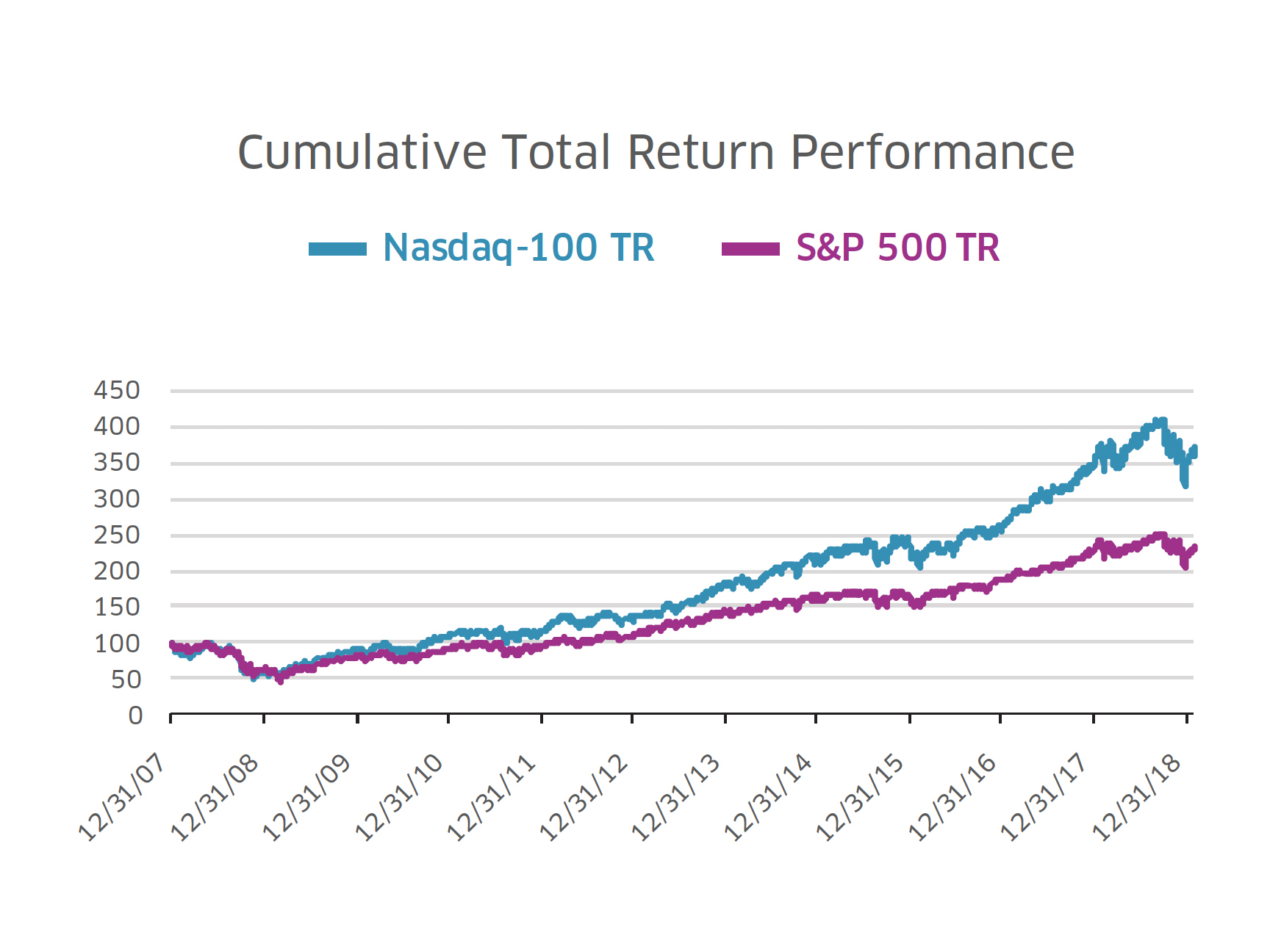

The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.HOW DIFFERENT ARE THE DOW AND THE S&P 500 Their performances have historically tracked relatively closely with each other, but the S&P 500 has been better recently. Its 27.5% rise for the last 12 months easily tops the 19.7% gain for the Dow.S&P 500 Index Versus Nasdaq 100 Performance

Nasdaq 100 has outperformed S&P by a wide margin. The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%.

