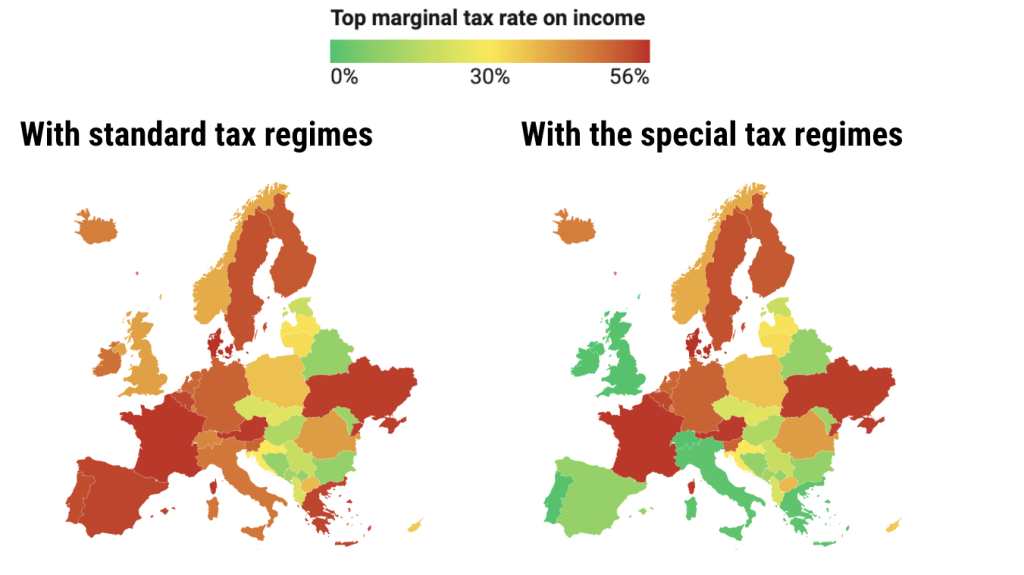

European countries like Luxembourg, Switzerland, and Monaco are renowned as tax havens due to their low tax rates and privacy laws. Luxembourg offers attractive tax treatments for international corporations and Switzerland is known for its banking secrecy and favorable tax regimes for foreign companies.Destinations like Switzerland and Austria, although not strictly tax havens, are nevertheless popular for offshore banking services and a safe destination for assets.Unlike many countries, San Marino imposes a 0% corporate tax on the profits earned by businesses. This tax-friendly environment allows crypto businesses to retain a more significant portion of their earnings, fostering reinvestment and innovation.

Where is the cheapest tax in Europe : Bulgaria opens our list as the country that has one of the lowest tax rate in Europe. The country's 10% flat rate of personal income and corporate income taxes are among the lowest in the European Union.

Where do you pay least tax in Europe

Hungary (15 percent), Estonia (20 percent), and the Czech Republic (23 percent) have the lowest top rates. European countries that are not part of the OECD tend to feature lower rates and tax personal income at a single rate.

Where is the lowest tax in Europe : Bulgaria

Bulgaria and Romania (10 percent) levy the lowest rate, followed by Moldova (12 percent), Ukraine (19.5 percent), and Georgia (20 percent).

The Financial Secrecy Index ranks Austria as the 35th safest tax haven in the world. UPDATED: 23.04. 2024.

We are often asked about Croatia's tax system, which makes sense. Taxes are a big concern for most people, and most of us want to pay as little as possible. Croatia is not a tax haven or shelter.

How is Andorra a tax haven

Why Andorra was a tax haven The Principality of Andorra was for decades in the national and international lists of tax havens due to the application of banking secrecy and the lack of exchange of information on tax matters with other countries.Personal Income Tax

The progressive tax of 23% applies to personal income above the statutory limit, which has been set at 36 times the average monthly salary in 2024. Therefore, if an individual's income exceeds 36 times the average wage, they must pay 23% tax on this excess income instead of the basic 15% tax.These include Belgium, the Czech Republic, Georgia, Luxembourg, Malta, Slovakia, Slovenia, Switzerland, and Turkey. Of the countries that do levy a capital gains tax, Moldova levies the lowest rate, at 6 percent, followed by Bulgaria and Romania, at 10 percent each. Bulgaria

Bulgaria opens our list as the country that has one of the lowest tax rate in Europe. The country's 10% flat rate of personal income and corporate income taxes are among the lowest in the European Union.

