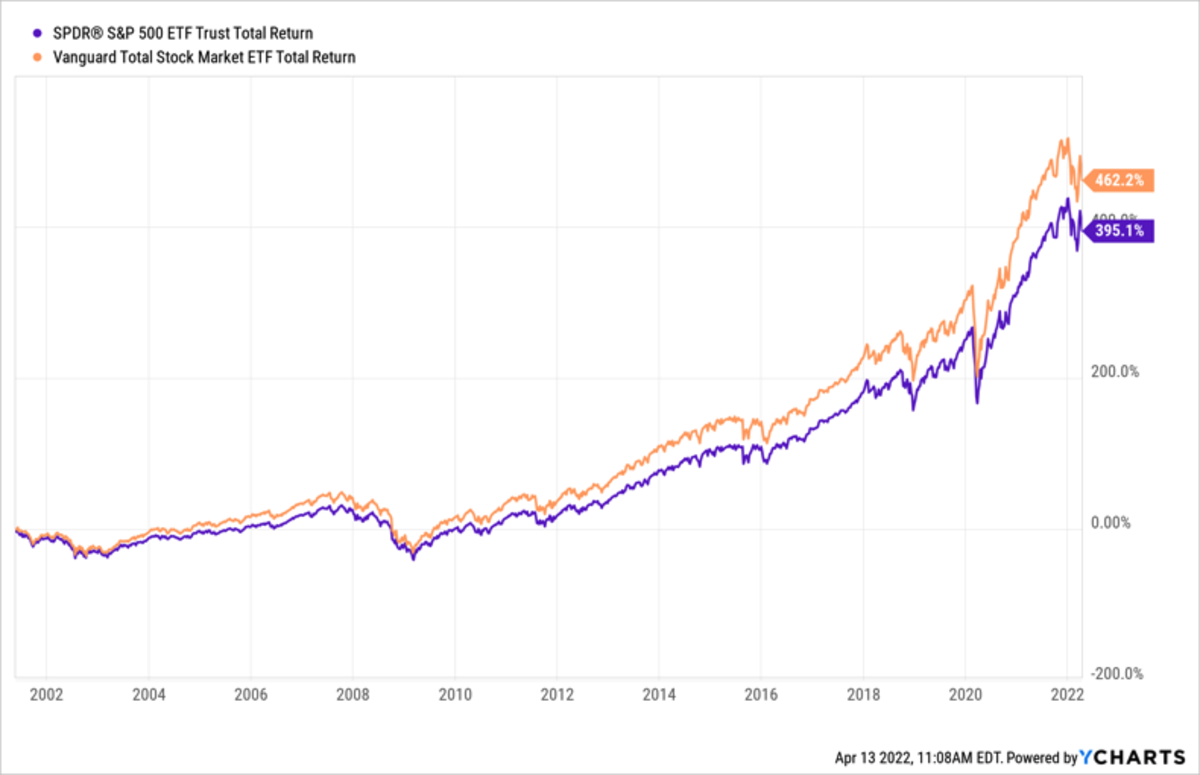

What is the difference between total market index fund and S&P 500 performance

We have also analyzed the performance of both indexes for calendar years from 1958 to 2022. The CRSP US Total Market Index outperformed in 35 years, compared to 30 years for the S&P 500. The largest annual outperformance was 5.05% for the CRSP Index and 4.73% for the S&P 500 Index.

What is different about S & P 500 : The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.

Market capitalization is essentially a synonym for the market value of equity. A company's market cap is a single incontrovertible figure because it's the number of outstanding shares multiplied by the price of a share. Market valuations can vary depending on the exact metrics and multiples that an analyst uses. Large-cap companies are those that have a market capitalization of over $10 billion. The S&P 500 measures the overall risk, return, and performance of the large-cap equities market.

What is the total stock market

A total stock market index fund is an investment vehicle that contains a basket of stocks within a mutual fund or exchange traded fund (ETF) that tracks an equity index. An equity index contains numerous stocks across various industries designed to represent the performance of the overall equity market.The largest Total Market ETF is the Vanguard Total Stock Market ETF VTI with $393.40B in assets. In the last trailing year, the best-performing Total Market ETF was MTUL at 72.73%. The most recent ETF launched in the Total Market space was the TCW Compounders ETF GRW on 05/06/24.Is Investing in the S&P 500 Less Risky Than Buying a Single Stock Generally, yes. The S&P 500 is considered well-diversified by sector, which means it includes stocks in all major areas, including technology and consumer discretionary—meaning declines in some sectors may be offset by gains in other sectors. Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky. S&P 500 index funds or ETFs will track the performance of the S&P 500, which means when the S&P 500 does well, your investment will, too. (The opposite is also true, of course.)

What is the difference between the S&P 500 index and the S&P 500 Total Return Index : The S&P 500 Total Return Index (SPTR) is one example of a total return index. The SPTR is different from the standard S&P Index (SPX), which does not include dividend gains.

What’s the difference between S&P 500 and S&P 100 : The index measures the performance of 50 of the largest, by FMC, companies in the S&P 500. S&P 100. The index measures the performance of 100 companies selected from the S&P 500.