Does the S&P 500 include Nasdaq stocks : How the S&P 500 Works. That's it. The index includes 500 of the largest (not necessarily the 500 largest) companies whose stocks trade on the New York Stock Exchange (NYSE), Nasdaq, or Chicago Board Options Exchange (CBOE).

What is the Dow Jones for dummies

Simply put, the Dow Jones is an index that measures the performance of 30 large, publicly-traded companies listed on the stock exchanges in the United States.

What is a major difference between the S&P 500 index and the Dow Jones Industrial Average quizlet : The DJIA is based on the price of stocks for 30 large companies; the S&P 500 is based on the price of stocks for 500 companies.

The S&P 500 isn't a company itself, but rather a list of companies — otherwise known as an index. So while you can't buy S&P 500 stock, you can buy shares in an index that tracks the S&P 500. The NASDAQ Composite is an index of more than 3,000 common equities listed on the NASDAQ stock market. The index is one of the most followed indices in the United States, alongside the Dow Jones Industrial Average and the S&P 500.

Is it good to invest in Dow Jones

In general, the benefits of investing in the Dow Jones Industrial Average outweigh the disadvantages. Consistent long-term returns: the Dow Jones has a long history of strong performance, with an average annual return of around 10% since its inception in 1896.You can't go wrong with either the Vanguard Total Stock Market ETF or the Vanguard S&P 500 ETF. Both offer very low expense ratios and turnover rates, and the difference in their tracking errors is negligible. The overlap in their holdings ensures that you'll get very similar returns going forward.The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average). However, its bankruptcy following the financial crisis led to its removal. Since then, the Dow has gone more than a decade without representation from the auto industry. Many investors note that Tesla's potential goes well beyond its vehicle manufacturing. For now, though, Tesla is squarely focused on cars and trucks.

What is Nasdaq for dummies : The Nasdaq is a U.S. stock exchange based in New York City. It officially opened for business in February 1971. There are more than 5,000 companies that trade on the exchange, including domestic and international firms. It was the first automated exchange in the world.

What is the Dow Jones and Nasdaq explanation : Both the Dow and the Nasdaq represent a stock market index, or an average of a great many numbers derived from the price movements of certain stocks. The Nasdaq also refers to an exchange where investors can buy and sell stocks.

What is the difference between the total stock market index and the S&P 500

The difference between a total stock market index fund and an S&P 500 index fund is that the S&P 500 Index includes only large-cap stocks. The total stock index includes small-, mid-, and large-cap stocks. However, both indexes represent only U.S. stocks. The S&P 500 index is composed of 505 stocks issued by 500 different companies. There's a difference in numbers because a few S&P 500 component companies issue more than one class of stock. For example, Alphabet Class C (GOOG 1.06%) and Alphabet Class A (GOOGL 1.08%) stock are both included in the S&P 500 index.The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.

Why is it called Nasdaq : 1971–2000. "Nasdaq" was initially an acronym for the National Association of Securities Dealers Automated Quotations.

Antwort What is the difference between DJIA and S&P 500 and Nasdaq? Weitere Antworten – What is the difference between DJIA and S&P 500 and Nasdaq

The Dow tracks 30 large U.S. companies but has limited representation. The Nasdaq indexes, associated with the Nasdaq exchange, focus more heavily on tech and other stocks. The S&P 500, with 500 large U.S. companies, offers a more comprehensive market view, weighted by market capitalization.HOW DIFFERENT ARE THE DOW AND THE S&P 500 Their performances have historically tracked relatively closely with each other, but the S&P 500 has been better recently. Its 27.5% rise for the last 12 months easily tops the 19.7% gain for the Dow.S&P 500 Index Versus Nasdaq 100 Performance

Nasdaq 100 has outperformed S&P by a wide margin. The average 10-year return of Nasdaq 100 over these 15 years was around 9%, while that of S&P 500 was about 5%.