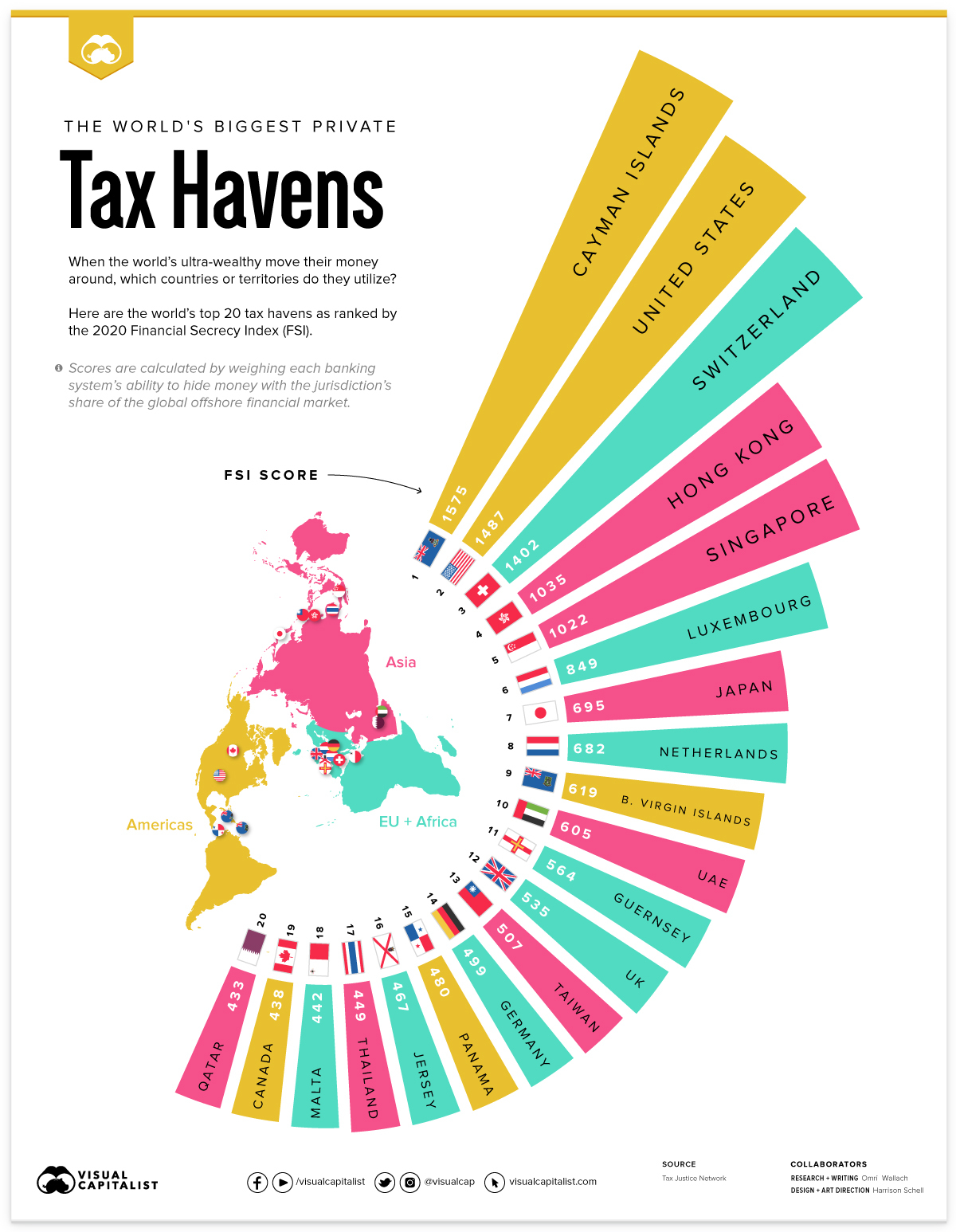

Where is the best tax haven country : 10 Best Tax Haven Countries for US citizens in 2024

Singapore. Singapore is considered a tax haven for US citizens due to its attractive tax policies and business-friendly environment.

Switzerland.

United Arab Emirates (UAE)

Cayman Islands.

Panama.

Hong Kong.

Puerto Rico.

Costa Rica.

Is Slovenia a tax haven : Slovenia is not exactly a tax haven in the EU, however, tax burdens are among the lowest in the share of GDP. Gregor Cerar, translated by K. Sm. The public has long been convinced that Slovenia is one of the most ungracious countries when it comes to taxation, especially in the economic field.