What is the difference between fair market value and total market value

Market value is an asset's current market price. Fair market value (FMV) differs in that it is the price a product would sell for on the open market with the following assumptions: Both buyer and seller are reasonably knowledgeable about the asset. Buyer and seller are behaving in their own best interests. The total market value of all positions in the account, including Core, minus any outstanding debit balances and any amount required to cover short option positions that are in-the-money. The account equity, as a percentage of the total market value of positions in your account.The difference between a total stock market index fund and an S&P 500 index fund is that the S&P 500 Index includes only large-cap stocks. The total stock index includes small-, mid-, and large-cap stocks. However, both indexes represent only U.S. stocks.

What’s the difference between the S&P 500 and the S&P 1500 : The S&P 1500 combines three widely followed indices—the S&P 500, S&P MidCap 400, and S&P SmallCap 600—in proportion to their free-float market capitalizations. Hence, the S&P 1500 uses the same inclusion criteria as its three component indices.

Antwort What is the difference between the S&P 500 and the total stock market? Weitere Antworten – What is the difference between the S&P 500 and the total market

The Total Stock Market fund tracks the CRSP US Total Market Index, which captures practically every investable U.S. stock in the market. The S&P 500 ETF tracks the S&P 500, which is a collection of about 500 of the largest U.S. companies that have been consistently profitable for at least a year.The S&P 500 has a market capitalization of $43.792 trillion dollars. The total market cap is calculated by summing the market capitalization of every company in the index. Each company's calculated market cap is based on the outstanding float share count.approximately 80%

It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $43 trillion as of January 2024.

Should I invest in Total market and S&P 500 : S&P 500 and total stock market index funds and ETFs are great ways for investors interested in using a passive investment strategy to own a broadly diversified basket of U.S. stocks. As a bonus, these index funds often charge some of the lowest fees in the investing marketplace.

What is the difference between total market index fund and S&P 500 performance

We have also analyzed the performance of both indexes for calendar years from 1958 to 2022. The CRSP US Total Market Index outperformed in 35 years, compared to 30 years for the S&P 500. The largest annual outperformance was 5.05% for the CRSP Index and 4.73% for the S&P 500 Index.

What is different about S & P 500 : The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.

Market capitalization is essentially a synonym for the market value of equity. A company's market cap is a single incontrovertible figure because it's the number of outstanding shares multiplied by the price of a share. Market valuations can vary depending on the exact metrics and multiples that an analyst uses.

Large-cap companies are those that have a market capitalization of over $10 billion. The S&P 500 measures the overall risk, return, and performance of the large-cap equities market.

What is the total stock market

A total stock market index fund is an investment vehicle that contains a basket of stocks within a mutual fund or exchange traded fund (ETF) that tracks an equity index. An equity index contains numerous stocks across various industries designed to represent the performance of the overall equity market.The largest Total Market ETF is the Vanguard Total Stock Market ETF VTI with $393.40B in assets. In the last trailing year, the best-performing Total Market ETF was MTUL at 72.73%. The most recent ETF launched in the Total Market space was the TCW Compounders ETF GRW on 05/06/24.Is Investing in the S&P 500 Less Risky Than Buying a Single Stock Generally, yes. The S&P 500 is considered well-diversified by sector, which means it includes stocks in all major areas, including technology and consumer discretionary—meaning declines in some sectors may be offset by gains in other sectors.

Investing in an S&P 500 fund can instantly diversify your portfolio and is generally considered less risky. S&P 500 index funds or ETFs will track the performance of the S&P 500, which means when the S&P 500 does well, your investment will, too. (The opposite is also true, of course.)

What is the difference between the S&P 500 index and the S&P 500 Total Return Index : The S&P 500 Total Return Index (SPTR) is one example of a total return index. The SPTR is different from the standard S&P Index (SPX), which does not include dividend gains.

What’s the difference between S&P 500 and S&P 100 : The index measures the performance of 50 of the largest, by FMC, companies in the S&P 500. S&P 100. The index measures the performance of 100 companies selected from the S&P 500.

What is the difference between fair market value and total market value

Market value is an asset's current market price. Fair market value (FMV) differs in that it is the price a product would sell for on the open market with the following assumptions: Both buyer and seller are reasonably knowledgeable about the asset. Buyer and seller are behaving in their own best interests.

The total market value of all positions in the account, including Core, minus any outstanding debit balances and any amount required to cover short option positions that are in-the-money. The account equity, as a percentage of the total market value of positions in your account.The difference between a total stock market index fund and an S&P 500 index fund is that the S&P 500 Index includes only large-cap stocks. The total stock index includes small-, mid-, and large-cap stocks. However, both indexes represent only U.S. stocks.

What’s the difference between the S&P 500 and the S&P 1500 : The S&P 1500 combines three widely followed indices—the S&P 500, S&P MidCap 400, and S&P SmallCap 600—in proportion to their free-float market capitalizations. Hence, the S&P 1500 uses the same inclusion criteria as its three component indices.