Does the S&P 500 include Nasdaq stocks : How the S&P 500 Works. That's it. The index includes 500 of the largest (not necessarily the 500 largest) companies whose stocks trade on the New York Stock Exchange (NYSE), Nasdaq, or Chicago Board Options Exchange (CBOE).

What is the Dow Jones for dummies

Simply put, the Dow Jones is an index that measures the performance of 30 large, publicly-traded companies listed on the stock exchanges in the United States.

What is a major difference between the S&P 500 index and the Dow Jones Industrial Average quizlet : The DJIA is based on the price of stocks for 30 large companies; the S&P 500 is based on the price of stocks for 500 companies.

The S&P 500 isn't a company itself, but rather a list of companies — otherwise known as an index. So while you can't buy S&P 500 stock, you can buy shares in an index that tracks the S&P 500.

The NASDAQ Composite is an index of more than 3,000 common equities listed on the NASDAQ stock market. The index is one of the most followed indices in the United States, alongside the Dow Jones Industrial Average and the S&P 500.

Is it good to invest in Dow Jones

In general, the benefits of investing in the Dow Jones Industrial Average outweigh the disadvantages. Consistent long-term returns: the Dow Jones has a long history of strong performance, with an average annual return of around 10% since its inception in 1896.You can't go wrong with either the Vanguard Total Stock Market ETF or the Vanguard S&P 500 ETF. Both offer very low expense ratios and turnover rates, and the difference in their tracking errors is negligible. The overlap in their holdings ensures that you'll get very similar returns going forward.The S&P 500 is a stock market index maintained by S&P Dow Jones Indices. It comprises 503 common stocks which are issued by 500 large-cap companies traded on American stock exchanges (including the 30 companies that compose the Dow Jones Industrial Average).

However, its bankruptcy following the financial crisis led to its removal. Since then, the Dow has gone more than a decade without representation from the auto industry. Many investors note that Tesla's potential goes well beyond its vehicle manufacturing. For now, though, Tesla is squarely focused on cars and trucks.

What is Nasdaq for dummies : The Nasdaq is a U.S. stock exchange based in New York City. It officially opened for business in February 1971. There are more than 5,000 companies that trade on the exchange, including domestic and international firms. It was the first automated exchange in the world.

What is the Dow Jones and Nasdaq explanation : Both the Dow and the Nasdaq represent a stock market index, or an average of a great many numbers derived from the price movements of certain stocks. The Nasdaq also refers to an exchange where investors can buy and sell stocks.

What is the difference between the total stock market index and the S&P 500

The difference between a total stock market index fund and an S&P 500 index fund is that the S&P 500 Index includes only large-cap stocks. The total stock index includes small-, mid-, and large-cap stocks. However, both indexes represent only U.S. stocks.

The S&P 500 index is composed of 505 stocks issued by 500 different companies. There's a difference in numbers because a few S&P 500 component companies issue more than one class of stock. For example, Alphabet Class C (GOOG 1.06%) and Alphabet Class A (GOOGL 1.08%) stock are both included in the S&P 500 index.The S&P 500's track record is impressive, but the Vanguard Growth ETF has outperformed it. The Vanguard Growth ETF leans heavily toward tech businesses that exhibit faster revenue and earnings gains. No matter what investments you choose, it's always smart to keep a long-term mindset.

Why is it called Nasdaq : 1971–2000. "Nasdaq" was initially an acronym for the National Association of Securities Dealers Automated Quotations.