Is Switzerland a tax haven

Key Takeaways. The European nation of Switzerland is considered to be an international tax haven due to low tax levels and privacy laws. Switzerland also has a history of favorable tax treaties, stable politics, and a wealth of advisors. Though Sweden has not traditionally been viewed as a tax haven in Europe, changes to its tax codes and the introduction of new investment vehicles have modified the country's image as a potential tax haven for foreign investors.The country used its low taxes as a selling point. In 1955 Liechtenstein, described itself (paywall) as a country “where citizens dwell virtually tax-free, and where similar freedom awaits foreign corporations.” (The top tax rate at that time was 1.4%.)

What is a good salary in Prague : Prague, the capital city, stands as the epicenter of economic activity in the Czech Republic. The average salary in Prague is significantly higher than the national average, with figures often surpassing 50,000 CZK (approximately €1,971) per month.

Antwort What is the best tax paradise in Europe? Weitere Antworten – What is the best tax haven in Europe

European countries like Luxembourg, Switzerland, and Monaco are renowned as tax havens due to their low tax rates and privacy laws. Luxembourg offers attractive tax treatments for international corporations and Switzerland is known for its banking secrecy and favorable tax regimes for foreign companies.Destinations like Switzerland and Austria, although not strictly tax havens, are nevertheless popular for offshore banking services and a safe destination for assets.Unlike many countries, San Marino imposes a 0% corporate tax on the profits earned by businesses. This tax-friendly environment allows crypto businesses to retain a more significant portion of their earnings, fostering reinvestment and innovation.

Where is the cheapest tax in Europe : Bulgaria opens our list as the country that has one of the lowest tax rate in Europe. The country's 10% flat rate of personal income and corporate income taxes are among the lowest in the European Union.

Where do you pay least tax in Europe

Hungary (15 percent), Estonia (20 percent), and the Czech Republic (23 percent) have the lowest top rates. European countries that are not part of the OECD tend to feature lower rates and tax personal income at a single rate.

Where is the lowest tax in Europe : Bulgaria

Bulgaria and Romania (10 percent) levy the lowest rate, followed by Moldova (12 percent), Ukraine (19.5 percent), and Georgia (20 percent).

The Financial Secrecy Index ranks Austria as the 35th safest tax haven in the world.

UPDATED: 23.04. 2024.

We are often asked about Croatia's tax system, which makes sense. Taxes are a big concern for most people, and most of us want to pay as little as possible. Croatia is not a tax haven or shelter.

How is Andorra a tax haven

Why Andorra was a tax haven The Principality of Andorra was for decades in the national and international lists of tax havens due to the application of banking secrecy and the lack of exchange of information on tax matters with other countries.Personal Income Tax

The progressive tax of 23% applies to personal income above the statutory limit, which has been set at 36 times the average monthly salary in 2024. Therefore, if an individual's income exceeds 36 times the average wage, they must pay 23% tax on this excess income instead of the basic 15% tax.These include Belgium, the Czech Republic, Georgia, Luxembourg, Malta, Slovakia, Slovenia, Switzerland, and Turkey. Of the countries that do levy a capital gains tax, Moldova levies the lowest rate, at 6 percent, followed by Bulgaria and Romania, at 10 percent each.

Bulgaria

Bulgaria opens our list as the country that has one of the lowest tax rate in Europe. The country's 10% flat rate of personal income and corporate income taxes are among the lowest in the European Union.

Where is the best tax haven country : 10 Best Tax Haven Countries for US citizens in 2024

Is Slovenia a tax haven : Slovenia is not exactly a tax haven in the EU, however, tax burdens are among the lowest in the share of GDP. Gregor Cerar, translated by K. Sm. The public has long been convinced that Slovenia is one of the most ungracious countries when it comes to taxation, especially in the economic field.

Is Switzerland a tax haven

Key Takeaways. The European nation of Switzerland is considered to be an international tax haven due to low tax levels and privacy laws. Switzerland also has a history of favorable tax treaties, stable politics, and a wealth of advisors.

Though Sweden has not traditionally been viewed as a tax haven in Europe, changes to its tax codes and the introduction of new investment vehicles have modified the country's image as a potential tax haven for foreign investors.The country used its low taxes as a selling point. In 1955 Liechtenstein, described itself (paywall) as a country “where citizens dwell virtually tax-free, and where similar freedom awaits foreign corporations.” (The top tax rate at that time was 1.4%.)

What is a good salary in Prague : Prague, the capital city, stands as the epicenter of economic activity in the Czech Republic. The average salary in Prague is significantly higher than the national average, with figures often surpassing 50,000 CZK (approximately €1,971) per month.